FTSE 100 closes above 7,500 for first time ever after UK inflation jumps to highest level since 2013

Britain’s benchmark index broke through 7,500 for the first time in its 33-year history as global fund managers warned stocks are the most overvalued since the dotcom bubble.

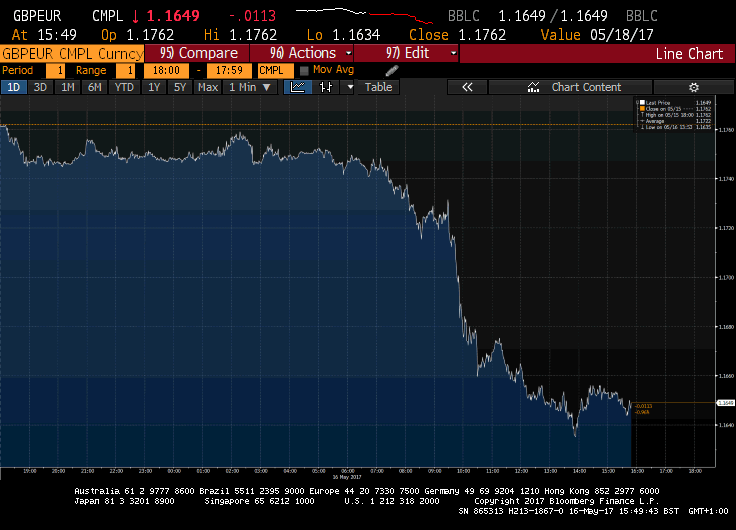

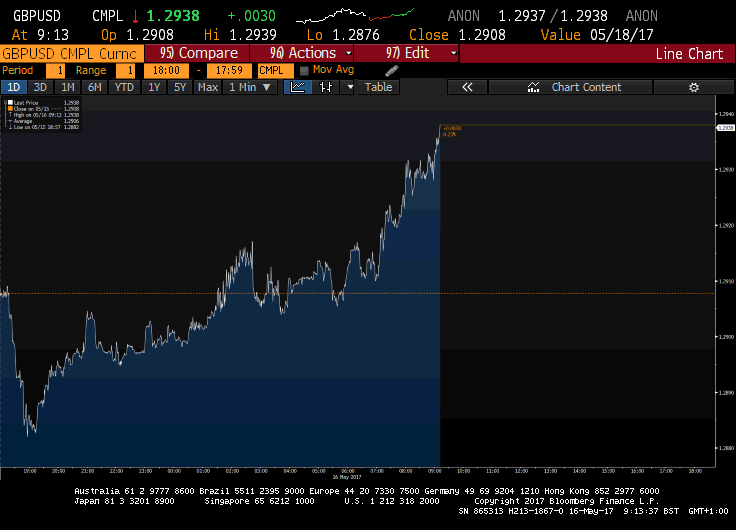

The FTSE 100 set yet another new high for a second successive trading session, closing 67.66 points, or 0.91pc, higher at 7,522.03, buoyed by pound weakness following strong UK inflation numbers. Inflation surged 2.7pc inflation causing the pound to fall back below $1.29 against the US, while it hit a one-and-a-half month low against a resurgent euro.

Jasper Lawler, of London Capital Group, said: “Rising inflation tends to make stocks relatively more attractive to bonds, which could make the next big hurdle for the FTSE of 8,000 more achievable.”

It took the blue chip index 17 years to climb from 6,000 to 7,000 points, from March 1998 to March 2015, although it flirted with the landmark 7,000 level in December 1999. However, its latest 500 point breakthrough comes just two years after it first touched 7,000 in 2015.

UK small-caps also eked out a fresh lifetime high, climbing by as much as 0.27pc to 5,645.01. The index is now up 9.5pc so far this year, compared to the FTSE 100 which has risen 4.4pc.

Global equities also touched fresh peaks. The MSCI World Index, a gauge of global stocks, made gains of 0.27pc, while the German DAX also set a new record high. On Wall Street, the S&P 50 and Nasdaq Composite scaled new peaks but later retreated to trade slightly negative amid worries over US President Donald Trump and his disclosure of information to Russian officials.

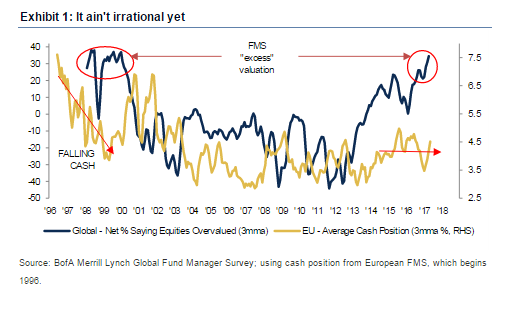

However, as stocks continued their dizzying ascent worldwide, a closely followed monthly survey of investors found stocks are the most expensive since January 2000.

After polling 213 investors managing $654bn in assets earlier this month, Bank of America Merrill Lynch found that the proportion of portfolio managers who think equities are overvalued rose to 37pc in May, up from 32pc in the previous month.

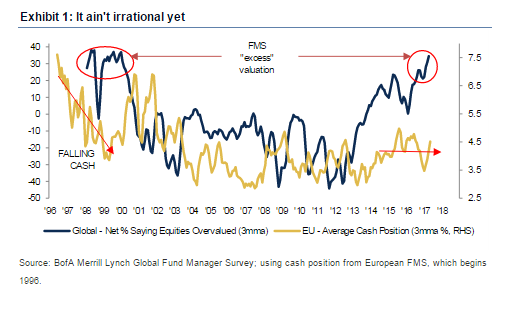

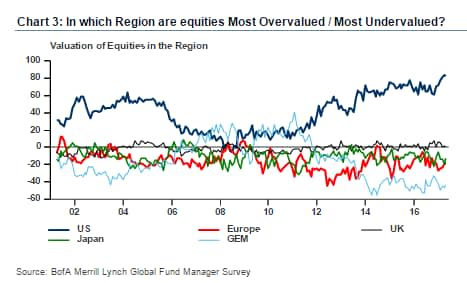

However, the perception across regions differed. The consensus views US equities as by far the most overvalued globally, the investment bank revealed, with some 82pc saying they are overvalued.

Meanwhile, 20pc of fund managers think European shares are undervalued.

The bank’s chief investment strategist Michael Hartnett said: “Investor sentiment is bullish.”

However, attempting to assuage fears that stocks are overvalued, he added: “Irrationality is not yet visible despite all-time highs in credit and equity markets, robust global earnings per share and a benign French election result.”

Allocation to European equities surged to its highest level since March 2015, its third highest level on record, the bank found, as global fund managers continued to pile into eurozone equities. Banking and technology stocks were among the most popular sectors in Europe.

However, Ronan Carr, European equity strategist at Bank of America Merrill Lynch cautioned: “The recent outperformance in European shares seems due for a pause, especially versus the US.”

Other highlights:

World stocks scale new peaks; FTSE 100 and DAX touch fresh highs

Euro breaks $1.10 against US dollar for first time since November

Pound hits seven-week low against resurgent euro

UK inflation tops expectations, hits 2.7pc in April

Market report: Global fund managers see stocks as most 'overvalued' since dotcom bubble

Global fund managers think stocks are the most overvalued since the dotcom bubble, a closely followed monthly survey of investors around the world has revealed, as Britain’s benchmark index closed above 7,500 for the first time ever.

The proportion of portfolio managers who regard equities as overvalued rose to 37pc this month, marking its highest level since January 2000, Bank of America Merrill Lynch found, after polling 213 investors managing $654bn in assets last week.

However, the perception differs across regions. Some 82pc of fund managers think US equities are expensive, while 20pc believe European shares are undervalued.

Chief investment strategist Michael Hartnett said: “Investor sentiment is bullish. But irrationality is not yet visible despite all-time highs in credit and equity markets, robust global EPS and a benign French election result.”

Despite mounting concerns shares are overvalued, bulls remained in control as the MSCI World Index, a gauge of global stocks, the German DAX, FTSE 100, Nasdaq and S&P 500 all set new intraday highs.

In London, the FTSE 100 broker the 7,500 barrier for the first time ever, closing up 67.66 points, or 0.91pc, at 7,522.03, as the pound weakened after data from the Office for National Statistics showed that UK inflation jumped 2.7pc in April.

Gains were broad-based. Diageo climbed 46p to £23.28, British American Tobacco added 111p to £55.05 and Reckitt Benckiser rose 153p to £75.16.

Meanwhile, an upbeat outlook lifted Vodafone to the top of the blue chip index, up 8.4p, or 4pc, to 219.5p. The group forecast a jump in cash flow this year after a tough 2016.

Experian climbed 26p to £17.05 on a price target upgrade by Barclays, while BAE Systems advanced 7.5p to 643p after Natixis hiked its price target to 604p from 550p.

On the other side, Hargreaves Lansdown was hurt by exchange-traded fund provider Vanguard’s plans to sell direct to investors in Europe for the first time. Shares tumbled 123p to £13.24.

Low-cost carrier easyJet lost altitude, down 95p to £12.15, after it reported a bigger-than-expected half-year loss of £212m.

Elsewhere, utilities companies came under pressure as Deutsche Bank cut their ratings to “hold” as it believes that the 2019 price review, which sets prices over 2020-25, will come into focus by the end of the year.

Analyst James Brand said: “ Given that current regulation looks generous we forecast that returns will be cut back meaningfully and expect this to become clearer when OFWAT publishes its final framework proposals in December 2017.” Shares in United Utilities fell 15p to £10.11 and and Severn Trent dropped 36p to £23.93.

Away from the blue chips, Berenberg began covering Countryside Properties with a “buy” rating, lifting the mid-cap stock to an 11-month high of 291.9p, up 14p on the day. Ahead of tomorrow's half-year results, analysts said they expect management to report new medium-term target. The broker also believes the stock’s current valuation is “undemanding” and trades at an “unjustified discount” as it sees “significant” growth potential in the housebuilding and partnerships divisions.

Its peer Crest Nicholson surrendered 16.5p to 620p after it said the price of its homes rose 12pc to an average of £418,000 in the six months to April 30.

Meanwhile, healthcare group BTG drifted 49p lower to 673p as it forecast slower-than-expected growth in its interventional medicine business.

Finally, Aim-listed precious metals explorer Greatland Gold bounced 17.2pc after it signed a deal with New York-listed giant Newmont Mining, granting it access to its Ernest Giles project in Western Australia.

On that note, it's time to close for today. I'll be back again tomorrow from 8.30am.

FTSE 100 closes above 7,500 for first time ever

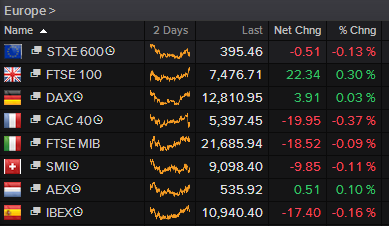

The FTSE 100 closed above the 7,500 level for the first time ever, thanks to broad-based gains from dollar-earners. European shares, meanwhile, were mixed by close of play as investors digested disappointed earnings update.

Here's the provisional closes:

FTSE 100: +0.91pc

DAX: -0.03pc

CAC 40: -0.21pc

IBEX: +0.17pc

Euro Stoxx 600: +0.01pc

Jasper Lawler, of London Capital Group, said: "The UK stock market reached a new milestone today when the FTSE 100 hit 7500 for the first time. Investors seem to be feeling confident about the outlook for Britain under what is expected to be the biggest Conservative party majority since Margaret Thatcher. On Tuesday The Labour Party released its manifesto with the slogan ‘For the many not the few’.

"Data from the ONS showed price inflation in the UK at its strongest since 2013. Rising inflation tends to make stocks relatively more attractive to bonds, which could make the next big hurdle for the FTSE of 8000 more achievable."

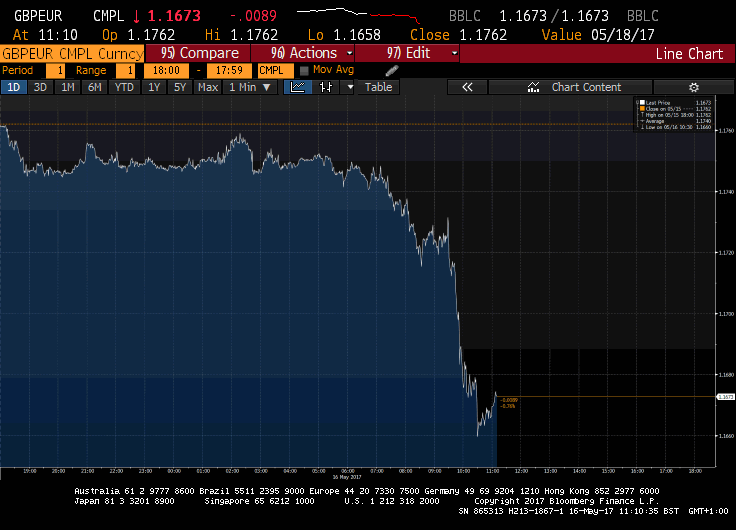

Pound skids to seven-week low against resurgent euro

The pound has now extended its losses and is trading at a seven-week low against the resurgent euro.

It is now down 1pc on the day at €1.1646. Earlier today, data from the ONS showed that inflation rose by more than expected to 2.7pc in April.

Activist Elliott attacks BHP Billiton's 'do nothing' approach

Shares in BHP Billiton have climbed 1.5pc today despite activist investor Elliott attacking its 'do nothing' approach. Sam Dean reports:

Activist investor Elliott Advisors has called for an independent review of BHP Billiton’s petroleum business as it continues its campaign to make sweeping changes to the world’s biggest mining company.

In an open letter to BHP management outlining its revised proposal, Elliott said there is “extremely broad and deep-rooted shareholder support” for an independent review of the petroleum arm of the company.

Elliott has complained of BHP’s “chronic underperformance” since it began its assault earlier this year, but has rowed back on earlier calls for the mining giant to have its main listing in London.

“Under Elliott’s revised proposal, BHP would stay incorporated in Australia, Australian headquartered and Australian tax resident, retaining full ASX and LSE listings, with ordinary shares listed on the ASX,” Elliott said.

Elliott, which holds a 4.1pc stake in BHP’s London listing, began its offensive in April when it unveiled proposals it claimed would unlock up to $46bn (£35bn) in value.

BoAML: Percentage of fund managers saying stocks are overvalued at highest level since tech bubble

According to this month's Bank of America Merrill Lynch fund manager survey, 37pc of fund managers think equities are overvalued, the highest level since January 2000.

World stocks at new highs, %age of fund managers saying stocks overvalued is highest since tech bubble.

But "it ain't irrational yet" -BAML pic.twitter.com/QFicLeFlsE— Jamie McGeever (@ReutersJamie) May 16, 2017

S&P 500 and Nasdaq open at fresh record highs

Boom! The S&P 500 and the Nasdaq have opened at record highs this afternoon.

At the opening bell:

Dow Jones: +0.15pc

Nasdaq: +0.13pc

S&P 500: +0.1pc

US factory output posts fastest growth in three years

Over in the US, factory output in April rose at its fastest pace in three years, supported by a surge in car production.

The Fed said manufacturing production rose by 1pc last month, beating forecasts and its biggest gain since February 2014.

Strong US Ind/Manuf production data

— Mike van Dulken (@Accendo_Mike) May 16, 2017

Boost for Brexit free trade deal chances after landmark EU court ruling

Our Europe Editor Peter Foster has the latest on the landmark EU court ruling:

Britain’s ambition to sign a quick Free Trade Agreement with the European Union after Brexit has received a significant boost after a landmark ruling by the European Court of Justice handed expanded trade negotiation powers to Brussels.

The much-anticipated decision from the court in Luxembourgsurprised experts by ruling that on key areas - including financial services and transport - the European Union does not need to seek ratification of a trade deal by the EU’s 38 national and local parliaments.

Trade experts said the ECJ ruling could substantially reduce the risk of any future EU-UK free trade agreement getting bogged down in the EU national parliaments, opening the way for an FTA to be agreed by a qualified majority vote of EU member states.

“The Court of justice says all services - even transport - can be ratified by a qualified majority vote, which is potentially quite a big opening for the UK,” said Steve Peers, professor of EU law at Essex University. “It could certainly make things easier.”

Euro surges to six-month high as Trump worries hit dollar

The euro is trading at its highest level since November 9 (when Donald Trump won the US presidential election) as the dollar continues to weaken amid worries over Trump and his disclosure of information to Russia officials.

The US president took to Twitter earlier today:

As President I wanted to share with Russia (at an openly scheduled W.H. meeting) which I have the absolute right to do, facts pertaining....

— Donald J. Trump (@realDonaldTrump) May 16, 2017

...to terrorism and airline flight safety. Humanitarian reasons, plus I want Russia to greatly step up their fight against ISIS & terrorism.

— Donald J. Trump (@realDonaldTrump) May 16, 2017

I have been asking Director Comey & others, from the beginning of my administration, to find the LEAKERS in the intelligence community.....

— Donald J. Trump (@realDonaldTrump) May 16, 2017

This political turmoil is weighing heavily on the dollar, sending it to six-month lows in intraday trade.

Speaking to Reuters RBC Capital Markets currency strategist Adam Cole said:

"(The story about Trump and Russia) probably is playing out as a weaker dollar on the view that Trump may not be around long enough to deliver his tax reform, which is at least partially priced into the dollar."

The euro charged to $1.1066, its highest level since November 9 in intraday trade.

BoAML: Allocation to eurozone equities hits two-year high

Allocation to eurozone equities hit their highest level in more than two years, a closely-followed monthly survey of investors around the world has revealed.

The proportion of portfolio managers who were overweight eurozone equities rose to 59pc in May, up from 48pc in the previous month, Bank of America Merrill Lynch found, after polling 213 investors managing $654bn in assets earlier this month.

Eurozone trade has become crowded: Allocation to Eurozone stocks surges to highest since Mar15 & 3rd highest on record (net 59% OW) (BofAML) pic.twitter.com/1Ux1h7I2g6

— Holger Zschaepitz (@Schuldensuehner) May 16, 2017

Strategists at the bank said: "European equities seem due a pause therefore (especially vs the US). Note Europe has strong EPS fundamentals - unlike in 2015 when a bigger rally was built more on hope."

The US investment bank also found that global risk appetite remains robust, as allocation to equities across the globe rose this month.

However, global fund managers regard equities as expensive - a net 37pc of respondents think global equities are overvalued, which is the highest since January 2000.

The perception of different regions varies. The consensus views US equities as being by far the most overvalued globally, with net 82pc saying they are overvalued. Net 20pc believe European equities are undervalued, while net 43pc say GEM equities are undervalued.

BoAML also found that global reacceleration is seen as the most important source of Eurozone economic growth, according to 34pc of European fund managers. 20-22pccite improving capex or consumer spending.

US stocks set to open little changed

Expect little change from US indices at the opening bell, after the S&P 500 and Nasdaq closed at record highs yesterday thanks to a bounce in oil prices.

As the first-quarter earnings season comes to an end, investors will turn their attention back to Trump's ability to deliver his promised growth strategies.

Here are the US opening calls courtesy of IG:

US Opening Calls:#DOW 21002 +0.11%#SPX 2402 0.00%#NASDAQ 5705 +0.08%#IGOpeningCall

— IGSquawk (@IGSquawk) May 16, 2017

easyJet skids on runway after suffering first-half loss in spite of record passenger numbers

Shares in easyJet have tumbled to the bottom of the blue chip index, down 5.8pc to £12.34, after it reported a better-than-expected half-year loss. Bradley Gerrard reports:

Budget airline easyJet has tried to calm investors over its first half losses by saying competitors in some of its key markets are retrenching and that it is continuing to attract customers.

The Luton-based carrier said its plan to maintain investment in the business had helped it defend its position in some of the company’s most treasured markets and expected this to continue. Nevertheless, its shares fell more than 5pc in early trading to £12.40.

EasyJet said there was “evidence that key competitors are reducing capacity plans”. These rivals include Alitalia, Air Berlin, Vueling and Norwegian. This trend could benefit easyJet's financial performance in the coming years.

The comments came as the airline suffered a pre-tax loss of £236m, a performance exacerbated by the fact the Easter holidays did not fall in the six months under review but did in the same period last year and a negative foreign exchange hit of £82m. The latter factor was caused by the pound’s fall against the euro and dollar, which makes costs in those currencies greater in sterling.

Half-time update: FTSE 100 continues to scale new peaks as European shares dip

The FTSE 100 stormed to new heights today as the pound extended its losses against the dollar following a surge in UK inflation in April. Vodafone also lifted the blue chip index after it promised higher dividends as it forecast a jump in cash generation.

Elsewhere, in Europe, after hitting a fresh record high, the DAX retreated joining its peers in the red following disappointing earnings updates in the region.

Here's a look at the state of play in Europe shortly after midday:

FTSE 100: +0.59pc

DAX: -0.08pc

CAC 40: -0.34pc

IBEX: +0.12pc

Euro Stoxx 600: -0.23pc

Mike van Dulken, of Accendo Markets, said: "Equity indices are mixed again this morning with the UK's FTSE the standout performer. This is thanks to GBP giving up all of this week's strength as UK inflation at a 3.5yr high is seen squeezing UK consumers even more, although UK-focused banks welcome the news. Vodafone results have also been well-received and Oil holding its recent rebound is supporting Energy. Disappointments today include results from easyJet and DCC while metals prices are weaker on revived China concerns, hampering Miners, and Hargreaves faces more competition.

"Germany's DAX is held back at break -even by EUR strength and declines for BMW, BASF, Continental and Fresenius while US Dow Jones futures tread water. The FTSE 100 has cracked 7500, completing one bullish flag and potentially in the midst of another. The DAX 30 is hovering at 12800, still in an uptrend trying to challenge recent highs."

Eurozone GDP rises 0.5pc in the first quarter

Away from the UK, economic growth in the eurozone rose as expected in the first three months of hte year.

A flash estimate from the EU's statistics office Eurostat showed first quarter GDP rise 0.5pc quarter-on-quarter.

Compared with the same quarter of the previous year, seasonally adjusted GDP rose by 1.7pc in the euro area and by 2.0pc in the EU28 in the first quarter of 2017, after +1.8pc and +1.9pc respectively in the previous quarter.

Euro area GDP +0.5% in Q1 2017 (EU 0.5%), +1.7% compared with Q1 2016: flash estimate from #Eurostathttps://t.co/HkhXEpdlrKpic.twitter.com/IOtvLFKnj6

— EU_Eurostat (@EU_Eurostat) May 16, 2017

FTSE 100 smashes 7,500 for first time ever

The FTSE 100 extended its gains in mid-morning trading, smashing the 7,500 level for the first time ever, buoyed by sterling weakness and a leg-up in Vodafone, which rallied after it forecast earnings growth ahead.

Michael Hewson, of CMC Markets, said: "Vodafone are in demand this morning despite reregistering a €6.1bn annual loss. The telecoms company wrote-off a large loss in its Indian operation but traders focused on the increased dividend and rosy outlook for next year."

The blue chip index touched a high of 7,505.46, before easing back to 7,496.45, up 0.56pc on the day.

Boom! https://t.co/wQSKO1YuPP

— Mike van Dulken (@Accendo_Mike) May 16, 2017

UK inflation figures – Groundhog Day?

Ben Brettell, Senior Economist, Hargreaves Lansdown, says today’s inflation bulletin from the ONS feels somewhat like "Groundhog Day, as the fall in sterling continues to make its way through to the high street, and higher oil prices continue to push inflation up globally".

Ed Hutchings, UK Sovereign Fund Manager, Aviva Investors, said the inflation numbers continue to be at odds with the wage data which remains broadly muted and is expected to remain such until the cloud of Brexit uncertainty is lifted.

He added: "For now and the remainder of 2017, it is likely the consumer will be squeezed further and with the potential for growth to slow further into the year to below the Bank of England’s forecasts, the MPC will no doubt continue to be cautious in how they proceed going forward.”

Pound hits five-week low against resurgent euro

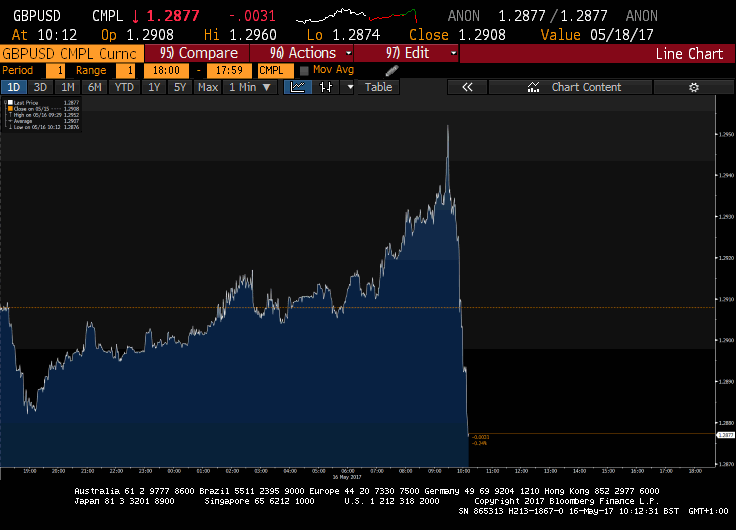

Sterling sank in morning trade as speculative investors slashed bets against the euro and traders sold hard into a bounce above $1.2950 that followed strong inflation numbers.

The pound hit an almost one-week high against the dollar immediately after the data showed inflation rose more than expected, to 2.7pc, in April, adding to headaches for Bank of England policymakers who have so far looked through this year's pick-up in price pressures bounce and kept interest rates steady.

Traders said its more than half-cent fall thereafter reflected a conviction in the market that sterling will struggle to top $1.30 this year given the scale of concern over Brexit negotiations with the European Union.

Investors have also tended to read the rise in inflation as purely the consequence of the pound's falls since last June's referendum vote to leave the bloc, and more likely to weigh on consumer sentiment than spur a rise in official BoE rates.

Report from Reuters

UK inflation not enough for the pound

Kathleen Brooks, of City Index, explains why the pound went into reverse following its immediate pop after UK inflation topped forecasts:

"A rise in prices for April was expected after the Bank of England brought forward its expected peak for CPI to the end of this year in last week’s Inflation Report.

"Thus, larger increases in CPI now may mean that price increases will be subdued in the summer months.

"This is one reason why the pound has been kept in check."

There's also another reason, she says. "Today is the euro's time to shine, after it broke $1.10 against the US dollar."

"This is helping to lift EUR/GBP, which is above 0.8850, and is also adding to the downward pressure on the cable rate. We will have to see if UK wage data and retail sales later this week can be enough to drive GBP/USD above 1.30, for now there is a shyness ahead of this level."

The pound is currently trading down 0.17pc against the US dollar at $1.2886.

Inflation figures confirm UK has entered a new pay squeeze

CPIH inflation up to 2.6%. Highest in four years. Confirmation that we've entered a new pay squeeze, with the real value of wages falling pic.twitter.com/XnNIMbYD9O

— Matt Whittaker (@MattWhittakerRF) May 16, 2017

Britain cannot afford another real wages slump, warns TUC

Commenting on the latest inflation figures, TUC General Secretary Frances O’Grady said:

“The last thing Britain needs is another real wage slump. But rising prices are hammering pay packets.

“Working people are still £20 a week worse off, on average, than they were before the crash. That’s why living standards must be a key battleground at this election.

“All the parties need to explain how they’ll create better paid jobs, especially in the parts of the UK that need them most.

“And there needs to be a recognition across the political spectrum of the damage pay restrictions in the public sector are doing. Nurses shouldn’t have to use food banks to get by.”

NEW RF pay projection following today's inflation figures. Real pay on course to fall by between -0.3% and -0.6% in three months to April pic.twitter.com/3CZ5H8F1JU

— ResolutionFoundation (@resfoundation) May 16, 2017

Experts react after UK inflation soars 2.7pc in April

Here's what the experts had to say after UK inflation soared 2.7pc in April:

Jeremy Cook, chief economist at World First

“New month, new highs in CPI and RPI and pressures on the pockets of the UK populace,"Mr Cook said.

"Bank of England Governor Carney warned of challenging times last week and our belief is that the UK economy will eventually see inflation above 3pc by the end of this year, certainly should the rally in the pound since the announcement of a general election fizzles out. No politician can tell you how much Brexit will cost but the man on the street is already paying.”

“As we have been saying for months now the true articulation of the impact of a rise in inflation will be borne out by the wage numbers due tomorrow morning but reports this morning that the latest CIPD/Adecco Group Labour Market Outlook survey shows that workers in the UK are in for further pain with employers only expecting to award median pay rises of just 1pc over the next year ahead.”

Inflation has risen everywhere, but more in the UK. That's the #Brexit effect (about 1pp so far) pic.twitter.com/mRFz75MueZ

— Chris Giles (@ChrisGiles_) May 16, 2017

Maike Currie, investment director for personal investing at Fidelity International

Currie blamed the 'Easter-effect' for the jump in inflation.

"The Brexit-hit pound pushing up import prices, a rise in the cost of clothing and electricity along with the so-called ‘Easter effect’ - the fact that the Easter holiday fell later this year contributing to a rise in air fares, have all contributed to the significant uptick in prices.

“Inflation is a ‘Jekyll and Hyde’ character - while it may be good news for borrowers, as it erodes the value of their debts, it has detrimental implications for savers, investors and retirees, chipping away at the value of future interest and dividend payments and eroding the worth of their original capital. Once pricing pressures become entrenched, consumers’ feel the pain, businesses don’t invest and the stock market gets worried."

#UK: Higher inflation & subdued nominal wage growth => pay squeeze! Slower private consumption growth going forward #GE2017#Brexitpic.twitter.com/VXCNBW67q7

— Danske Bank Research (@Danske_Research) May 16, 2017

Samuel Tombs, Pantheon Macroeconomics

Mr Tombs highlights that the jump in inflation is not just an Easter timing boost.

He said: "April’s pickup in inflation reflects more than just a temporary boost from the later timing of Easter this year compared to last. (Easter Sunday fell on April 16 this year, but on March 27 last year.) Airline fares inflation recovered to 6.8pc in April, from -22.8pc in March, because an Easter-boosted level of prices in April 2017 was compared to a “normal” level of prices in April 2016. The jump in airline fares inflation, however, accounted for only half of the rise in the headline inflation rate.

"The contribution of electricity and natural gas prices to inflation rose by 0.07 percentage points as two suppliers hiked prices. Core goods inflation increased to 1.4pc, from 1.3pc in March, boosting CPI inflation by 0.03pp, as more retailers hiked prices to account for sterling’s depreciation. Higher import prices also drove up food inflation to 1.5pc from 1.2pc. Reforms to Vehicle Excise Duty in April, which have increased the cost of most new car purchases, also contributed to the pickup in the headline rate. "

April's jump in CPI inflation wasn't just due to an Easter boost to airfares. Core goods, food & utility bills also played a role: pic.twitter.com/Und2eaW1gg

— Samuel Tombs (@samueltombs) May 16, 2017

Ian Kernohan, economist at Royal London Asset Management

Mr Kernohan highlights that wages are "still sluggish" despite the sharp fall in unemployment.

UK CPI & PPI output prices ahead of expectations, PPI input price inflation *may* have peaked. But still a lot of feed through to come.

— Duncan Weldon (@DuncanWeldon) May 16, 2017

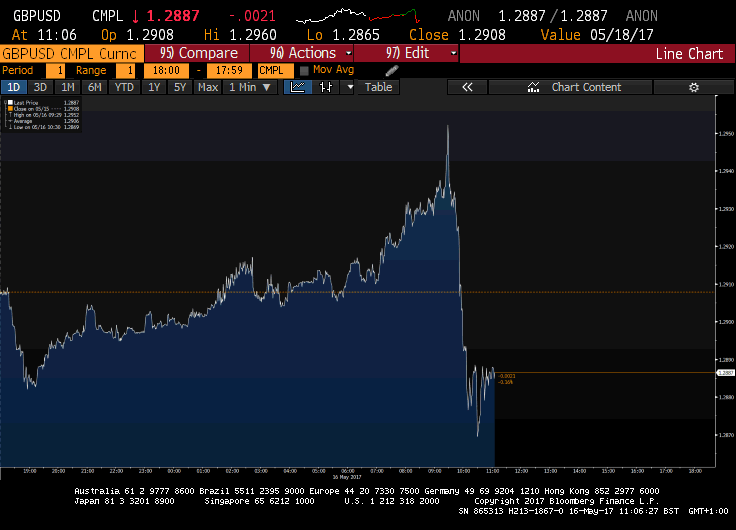

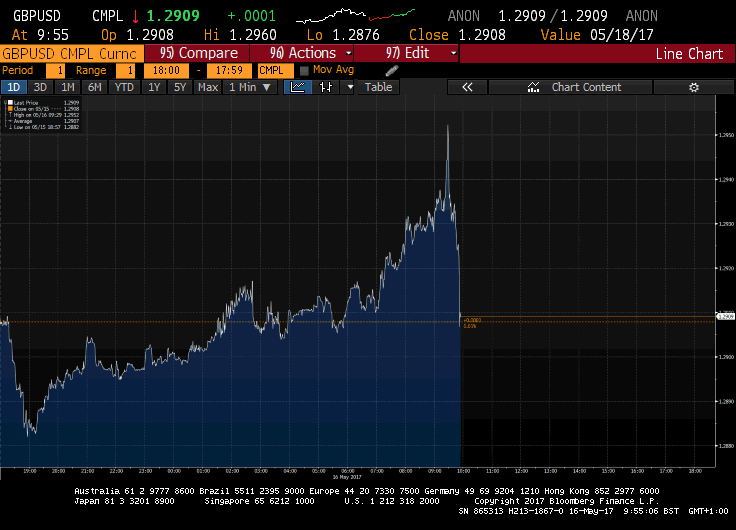

Pound turns negative on the day after UK inflation data

The small pop in the pound after UK inflation topped forecasts was short-lived, as the local currency skidded into negative territory.

The pound hit an almost one-week high against the US dollar of $1.2958, but it is now trading down 0.24pc on the day at $1.2876.

Squeeze on earnings & living standards tightens as UK inflation rises

Jamie McGeever, of Reuters, points out as UK inflation rises, the squeeze on earnings & living standards tightens.

As UK inflation rises, the squeeze on earnings & living standards tightens. Real wages falling again, and likely to fall further this year. pic.twitter.com/GQsYy6K5Mi

— Jamie McGeever (@ReutersJamie) May 16, 2017

UK inflation jumps to 2.7pc in April

Here's our full report by our economics correspondent Szu Ping Chan on inflation:

A jump in air fares over Easter, higher clothing prices and increases in road tax pushed inflation to a three and a half year high last month, according to official figures.

Prices, as measured by the consumer prices index (CPI), rose by 2.7pc in the year to April, up from 2.3pc in March.

This was the third straight month that inflation has been above the Bank of England's 2pc target, and was slightly above economists' expectations of a rise to 2.6pc.

It is the joint-highest rate since July 2013, when inflation stood at 2.8pc.

UK May CPI inflation 2.7%y/y. Easter air fares, vehicle excise duty, clothes & electricity bills. Producer price inflation eased to 16.6%y/y pic.twitter.com/4KbkJBqJWZ

— Rupert Seggins (@Rupert_Seggins) May 16, 2017

The Office for National Statistics (ONS) said the increase was driven by a a jump in air fares last month.

The spike was attributed to the late timing of Easter this year, which fell in April compared with March in 2016, pushing up prices ahead of the school holidays.

Changes to Vehicle Excise Duty (VED) introduced at the start of April also pushed up the headline rate, according to the ONS, as well as price increases by two of the "Big Six" energy companies.

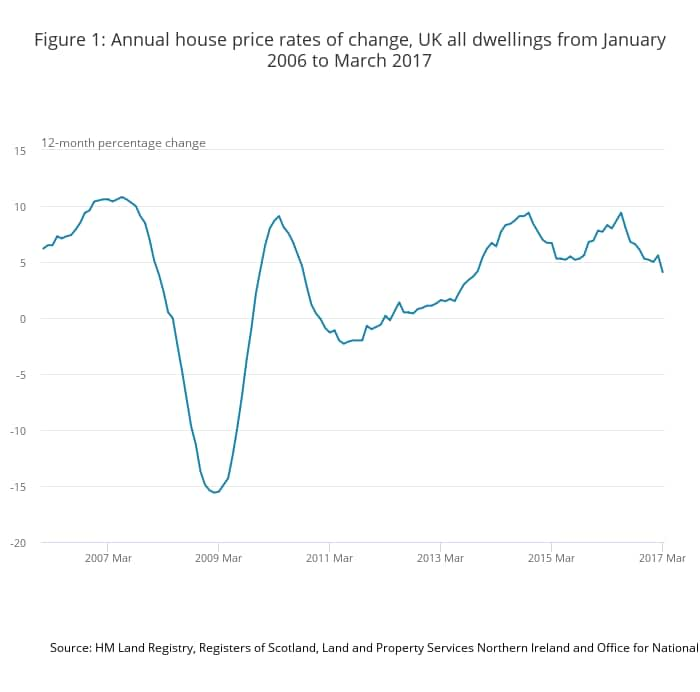

House prices in March rose at their weakest rate since October 2013

House prices in March rose at their weakest rate since October 2013, up 4.1pc on the year, data from the Office for National Statistics showed this morning.

The average UK house price was £216,000 in March 2017. This is £9,000 higher than in March 2016 and £1,000 lower than last month.

Figure 1: Annual house price rates of change, UK all dwellings from January 2006 to March 2017

Factory output prices increased 3.6pc in April

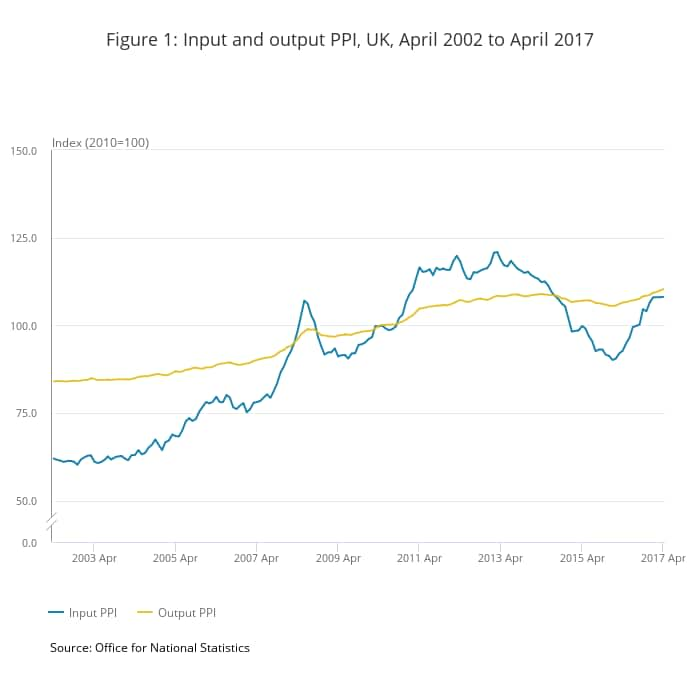

In separate data released from the Office for National Statistics this morning:

Services prices - which the BoE view as a guide to domestic inflation pressures - rose by 3pc, marking its biggest jump since September 2013, though this was affected by higher air fares;

Factory output prices - a guide to future consumer price pressures - increased 3.6pc, unchanged from the previous month and above forecasts of an annual increase of 3.4pc;

Prices paid by factories for materials and energy rose at the weakest annual pace since November, up 16.6pc.

Markets react to UK inflation data: Pound quickly surrenders gains

Here's a look at how markets digested the inflation figures:

Pound hit an almost one-week high against the US dollar of $1.2958 in the immediate aftermath of the data release, before quickly falling back to levels seen in the hour before the data. It currently trades at $1.2905,down 0.03pc on the day.

Gilt futures also dipped more than 10 ticks after the data pointing to a small rise in expectations for future bond yields.

The FTSE 100 continues to trade at record highs, up 0.31pc at 7,478.75.

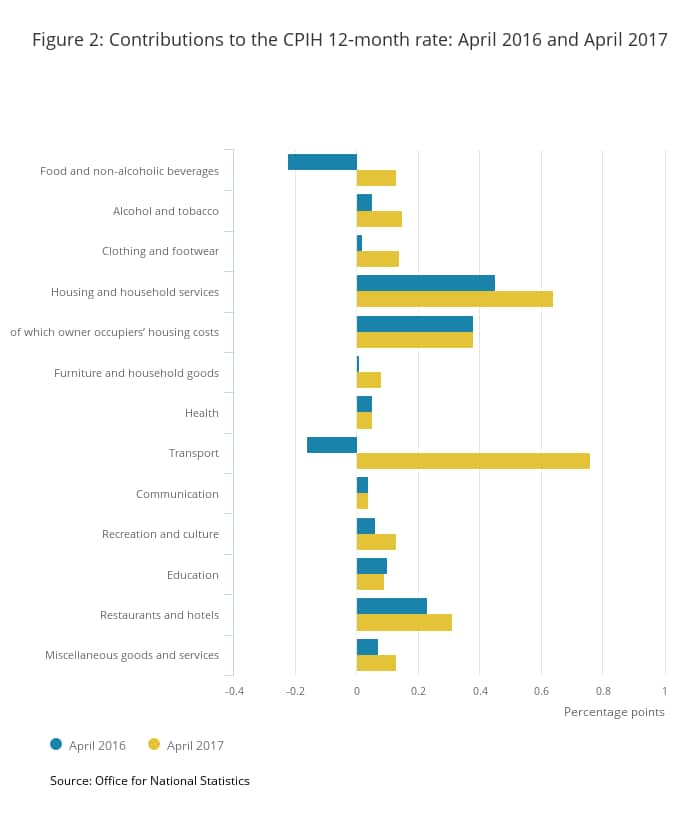

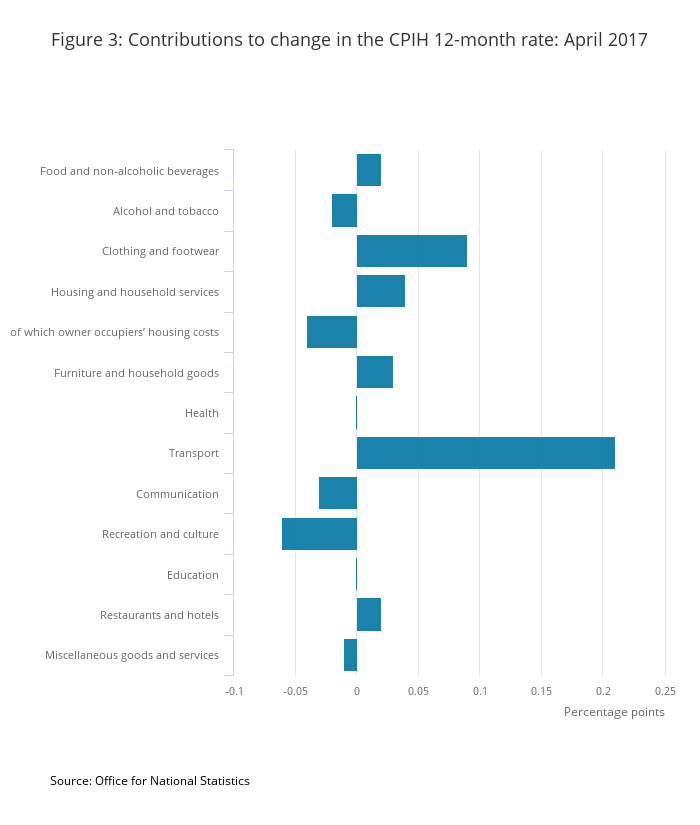

UK inflation: Key charts

Here are the key charts from the ONS data release on UK inflation:

Figure 1 compares the 12-month inflation rates for CPIH and the Consumer Prices Index (CPI), along with the rate for the owner occupiers’ housing costs (OOH) component of CPIH.

Figure 2 shows that price movements for all the broad categories of goods and services had an upward effect on the Consumer Prices Index including owner occupiers’ housing costs (CPIH) 12-month rate in April 2017.

Figure 3 shows how each of the main groups of goods and services impacted on the change in the Consumer Prices Index including owner occupiers’ housing costs (CPIH)12-month rate between March 2017 and April 2017.

Key points: UK inflation jumps more than expected in April to hit highest since 2013

UK inflation rose to its highest level since September 2013 last month, data from the Office for National Satistics showed this morning. Here are the key points from the data release:

Consumer prices increased in April by 2.7pc compared with a year earlier, beating forecasts of 2.6pc and up from March's figure of 2.3pc;

Inflation has accelerated in Britain in recent months, pushed up by a weakening of the pound since last year's Brexit vote and by the rise in oil prices which has fuelled inflation in other countries too;

The latest inflation figures were boosted most of all by airfares during the Easter holidays, last year it fell in March;

Rising prices for clothing, vehicle excise duty and electricity also pushed up consumer prices;

Upward contributions were partially offset by a fall in motor fuel prices between March 2017 and April 2017, compared with a rise between the same 2 months a year ago;

Excluding oil prices and other volatile components such as food, core consumer price inflation rose to 2.4pc, the strongest rate since March 2013 and above economists' expectations for it to rise to 2.2pc.

Latest CPIH data available https://t.co/McYaAyUBoL

— ONS (@ONS) May 16, 2017

Breaking: Inflation rises more than expected to 2.7pc

UK inflation rises by more than expected to 2.7pc in April, its highest level since September 2013.

Analysts expected it to hit 2.6pc.

#UnitedKingdom Annual #Inflation at 2.7% https://t.co/ab53WAmpXRpic.twitter.com/fDSYOBalMU

— Trading Economics (@tEconomics) May 16, 2017

More to follow....

FTSE 100 storms to 7,480 ahead of UK inflation data

Ahead of UK inflation data, the FTSE 100 is trading up 0.31pc on the day at a fresh record high of 7,477.30.

#FTSE hits 7480p before the #UK#CPI data due in 10 minutes. Stronger #pound doesn't seem to bother so far.

— Ipek Ozkardeskaya (@IpekOzkardeskay) May 16, 2017

Inflation but no BOE reaction means pound weakness

Jeremy Cook, of World First, thinks the pound may also struggle for a leg-up this morning despite data, due for release at 9.30am, expected to show that inflation pressures continue to build.

He said: "CPI is forecast to have risen to 2.6pc from 2.3pc in March but digging into these figures suggested that the timing of the Easter holidays played a delaying factor on certain price increases and the upwards trend of price gains will continue in April. We expect the weak pound, increases in commodities and the generalised pattern of global reflation to have contributed to a pickup in CPI this morning.

"We see sterling weakness today given the relative level of ambivalence shown by the Bank of England last week, gains in CPI at the moment are unlikely to prompt a response in rates. As we have been saying for months now the true articulation of the impact of a rise in inflation will be borne out by the wage numbers due tomorrow morning but reports this morning the latest CIPD/The Adecco Group Labour Market Outlook survey shows that workers are in for further pain with employers only expecting to award median pay rises of just 1pc over the next year ahead."

Dollar loses on leaks - World First Morning Update May 16th - https://t.co/qkLuZKGSnFpic.twitter.com/iRHPq19z0M

— World First (@World_First) May 16, 2017

Pound climbs ahead of UK inflation numbers

Pound climbed against the weaker US dollar as investors awaited UK inflation figures, due for release at 9.30am.

The local currency inched up 0.23pc to $1.2937 against the US dollar.

Analysts predict inflation will jump to 2.6pc in April.

Alexandra Russell-Oliver, currency markets analyst at Caxton, said: "This could offer the pound support as markets speculate on the possible timing of a rate hike. While the Bank is expected to keep policy on hold for some time, so long as the likely overshoot remains tolerable, accelerating inflation could shift those expectations forward.

"However, the greater risk for the pound is likely to the downside if inflation comes in lower than expected."

Italy's economic growth remains weak in first quarter

Away from the UK, Italy's economic growth remained weak in the first quarter. Reuters has the details:

Italy's economy posted modest growth in line with expectations in the first quarter and continued to underperform most of its euro zone partners, data showed this morning.

Gross domestic product rose 0.2pc from the previous three months, national statistics institute ISTAT reported, the same moderate rate as in the last quarter of 2016.

On a year-on-year basis, GDP was up just 0.8 percent, slowing from a 1pc rise in the fourth quarter of last year.

Euro area Q1 GDP growth, continued:

Italy still the laggard (+0.2% QoQ)

Netherlands bit disappointing (+0.4% QoQ)— Frederik Ducrozet (@fwred) May 16, 2017

v

The data shows the euro zone's third largest economy, after a long recession that ended in 2014, is still struggling to build up sufficient growth momentum to significantly improve living standards or cut unemployment.

So-called "hard" data, such as industrial output and GDP, have so far failed to reflect extremely buoyant surveys of sentiment and activity levels among purchasing managers in both the manufacturing and services sectors.

ISTAT said growth was supported by domestic demand in the first quarter, while trade flows were a drag on activity.

Euro area Q1 GDP growth, continued:

Italy still the laggard (+0.2% QoQ)

Netherlands bit disappointing (+0.4% QoQ)— Frederik Ducrozet (@fwred) May 16, 2017

It gave no numerical breakdown of components with its preliminary estimate, but said industry had contracted, while services and agriculture were positive.

Over the whole of last year, Italy's economy grew 0.9pc, around half the average rate of the 19-nation euro zone, following growth of 0.8pc in 2015.

Its underperformance compared to its peers continued in the first quarter, when the euro zone as a whole grew by 0.5pc, according to preliminary aggregate data released on May 3.

UK inflation expected to hit 2.6pc year-on-year

Here's what economist Rupert Seggins predicts ahead of UK inflation data release:

(1/4) UK inflation expected to hit 2.6%y/y according to consensus forecast, with a 0.5% rise in core prices from 1.8% to 2.3% predicted. pic.twitter.com/fveBBvPDGz

— Rupert Seggins (@Rupert_Seggins) May 16, 2017

(2/4) The energy price contribution turned last month and is going to carry on falling.

— Rupert Seggins (@Rupert_Seggins) May 16, 2017

(3/4) Likely to be more of a rise in food inflation owing to previous global price increases. pic.twitter.com/tfFCIh9O35

— Rupert Seggins (@Rupert_Seggins) May 16, 2017

(4/4) On past form, a sterling driven jump in core inflation is still a few months away. Consensus forecast evidently disagrees. pic.twitter.com/s0GkyLHpyk

— Rupert Seggins (@Rupert_Seggins) May 16, 2017

UK inflation: What the experts predict

Ahead of the release of UK inflation at 9.30am, here's what the experts had to say:

David McNamara, of Davy, says UK CPI inflation is expected to have accelerated sharply in April.

He added: "While the consensus estimate is for a rise to 2.6pc from 2.3pc in March, the actual out-turn might surpass that as the late timing of Easter boosts the year-on-year (yoy) comparison. The big picture is that underlying inflationary pressures continue to build in the UK economy as the impact of weaker sterling and higher energy prices now feeds into consumer prices. We expect inflation to peak at 3pc towards the end of 2017."

Connor Campbell, of SpreadEx, said analysts are expecting the CPI number to jump from 2.3pc to 2.6pc month-on-month, a reading that would be the highest in more than three-and-a-half years.

He added: "In theory this would inject a bit of life into the pound – which is currently up 0.3pc against the dollar but down 0.1pc against the euro – and could, potentially, cause the UK index to fall from its current peak. It will be a test of the FTSE’s resilience to see how it copes with this challenge, and may help indicate the longevity of these highs going forwards."

UK core inflation climbing. Most of the most accurate forecasters in @ReutersPolls see it coming in above 2.2% yy median for April. pic.twitter.com/LNJ81BDcwP

— Ross Finley (@rossfinley) May 16, 2017

Meanwhile, strategists at Barclays expect inflation will continue to rise, with April headline CPI printing 2.5pc y/y, after 2.3pcy/y in March.

"In our view, this will be driven by volatile and core components, the latter pushing core CPI up to 2.2pc y/y in April from 1.8pc y/y in March. We forecast the RPI-CPI basis will print unchanged at 0.8pc, resulting in RPI of 3.3pc y/y or an index print of 269.9 for April."

Euro hits six-month high on dollar weakness

The weakness in the dollar propelled the euro across the $1.10 mark for the first time since the results of the second round of the French presidential run-off on May 7.

The single currency jumped to a six-month high of $1.1025 against the US dollar, up almost half a percent on the day, amid concerns over whether US interest rates would rise next month, which in turn weakened the dollar.

According tot he CME's FedWatch tool, investors are still pricing in a 73pc change that the Fed could hike rates next month.

#Euro just hits $1.1023, highest since Nov2016 ahead of GDP data. pic.twitter.com/COwOkIygno

— Holger Zschaepitz (@Schuldensuehner) May 16, 2017

FTSE 100 and Dax hit fresh record highs for second consecutive trading session

Disappointing earnings updates may be weighing on banks and pharma stocks in Europe, but London's FTSE 100 and the German DAX outperformed its peers, hitting fresh record high for a second day in a row.

Here's a snapshot of the current state of play in Europe:

Mike van Dulken, of Accendo Markets, said: "A flat start is in spite of gains on Wall Street and in Asia overnight, as oil resumes its uptrend amid continued supportive production-cut rhetoric from OPEC and friends. Taking the shine off this, however, is metals prices giving up some ground - even as the USD retreats - as supply disruptions end and lingering fears about the Chinese economy offset excitement about the “One Belt, One Road” initiative."

World stocks scale new peaks

The MSCI World Index, a gauge of global stocks, scaled new peaks overnight thanks to a bounce in Asian stocks and a rally on Wall Street, reflecting the jump in oil prices following Saudi and Russia's pledge to extend supply cuts through to Q1 2018.

Agenda: Investors eye UK inflation data

Good morning and welcome to our live markets coverage.

Overnight Asian stocks climbed to a fresh two-year high after a rally on Wall Street, buoyed by gains in oil following a pledge by the world's two biggest oil producers to extend the supply cuts until March 2018.

Oil steadied around the $52 per barrel level after hitting its highest level in more than three weeks yesterday.

On Wall Street last night, the S&P 500 and the Nasdaq notched record closing highs, powered by demand for technology stocks after a global cyber attack and by rising oil prices. It followed similar gains in Europe, where the FTSE 100 and DAX both scaled new peaks.

Good morning from Berlin! Asia stock rally fades as valuations look stretched. Japan pares gains after Nikkei came within 2 points of 20k. pic.twitter.com/igmuZmHlEy

— Holger Zschaepitz (@Schuldensuehner) May 16, 2017

UK inflation takes centre stage today, which is seen rising from March's 2.3pc to 2.6pc.

Previewing the data release, Michael Hewson, of CMC Markets, said:

"It is expected that we could get a jump to 2.6pc, while core prices could also jump above the 2pc level, from 1.8pc to 2.2pc. If we do indeed get a sharp jump in CPI then it is likely to increase the prospect of further splits on the Bank of England monetary policy committee, with Michael Saunders and Ian McCafferty the two most likely to break ranks, and push for a rise in rates.

"McCafferty could break ranks because he’s got previous having called for rate hikes on two previous occasions, and Saunders given his recent comments to small businesses last month. RPI is expected to rise to 3.4pc from 3.1pc."

Our European opening calls:$FTSE 7456 +0.03%

$DAX 12800 -0.06%

$CAC 5397 -0.38%$IBEX 10953 -0.05%$MIB 21669 -0.16%— IGSquawk (@IGSquawk) May 16, 2017

Also on the agenda:

Full-year results: BTG, NewRiver Retail, Premier Foods, Vodafone Group, Speedy Hire

Interim results: Zytronic, Jackpotjoy, Avon Rubber

Trading update: CYBG, ITE Group, EI Group, easyJet, Manchester United, Crest Nicholson

AGM: Faron Pharmaceuticals, Xaar, IWG, Rockhopper Exploration

Economics: HPI y/y (UK), PPI input m/m (UK), CPI y/y (UK), RPI y/y (UK), CB Leading index m/m (UK), housing starts (US), building permits (US), industrial production m/m (US), NAHB housing market index (US), flash GDP q/q (EU), ZEW economic sentiment (EU), trade balance (EU), ZEW economic sentiment (GER)

Yahoo Finance

Yahoo Finance