FTI Consulting (FCN) Banks on Rising Demand and Global Presence

FTI Consulting, Inc. FCN, has outperformed its industry in the past year, growing 13% compared with its industry’s 3.5% increase. FTI Consulting is banking on the upbeat demand for its products due to the increased regulations and business litigations.

FTI Consulting, Inc. reported mixed first-quarter 2023 results. Adjusted earnings per share of $1.34 missed the Zacks Consensus Estimate by 19.8%, decreasing 19.3% on a year-over-year basis. Total revenues of $806.7 million surpassed the consensus mark by 2.4% and rising 11.5% on a year-over-year basis.

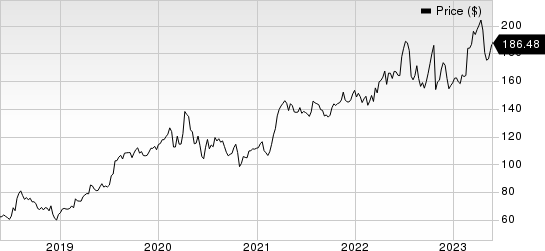

FTI Consulting, Inc. Price

FTI Consulting, Inc. price | FTI Consulting, Inc. Quote

Current Situation of FTI Consulting

The demand for FTI Consulting’s products has been on the rise due to the increasing regulation and legal proceedings. The continuous pursuit to gain competitive supremacy amongt businesses has been boding well for FTI Consulting as businesses tend to transform through M&A, divestiture and other restructuring activities.

FTI Consulting has been returning value to its customers through regular share repurchases. In 2022, 2021 and 2020, the company had repurchased shares worth $85.4 million, $46.1 million, and $353.6 million, respectively. These initiatives not only instill investors’ confidence but also positively impact earnings per share.

FTI Consulting’s international presence also bodes well. The international operations of the company help expand its geographic footprint and contribute to the top-line growth. The company earned almost 37% of its revenues from its international businesses in 2022.

FTI Consulting’s liquidity position is impressive and poses less risk of default. The company's current ratio (a measure of liquidity) was 2.51 at the end of first-quarter 2023, higher than the 2.40 recorded at the end of the prior-year quarter.

Some Concerning Points

FTI Consulting’s global presence exposes it to the risk of foreign currency fluctuations. Appreciation or depreciation of the U.S. dollar versus foreign currencies impacts the company’s results.

FCN’s business is troubled by seasonality as professionals and clients tend to take vacations during the fourth quarter of the year, which impacts revenues across segments.

Zacks Rank and Stocks to Consider

FCN currently carries a Zacks Rank #3 (Hold).

Investors interested in the Zacks Business Services sector can consider the following stocks:

Green Dot GDOT: For second-quarter 2023, the Zacks Consensus Estimate of Green Dot’s revenues suggests a decline of 4.5% year over year to $339.2 million and the same for earnings indicates a 52.7% plunge to 35 cents per share. The company has an impressive earning surprise history, beating the consensus mark in all four trailing quarters, the average surprise being 37.3%.

GDOT has a VGM score of A and currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Maximus MMS: For second-quarter 2023, the Zacks Consensus Estimate of Maximus’ revenues suggests an increase of 6.1% year over year to $1.2 billion and the same for earnings indicates a 35.9% rise to $1.06 per share. The company has an impressive earning surprise history, beating the consensus mark in three instances and missing on one instance, the average surprise being 9.6%.

MMS has a VGM score of A along with a Zacks Rank #2 (Buy).

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

FTI Consulting, Inc. (FCN) : Free Stock Analysis Report

Green Dot Corporation (GDOT) : Free Stock Analysis Report

Maximus, Inc. (MMS) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance