FTSE 100 hits new record high and Dow Jones smashes 21,000 on Trump-trade but pound sinks below $1.23 on weak data

Pound falls to almost six-week low as Brexit fears resurface

FTSE 100 hits new record high after Trump's address to Congress

Trump offers few policy details, surprises and less protectionism

Fed officials jolt mraket wwith talk of pending rate hike

UK factory growth slows in February

Dow Jones smashes 21,000 for first time ever

Markets wrap: FTSE 100 hits record high and Dow Jones breaks 21,000 on Trump speech and rate hike talk

Renewed optimism over a huge economic stimulus in the US and hopes of a rate hike this month stoked new stock market records on both sides of the Atlantic.

“Animal spirits have taken over,” said Neil Wilson, of ETX Capital, as the FTSE 100 charged to a fresh intraday record high of 7,383.05. It closed at a new peak of 7,382.9, up 119.46 points, or 1.64pc, on the day, while the more domestically-focused FTSE 250 also hit an intraday high of 18,983.01.

On Wall Street, the Dow Jones crossed the 21,000 mark for the first time ever, as industrial and banking stocks rallied. Clocking in at 25 trading sessions, the rally from 20,000 to 21,000 is the Dow’s fastest move between thousand-point milestones since 1999.

Look, no strings. Dow Jones has just recorded its fastest 1000 point rise in history. Less Trump bump as Trump bubble pic.twitter.com/76ywRUesyw

— jeremy warner (@JeremyWarnerUK) March 1, 2017

Investors praised US President Donald Trump’s measured tone in his first major speech to Congress, while his promise to boost the US economy with a “massive” tax relief and a $1 trillion infrastructure spending spree reignited the so-called ‘Trump-trade’.

However, Trump’s trillion-dollar infrastructure plan was largely overshadowed by hawkish comments from two influential Federal Reserve policymakers. Late on Tues, New York Fed President William Dudley said the case for tightening monetary policy had become “a lot more compelling”, while San Francisco Fed President John Williams said “I personally don’t see any need to delay” raising interest rates.

#Fed stole show in markets. Odds of March US hike jumped to 80% after hawkish Dudley interview on CNN. Says 'fairly soon' means near future. pic.twitter.com/BtCVG0c9gj

— Holger Zschaepitz (@Schuldensuehner) March 1, 2017

The comments spurred a rally in bank stocks, as their profits get a boost from higher interest rates, while on currency markets, the dollar hit a seven-week high.

According to Fed funds futures, the markets now see a US rate hike in March as more likely than not.

Jasper Lawler, of London Capital Group, said: “With unemployment and inflation objectives close to target and no ‘financial tightening’, the Fed’s code for falling markets, they are all out of excuses not to hike in March.”

Back in the UK, a sinking pound also contributed to the FTSE 100’s ebullient rally. The pound fell below $1.23 for the first time since January 23 after weak economic data and as political nerves bubbled ahead of the Brexit bill defeat in the House of Lords.

Since hitting a nadir of 5,537 just over a year ago, the FTSE 100 has surged 33pc. Despite worries about imminent Brexit negotiations, Tom Stevenson, of Fidelity International, said: “The post-2009 bull market is long in the tooth but I expect it to continue this year.”

On that note, it's time to close for today. I'm back again tomorrow morning from 8.30am.

Market Report: CRH rallies to five-week on upbeat earnings and Trump's trillion-dollar infrastructure pla

Strong earnings and Trump’s trillion-dollar infrastructure plan cemented CRH’s place among the top FTSE 100 risers yesterday.

The Irish firm, which is the biggest producer of asphalt for highway construction in the US, reported earnings before interest, tax, depreciation and amortisation growth of 10pc to €3.08bn, slightly ahead of its November forecast buoyed by strong growth in the US. It also increased its dividend by 4pc to 65c.

CRH generates 65pc of its earnings from the US, 55pc of which comes from infrastructure. Since January it has splashed out €500m on eight transactions in North America, where it sees continued momentum in construction.

The FTSE 100 stock also enjoyed a boost after US President Donald Trump said he would seek legislation for $1 trillion investment in infrastructure during his address to Congress on Tuesday.

Aynsley Lammin, of Canaccord Genuity, said: “We expect good momentum in organic growth, the potential benefit from US tax cuts and infrastructure spend combined with leverage falling fast to help the shares to move higher over the medium term.”

Shares rallied 134p, or 4.9pc, to a five-week high of £28.54. Its peer Ashtead also benefitted from the Trump bump, leaping 95p to £17.51.

The reignited Trump-trade and a weakening pound at the hands of a resurgent dollar propelled the FTSE 100 to a new record closing high of 7,382.90, up 119.46 points, or 1.64pc, on the day.

Banking stocks also rallied after two influential Fed policymakers suggested rates could rise this month. Barclays advanced 6.4p to 232.9p, HSBC rose 15.9p to 662.4p, Royal Bank of Scotland climbed 6.1p to 243.9p, Lloyds added 0.2p to 68.8p and Standard Chartered closed up 26.1p at 748.5p.

However, rising rate hike expectations dragged gold prices lower. In its wake, Randgold Resources lost 85p to £74.25 and Fresnillo surrendered 13p to £14.73.

Elsewhere, miners rose the ranks as copper climbed on concerns about a supply shortage. Glencore jumped 15.7p to 337.8p, BHP Billiton edged up 56p to £13.54, Antofagasta made gains of 25.5p to 837.5p and Anglo American finished the day 39.5p higher at £13.10.

Broadcaster ITV soared 9.2p to 211.7p after it reported a 3pc rise in adjusted earnings per share thanks to growth in its studios production business. It also announced a special dividend of 5pc per share, which Sophie Bell, of Credit Suisse said demonstrates management’s confidence in the rebalanced business “despite ad market volatility”.

Housebuilder Persimmon also made strides, up 89p to £21.50, on the back of a price target upgrade by UBS, while Taylor Wimpey inched up 5.7p to 185.7p after Barclays and Deutsche Bank raised its price target to 195p and 249p, respectively.

Takeover chatter propelled shares in Aberdeen Asset Management 4.8p higher to 281.3p, while hedge fund firm Man Group faltered 2.9p to 143.5p after it blamed “unforgiving” market conditions for a slide in annual pre-tax profits.

On the mid-cap index, International Personal Finance suffered a hefty loss of 19.2p, or 10.6pc, to 162p, as full-year pre-tax profits slumped 20.2pc due to fierce competition from digital and payday lenders. It was also hurt by regulatory changes that capped non-interest costs hurting profitability.

Finally, after markets closed the FTSE Russell confirmed that Capita and Dixons Carphone will leave the FTSE 100 following the latest quarterly reshuffle. The rebalance sees Scottish Mortgage Investment Trust and Rentokil Initial join the blue chip index. All changes will take effect from the start of trading on March 20.

Capita and Dixons Carphone demoted from FTSE 100 after quarterly reshuffle

Outsourcer Capita and Dixons Carphone have been booted out of the FTSE 100 in the latest quarterly reshuffle of index constituents.

The two firms will make way for Scottish Mortgage Investment Trust and Rentokil, who will join the blue chip index in the rebalance.

The FTSE 250 Index will see the following changes in addition to those mentioned above:

Entering the FTSE 250:

Northgate

Sanne Group

Syncona

Exiting the FTSE 250:

Brown (N) Group

CMC Markets

International Personal Finance

All changes from this review will be implemented at the close of business Friday, 17 March 2017 and take effect from the start of trading on Monday, 20 March 2017.

Trump growth trade and sterling weakness add fuel to the equity fire

Tom Stevenson, investment director at Fidelity International, saidnew stock market records on both sides of the Atlantic today as the Trump growth trade and sterling weakness "add fuel to the equity fire".

" The FTSE 100 has closed at an all time high of 7,383 as further weakness in sterling and rising commodity prices boost the stock market in London. The FTSE 250 also hit a record high. Over the pond, it was all about President Trump’s speech to Congress, which overcame initial scepticism to send the Dow Jones Industrial Average through the 21,000 barrier today. It only cleared 20,000 three weeks ago, making this the fastest rise between 1,000 milestones since 1999.

“Since last year’s low of 5,537 (11 February 2016), the FTSE 100 index is up 1,846 points, or 33pc. We think the bulls will emerge victorious from a two-way pull for the UK benchmark this year. Despite worries about the imminent Brexit negotiations, the growth outlook is positive on both sides of the Atlantic and bond yields should continue to rise. That will make equities more interesting than fixed income. The post-2009 bull market is long in the tooth but I expect it to continue this year.”

FTSE 100 closes at new record high

The FTSE 100 closed at a new record high this even as Trump's speech to Congress reignited a rally in resource stocks, while Fed policymakers talking up a March rate hike boosted banking stocks.

By close of play, the FTSE 100 gained 1.64pc to finish at 7,382.90, a new all-time closing peak.

In Europe, the Stoxx 600 hit its highest level in almost 15 months, closing 1.5pc higher. Meanwhile, the DAX rallied 2pc, the CAC jumped 2.2pc and the IBEX advanced 1.98pc.

Joshua Mahony, of IG, said: "The FTSE has enjoyed an outstanding day, thanks in part to a weakening pound at the hands of a resurgent US dollar. Trump’s infrastructure promise has clearly had a substantial effect upon the FTSE, with the leaderboard including firms such as Ashtead and CRH which stand to gain substantially from the approval of $1 trillion in spending."

Hedge fund giant Man Group stumbles to loss in choppy markets

Shares in Man Group fell 1.4pc after annual pre-tax profits fell to $205m due to "unforgiving" market conditions. Tim Wallace reports:

Intense market volatility damaged Man Group’s earnings in 2016, sending shares tumbling yesterday - though the stock regained some ground on hopes that the opening months of 2017 have been better for the hedge fund business.

The FTSE 250 finance group made a loss of $272m (£221m) for 2016, in large part because of impairments recorded on its GLG and FRM funds - a decision made because earnings have been worse than expected, so the company must cut the value of expected future income.

Revenues also suffered due to choppy market conditions.

Net management fees fell by 9pc over the course of the year to $691m while performance fees dived by almost two-thirds to $112m.

As a result the firm’s shares dropped by 10pc in early trading, but recovered later in the day to a more modest 1.8pc loss.

In part that was due to a rise in overall assets under management which increased by 3pc to $80.9bn.

Dow Jones 1,000 point advances

Dow's 1000 point gains

20K-21K: 24 days

19K-20K: 42 days

18K-19K: 23 mths

17K-18K: 25 wks

16K-17K: 32 wks

15K-16K: 29 wks

14K-15K: 6 yrs— Jamie McGeever (@ReutersJamie) March 1, 2017

Trump’s $1trn spending pledge sends markets to new record highs

Michael Hewson, of CMC Markets,comments on the first trading session of the month:

"We’ve seen a turbo charged start to the month on the back of US President Donald Trump’s pledge to spend up to $1trn on rebuilding the infrastructure of the United States, with the FTSE100 and FTSE250 both making new record highs, as the reflation trade takes another leg higher.

"With senior Fed officials talking up the prospect of a US rate rise just prior to Mr Trumps speech last night, markets are riding a wave of optimism that increased spending will boost inflation, which in turn will boost returns for construction and manufacturing companies, while higher rates will boost financials."

The FTSE 100 is currently up 1.54pc at 7,375.48 with just an hour of trading to go. The blue chip index looks set to close at a record peak.

ISM US manufacturing beats expectations

The ISM's US manufacturing activity index came in ahead of expectations in February, with a reading of 57.7, beating consensus forecasts of 56.0 and January's reading of 56.0.

According to the ISM, new orders hit their highest level since December 2013, rising to 65.1, up from 60.4 in January.

USA ISM Manufacturing PMI announcement - Actual: 57.7, Expected: 56.0 pic.twitter.com/mGrweNcF6T

— Spreadex (@spreadexfins) March 1, 2017

Earlier this afternoon, Markit's US manufacturing PMI index came in at 54.2 for February, down from 55 in January and below a flash estimate of 54.3.

US Markit Manufacturing PMI Comes in at 54.2 vs prev 54.3, with domestic demand offsetting subdued exports. pic.twitter.com/k8U9YBvzhc

— Sigma Squawk (@SigmaSquawk) March 1, 2017

Dow's rally to 21k the fastest 1,000 point advance since 1999

Clocking in at 24 trading sessions, the rally from 20,000 to 21,000, is the Dow's fastest 1,000 point rally since 1999 (and the second-fastest on record).

It took 42 trading sessions for the Dow to climb from 19,000 to 20,000. The Dow broke the 20k landmark on January 25.

The fastest-ever 1,000 point rally was from 10,000 to 11,000 in early 1999, which took just 24 sessions.

The Dow just topped 21,000 for the first time... but does it matter? https://t.co/GhQuTrlGL9#Daybreakpic.twitter.com/ND8Yr8FjAD

— Bloomberg (@business) March 1, 2017

Dow, FTSE record highs as animal spirits take over

“Animal spirits have taken over," that's what Neil Wilson, of ETX Capital said this afternoon, after the Dow Jones and the FTSE 100 smashed new record highs.

"As expected, the Dow Jones has soared through the 21,000 mark just over 3 weeks after breaking the 20k level for the first time. It’s the quickest time ever to 1,000-point milestone, beating the record set in 1999. But this looks a bit different to the dotcom boom and bust as we are dealing with a complete reversal in fund allocation in the form of a major shift away from bonds to equities.

"Today’s boost is all down to the president’s speech to Congress last night. Trump’s rallying call to reignite the American spirit has produced the desired effect on the markets, pushing stocks to fresh all-time highs. Indeed it’s because of Trump that we are here – the prospect of stronger growth, lower taxes, more spending and higher earnings is like a magic cocktail for equities. Of course details of tax reforms will be crucial – there is still the scope for disappointment as markets are pricing in a huge surge in corporate earnings."

New hats please

21 club. Dow tops 21,000 for first time. This hat is soooo late January. pic.twitter.com/v5KTAYwuTZ

— Paul R. La Monica (@LaMonicaBuzz) March 1, 2017

Dow Jones breaks 21,000

US stocks opened at record intraday highs and the Dow Jones smashed the 21,000 barrier for the first time ever as Trump's more measured tone in his address to congress reassured investors.

Here's the current state of play:

Dow Jones: +0.94pc at 21,006

Nasdaq: +0.85pc

S&P 500: +0.79pc

It's a historic market open, as the Dow tops 21,000 for the first time https://t.co/yZSXO28tNtpic.twitter.com/PdvsyGdPfK

— Bloomberg (@business) March 1, 2017

BREAKING: Dow hits 21,000 for the first time ever https://t.co/yVVE8XZamYpic.twitter.com/9EIiqIyH3w

— CNBC Now (@CNBCnow) March 1, 2017

PepsiCo planning to shut down its Walkers factory in Durham

Away from markets, PepsiCo has announced plans to close its Walkers crisp factory in County Durham at the end of the year, putting 400 jobs at risk.

PepsiCo says it is proposing to close its Walkers Snacks factory in Peterlee in County Durham putting 380 jobs at risk

— Sky News Newsdesk (@SkyNewsBreak) March 1, 2017

In a statement, the company said: "In order to improve the efficiency of our UK snacks manufacturing operations, we are proposing the closure of our factory at Peterlee.

"Crisps currently produced at the site would be manufactured at our other facilities in the UK.

"Peterlee has been an important site for our business but the changes we are proposing present significant productivity and efficiency savings crucial for ensuring the long-term sustainable growth of our business in the UK."

Meanwhile, Twitter was quick to respond, remembering that Prime Minister Theresa May is giving up crisps for Lent:

A day after May announces she is giving up crisps for lent, Walkers says it is closing a UK crisp factory. How many bags was she eating!?

— Kylie MacLellan (@kyliemaclellan) March 1, 2017

PM Theresa May gives up salt & vinegar crisps for Lent. Next day Pepsi shuts Walkers Crisps factory in County Durham....

— Ashley Armstrong (@AArmstrong_says) March 1, 2017

US consumer spending slows; inflation pushes higher

US consumer spending rose by less than expected in January as the largest monthly increase in inflation in four years eroded households' purchasing power, data from the Commerce Department showed this afternoon.

Here are the key points from the January data release:

Consumer spending, which accounts for more than two-thirds of US economic activity, increased 0.2pc (Compared with 0.5pc in December and forecasts of 0.3pc);

Personal consumption expenditures (PCE) price index increased 0.4pc, marking its largest gain since February 2013;

In the 12 months through January, the PCE price index jumped 1.9pc;

Excluding food and energy, the so-called core PCE price index rose 0.3pc, in January, its biggest increase since January 2012;

The core PCE price index increased 1.7pc year-on-year after a similar gain in December.

The core PCE is the Fed's preferred inflation measure and is running below its 2pc target (Inflation is now in the upper end of the range that Fed officials in December felt would be reached this year);

When adjusted for inflation, consumer spending fell 0.3pc in January, the first drop since August;

Consumer spending increased at a 3pc annualized rate in the fourth quarter, helping to blunt some of the impact on the economy from a wider trade deficit.

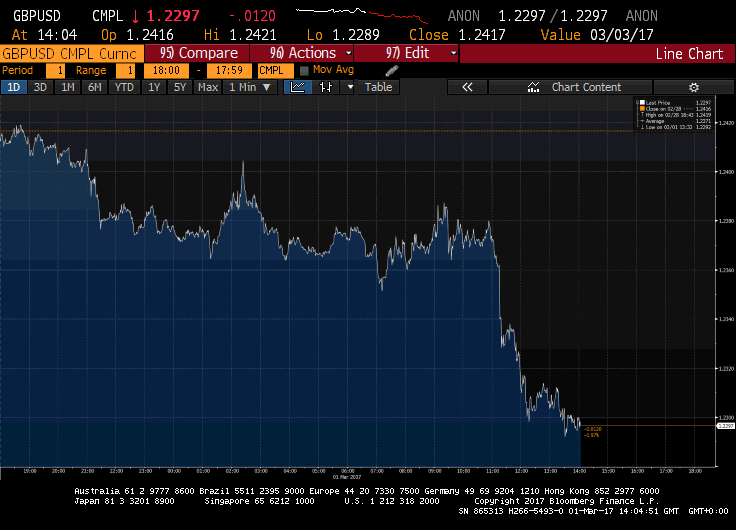

Pound sinks below $1.23

The pound has dropped below $1.23 towards a six week low as Brexit concerns begin to weigh on the currency again. Weaker-than-expected economic data released earlier today did little to help.

Sterling has been struggling in recent weeks in the face of figures in the past fortnight suggesting the UK economy was finally beginning to suffer from the uncertainty around Britain's planned exit from the European Union over the next two years.

Quite the nose dive in the pound GBPUSD - 170 points off yesterday's highs. Six week support coming in at 1.2250: pic.twitter.com/G6bU9RRp4J

— David Jones (@JonesTheMarkets) March 1, 2017

UK export activity accelerates in February as eurozone manufacturing booms

Here's our full report by Szu Ping Chan on UK manufacturing:

Britain's manufacturing sector maintained a "solid" start to the year in February amid a sharp acceleration in new export orders, according to a closely watched survey.

IHS Markit's latest barometer of the sector showed the weaker pound boosted overseas orders for a ninth consecutive month, led by sales to the rest of Europe, the US and Asia, even as the overall pace of growth slowed.

The UK manufacturing purchasing managers' index (PMI) eased to 54.6 in February, from a downwardly revised 55.7 in January, as domestic orders slowed.

#UK#manufacturing#PMI at 54.6 in Feb (55.7 in Jan). Output and new orders rise solidly albeit at slower rates. https://t.co/uhTrJno81Qpic.twitter.com/nwMqT6PUtX

— Markit Economics (@MarkitEconomics) March 1, 2017

Britain's manufacturing sector maintained a "solid" start to the year in February amid a sharp acceleration in new export orders, according to a closely watched survey.

IHS Markit's latest barometer of the sector showed the weaker pound boosted overseas orders for a ninth consecutive month, led by sales to the rest of Europe, the US and Asia, even as the overall pace of growth slowed.

The UK manufacturing purchasing managers' index (PMI) eased to 54.6 in February, from a downwardly revised 55.7 in January, as domestic orders slowed.

FTSE 250 also hits a new record high

The mid-cap index has also hit a new record high. It is trading up 0.8pc on the day at 18,913.

Could the Dow break 21k today?

Time for a new celebratory hat? The Dow Jones could break the 21,000 barrier when Wall Street opens later.

US stock index futures were higher this afternoon as investors assessed President Donald Trump's speech, while bank stocks rose on increased possibility of an interest rate hike this month.

In his first address to a joint session of Congress late Tuesday, Trump said he wanted to boost the US economy with a "massive tax relief", overhaul the Affordable Care Act and make a $1 trillion effort on infrastructure.

— IGSquawk (@IGSquawk) March 1, 2017

Breaking: FTSE 100 hits new record high

The FTSE 100 has touched a new intraday record high, surpassing its previous peak of 7,354.14 which it touched on January 16.

The blue chip index rose 1.3pc to 7,358.89.

If it closes above 7,345.18 it will also set a new closing high.

German inflation hits 4-1/2 year high in February

German inflation accelerated further in February, reaching its highest level in four-and-a-half years and surpassing the European Central Bank's price stability target of just under 2 percent, preliminary data showed this afternoon.

German consumer prices, harmonised to compare with other European countries (HICP), rose by 2.2pc on the year after an increase of 1.9pc in January, the Federal Statistics Office said.

German inflation up to 2.2%, highest since Aug 2012. As recently as May last year it was 0%. Raises probability of 2% euro zone CPI tomorrow pic.twitter.com/5YPhssUHym

— Jamie McGeever (@ReutersJamie) March 1, 2017

This was the highest annual inflation rate since August 2012 and came in slightly stronger than a Reuters consensus forecast of 2.1pc.

On a non-harmonized basis, annual inflation also picked up to 2.2pc after 1.9pc in January.

Rising energy prices and higher food costs again were the main drivers behind the overall increase in February, a breakdown of the non-harmonized data showed.

With a federal election set for September, the inflation figures are likely to fuel calls for an end to the European Central Bank's loose monetary policy.

Report from Reuters

FTSE 100 four points shy of record high

The FTSE 100 is just four points shy of setting a new record peak.

Moments ago it touched 7,350.19, bringing it within touching distance of a new peak. On January 16, it set an intraday record high of 7,345.18.

If the blue chip index can hold on to its current gains, it could set a new closing high. The FTSE's record close stands at 7,345.18, which it set on January 3.

Eurotunnel chief confident post-Brexit as rail link enjoys record year

Channel tunnel operator Eurotunnel was bullish over its prospects despite Britain's vote to leave the European Union, predicting a further increase in profits and dividends this year and next year. Bradley Gerrard reports:

Eurotunnel chief Jacques Gounon has said Brexit will not derail his company thanks to upbeat statements by Prime Minister Theresa May, as the business reported its best year ever.

Mr Gounon, whose Eurotunnel Group operates the cross-Channel link between the UK and mainland Europe, said statements by the Prime Minister that she wanted the barrier-free trade between the two sides to continue once the country leaves the EU gave him confidence that Brexit would not negatively hit his business.

“Theresa May has said she doesn’t want to prevent free trade and more importantly she said she wants frictionless borders,” Mr Gounon said.

Achieving this aim will be key for a company such as Eurotunnel, which besides transporting 2.66m passenger vehicles and 1.64m trucks in 2016 is key in cross-Channel logistics.

France's CAC 40 hits highest level since December 2015

Elsewhere, the CAC 40 in Paris has surged to its highest level since December 2015, up 1.6pc at 4,936.

The latest move higher comes after Francois Fillon said he would not pull out of the French presidential election campaign despite being summoned by magistrates investigating payments made to his wife.

FTSE continues charge towards record high

The FTSE 100 continues to extends its gains, and just eight points shy of a new all-time peak.

It is currently trading at 7,346. The blue chip index hit a record high on January 16 of 7,354.14.

Royal Mail escapes price caps as regulator gives clean bill of health to postal service

Shares in Royal Mail dipped 0.9pc despite Ofcom noting that the FTSE 100 company's performance has improved since it introduced a new regulatory framework in 2012. Alan Tovey has the details:

Royal Mail has escaped new price controls and a major shake-up of how it operates after a review by regulator Ofcom gave the current postal system a clean bill of health.

Ofcom brought in a new regulatory framework in 2012 after the strain of the “universal postal system” pushed Royal Mail to a £100m loss. Under the universal system, the company is required to deliver to every UK address six days a week at a standard price.

Part of the arrangement saw the regulator give Royal Mail more commercial freedom but put in place a cap on second-class stamp prices.

Ofcom’s review has concluded that the new measures were “generally working well” for customers. Therefore it has decided to keep the current system - which had been due to end in 2019 - in place for a further three years.

Half-time update: European bourses rally on Trump-trade

European bourses made solid gains as resource stocks rallied after after US President Donald Trump pledged $1 trillion of infrastructure spending in his first speech to Congress.

Just after the midday:

FTSE 100: +1.03pc

DAX: +1.32pc

CAC 40: +1.47pc

IBEX: +1.51pc

Connor Campbell, of SpreadEx, said: "A resurgent Trump rally gathered pace as Wednesday progressed, the European indices ignoring a mixed bag of manufacturing data.

"The FTSE barrelled towards a fresh all-time high this morning, rising more than 50 points to lurk just below 7350. It’s its best price in a month and a half, and one that paid no attention to the fact that the UK’s manufacturing PMI unexpectedly fell from 55.7 in January to 54.6 in February."

France risk spread over Germany rises as Fillon vows to stay in election race

France's risk spread over Germany rose after Francois Fillon said he would not pull out of the French presidential election campaign despite being summoned by magistrates investigating payments made to his wife.

#France risk spread over #Germany rises as Francois Fillon stays in French presidential election race. pic.twitter.com/Iif1nGoflJ

— Holger Zschaepitz (@Schuldensuehner) March 1, 2017

French 10-year government bond yield gap against Germany widened marginally following the announcement, while Europe's Stoxx 600 and the CAC 40 pared gains.

In a speech Fillon said: ""I won't give in, I won't surrender, I won't pull out, I'll fight to the end."

No major news for #CAC40 or French 10 year #bonds after the #Fillion news. Euro is flat and CAC is still up pic.twitter.com/xDdjgYeXF5

— Naeem Aslam (@NaeemAslam23) March 1, 2017

Brexit bill to be defeated in Lords

David Cheetham, of XTB, weighs in on expectations the Brexit bill will be defeated in the House of Lords:

"The government is facing a first defeat in the House of Lords for its Brexit bill later today with an amendment to the draft legislation to protect the rights of EU citizens living in the UK expected to be agreed upon by peers.

Road to Brexit | Article 50 and the House of Lords

"This could be seen as the first of several developments relating to the bill in which the Lords reject something in the red chamber and send it back down the corridors to the green benches. The upper house will be hoping that some backbenchers in the commons will join them and push back at the government, however this is unlikely to ultimately frustrate the process of triggering Article 50 to any great extent. Perhaps in light of this there’s little by the way of a discernible reaction seen in the markets as of yet."

Brexit concerns pressure the pound

The sharp slide in the pound today, currently down 0.7pc at an almost six-week low of $1.2236, can be attributed to a combination of a technical break and concerns about the House of Lords sending the Brexit bill back to Commons with amendments.

Anthony Cheung, of Amplify Trading, explains that although such a move doesn't throw the triggering of Article 50 off-course, it does provide "just another obstacle to what has been a largely smooth passage up until this point".

Bubbling in the background this week has also been "a deterioration in UK consumer confidence, as households start to feel the pressure from rising inflation".

"This is something that will only become more acute in the coming months as inflation continues to rise apace; the Brexit pain is forthcoming."

Follow our live politics blog: Theresa May braced for first Brexit Bill defeat in the House of Lords

How long until Theresa May’s Brexit deadline? 11:23AM

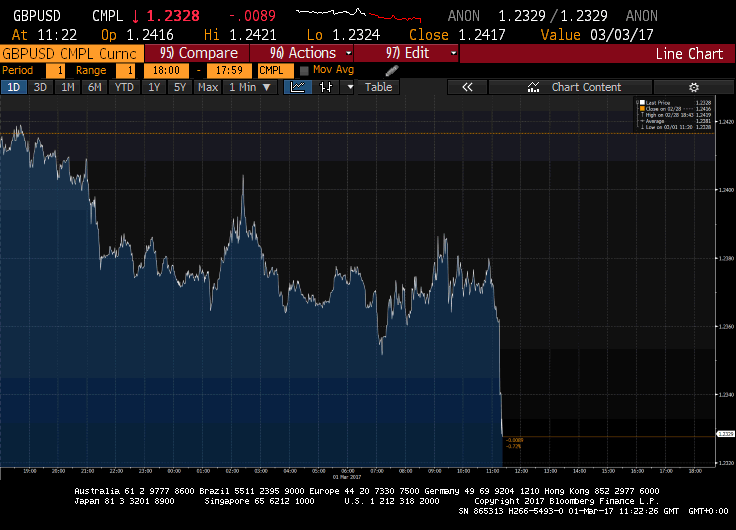

Pound skids to almost six-week low

Pounds slumps to $1.2334, to its lowest level in almost six weeks.

Earlier today, it weakened after UK manufacturing and credit data.

Trump makes America wait again

Anthony Cheung, of Amplify Trading, weighs in on the Trump-inspired move

in his morning briefing. He explains why European bourses have risen following Trump's Congressional address:

Mr Cheung notes that his address to Congress was "almost a re-run of the morning he won the election" as his tone was "more conciliatory".

"He has managed the tone exceptionally well," Mr Cheung explains.

Although he made "America wait again", his Presidential tone has somewhat negated this.

"After all the promises and hype, he's managed to play that off by sounding somewhat Presidential it seems and the market liked it."

Interestingly, Mr Cheung points out that the market was positioned for a negative outcome. People were expecting Trump to underwhelm, he adds.

He said Trump has delivered something that is a "net neutral", in that the address was positive in tone, but lacking in details.

Markets were looking for an underwhelming event, Mr Cheung said, and that hasn't happened and so it's "a net positive".

"That's why equities haven't fallen out of the bed this morning... that's why they have risen."

However, he cautioned if Trump is not forthcoming with specifics about his policy plans at some point the market will "lose patience".

French markets calm even though Fillon cancels appearance

French markets remained subdued after French presidential candidate Francois Fillon abruptly cancelled a high-profile campaign appearance this morning.

The cancelled appearance comes after a newspaper reported he had been summoned by magistrates investigating a 'fake work' scandal involving his wife.

Fillon was holding talks with senior officials of his party, and there was no confirmation of the report in the Journal du Dimanche newspaper.

No clear reax yet in French mkts since Fillon news started to emerge abt 7GMT -Bund/OAT a tad wider, CAC+bank stx higher, euro barely budged pic.twitter.com/MXzsKf8OmO

— Mike Dolan (@reutersMikeD) March 1, 2017

The 62-year-old former prime minister said he would make a statement at noon (1100 GMT). A source close to Alain Juppe, whom Fillon defeated in the contest to be The Republicans' candidate, said he would appear alongside Fillon.

Report from Reuters

FTSE 100 nears record highs as Trump-trade returns

The FTSE 100 neared an all-time high in mid-morning trade as the Trump-trade returned after the US President's Congressional address.

It rose 0.9pc at 7,327.44, nearing a record high of 7,354.14, which it hit on January 16.

Although it wasn't the most policy-intensive speech ever given by the US president, Chris Beauchamp, of IG, said the market action in Europe so far certainly gives the impression that investors are not too bothered.

"Even those with short memories should recall that there was a significant volume of opinion that suggested the Trump trade would fail after the inauguration. Perhaps history is repeating itself once again."

"Arguably the more important developments overnight have been the ramping up of expectations regarding a Fed hike in March. Policymakers have been falling over themselves in the rush to suggest the US economy is ready for another hike, just one quarter after the last one. Compared to the languid pace of tightening over the past year or more, this is a positively giddy pace.

ITV declares special dividend but warns ad revenue will fall on 'economic uncertainty'

Shares in ITV rose 2.1pc this morning after the broadcaster said it would pay a special dividend thanks to growth in its studio production business. Jon Yeomans reports:

ITV has reported a rise in sales and a special dividend, but warned that "economic uncertainty" would continue to drag on advertising revenue.

The UK's biggest commercial broadcaster recorded a 4pc rise in revenue to £3.5bn in the year to December, while pre-tax profit slid 14pc to £553m.

Underlying profits edged up to £847m from £843m in 2015.

However advertising sales - a key measure for the FTSE 100 company - fell 3pc during the year to £1.67m.

ITV warned that advertising revenue would continue to drop by as much as 6pc in the first four months of 2017, "impacted by current economic uncertainty". Ad sales are expected to fall by as much as 15pc in March alone, it warned.

UK consumer credit growth slows for a second month

Data released from the Bank of England this morning showed that British consumers borrowed more in January than they did in the previous month. However, the pace of increase slowed for a second straight month.

Figures from the central bank showed consumer credit rose by £1.416bn, in line with expectations and just up from an increase of just under £1bn in December.

Unsecured consumer credit at highest level since December 2008, this morning's @bankofengland data pic.twitter.com/y3unMGrzox

— Spencer Thompson (@SThompson20) March 1, 2017

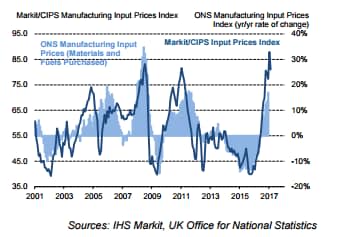

Barclays: UK manufacturers continue to register strong levels of output

Two months into 2017 and despite a slowing in the rate of growth in February, Mike Rigby, Head of Manufacturing at Barclays, said manufacturers continue to register strong levels of output, healthy order books and growing trade courtesy of a weak sterling.

"However, despite the recent surge in exports, the sector continues to rely mostly on domestic demand and with price rises feeding through on the back of growing input costs, even with their recent easing, inflationary pressure continues to hover with intent. It’s how manufacturers now respond, particularly in their investment intentions, that will help determine how long the raised level of optimism in the sector continues.”

#PMI shows #UK#manufactuirng activity still solid in Feb but slowed to 3-month low. PMI down to 54.6 (55.9in Jan) https://t.co/ICwKEHjjzG

— Howard Archer (@HowardArcherUK) March 1, 2017

UK manufacturing growth slows: What the experts say

Weighing in on the latest UK manufacturing PMI figures, Dave Atkinson, UK head of manufacturing at Lloyds Bank Commercial Banking, said there will be fears that the latest PMI data suggests the manufacturing sector is showing the "first signs of slowdown since last summer" as the UK prepares to begin in earnest the process of leaving the European Union.

“Yet despite persistent headwinds, principally the uncertainty around future trade terms and pricier imports as a result of the weaker pound, some exporting manufacturers are taking the opportunity to review their international trade strategies and look beyond the EU, especially taking advantage in the short term of the devaluation of sterling making our exports more competitive.

“Firms are also becoming more skilled at dealing with unexpected geopolitical events. Businesses in the car manufacturing supply chain are waiting to see how the PSA-Opel deal will pan out with elections in several major European countries this year.

Key part of UK Manufacturing PMI - Inflation close to record highs and pass through continuing at similar levels. pic.twitter.com/XqeBHJgV04

— World First (@World_First) March 1, 2017

Shannon Murphy, assistant head of risk underwriting at Euler Hermes, said the industry is now reaching a critical point as the benefits of export growth are being increasingly offset by rising import costs.

“We’re seeing a growing number of manufacturers switch to local suppliers as they reach their limit for absorbing input price inflation. For those subsectors without an established UK supply chain of original equipment manufacturing, such as the automotive industry, the outlook is more challenging. Passing on costs to the consumer will be difficult, and businesses are becoming more nervous about the risk of an increase in late payments and the threat to future growth.”

UK manufacturing PMI provides another confirmation of inflationary pressures building in the UK economy, largely due to weak GBP pic.twitter.com/yvbEWs5xQJ

— Johnny Bo Jakobsen (@jbjakobsen) March 1, 2017

Can robust growth in UK manufacturing be sustained?

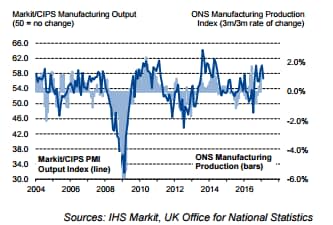

Although rates of expansion in output and new business lost impetus in February, Rob Dobson, of IHS, points out that growth remained comfortably above the long-run averages.

"The survey is signalling quarterly manufacturing output growth close to the 1.5pc mark so far in the opening quarter which, if achieved, would be one of the best performances over the past seven years."

Dobson says the big question remains as to whether robust growth can be sustained or whether it will continue to wane in the coming months.

"The slowdown in new order growth and a drop in backlogs of work suggest output growth may slow further. However, elevated business optimism, continued job creation, a recovery in export orders and rising levels of purchasing all suggest that any easing will be only mild. Indeed, almost 50pc of companies expect production to be higher in one year’s time."

����PMI manufacturing input prices due to weaker #GBP & higher commodity prices => CPI #inflation to move higher in coming months! pic.twitter.com/oxGD0farh4

— Danske Bank Research (@Danske_Research) March 1, 2017

Meanwhile, Duncan Brock, Director of Customer Relationships at the Chartered Institute of Procurement & Supply, said “Buoyant economic conditions gave the sector a spring in its step. Levels of new business and overall activity grew for the seventh consecutive month, underpinned mainly by a strong rise in new export orders. The investment goods sector was the biggest winner with the fastest growth in production.

“As a result, manufacturers had the confidence to maintain good levels of job creation reflecting a positive mood around continuing market expansion. Any lingering wintry chills however, were attributed to the continuing rise in input prices. This month, the impact of the weak pound combined with a shortage of some raw materials meant cost inflation remained at one of its highest levels since records began. Consequently, suppliers were squeezed and delivery times were lengthened, the latter to the second-greatest extent since May 2011.”

UK manufacturing: Key charts

Here are the key charts from Markit's UK manufacturing PMI:

The chart below shows manufacturing output:

The final chart documents the UK manufacturing input prices index:

UK manufacturing: Key findings

Data from Markit showed this morning that the British factory sector grew more slowly than expected. However, it still looks set to help the economy keep up its strong, post-Brexit vote momentum in early 2017.

Here are the key findings:

UK Manufacturing PMI at 54.6 in February (compared to 55.7 in January and below forecasts of 55.6);

Output and new orders rise solidly, albeit at slower rates;

Price inflationary pressures remain elevated.

Pound weakens on weaker-than-expected manufacturing data

The pound has slipped on the back of weaker-than-expected UK manufacturing data.

Data from Markit showed the PMI slipped to 54.6 from 55.7 in January, below forecasts of 55.6.

It also showed a slight easing in inflation pressures.

GBPUSD drops on weaker-than-forecast manufacturing PMI pic.twitter.com/hYq2w0r6AL

— Neil Wilson (@neilwilson_etx) March 1, 2017

Rob Dobson, an economist at IHS Markit, said the survey suggested manufacturing output growth close to 1.5pc in the first quarter, which would be one of the best performances in the last seven years.

"The big question remains as to whether robust growth can be sustained or whether it will continue to wane in the coming months," he said.

The local currency fell by around 20 ticks to $1.2366 after the data was released. It also trimmed gains against the euro, to 0.2pc at 85.2p per euro.

Breaking: UK factory growth slows in February

UK factory growth slowed by more than expected in February, data from Markit showed this morning.

The overall manufacturing PMI slipped to 54.6 from 55.7 in January, below forecasts of a reading of 55.6.

UK #manufacturing PMI at 54.6 in Feb (55.7 Jan). Growth still solid but slowing. Prices rising at near-record rates https://t.co/pjU9I9oAqLpic.twitter.com/7nvKNWIOTe

— Chris Williamson (@WilliamsonChris) March 1, 2017

More to follow...

Eurozone factory activity touches six-year high on weaker euro

The upturn in euro zone factory activity accelerated in February to the fastest rate in nearly six years, according to a business surveythat also showed a weaker euro boosted demand for exports.

IHS Markit's final manufacturing Purchasing Managers' Index for the euro zone rose to 55.4 in February, the highest since April 2011, from January's 55.2. It was revised down slightly from a flash estimate of 55.5 but remained far above the 50 mark denoting growth in activity.

#Eurozone Manufacturing #PMI rises to 70-month high as growth accelerates in

Germany, the Netherlands and Italy. https://t.co/FR2cdG3sVvpic.twitter.com/vUglUl8ca1— Markit Economics (@MarkitEconomics) March 1, 2017

An index measuring output, which feeds into the composite PMI, due on Friday, jumped to 57.3, which was also the highest in nearly six years. The flash composite PMI suggested economic growth of 0.6 percent in the first quarter.

"Euro area manufacturers are reporting the strongest production and order book growth for almost six years, in what's looking like an increasingly robust upturn," said Chris Williamson, chief business economist at IHS Markit.

"This year has seen firms more optimistic about the future than at any time since the region's debt crisis. Companies are reporting stronger demand in both home and export markets, with the weakened euro providing an accompanying tailwind to help drive sales."

Renewed optimism about the region's economic outlook in recent weeks has been buoyed by a weak euro, which makes the currency bloc's exports relatively cheap on world markets.

The latest PMI survey's new export orders sub-index rose to the highest since April 2011 at 55.5, up from January's 55.2.

Report from Reuters

February manufacturing PMI round-up

Here's a run down of the PMI manufacturing data released so far this morning (we get UK figures at 9.30am):

China manufacturing PMI expands faster than expected

Activity in China's manufacturing sector expanded faster than expected in February, an official survey showed overnight. The official PMI rose to a three-month high of 51.6 in February, up from 51.3 in January and beating forecasts of a reading of 51.1.

Anything above the 50-point mark that separates growth from contraction on a monthly basis.

#China mfg #PMI rises to 51.7 in February. Joint-second strongest growth rate for just over four years. https://t.co/fmu4S9OYu8

— Markit Economics (@MarkitEconomics) March 1, 2017

#ASEAN mfg #PMI rises to 50.3 in February, up from 50.0 in January. Business optimism hits 32-month low. https://t.co/h5xORjRztHpic.twitter.com/raHQODjCgb

— Markit Economics (@MarkitEconomics) March 1, 2017

Russian manufacturing activity expands at slower pace in February

Russia's PMI fell to 52.5 in February, seeing manufacturing activity expand at a slower pace than the previous month as hiring softened.

The index's reading came in at 52.5 last month, down from 54.7 in January.

Paul Smith, of IHS Markit, said: "Rates of growth in output, new orders and employment all eased from January peaks."

#Russia mfg #PMI dips amid slower rises in output, new orders

and employment https://t.co/keyF5zZI44— Markit Economics (@MarkitEconomics) March 1, 2017

Irish manufacturing growth slows despite stronger UK demand

Despite stronger UK demand, growth in Irish manufacturing slowed in February. A sharp rise in input costs weighed heavily on profit margins.

The PMI index fell to 53.8 in February, down from 55.5 in the previous month.

#Ireland Manufacturing #PMI falls to 53.8 in February pic.twitter.com/BPqMZ5aMGE

— CEEMarketWatch (@CEEMarketWatch) March 1, 2017

Robust growth boosts Dutch manufacturing

Dutch manufacturing activity improved at the fastest rate in nearly six years. The seasonally adjusted NEVI Purchasing Managers' Index stood at 58.3, its highest level in 70 months, driven partly by the sharpest increase in output in more than 10 years and the fastest increase in employment since 2011.

#Netherlands mfg #PMI at 70-month high of 58.3 in Feb. Output expands at quickest pace since July 2006. https://t.co/6pTQWj6Qvq

— Markit Economics (@MarkitEconomics) March 1, 2017

Turkish manufacturing activity steadies in February

Turkish manufacturing activity steadied last month as output and staff levels rose, official data showed this morning. The PMI index rose to 49.7 from 48.7 in January.

Spanish factory demand steady as cost of materials rises

Markit's Purchasing Managers' Index (PMI) of manufacturers slipped to 54.8 in February from 55.6 in December, missing consensus forecasts of 56.0, as the cost of materials rose.

Operating conditions in #Spain manufacturing sector improve for thirty-ninth consecutive month. #PMI at 54.8 in Feb. https://t.co/b0A6TtqiaJ

— Markit Economics (@MarkitEconomics) March 1, 2017

Italy factory activity strongest for 14 months

Italian manufacturing activity grew in February at its fastest rate for more than a year. Data from Markit showed it rose to 55.0 in February, from 53.0 in January.

#Italy manufacturing #PMI climbs to 55.0 in February, a 14-month peak. Employment growth highest since late-2000. https://t.co/rvA8Y8VhKKpic.twitter.com/qh4Mi0MdUq

— Markit Economics (@MarkitEconomics) March 1, 2017

French factory activity eases as higher prices hit demand

French manufacturing activity expanded at a slower pace in February as growth in new orders eased and firms hiked prices at the fastest rate in five and a half years. It fell to 52.2 in February from 53.6 in the previous month.

#France mfg #PMI at 52.2 in February, down from 53.6 in January. Firms increase output at fastest pace in 69 months. https://t.co/mMe37J7YCXpic.twitter.com/8Ye1ApQfvW

— Markit Economics (@MarkitEconomics) March 1, 2017

German manufacturing activity nears six-year high

German manufacturing expanded at the strongest rate in nearly six years in February. It rose to 56.8 from 56.4 in January, its highest reading since May 2011.

#Germany mfg #PMI rises to 69-month high of 56.8 in Feb. Output increase at strongest rate since Jan 2014. https://t.co/krMQhJBJ5W

— Markit Economics (@MarkitEconomics) March 1, 2017

Greek factory activity slows in February for sixth straight month

The PMI index rose to 47.7 points last month from 46.6 in January. Readings below 50 denotes a contraction in activity.

It marks the sixth straight month of contraction for Greek manufacturing activity as declining new business led to production cuts and job shedding.

#Greece manufacturing conditions deteriorate for sixth successive month. #PMI at 47.7 in Feb (46.6 in Jan). https://t.co/ZL2vEX4CU8

— Markit Economics (@MarkitEconomics) March 1, 2017

President Trump could take a backseat as Fed steals the limelight

After dominating the markets since November, Kathleen Brooks, of City Index, thinks US President Trump could now fade into the background as the focus shifts to the Fed and the prospect of rate increases.

"This opens up a range of questions for investors: can the equity market rally withstand sooner-than-expected rate hikes from the Fed? If the Fed hikes in March, will it do so again In June, or is it just one and done? Will the US Treasury be happy with a rising dollar? This is set to be an interesting month especially combined with Dutch elections and the potential triggering of Article 50 in the UK, these are the key ingredients for a spike in volatility at some stage."

Trump Congressional address: What the experts say

Here's what the experts had to say about the Trump Congressional address and the Fed policymakers, who stole the US President's limelight:

Jens Nærvig Pedersen, of Danske Bank, like most noted the failure of Trump to deliver "much new information" on his policies during his address to Congress.

"He reiterated some of the key parts of this economic programme, e.g. his plans on spending $1 trillion on public infrastructure and taxing imports. He also mentioned intensions of lowering taxes for persons and corporations. He did not provide much further details than what has already been presented. In turn, the market reaction to the speech was relatively muted."

Danske Banks notes it was the two speeches from Fed policymakers that attracted "more attention".

"Dudley (voter, dovish) said that the case for tightening has become ‘a lot more compelling’ and that the ‘risks to the outlook are now starting to tilt to the upside’. Williams (non-voter, neutral) said that he expects the Fed to consider a March hike seriously. The hawkish comments sent US rates higher and EUR/USD lower."

Not much new from Trump yesterday - instead Fed stole the limeligt raising expectations of a March hike https://t.co/7lNtGYK0zJ

— Danske Bank Research (@Danske_Research) March 1, 2017

Edward Hardy, of World First, also notes that Trump's speech was heavy on rhetoric, but light on detail.

Trump heavy on rhetoric, light on detail - World First Morning Update 01/03/17 - https://t.co/UHBduz8Kdvpic.twitter.com/Mmee8e5qlg

— World First (@World_First) March 1, 2017

Strategist Jim Reid of Deutsche Bank said Trump's address had a familiar ‘America first’ theme throughout and plenty of echoes of his inaugural address.

"However the disappointment market wise has been the lack of detail.

But there did seem to be a big effort to sound presidential."

Reid flags: "The tax subject was only really lightly touched. Trump said that his economic team is developing a “historic tax reform that will reduce the tax rate on our companies so that they can compete and thrive anywhere and with anyone” and also “at the same time provide massive tax relief for the middle class”. There was no specific mention whatsoever of the much anticipated border-adjusted tax. Another subject of much debate, bank regulation, was also avoided."

Trump speech revives campaign themes but details remain scarce & impact on markets very limited. Dollar almost unch. https://t.co/21freyEvHEpic.twitter.com/AXFMQ4WJer

— Holger Zschaepitz (@Schuldensuehner) March 1, 2017

Recent Fed rhetoric

As the Fed steals the show from Trump, here's a useful summary of recent Fed rhetoric from Natixis:

Useful summary of recent Fed rhetoric via Natixis pic.twitter.com/mtl07qQZNk

— RANsquawk (@RANsquawk) March 1, 2017

Fed officials jolt market with talk of pending rate hike

A handful of Federal Reserve policymakers yesterday jolted markets into higher expectations for a March US interest rate increase, with comments that suggested rate-setters are worried about waiting too long in the face of pending economic stimulus from Washington.

New York Fed President William Dudley said on CNN that the case for tightening monetary policy "has become a lot more compelling" since the election of President Donald Trump and a Republican-controlled Congress.

John Williams, president of the San Francisco Fed, said that with the economy at full employment, inflation headed higher, and upside risks from potential tax cuts waiting in the wings, "I personally don’t see any need to delay" raising rates.

"In my view, a rate increase is very much on the table for serious consideration at our March meeting."

In remarks to a joint session of Congress, Trump offered little detail about planned tax cuts or new infrastructure spending beyond the broad strokes he offered during the election campaign -- leaving policymakers with little to add to their analysis.

#Fed stole show in markets. Odds of March US hike jumped to 80% after hawkish Dudley interview on CNN. Says 'fairly soon' means near future. pic.twitter.com/BtCVG0c9gj

— Holger Zschaepitz (@Schuldensuehner) March 1, 2017

Williams, unlike Dudley, is not a voter this year on policy, but his views are seen as influential among his colleagues.

The comments sparked a flurry of selling in the bond market, with the two-year Treasury yield jumping to its highest level since December.

Interest rate futures implied traders saw a nearly a 57pc chance the Fed would raise rates at its March 14-15 meeting, up from roughly 31pc late on Monday, and around 20pc a week ago, according to Reuters data.

Keep an eye on this. US yield curve flattens sharply - now flattest since US election - as soaring March Fed hike not matched by long end. pic.twitter.com/jTJQuDBeyi

— Jamie McGeever (@ReutersJamie) March 1, 2017

Market expectations are likely to be shaped further this week when Fed Gov. Lael Brainard speaks on Wednesday in Boston and when Fed Chair Janet Yellen updates her views on the economy in a Chicago address on Friday. The Fed's next meeting is in two weeks.

Report from Reuters

European bourses bounce on Trump infrastructure spending pledge and upbeat results

European bourses bounced this morning as basic resources rallied after Trump pledged $1 trillion of infrastructure spending in his first speech to Congress. Upbeat results also lifted European shares.

Here's a snapshot of the current state of play:

Mike van Dulken, of Accendo Markets, said: "Calls for a positive open come thanks to US President Trump’s overnight Congressional address offering a less divisive and more optimistic outlook to his inauguration speech. While typically long on rhetoric, and perhaps lacking the policy detail markets craved, he offered just enough to keep bulls happy by reiterating pledges for $1 trillion infrastructure spend and $54bn defense boost.

"Sentiment buoyed further by hawkish comment from the Fed’s Dudleytalking up a March rate hike and thus sending USD higher and both GBP and EUR lower to boost optimism in the FTSE and DAX. Add to this solid China PMI Manufacturing and an Aussie GDP beat and metals prices are higher despite dollar strength."

Donald Trump hails 'new chapter of American greatness' in Congress speech - but hints at softening on immigration policy

Here's our full report on Trump's Congressional address by Chris Graham:

Heralding a "new chapter of American greatness," President Donald Trump delivered a more optimistic and presidential tone as he addressed Congress for the first time on Tuesday night.

In an appeal to American optimism, Mr Trump declared, "The time for small thinking is over." Still, he employed dark language to describe the threat posed by "radical Islamic terrorism" - a term his own national security adviser rejects as inflammatory - and warned against "reckless" and "uncontrolled entry" of refugees and immigrants from countries with ties to extremist groups.

At the #JointSession Trump says "The time for small thinking is over, the time for trivial fights is behind us" https://t.co/fZHlqsaxngpic.twitter.com/6kEw2XDcNk

— BBC News (World) (@BBCWorld) March 1, 2017

Mr Trump's overall message on immigration, one of his signature campaign issues, was unexpectedly mixed. He said he believed "real and positive immigration reform is possible" and had suggested to news anchors earlier that he was open to legislation that could provide a pathway to legal status for some of the millions of people living in the US illegally.

Trump #JointSession: My job is not to represent the world. My job is to represent the United States of America https://t.co/nIl8iuy7rEpic.twitter.com/MtAiXfYwd4

— BBC News (World) (@BBCWorld) March 1, 2017

In his hour-long address, Mr Trump defended his early actions in office and ignored the missteps that have set even his allies in Washington on edge. He outlined a populist agenda centred on promises to compel companies to bring manufacturing jobs back to the US. He was unusually measured and embraced the pomp and tradition of a presidential address to Congress.

Agenda: Markets digest Trump Congressional address; Investors eye manufacturing data

Good morning and welcome to our live markets coverage.

There's plenty markets to digest this morning.

Last night, the Dow Jones snapped its 12-day streak of record losses before US President Donald Trump's Congressional address.

Tax higlighted Trump speech last night. Not much new details on #trumponomics though. https://t.co/UAsqc6W803pic.twitter.com/lsG2hxBDd3

— Danske Bank Research (@Danske_Research) March 1, 2017

During his address, Trump offered few details on his plans for infrastructure spending and tax reform. He pledged to overhaul the immigration system, improve jobs and wages for Americans and promised "massive" tax relief to the middle class and tax cuts for companies, but offered few clues on how they would be achieved.

����Not much new about #Trumponomics in Trump's speech - just a repetition of old pledges. #JointAddress

— Danske Bank Research (@Danske_Research) March 1, 2017

Meanwhile, the dollar enjoyed a boost on growing expectations of a rate hike this month. Yesterday, New York Fed President William Dudley said that the case for tightening monetary policy "has become a lot more compelling", while San Francisco Fed President John Williamssaid that a rate increase was very much on the table for serious consideration at the March meeting given full employment and accelerating inflation.

Fed stole show in mkts, just hours before Trump speech to Congress. Odds of a March hike jumped to 72% after hawkish Dudley interview on CNN pic.twitter.com/VzIwkDtwP6

— Holger Zschaepitz (@Schuldensuehner) February 28, 2017

So a March hike is now a 86.5% probability. (43% this time last week). Does the #Fed have any choice but to raise rates. pic.twitter.com/kLDtgxBlau

— Guy Johnson (@GuyJohnsonTV) March 1, 2017

Elsewhere, later this morning, we get manufacturing figures for the UK, eurozone and US.

Also on the agenda:

Full-year results: Carillion, Bank of Cyprus, Fisher (James) & Sons, BBA Aviation, International Personal Finance, Inchcape, ITV, Evraz, Admiral Group, Elementis, Man Group, Empresaria Group, Livanova, Riverstone Energy

Economics: BRC shop price index y/y (UK), net lending to individuals m/m (UK), M4 money supply m/m (UK), manufacturing PMI (UK), mortgage approvals (UK), personal income m/m (US), personal spending m/m (US), final manufacturing PMI (US), ISM manufacturing PMI (US), IBD/TIPP economic optimism (US), construction spending m/m (US), Beige book (US), final manufacturing PMI (EU), final manufacturing PMI (GER), unemployment change (GER)

European opening update courtesy of CMC MARKETS - FTSE +21, DAX +33, CAC +17 at 6.16am - slightly more upbeat

— David Buik (@truemagic68) March 1, 2017

Yahoo Finance

Yahoo Finance