FTSE 100 Live: Average earnings rise 6.4%, Ocado shares slide after update

Average weekly earnings rose by a bigger-than-expected annual rate of 6.4% in the three months to November, figures showed today.

The increase, which remains significantly below inflation, was revealed by the Office for National Statistics alongside an unchanged unemployment rate of 3.7%.

Elsewhere, the FTSE 100 index is showing little appetite for breaking into record territory after weak sessions for stocks including Ocado and Unilever. Figures from China earlier revealed its Covid-hit economy last year grew at its second slowest pace since 1976.

FTSE 100 Live Tuesday

Earnings growth adds to rates rise pressure

Ocado shares fall after “year to forget”

Diageo to buy Don Papa rum in €438 million deal

That’s all folks. Tomorrow: UK inflation

Tuesday 17 January 2023 17:59 , Simon Hunt

That concludes our liveblog coverage today, after Britishvolt, a company that was set to be one of the UK’s biggest EV battery-makers, went into administration.

The Evening Standard City Desk will be back at 7am tomorrow, where we’ll find out whether UK inflation is coming down -- and if so, by how much.

Man United shares edge up 2% after reports of takeover offier

Tuesday 17 January 2023 17:07 , Simon Hunt

Shares in Manchester United jumped this evening after it was revealed that billionaire Jim Ratcliffe was making a bid to take the company private.

The stock rose about 2% to $23.11, after the Times newspaper reported the INEOS owner was ready to make an offer for the Premier League club.

Ratcliffe has a wealth of $12.4 billion according to a Bloomberg estimate.

FTSE closes down 9 points: Evening wrap

Tuesday 17 January 2023 16:47 , Simon Hunt

It was within touching distance of hitting a record close, but in the end the FTSE 100 fininished down 9 points at 7,851 after today’s trading session in London.

Shares fell in most sectors, but utilities firms bucked the trend, rising an average of 1.49%. Shares in spirits maker Diageo also did well, up almost 2% after it announced the acquisition of a new rum company in a £400 million deal.

The pound gained almost a cent against the dollar, rising from $1.2171 at 7am to $1.2266.

Tomorrow’s inflation numbers -- and whether price rises are above or below expectations -- are likely to signal whether a record high for the FTSE tomorrow is within contention.

Stocks make gains in New York: Wall Street Open

Tuesday 17 January 2023 15:21 , Simon Hunt

Stocks made gains in the opening minutes of trade on Wall Street as investors weighed the prospects of some of the US’s biggest stocks as earnings season got underway in earnest.

It was a mixed picture for big investment banks: Morgan Stanley’s shares got a boost after sales from its wealth management arm came in above expectations, but Goldman Sachs shares slid after its revenue figures came in below forecasts.

The S&P rose 0.3%, while the Nasdaq was up 0.5% after the opening bell.

Hertz signs deal to add 10,000 EVs to Uber’s London fleet

Tuesday 17 January 2023 14:14 , Simon Hunt

Hertz has reached an agreement to introduce an extra 10,000 electric vehicles to Uber’s fleet by 2025 after agreeing a new partnership.

A wide range of new EVs will be offered to Uber drivers in the capital, including models from Tesla and Polestar.

The deal is part of a wider plan in which the car hire company will make up to 25,000 Electric Vehicles (EVs) available to Uber drivers to rent across Europe by 2025, beginning in London with the aim to expand to Paris and Amsterdam.

LME group general counsel to step down amid threat of legal action

Tuesday 17 January 2023 13:20 , Simon Hunt

The general counsel of the London Metal Exchange, Tom Hines, has resigned from his role as the exchange faces a wave of legal threats over its handling of the nickel crisis last year.

Hine said: “I have taken the difficult decision to move on from the LME with the intention of setting up my own business and I would like to thank all of my colleagues for their support and collaboration over the years.”

The Exchange is facing legal action from five trading firms over its handling of massive fluctuations in the price of nickel in March, when it decided to cancel as much as $4 billion in trades.

An LME spokesperson said: “We consider that application to be without merit, and we look forward to setting out our arguments opposing the application in due course.”

Pound’s rally takes it nearer to $1.23 as inflation data looms into next Bank of England rate call

Tuesday 17 January 2023 13:12 , Michael Hunter

Sterling’s strong start to 2023 took it nearer to $1.23 today, a level it last touched in mid-December.

The pound was at $1.2253 in midday trade, taking it up 1.6% for the year to date and up by almost a fifth from its record low of $1.0379 hit during the run on UK financial assets after the Truss government’s “mini”-Budget.

Analysts say that some of the mometum in the rally comes from expectations that the Bank of England will lift interest rates by 0.50% again at its next meeting in February, with recent better-than-feared economic data looking to give policy makers more room to fight inflation. That thinking faces a stern test from consumer price inflation data due out on Wednesday, The CPI reading for December is expected to rise by 0.4% month-on-month, in line with the previous reading, with the annual rate of inflation inching down to 10.5% from 10.7%.

Chris Turner, global head of markets at Dutch Bank ING, said: “The longer the BoE stays in hawkish mode, the more support sterling can get.

“ Depending on the resilience of tomorrow’s release of December UK CPI data it seems too early to dismiss the risk of another 50bp rate hike from the Bank of England on 2 February.”

Company insolvencies up by almost a third in December

Tuesday 17 January 2023 13:11 , Simon Hunt

The number of companies going bust rose by almost a third in December according to official numbers out today, in a stark reminder of the impact of high inflation and the cost of living crisis on businesses.

According to the government’s Insolvency Service, the number of companies registering with it was just under 2,000 in the month, up 32% year-on-year and 76% higher compared with 2019, the last year before the pandemic hit.

The number of compulsory liquidations rose by more than three-and-a-half times year-on-year to 183, up 8% from December 2019. That represented a rise from historic lows in winding-up orders reached during the pandemic, when tax officials at His Majesty’s Revenue and Customs stood back from taking action.

FTSE 100 midday movers: Ocado back in the action

Tuesday 17 January 2023 12:03 , Michael Hunter

Ocado, so often one of the biggest movers on the FTSE 100 in 2022, is back on the charts today, but not a the end of the market it would have preferred.

Having called 2022 a “year to forget” shares in the online grocer and e-commerce tech platform are the biggest single fallers on the main London stock index. The company said shoppers embraced the high street over internet deliveries and cut back on pricier items as it reported sales in the full year down 3.8% to £2.2 billion, the first time in its 23-year history that revenue has fallen.

There was a defensive feel to trade at the top of the market, with utility company SSE making the biggest single gain.

Paperchase lines up administrators amid search for rescue buyer

Tuesday 17 January 2023 11:58 , Simon Hunt

Paperchase is lining up administrators amid a continued search for a rescue deal.

The beleaguered High street stationer has told corporate restructuring business Begbies Traynor to be on standby in the event that rescue talks collapse, forcing it into insolvency, according to reports from Sky News.

It’s the second time in two years the retailer has been on the brink of administration after it filed a notice to appoint administrators in January 2021.

The firm put itself up for sale earlier this month after being bought by investor Steve Curtis in August last year.

Luxury lift shopper numbers ‘like 2019’

Tuesday 17 January 2023 11:17 , Simon Hunt

Top retailers in Knightsbridge including Harrods, Harvey Nichols and Burberry said shopper numbers almost matched pre-pandemic levels in the first week of the post-Christmas sales.

Figures compiled by the Knightsbridge Partnership, which represents around 300 businesses in the area, and seen exclusively by the Evening Standard show that footfall between December 26 and January 2 was 45% higher than the same week the previous year, and less than a percentage point below 2019.

More shoppers visited Knightsbridge on the opening day of the Boxing Day sales than on any other day that week, the report found.

Michael Ward, managing director at Harrods, said: “This year’s Boxing Day sales have so far outperformed our expectations for this year.” The area has recently seen a new Apple Store in Brompton Road and the return of Burberry’s flagship store.

Britishvolt to file for insolvency: reports

Tuesday 17 January 2023 10:31 , Simon Hunt

Britishvolt is expected to file for insolvency today in a blow for the UK’s ambitions to gain a foothold in the global EV battery market.

The startup is set to begin court proceedings to enter administration as soon as this afternoon, according to reports by Bloomberg News.

Last week, the firm said it was in talks with a consortium of investors in order to help finance the construction of its Blythe battery factory, in a deal which would see its valuation drop more than 90%.

The business is seen as a crucial element of the UK’s drive to grow its electric vehicle manufacturing capability. In January last year, it received an in-principle offer of government funding as part of its Automotive Transformation Fund, an £850 million programme to electrify Britain’s automotive supply chain.

THG shares under pressure, FTSE 100 lower

Tuesday 17 January 2023 10:24 , Graeme Evans

The new year optimism of Hut Group boss Matt Moulding failed to win over the City today as shares in his THG e-commerce business came under more pressure.

Founder and chief executive Moulding reported record annual sales of £2.25 billion and said efficiencies and falling commodity prices meant THG was well placed for substantial margin expansion.

However, his comments were offset by disappointment over recent sales as analysts at Jefferies said the LookFantastic beauty brand and THG’s Ingenuity ecommerce platform missed estimates in the final quarter.

The City bank trimmed its price target by 10p to 85p, adding that the “laboured” end to the year highlighted uncertainty over the pace of THG’s margin rebuild.

Shares slumped 7% or 4.7p to 63.75p, a decline that unwound the recovery seen since the stock fell as far as 31p in October. Back in May, the THG board rejected a takeover proposal of 170p at a 40% premium to the previous day’s share price.

THG’s weakness came during a lacklustre session for the wider London market as the FTSE 100 index resisted an all-time high by easing 0.2% or 15.72 points to 7844.35.

Big fallers included Unilever, which dropped 51p to 4179p after analysts at Bernstein cut the consumer goods group to “underperform” with target price of 3500p.

Experian also dropped 30p to 2925p, despite strong trading in Latin America helping the credit checking firm to report an in-line growth rate of 7% for the December quarter.

The FTSE 250 index weakened 34.01 points to 20,048.32, with cyber security firm NCC the biggest faller after Berenberg removed its “buy” recommendation and lowered its target price to 240p. The shares fell 6% or 11.6p to 195.4p.

There was encouragement for investors in the recruitment sector after Hays reported an 8% rise in fees in the fourth quarter following a record November. Its shares added 2.8p to 121.8p, continuing the rebuild seen since a cautious update from rival Robert Walters.

Other stocks doing well today included McBride, with the supermarket supplier of household cleaning products up 0.2p to 26.4p after reporting a return to profitability in the final two months of 2022.

Shares in Esken, the owner of Southend airport, also rose 6% or 0.3p to 5.5p after it announced a new airline route with easyJet to Amsterdam.

Revolution to shut bars on Monday and Tuesday

Tuesday 17 January 2023 10:07 , Simon English

THE strife in the bar trade was laid bare today when Revolution issued a profit warning and said it would close of number of venues on Monday and Tuesday.

Train strikes and soaring energy bills have hit pubs hard. Revolution said some of its bars won’t open at the start of the week this month and next to save costs.

Profit for the year will be at the bottom of City expectations at around £7 million.

Chief executive Rob Pitcher said: “The first Christmas since 2019 without the shadow of Covid, saw a new company record for pre-booked party revenue allowing us to be optimistic of a strong Christmas period. However, the continued train strikes had a material impact on whether guests attended their office Christmas parties, how long they stayed and whether they met up with friends on a separate occasion.”

Revolution shares fell 2.4p to 5p which leaves the equity in the business valued at £11.5 million.

That compares to debts of £18.5 million.

Other pub chains are thought likely to follow suit on closing venues in quiet parts of the week.

Revolution said: “The decision to close some bars on a Monday and Tuesday in the early weeks of the year allows us to minimise energy usage in our quietest period whilst also allowing our teams to recover after the busy Christmas period.”

A “year to forget” for Ocado

Tuesday 17 January 2023 09:53 , Simon English

OCADO saw sales fall last year as shoppers embraced the high street over internet deliveries and cut back on pricier items.

Its UK retail arm, jointly owned by Marks & Spencer, saw sales in the full year down 3.8% to £2.2 billion, the first time in its 23-year history that revenue has fallen.

In the fourth quarter, sales were up 0.3% to £549 million, which the City regards as respectable though worse than rivals such as Sainsbury and Tesco which did much better over the festive season.

While Ocado now has 940,000 active customers, they shop less often. The company said there was “an unwind of pandemic shopping behaviours accelerated by the onset of the current cost of living crisis”.

The shares fell 42p, 5%, to 766p. M&S shares also took a smaller hit, down 1p to 150p.

Ocado expects to break even for the year.

Clive Black at Shore Capital, a long-term Ocado sceptic, called 2022 a “year to forget” for the grocer. Ocado has been around for 23 years including 13 on the stock market.

The joint venture’s average basket value was down 1.3% in the quarter to £117 as a 7.6% increase in average selling prices was offset by a 8.3% fall in average items per basket.

Black said: “We believe it is simply a business that struggles to prove that it can make money, which appears not to be its prime aim.”

City retail analyst Nick Bubb said: “It was tougher at Christmas for online players like Ocado, THG and Naked Wines than the multi-channel retailers.”

Chris Beckett, head of equity research at Quilter Cheviot, said:

“Ocado Retail, the joint venture between Ocado and M&S, delivered a poor fourth quarter trading statement today, highlighting that the bumper Christmas sales have not been enjoyed across all retailers. Consumer trends are still normalising following the pandemic, so numbers will be volatile in the short-term, but it is at least encouraging to see the business growing customer numbers and revenue.”

Wise shares fall after volume growth slows

Tuesday 17 January 2023 09:25 , Simon Hunt

Shares in Wise fell 5.8% to 604p this morning after the London-based fintech saw slowing volume growth.

The internatioanal money transfer business saw volume over the three months to the end of December grow 28% to £26.4 billion, coming in below analyst expectations.

However, the firm was more upbeat about growth prospects, raising its full-year total income growth guidance to 68-72%, from 55-60% previously.

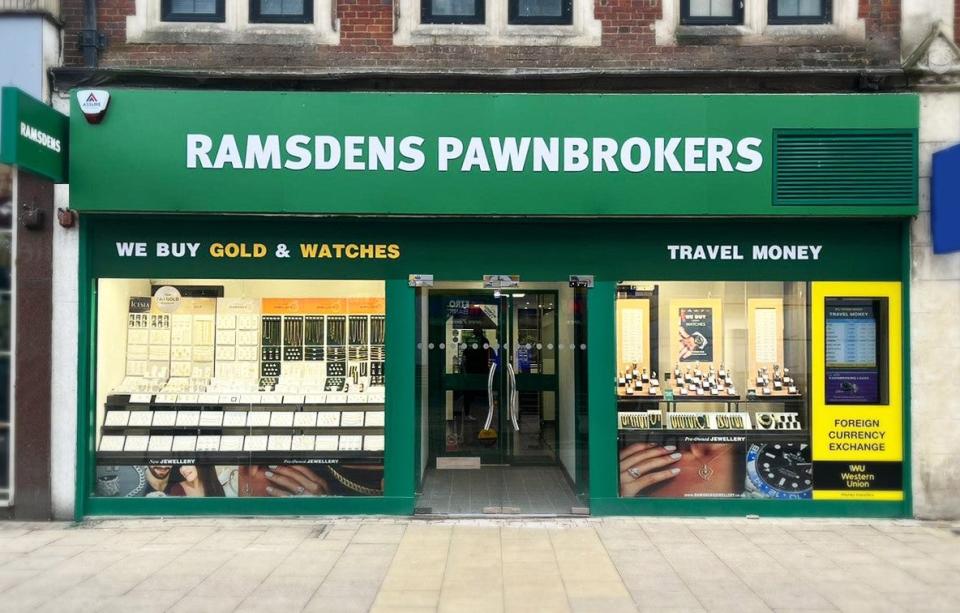

Ramsdens shares boost after profits grow 71%

Tuesday 17 January 2023 08:59 , Simon Hunt

Shares in Ramsdens got a boost this morning after the firm announced a 71% jump in profits to £38.2 million as consumers turn to high street pawnbrokers to get them through a cost of living crisis.

The business, which offers loans on jewellery and watches, posted a 62% jump in sales to £66 million for the year to £66.1 million and declared a 9p full-year dividend, well up from the 1.2p from the previous year.

The Middlesbrough-based business also has plans for expansion to the South East, and this week opened its first London store in Croydon (below).

Ramdens boss Peter Kenyon told the Standard: “Bills are probably a bit higher so the customer demand to borrow £100 has now gone up to £120.

“But the cost of living crisis hasn’t hit everyone and there are still people out there with cash to spend on jewellery.”

Ramdens shares climbed 6% to 222p in early trade this morning.

FTSE 100 lower, Ocado shares down 8%

Tuesday 17 January 2023 08:45 , Graeme Evans

European markets have made a subdued start to the session, with the FTSE 100 index down 8.52 points to 7851.55 and the FTSE 250 index off 59.79 points at 20,022.65.

Ocado fell by 8% on the back of an update from its retail division, a decline of 68.6p to 739.4p that continues a recent run of sharp share price movements.

Credit checking firm Experian fell 28p to 2927p after a trading update, while Unilever lost 67.5p to 4162.5p after analysts at Bernstein cut the consumer goods group to an “underperform” recommendation with target price of 3500p.

Among other companies reporting updates today, shares in FTSE 250-listed recruitment business Hays rose 2.1p to 121.1p but Hut Group e-commerce firm THG fell back 7% or 4.8p to 63.7p.

FTSE 100 down 6 points

Tuesday 17 January 2023 08:04 , Simon Hunt

The FTSE 100 is down 6 points to 7,853 in the opening minutes of trade as it hovers near a record high. Here’s a look at the biggest opening moves.

Shares in SSE PLC climbed the most, up 0.95% to 1698.5p.

Shares in F&C Investment Trust PLC were up 0.64% to 951p.

Shares in Anglo American PLC were up 0.63% to 3575p.

Shares in Berkeley Group Holdings PLC fell the most. They were down -1.39% to 4395p.

Shares in Unilever PLC dropped -1.12% to 4182.5p.

Shares in Prudential PLC were down -1.09% to 1311p.

FTSE 100 remains near all-time high

Tuesday 17 January 2023 07:47 , Graeme Evans

The FTSE 100 added another 0.2% yesterday and is forecast by CMC Markets to open unchanged at 7860.

That level compares with the intraday high in May 2018 of 7903 and the record close of 7877, which was set in the same month.

US markets were closed yesterday for Martin Luther King Day, but traders in London will have been encouraged this morning by better-than-expected figures from China’s economy and recent falls in European natural gas prices.

Crest Nicholson says housing market shows signs of ‘resilience’ as annual profit meets forecasts

Tuesday 17 January 2023 07:47 , Michael Hunter

Housebuilder Crest Nicholson has pointed to “signs of resilience” in the housing market into 2023 as it reported annual profit in line with forecasts, even after the impact of September’s “mini”-Budget.

Peter Truscott, chief executive, said the FTSE 250 company “had to navigate operational disruption throughout the year and faced increased economic uncertainty in our final quarter,” but adjusted profit before tax hit guidance, at £137.8 million, up from £107.2 million.

Looking ahead, Crest voiced confidence in the housing market, saying that at the start of 2023, “there are signs of the resilience that has characterised the housing market through recent years. The cost of borrowing is starting to reduce and availability remains good for those with higher levels of equity.”

It added that demand for new homes “is still strong”, and said it remained “confident in the long term fundamentals” of the market, with “inflation forecast to have peaked.”

Earnings jump adds to rates rise pressure

Tuesday 17 January 2023 07:39 , Graeme Evans

Today’s bigger-than-expected jump in average weekly earnings of 6.4% is expected to ramp up pressure on the Bank of England’s monetary policy committee (MPC) to announce another big increase in interest rates next month.

The earnings figure including bonuses compared with an upwardly revised improvement of 6.2% seen in the previous three month period. The tightness of the labour market was also shown in a surprise rise of 27,000 in the number of people in employment.

Samuel Tombs, chief UK economist at Pantheon Macroeconomics, wrote on Twitter: “Very hard to see the MPC slowing down next month and hiking the bank rate by only 0.25% in the wake of this morning's wage data - plenty of near-term momentum in both the average weekly earnings and PAYE data. Another 0.5% hike looks highly likely.”

China annual growth slows to 3%

Tuesday 17 January 2023 07:29 , Graeme Evans

China’s Covid-hit economy expanded by 2.9% in the fourth quarter, meaning the overall rate of 3% for 2022 was the second weakest since 1976 and a big miss against the government’s initial target for 5.5% growth.

However, there was encouragement that activity held up reasonably well in the face of December’s surge in Covid cases.

The fourth quarter GDP figure was better than expectations for a rise of 1.6%, while a 1.8% drop in retail sales in December compared with a forecast 9% fall. Industrial production grew 1.3% year-on-year, well above the 0.1% predicted.

China is expected to announce a 2023 growth target in March, having recently relaxed its zero-Covid restrictions.

Naked Wines ups earnings outlook after ‘pivot to profit’

Tuesday 17 January 2023 07:27 , Simon Hunt

Naked Wines has strengthened its earnings outlook for the year on the back of “solid” third-quarter trading as the wine subscription service continues with its “pivot to profit”.

The firm has raised the top end of its EBIT outlook from £13 million to £17 million for the full 2023 financial year.

However, new customer levels were down 32% on the prior year, while total sales fell 6% at constant currencies.

Nick Devlin, Group Chief Executive, said: “The consumer and marketing environment remains challenging and opportunities to invest in new customer recruitment at attractive payback levels continue to be limited.”

Diageo to buy Don Papa rum in €438 million deal

Tuesday 17 January 2023 07:15 , Simon Hunt

London-based spirits maker Diageo has agreed to buy Don Papa rum in a €438 million (£389 million) deal.

The upfront consideration is €260 million with a further potential consideration of up to €177.5 million through to 2028 subject to performance, Diageo said.

The drink, which is made in the Phillipines, is on sale in over 30 countries worldwide and is popular in France and Germany. First launched in 2012, it is named after Papa Isio, who was one of the leading figures of the late 19th century Philippine revolution.

Stephen Carroll, Founder, Don Papa Rum, said: "Diageo has a strong track record in nurturing founder-led brands.

“They believe in our unique story and have genuinely embraced our brand idea.”

Diageo said the acquisition will be funded by existing cash reserves.

Yahoo Finance

Yahoo Finance