Frontier Group Holdings Inc (ULCC) Reports Mixed Q4 and Full Year 2023 Results

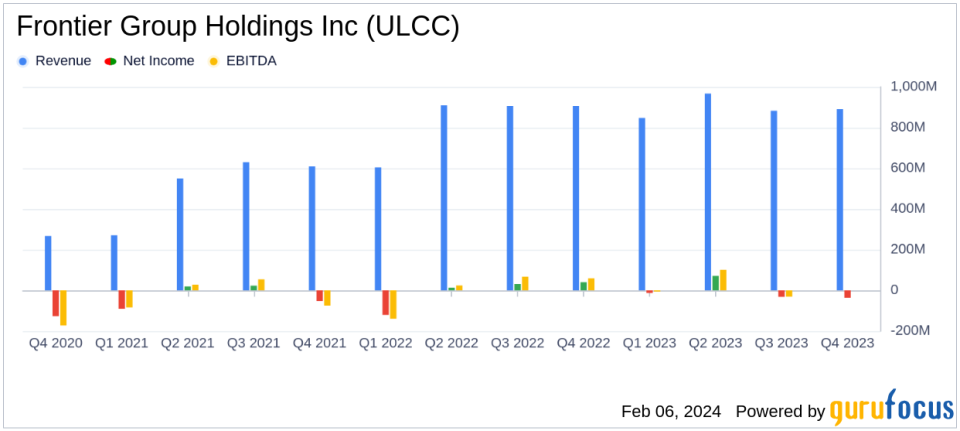

Total Operating Revenues: Q4 revenues decreased by 2% year-over-year to $891 million.

Net Loss: Reported a net loss of $37 million in Q4, including a non-cash valuation allowance against deferred tax assets.

Cost Performance: Q4 Cost per available seat mile (CASM) decreased by 10% compared to the same quarter in 2022.

Fleet Expansion: Took delivery of four A321neo aircraft, increasing fuel-efficient fleet proportion to 79%.

Liquidity: Unrestricted cash and cash equivalents stood at $609 million as of December 31, 2023.

Forward Guidance: Anticipates 12 to 15% capacity growth and 3 to 6% adjusted pre-tax margin for full year 2024.

On February 6, 2024, Frontier Group Holdings Inc (NASDAQ:ULCC) released its 8-K filing, detailing its financial results for the fourth quarter and full year of 2023. The ultra-low-cost carrier, known for its "Low Fares Done Right" philosophy, operates a fleet of 136 Airbus single-aisle aircraft and is recognized as the most fuel-efficient major U.S. carrier.

Financial Performance Overview

Frontier's Q4 operating revenues saw a slight decline of 2% year-over-year, totaling $891 million. This was accompanied by a net loss of $37 million, which included a $37 million non-cash valuation allowance against deferred tax assets. Despite the revenue dip, the company achieved a 0.7% pre-tax margin and a 0.8% adjusted pre-tax margin. The adjusted net income stood at $1 million, excluding special items.

The cost performance for the quarter was a highlight, with CASM decreasing by 10% compared to the same quarter in 2022, reflecting the company's ongoing efforts to optimize operations and reduce expenses. The adjusted CASM, excluding fuel, also saw an 8% decrease, indicating improved operational efficiency.

Operational Highlights and Challenges

Frontier's operational performance in Q4 was strong, with a 99.5% completion factor and the highest on-time arrivals and departures since 2015 for the month of December. The airline's commitment to fuel efficiency was evident as it generated 105 available seat miles (ASMs) per gallon, a 3% increase over the comparable quarter in 2022.

However, the company faces challenges in the competitive airline industry, including the need to navigate fluctuating fuel prices and evolving consumer demand. The decrease in total operating revenue and the reported net loss underscore the importance of Frontier's strategic initiatives aimed at expanding profitability and managing costs.

Strategic Initiatives and Forward Guidance

Frontier's strategic initiatives include network simplification, focusing on overpriced and underserved markets, diversifying revenue streams, and enhancing customer engagement. The company also announced new crew bases and expanded operations from 10 bases, aligning with its growth strategy.

For the first quarter of 2024, Frontier anticipates a capacity growth of 5 to 7% compared to the 2023 quarter, with fuel costs expected to be between $2.85 to $2.95 per gallon. The full year 2024 outlook projects a capacity growth of 12 to 15% and an adjusted pre-tax margin of 3 to 6%, excluding special items.

Conclusion

Frontier Group Holdings Inc (NASDAQ:ULCC) is navigating a challenging landscape with a focus on operational efficiency and strategic growth. While the Q4 and full year 2023 results presented mixed outcomes, the airline's cost management and fleet expansion efforts position it for potential profitability improvements in the coming year. Investors and stakeholders will be watching closely as Frontier continues to execute its plans in the dynamic airline industry.

For a detailed analysis of Frontier Group Holdings Inc (NASDAQ:ULCC)'s financial performance and future outlook, visit GuruFocus.com.

Contacts:

Explore the complete 8-K earnings release (here) from Frontier Group Holdings Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance