Miners lift FTSE 100 after strong Chinese GDP data; pound edges down as round two of Brexit talks begins

Market report

SCOTTISH engineer Weir Group soared on a buoyant mid-cap 250 index after upping its revenue guidance, driven by a boom in the US shale industry.

The upturn in North American drilling will help it deliver “low double-digit operating margins in the first half”, Weir told shareholders ahead of its interim results later this month. The update pushed Weir 154p, or 8.4pc, higher to £19.78.

Investec analyst Andy Douglas said: “The extent of the oil and gas upgrades are significant, obviously, and shows how volatile this end market can be.

“This time, it’s going in the group’s favour, and they are very much benefitting from it.”

Troubled outsourcer Mitie Group advanced 5.4p to 279.1p after Investec bought into the company’s revival plan, giving it a double upgrade from sell to buy.

Investec analyst Daniel Cowan argued: “We think the market has yet to appreciate the full extent of the potential turnaround at Mitie under new leadership.”

Convinced by the outsourcer’s turnaround tale, Mr Cowan told clients that chief executive Phil Bentley and his team’s track record of reviving strugglers, such as British Gas, made Mitie an appealing pick.

Pearson finished the session among the FTSE 100’s biggest laggards, closing 4p lower at 631.5p, after Berenburg slashed its target price for the struggling publisher from 605p to 490p, describing last week’s sale of a 22pc stake in iconic Penguin Random House as “robbing Peter to pay Paul”.

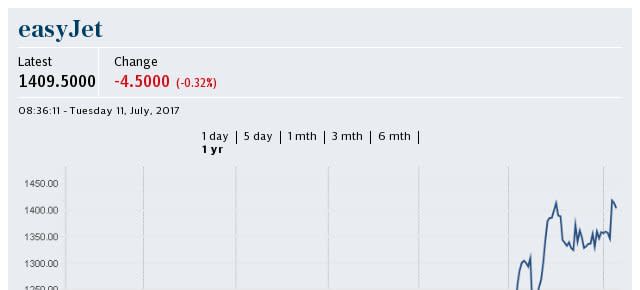

Elsewhere on the FTSE 100, the managerial merry-go-round sent ITV 2.3p higher to 177.3p as it unveiled easyJet boss Carolyn McCall as chief executive. While the no-thrills airline suffered early on in intraday trade from her departure, it rallied and ended up outperforming McCall’s new employer on the blue-chip index, flying 20p higher to £14.31. Elsewhere, indications dating back to Friday evening that AstraZenka boss Pascal Soriot would remain at the pharmaceutical giant lifted its shares 41.5p to £50.40.

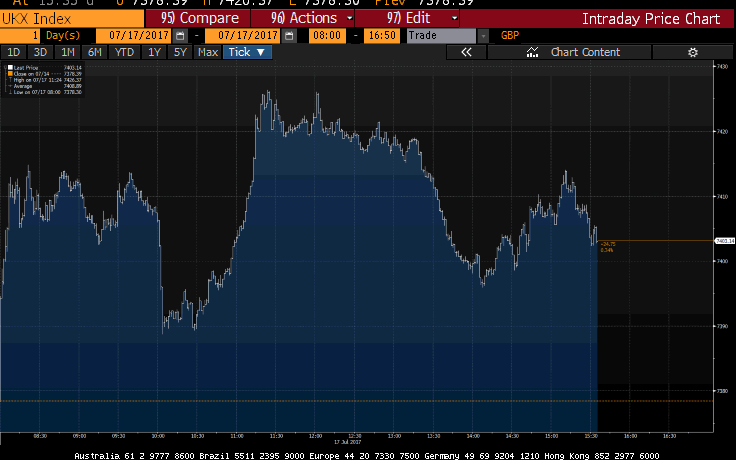

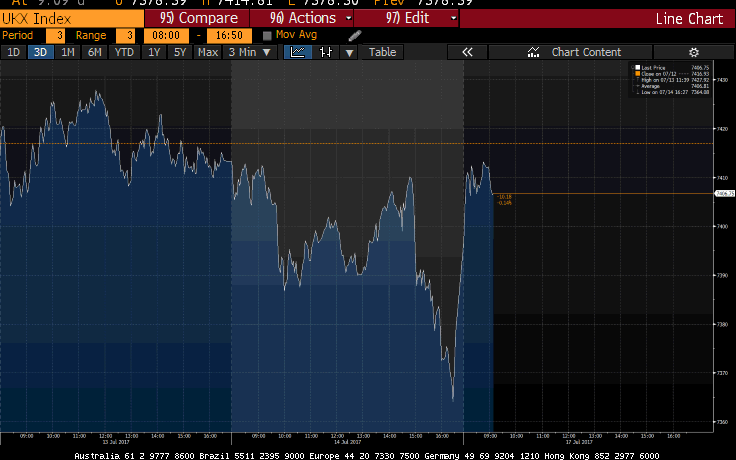

The mining giants dominated the leaderboard yet again on the FTSE 100 after metal-hungry China posted higher-than-expected GDP growth in the second quarter. The blue-chip index outperformed its lagging European counterparts to advance 25.74 points to 7404.13.

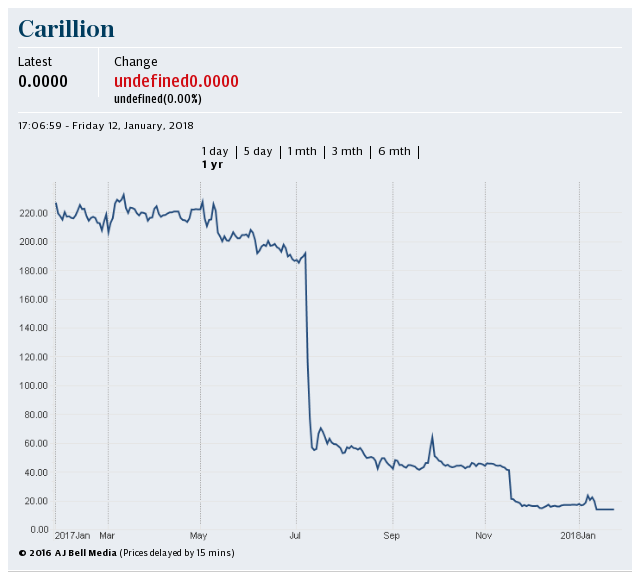

Construction giant Carillion soared 19.2pc after bagging one of the HS2 contracts despite last week’s disastrous trading update. It clawed back a further 10.75p to close at 66.90, leaving it 64.7pc lower than its share price prior to chief executive Richard Howson’s departure announcement and the surprise profit warning. and the told the markets of his departure and a surprise profit warning.

Markets wrap: Chinese GDP data drives FTSE 100 higher

The FTSE 100 outperformed the other major European markets today as commodity stocks advanced following the higher-than-expected GDP data from metal-hungry China. The world's second-largest economy expanded by 6.9pc in the second quarter compared with a year ago. With little else to shift momentum today on the markets, the strong performance from the Asian powerhouse has dominated sentiment.

The slightly weaker pound helped the UK's benchmark index finish 25.74 points higher at 7404.13 with its US counterparts struggling to gain traction in early trading.

European Closing Prices:#FTSE 7404.13 +0.35%#DAX 12587.16 -0.35%#CAC 5230.17 -0.10%#MIB 21484.84 -0.03%#IBEX 10651.2 -0.04%

— IGSquawk (@IGSquawk) July 17, 2017

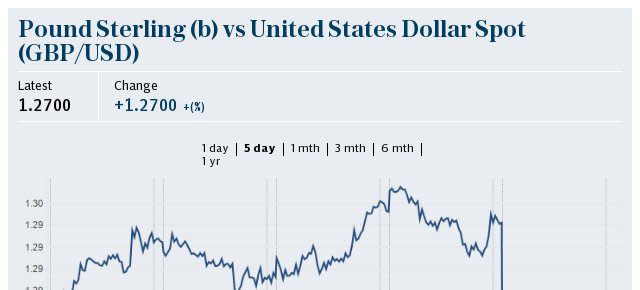

Very little has occurred on the forex markets today. The pound has slowly weakened against the dollar, retreating back below the $1.31 mark.

With no major UK economics data out today, only the start of the second round of Brexit negotiations could damage the pound's position against the euro. It is finishing the day 0.25pc lower at €1.1386 against the euro.

IG chief market analyst Chris Beauchamp commented on the inertia on the currency markets today:

"Recent US dollar weakness has taken a break today, but Friday’s big move lower in the greenback confirms that more losses could be on the way, which is likely to spell further good news for commodity prices and miners as well."

I can promise a little more action for the pound tomorrow, however. UK inflation data is due and Mark Carney is also scheduled to speak, on what we will have to find out.

Thanks for following today's coverage, see you again tomorrow morning.

London's exposure to commodities giving it the edge over Europe

The strong presence of global miners on the London stock exchange is giving it the edge over its Eurozone counterparts today, according to David Madden, CMC Markets analyst. Glencore, BHP Billiton and Rio Tinto have all been propelled higher by the strong Chinese GDP data released overnight.

Mr Madden commented on the US markets this afternoon:

"The Dow Jones and S&P 500 are fractionally in the black today as the bullish sentiment from last week still lingers.

"Record highs for both US indices were achieved on Friday as positive quarterly updates from US banks and weaker than expected inflation data gave traders a reason to buy."

KKR lays out succession plans with co-president appointments

The US private equity giant behind Trainline and Toys 'R' Us has named two potential successors to its co-founders, more than 40 years after the business was established.

KKR said it had appointed two of its senior executives, Scott Nuttall and Joe Bae, as co-presidents and co-chief operating officers.

Henry Kravis and George Roberts, who founded the firm and are in their early 70s, will remain as co-chief executive officers and co-chairmen.

However, in hiring Mr Nuttall and Mr Bae, KKR said it was "ensuring we have the right team and leadership structure to serve our clients and partners for decades to come".

Read Hannah Boland's full report here

US markets will be 'dictated by reporting companies' rather than 'rate hike chatter'

A lack of "Grade A" data from the US could mean that the markets will be "dictated by its reporting companies rather than any rate hike chatter", commented Spreadex analyst Connor Campbell on today's sluggish start stateside.

He added on today's markets:

"Following a far worse than forecast Empire State manufacturing index reading, falling from 19.8 to 9.8 month-on-month, there wasn’t much reason for the Dow Jones to build on its recent highs this Monday.

"Instead the Dow sat flat at 21630, around 50 points away from last Friday’s intraday peak.

The UK is putting in the strongest performance of the European markets, helped by a weaker sterling and commodity stocks boosted by the Chinese GDP data, according to Mr Campbell. The UK's benchmark index is the only European index to not spend the day struggling to stay out of negative territory.

Employment at record high as global recovery creates jobs

Employment across the rich world hit a new record high at the start of 2017 with the widespread economic recovery pushing up demand for workers.

A total of 557m people were in work across the 35 countries in the Organisation for Economic Co-operation and Development (OECD) at an employment rate of 67.4pc.

That is the highest number in the study’s 12-year history and compares with a financial crisis-era low of 64.4pc at the end of 2009.

Read Tim Wallace's full report here

Glencore mulls spin-off company to snap up mining royalties

Glencore is considering creating a standalone company to acquire lucractive mining royalties around the world.

The spin-off business would be seeded with at least £300m of streaming agreements Glencore already owns, and would pursue deals in copper, zinc, nickel and cobalt with a view to an eventual stock market listing.

Glencore’s plan, first reported by industry title Global Mining Observer, would look to emulate the model of companies such as Canada-based Franco-Nevada, which does not own any mines but instead makes money by “streaming” supply from miners for resale. In return, the streaming company advances loans to the miner to help fund capital projects.

Glencore shares have advanced 5.75p to 321.85p.

Read Jon Yeomans' full report here

US markets start slowly; Carillion and Weir lead the FTSE 250

US markets haven't started the week as brightly as its European counterparts did this morning with the Dow Jones and S&P 500 opening flat.

The only economics data in the US for investors to mull over is the Empire State manufacturing index, which showed manufacturing falling from June's exceptional 19.8 reading to 9.8. Despite the unusually high June reading, July's figures are a disappointment with economists expecting it to dip to 15.

Pantheon Macro commented:

"The Empire State survey is not the last word, though; we need to see the Philly Fed and Chicago PMIs before we can finalize our forecasts; all three are volatile month-to-month."

UK

Carillion has leapt to the top of the FTSE 250 today after securing the HS2 contract along with French construction firm Eiffage and UK peer Kier Group. Shares are up 11.8p, or 21pc, to 67.95p as the company begins to recover ground lost in last week's share price collapse.

Also underpinning the mid-cap index's gains today is Weir Group which has risen 153p to £19.77 after telling shareholders of better than expected results at its fracking sites in North America.

Mining stocks have continued to prop up the FTSE 100 index, which has pared some gains this afternoon.

China's economy showed 'surprising resilience'

The Chinese economy showed "surprising resilience" in the second quarter despite "efforts to rein in financial leverage and property speculation", said Amrith Venkata, chief executive at Sun Global Investments.

He added:

"Robust exports and resilient consumption helped offset a slowdown in consumption."

Despite the Chinese GDP growth boosting stocks globally, the Shanghai Shenzhen CSI 300 Index did not benefit from the expectations-beating figures as investors fretted over increased intervention from the Chinese central bank in reducing financial risk.

At a conference over the weekend, President Xi Jinping said that the central bank would play a bigger role in the financial services sector. According to Mr Venkata, Mr Xi's 31 uses of "risk" and 28 uses of "regulation" are "definitive signs for investors to worry about".

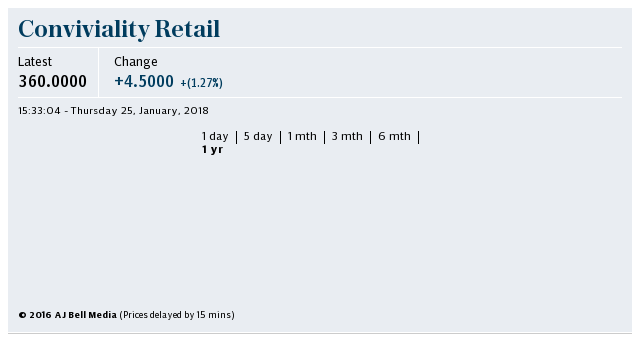

Profits more than double at Bargain Booze owner Conviviality after trio of acquisitions

Profits at Bargain Booze owner Conviviality more than doubled last year as the drinks specialist restructured its business following a series of acquisitions.

In its results for the year ended April 30, Conviviality said profits before tax rose to £22.5m, up from £9.1m in the previous year. Revenues, meanwhile, soared by 85pc from £841m to £1.56bn.

The company acquired wine specialist Bibendum in May last year, completing a trio of moves after it swooped on drinks wholesaler Matthew Clark in October 2015 and then outdoor bar operator Peppermint.

The strong trading has also continued into the new financial year, with sales up 9pc for the nine weeks ended July 2, compared to the same period last year.

Read Sam Dean's full report here

Former Barclays chief will stand trial over Qatari fundraising in January 2019

The former boss of Barclays and three other ex-directors of the bank have been told that they will stand trial in January 2019 over the bank's emergency fundraising with Qatar almost a decade ago.

Mr Justice Edis confirmed the trial date at Southwark Crown Court on Monday morning, with ex-chief executive John Varley as well as Roger Jenkins, Thomas Kalaris and Richard Boath all attending the hearing.

The four men, who were released on bail earlier this month after making their first court appearance over the charges they face for their actions during the crisis, spoke only to confirm their names.

Alongside the bank itself, the four were last month charged by the Serious Fraud Office with fraud and unlawful financial assistance over their dealings with Qatari investors in 2008. They are the first senior bankers to face charges over events during the crash, when the world's banking system faced collapse.

FTSE 100 erases losses sustained at end of last week

As we approach the opening bell in New York, European stock markets are stabilising with a slightly weaker pound helping UK stocks erase losses sustained at the end of last week.

Head of research at Accendo Markets Mike Van Dulken said that the weak dollar is contributing to the mining and oil stocks' gains in addition to the strong growth data out of China.

He added:

"International exposure benefits from GBP off its highs as Brexit negotiations recommence. Germany's DAX underperforms as EUR strength (vs USD and GBP) hindering exporters from bigger gains to keep the index around breakeven."

Norwegian's UK subsidiary seeks US permissions to fuel long-haul expansion

Low-cost airline Norwegian's UK subsidiary has received "tentative approval" for a US foreign air carrier permit which it believes will enable it to better use its fleet to fuel its long-haul expansion plans.

At the moment all of its cheaply priced flights from the UK to the US are made by aircraft operating within its Norwegian registered airline, which is called Norwegian Air Shuttle.

But while Norway is included in the EU-US Open Skies agreement - which enables frictionless flights between the continents - it does not have traffic rights to other regions where the airline wants to grow, such as South America, South Africa and places in Asia.

Read Bradley Gerrard's full report here

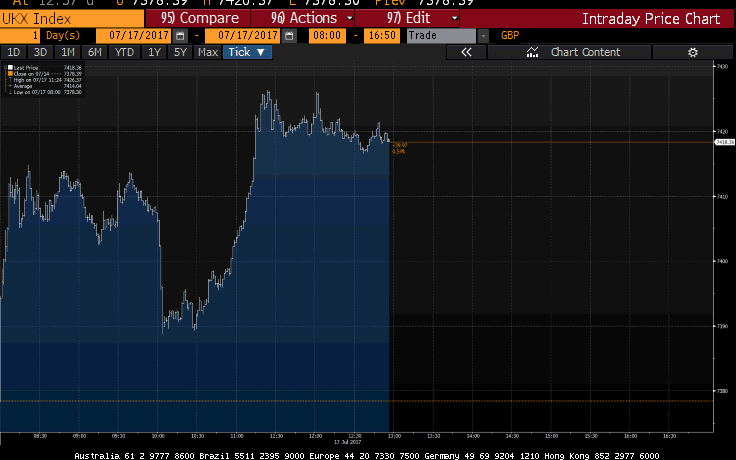

Half-time update: FTSE 100 boosted by strong Chinese data; forex markets little changed

With Eurozone inflation data in line with expectations and only house price data released in the UK, the currency markets have been very quiet today. The pound has inched down to $1.3068 against the dollar and to €1.1405 against the euro, both 0.08pc falls.

Therefore, the pound has been unable to dictate movement on the FTSE 100, which has gained 42.02 points to 7420.41. Mining stocks buoyed by the strong Chinese GDP data and the oil giants boosted by oil's gains holding firm has propelled the index through the 7400 barrier today. The data from China showed that the second-largest economy in the world grew by 6.9pc in the second quarter compared with a year ago.

The biggest riser on the FTSE 100 is ITV (+2.97) after easyJet chief executive Carolyn McCall was appointed for the top job at the broadcaster.

Here's the current state of play in Europe:

FTSE 100: +0.58pc

DAX: -0.17pc

CAC 40: +0.05pc

IBEX: -0.11pc

Markets 'solidify' earlier positions

With little more data to come and the Eurozone inflation reading failing to "ruffle many feathers", the markets have mainly solidified on positions made earlier today, according to Spreadex analyst Connor Campbell.

He added:

"With David Davis in Brussels to continue talks with his EU counterparts the pound, with little else to do, resumed fretting about Brexit, falling 0.2% against the dollar and 0.1% against the euro.

"And though this still leaves sterling pretty damn close to its recent highs, it was enough of a drop to give a bit of a boost to the FTSE."

Pound eases off as round two of Brexit negotiations begins; Shire and Rolls Royce struggle on FTSE 100

RT Brexit: Pound falls from 10-month high against dollar because of fears about political disarray … pic.twitter.com/mVRQNeYQEr

— Bullish Market (@Bullish) July 17, 2017

David Davis' return to Brussels for round two has seen the pound ease off the ten-month high it recorded against the dollar on Friday. A weekend of leaks and posturing by prime minister wannabes has seen the pound's momentum dissipate. I wouldn't overegg its impact though, the pound is currently flat at $1.3074 against the dollar.

On the FTSE 100, Pharma firm Shire and engineering company Rolls Royce are the biggest laggards on the index this morning. The former's chief executive told the Financial Times this weekend that the company's drugs pipeline means that the company is undervalued by investors. Those pesky investors, however, have sent Shire to the bottom of the index this morning, its share price falling 49.5p to £41.20.

Markets see UK hike threat as "half-hearted" ahead of tomorrow's inflation data

The markets see the UK's hike threat as "half-hearted", according to John Wraith, UK rates analyst at UBS, ahead of the inflation data tomorrow. A rise in tomorrow's inflation figures will embolden the calls for an early interest rate rise. At the moment, the probability of a December hike is 50/50.

Although the Bank of England's Monetary Policy Committee voted to leave interest rates as they are in the June meeting, the tighter than expected vote (5-3) and subsequent hawkish comments from the central bank's chief economist Andy Haldane and MPC external member Ian McCafferty has lifted hopes of an early rise.

Mr Wraith believes that while MPC rhetoric justifies the increased probability of a rise, the macro data does not.

He added:

"Beyond the mechanical repricing of short-end rates in response to the change in the tone of Central Bank communication, we think the market is showing a similar lack of conviction as we sense over the case for tighter monetary policy."

Who are the seven female bosses in the FTSE 100?

Following Carolyn McCall's appointment as head of ITV, Sophie Christie has put together a gallery of the seven female chief executives in the FTSE 100.

Investors focus on week ahead and Chinese data due to today's lack of economic releases

#Copper price hits highest since early March after better than expected China GDP data

— DailyFX Team Live (@DailyFXTeam) July 17, 2017

Chinese data is moving markets most this morning but much of this week's action is yet to come, according to IG market analyst Josh Mahony. He added that the strong Chinese retail data will help persuade the markets that the country's plan to bump up domestic demand to shift its reliance on exports is starting to work.

Mr Mahony said on today's markets:

"On a day devoid of any top level European and US economic releases, much of the focus is upon the week ahead and the Asian session behind us. UK-EU Brexit discussions continue apace today, with the relationship seemingly souring amid critical comments from Boris Johnson and a drive from France towards a hard Brexit.

"There is now a clear need to get a transitional deal into place, with the negotiations looking ever more unlikely to conclude satisfactorily within the two-year deadline."

Of the big releases Mr Mahony alluded to, the UK CPI data due tomorrow will have the biggest impact if a rise in inflation reinvigorates hawkish sentiment. Analyst expectations are that it has held firm at 2.9pc.

Eurozone inflation for June confirmed at 1.3pc

Euro area annual inflation confirmed at 1.3% in June (May 1.4%) #Eurostathttps://t.co/8SszPc9vS9pic.twitter.com/0T7NEMsgGH

— EU_Eurostat (@EU_Eurostat) July 17, 2017

Eurozone inflation for June has been confirmed at 1.3pc in the last few moments, a slight dip from May's 1.4pc figure.

No amendment to the preliminary reading means there has been little reaction on the currency markets. This morning the pound is flat against the euro at €1.1417.

ITV shares boosted by chief executive appointment

Delighted #ITV has appointed it's first female CEO.Carolyn McCall is a woman with an incredibly strong track record in media & strategy ���� https://t.co/OC2BObDnj4

— Bríd Stenson (@bridstenson) July 17, 2017

ITV has climbed 4.4p, or 2.5pc, higher to 179.4p this morning following the news of Carolyn McCall's appointment as chief executive. Meanwhile, easyJet shares fell in early trading but have since rallied and are in positive territory.

The share price reaction to the news is a "mark of respect shown by investors", according ETX Capital analyst Neil Wilson.

The move could have ramifications for the FTSE 100 airline, however:

"It comes at a pivotal moment for the airline as it repositions the business in the wake of Brexit.

"Last week it announced it would open a new European HQ in Vienna but there remains anxiety (shared by Ryanair) over the ease of flying between the UK and EU after Brexit."

EasyJet boss Dame Carolyn McCall named as new ITV chief executive

EasyJet boss Dame Carolyn McCall is leaving the airline after seven years at the helm to take over the top job at ITV.

After a weekend of speculation, both companies confirmed on Monday morning that Dame Carolyn will replace outgoing ITV chief executive Adam Crozier in January next year.

She said:

"This was a really difficult decision for me to make. I have had an amazing seven years at easyJet, I am so proud of what the airline and its people have achieved in that period.

"After seven years, the opportunity from ITV felt like the right one to take. It is a fantastic company in a dynamic and stimulating sector.”

Read Sam Dean's full report here

Flat pound helping the FTSE 100 advance

A combination of a flat pound and commodity stocks boosted by strong figures from metal-hungry China has taken the FTSE 100 through the 7,400 barrier this morning.

Spreadex analyst Connor Campbell commented:

"That was joined by a far stronger than forecast industrial production number, an 11% increase in retail sales year-on-year and solid fixed asset investment figure.

"Understandably the FTSE’s commodity stocks were pretty pleased with the outcome of all this."

The pound's gains on the dollar weighed heavily on the blue-chip index on Friday but the relative calmness of the currency markets this morning has helped the benchmark index.

Mr Campbell added:

"It helps that the pound appears to be taking a breather this morning. The currency opened flat against the dollar just below 1.31, unable just yet to build on its recent Fed-inspired 10 month peak.

"Sterling fared slightly better against the euro, climbing 0.1% to keep at a one month high."

Carillion shares begin long recovery but is it still fit for purpose?

Carillion has been awarded the HS2 contract but can it deliver?

Further troubles may lie ahead for the construction giant, according to Neil Wilson, senior market analyst at ETX Capital.

He said:

"The stock rose 6.5% on the open – a healthy move normally but small fry when measured against last week’s 71% fall. This ought to help its share price but whether it can deliver these contracts is another matter.

"It could make it a slightly more attractive prospect to rescue if it comes to that. But it’s hard to see an awful lot to be cheerful about. This stock could have further downside. We await the outcome of what HSBC and EY [EY and HSBC have been brought in as financial advisors by Carillion] can achieve to get the firm out of this mess."

Indeed. Carillion's recent record is negative, and should not be in charge of a project as big as HS2 https://t.co/lN7Fttkkr8

— Stefan Garcia (@stefangarciaa) July 17, 2017

Struggling Carillion named as one of the contractors for HS2

Struggling outsourcer Carillion has been named as one of the winners of £6.6bn worth of contracts awarded by the Government for the development of the HS2 rail line.

Carillion, which last week saw almost £600m wiped off its market capitalisation after it issued a shock profit warning, is part of two joint ventures that have been awarded contracts to build tunnels for the controversial high speed line.

In a separate announcement, the construction giant said it had enlisted professional services firm EY to help with its strategic review following its week of chaos, in which its share price plummeted more than 70pc. Carillion’s shares rose more than 8pc in early trading.

Read Sam Dean's full report here

Commodity stocks rise on China data; oil holding to gains also boosting stocks

Early on in London unsurprisingly the main beneficiaries of the strong data in China on the FTSE 100 are the big miners which derive a large chunk of their revenues from the Asian powerhouse.

The pound's strength against the dollar could hold back the benchmark index today, however, according to Accendo Markets head of research Mike Van Dulken.

He added:

"Buoying UK sentiment is oil holding rebound highs and copper spiking after fresh better-than-expected China GDP data put it in-line for re-acceleration of growth in 2017.

"This after six years of slowing, suggesting successful management of stimulus."

Brent crude holding onto gains made in last week's rally has lifted the two oil giants, BP and Shell, on the blue-chip index. Brent is currently trading at $49.15 per barrel.

Agenda: Chinese GDP figures lift the FTSE 100

Stronger than expected Chinese GDP growth figures have been the main catalyst of movement on Asian markets overnight with the Hong Kong Hang Seng Index enjoying a boost from the news that the world's second largest economy expanded by 6.9pc in the second quarter compared with a year ago.

However, the Shanghai Shenzhen CSI 300 Index in China was pushed down after President XI Jinping indicated that the People's Bank of China, the country's central bank, would play a bigger role in reducing risks in the financial system at a government conference that takes place once every five years. The Nikkei in Japan is closed due to a public holiday.

Good morning! Stocks headed to fresh all-time high as econ momentum in China boosted optimism for global growth. Oil rises on higher demand. pic.twitter.com/HtMVhkFioh

— Holger Zschaepitz (@Schuldensuehner) July 17, 2017

The FTSE 100 has started the week brightly. AstraZeneca has rebounded after its chief executive Pascal Soriot indicated that he would stay at the pharma giant and ITV has been lifted by news that it has appointed easyJet chief executive Carolyn McCall as boss.

Soft US inflation data helped the pound move above $1.30 against the dollar at the end of last week with UK inflation data out tomorrow expected to set the tone for sterling's movement this week. This morning, it is hovering just below $1.31.

There's very little economics data to move sterling this morning with house price data from Rightmove, which showed prices at a standstill in July, the main release. Final Eurozone CPI data for June is due at 10am.

Interim results: Etalon Group

Trading update: Rio Tinto

AGM: Renewi

Economics: Rightmove house price index m/m (UK), wholesale price index m/m (GER)

Yahoo Finance

Yahoo Finance