FTSE 100 Live: ‘A radical decline in UK investment’ — London Stock Exchange boss grilled on US listings

GSK, housebuilder Persimmon and the consumer products group Reckitt Benckiser are among the blue-chips updating investors today.

Asia-focused lender Standard Chartered has also given an insight into trading conditions during a turbulent time for the banking industry.

The FTSE 100 index is lower, despite Microsoft and the Google owner Alphabet beating Wall Street forecasts last night.

FTSE 100 Live Wednesday

Persimmon shares up on trading green shoots

Microsoft and Alphabet boosted by cloud progress

Standard Chartered highest profit in nine years

Hoggett: ‘I want a mother in Cumbria to care’ about London Stock Exchange

15:36 , Daniel O'Boyle

Julia Hoggett told the Treasury Committee that she wants the entire country to care about the London Stock Exchange, by reminding the public of its role in providing funding for companies that provide jobs and key goods and services.

“We talk about it as deals, IPOs, fees. Not the things driving the real economy,” she said.

“I want everyone to talk about how we have a vibrant capital market that provides the capital to finance the jobs and the futures for them and their kids.

“I want a mother in Cumbria to care that we can finance a startup in Cumbria that provides jobs to allow her to buy a house so she cann stay in Cumbria and be near her grandkids.”

Mixed start for US stocks

15:20 , Daniel O'Boyle

Shares in most major US-listed companies are roughly level today, though tech stocks fared better while the largest-cap firms struggled.

The S&P 500 is down very slightly to 4,069.40, while the Dow Jones is down 0.3% to 33,435.68. The Nasdaq though, hit hardest by declines yesterday, is up 0.6% to 11,874.10.

GSK chair: UK ‘can’t complain’ about US listings if it won’t fund startups

14:49 , Daniel O'Boyle

GlaxoSmithKline chair Jonathan Symonds cited funding for early-stage companies as a key reason why UK companies tend to list abroad.

“When a company comes to that critical decision in its life of ‘do we list and where do we list’ the vast majority of companies in UK life sciences have been almost entirely funded by US capital,” he said. “Therefore the vast majority of its board is from outside the UK.

“So when it comes to the question of where do we list, the UK isn’t getting a fair opportunity.

“If the capital is all imported, I don’t think we can complain if the company is exported,” he said.

London Stock Exchange CEO: We need to recognise that stock markets are about risk

14:44 , Daniel O'Boyle

London Stock Exchange boss Julia Hoggett said there needed to be more understanding that equities markets inherently involve risk, as she cited the lack of investment from pension funds in companies pursuing listings abroad.

“We need to recognise that stock markets are about risk capital,” she said. “We have to recognise that not every time, companies will succeed. Some will fail, and not every companies will have the returns expected.”

London Stock Exchange boss and Lord Mayor grilled over US listings

14:20 , Daniel O'Boyle

London Stock Exchange CEO Julia Hoggett and the Lord Mayor of the City of London Alderman Nicholas Lyons are facing questions from the treasury committee about why London-listed firms are increasingly pursuing US listings.

The cross-party Committee is likely to explore what lessons regulators, the Government and the London Stock Exchange (LSE) can learn from ARM not listing in the UK, and the role of the LSE in promoting firms to list.

MPs may use the session to discuss the international competitiveness of the UK, whether it’s concerning when British firms choose to list overseas, and new sources of growth and investment.

Wall Street shares set for minor recovery

14:12 , Daniel O'Boyle

US shares are set for a slight recovery when trading begins on Wall Street, according to futures markets.

The S&P 500 is set to open up 0.3% to 4104.75, while the Dow Jones is set to rise by 0.2% to 33724.00. The S&P 500 fell by more than 1% yesterday while the Dow was down 0.9%.

The tech-led Nasdaq had an even sharper fall yesterday, losing 2%, but also appears set for the best recovery, rising 1.1% to 12950.50, after stronger-than-expected earnings from some of the sector’s giants after closing bell yesterday.

Germany raises GDP forecast

13:22 , Daniel O'Boyle

The German government has raised its GDP forecast for 2023, now expecting growth of 0.4%.

The government had previously epxected growth of 0.2%.

The improved outlook is in contrast with the UK, where the economy appears set to flatline this year.

Monopolies watchdog blocks Microsoft’s £57 billion takeover of Call of Duty publisher Activision

12:57 , Daniel O'Boyle

The UK Government’s monopolies watchdog has blocked Microsoft's $69 billion (£56.6 billion) takeover of Call of Duty and World of Warcraft publisher Activision Blizzard over concerns it would give the tech behemoth too much dominance over the emerging cloud gaming space.

Microsoft intended to buy Activision in the hopes of adding Activision’s games, like Call of Duty and Crash Bandicoot, to its Xbox Game Pass platform with the aim of boosting subscriber numbers.

‘Nothing we can do’ to turn a profit — Heathrow boss slams CAA cap

12:13 , Daniel O'Boyle

Heathrow is on course for a fourth consecutive year in the red after it slumped to a loss of £139 million in the first three months of the year.

Boss John Holland-Kaye blamed an unfavourable decision on the level of take-off and landing fees that the west London hub can charge airlines for the failure to recover into profit despite a huge leap in passenger numbers since the end of the pandemic.

New boss takes charge at under-pressure CBI

11:27 , Daniel O'Boyle

The new boss of the Confederation of British Industry has taken the reins at the influential trade body which has been shaken by allegations of widespread sexual harassment.

Rain Newton-Smith faces a battle to reform the group after many questioned the wisdom of appointing a CBI insider to the top job.

Public service productivity figures ‘a clear blight on UK growth’

11:13 , Daniel O'Boyle

UK public service productivity was flat in the last three months of 2022, according to the ONS, in the latest sign pf economic stagnation.

“Productivity is flat, which is a clear blight on UK growth,” Goodshape CEO Alun Baker said. “This is unfortunate but unsurprising, given employers lost 25% more working days due to absence this quarter when compared to Q4 2021.

“The UK’s output is determined by our workforce’s health and wellbeing. Today’s productivity figures show we are failing to implement meaningful measures to improve the health and wellbeing of our people. All too often, employers invest in symbolic gestures to signal that employee wellbeing is being taken seriously. But, it’s a token rather than a clear mantra for change. “

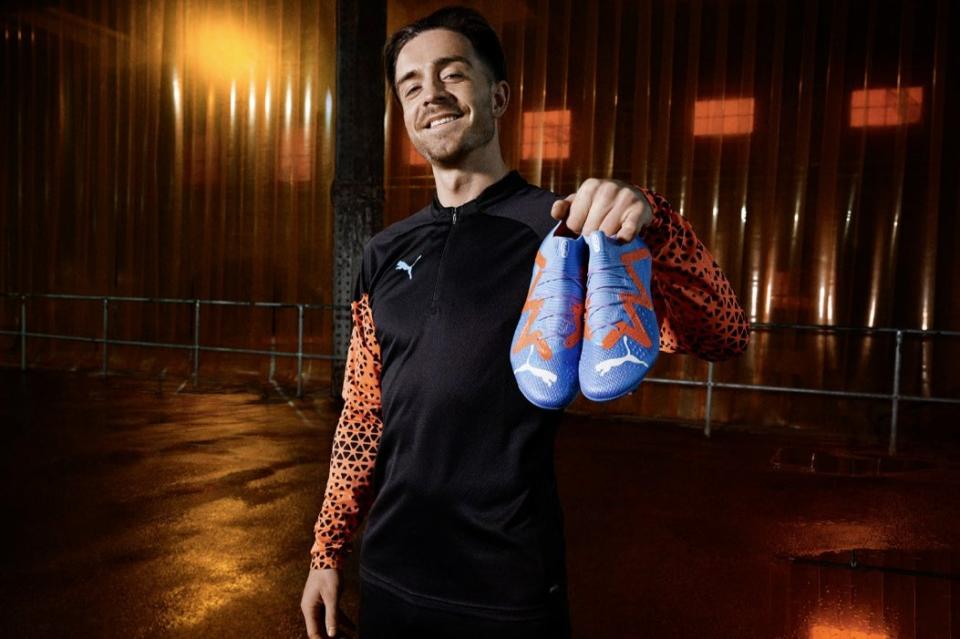

Puma first quarter sales boosted by bumper footwear demand

10:39 , Joanna Hodgson

Sportswear brand Puma has revealed bumper demand for footwear helped lift first quarter sales up to reach €2.2 billion (£2 billion.)

The German company, known for its jumping cat logo, recorded a 14.4% group sales rise, with footwear 28.8% higher with strong performances in its football, basketball and running lines.

The company pointed to highlights from the quarter including signing a new “long-term partnership” with Jack Grealish which will see the Manchester City player wear Puma boots.

FTSE 100 holds firm, CRH and Bunzl lower

10:18 , Graeme Evans

Results from Microsoft and Alphabet today helped to steady nerves at a time of mounting worries over the global economic outlook.

The FTSE 100 index fell 20.81 points to 7870.32, representing a resilient showing given Tuesday’s 1.5% slide for the S&P 500 and the Nasdaq’s worst session in a month.

Developments after the US closing bell offered some encouragement, however, with shares in Microsoft and the Google and YouTube parent Alphabet both higher after they revealed the positive impact that AI innovation is having on their cloud businesses.

In London, there was a mixed reception to a wave of first quarter trading updates. Outsourcer Bunzl was one of those to meet expectations, but in a jittery market its shares gave up recent gains by falling back 72p to 3130p.

The biggest slide came from building supplies firm CRH after an outlook statement highlighting strong infrastructure demand in North America was clouded by a challenging backdrop in Europe due to pressure on the new-build residential sector.

CRH’s shares fell 5% or 182p to 3840p after what looks set to be one of its last updates as a FTSE 100-listed company. The Ireland-based firm, which generates about 75% of its earnings in the US, revealed that plans for a primary listing in New York will be put to a shareholder vote on 8 June.

The FTSE 250 index stood 61.25 points lower at 19,154.14, despite a stronger session for Harbour Energy and progress by housebuilders Redrow and Bellway on the back of today’s resilient update by Persimmon.

Biomass power station business Drax led the risers board, adding 4% or 24.8p to 644p after announcing a £150 million buyback programme in its AGM trading update.

Among smaller companies, shares in W7 and Technic cosmetics business Warpaint London lifted 6.5p to 202.5p on AIM after it reported record annual sales of £64.1 million and a rise in pre-tax profits to £7.7 million.

Working days lost to sickness rockets to record high as NHS backlogs hit economy

10:02 , Daniel O'Boyle

The total number of days lost due to sickness in 2022 was the highest in history, according to new Government data, as long NHS waiting lists kneecap the economy.

The number of days lost to sickness last year rocketed to 185.6 million, almost 25% more than in 2021 and overtaking 1999 as the highest number of days lost since records began in 1995.

While part of the increase in days lost was due to the population growing over time, the percentage of total available of working hours lost was still the highest since 2004.

The O2 launches £15,000 members club — with walkway above the arena

09:07 , Daniel O'Boyle

The O2 today announced the launch of a new private members club where 300 people can watch every show at the venue from a private walkway above the arena.

The Residence at the O2, which also includes a champagne bar and restaurant, was the result of a £7 million investment.

“We’re sort of following the football season-ticket model but with access to 220 varied events,” the O2’s senior director of premium Matt Botten said.

Persimmon and Standard Chartered shares rally, FTSE 100 lower

08:36 , Graeme Evans

Persimmon is at the top of the FTSE 100 index after the housebuilder’s trading update sent its shares up by 4% or 43.5p to 1279.5p.

The update also boosted rival Taylor Wimpey, which lifted 1.5p to 122.6p ahead of its own trading statement tomorrow. Others on the risers board included Smith & Nephew, which improved 22.5p to 1296.5p following the medical devices firm’s in line trading update.

The FTSE 100 index was 19.61 points lower at 7871.31 in reaction to yesterday’s weak session on Wall Street, with Associated British Foods the leading faller as the conglomerate continues to come under pressure following Tuesday’s interim results.

The Primark owner fell 56p to 1928p, just ahead of Bunzl after the outsourcing firm lost 86p to 3116p in the wake of an update.

Standard Chartered rose 3.8p to 624.4p after its first quarter figures, while Lloyds Banking Group was close to its opening mark during a calmer session for banking stocks.

The FTSE 250 index eased 53.08 points to 19,162.31, despite gains of 3% for Tullow Oil and Harbour Energy. Biomass power station business Drax rose 5% or 30.2p to 649.4p after its trading update.

FTSE 100 seen lower after Wall Street sell-off

07:48 , Graeme Evans

Concerns over the deteriorating economic outlook weighed on markets yesterday as the S&P 500 closed 1.5% lower and the tech-focused Nasdaq lost 2% during its worst session for a month.

Most of the losses came after London’s closing bell, meaning that CMC Markets expects the FTSE 100 index to extend yesterday’s 0.3% decline by 30 points to 7861 this morning.

Commodity-focused stocks have been the target of recent selling in London and elsewhere amid expectations that the continued rise in global interest rates will slow demand.

Oil prices fell sharply yesterday, although trading on futures markets steadied today to leave Brent crude at $81.24 a barrel.

Financial stocks also had a difficult session after Spanish bank Santander and UBS in Switzerland both set aside larger than expected provisions in their Q1 numbers.

GSK says no more Covid revenues as first quarter sales slide

07:44 , Simon Hunt

GSK has warned it expects no further revenues from its coronavirus-related treatments after it reported a drop in first-quarter sales.

Turnover for the first three months of 2023 fell 8% to just under £7 billion as COVID-19 solutions sales fell from £1.3 billion last year to £132 million in 2023.

The firm said in an update: “Based on known binding agreements with governments, GSK does not anticipate further significant COVID-19 pandemic-related sales or operating profit in 2023.

“Consequently, the Company now expects full-year 2023 turnover growth to be impacted by approximately 9%, with Adjusted Operating profit growth being reduced between 5% to 6% versus the prior year.”

New home completions tumble at Persimmon, but encouraging signs from recent trading

07:42 , Joanna Bourke

First quarter home sale completions tumbled 42% at Persimmon, but the builder today showed some green shoots have appeared in the market with visitor numbers to sites improving.

Persimmon, one of the UK’s largest housebuilders, completed sales on 1,136 homes in the three months to March 31, down from 1,950 a year earlier.

The value of its forward sales order book also dropped, down to £1.7 billion from £2.4 billion.

Chief executive Dean Finch said the performance was as expected “and reflects the challenging trading conditions” in the last few months of 2022.

The FTSE 100 company is among firms hit by the UK housing market slowing in recent months, with consumer finances hit from the cost of living crisis and high mortgage rates hurting demand.

But Finch said: “Trading over recent weeks has offered some signs of encouragement with visitor numbers up, cancellation levels normalising and sales rates continuing the steady improvement evident since the start of the year.”

The update comes after the firm last month said total home sales completed increased to 14,868 last year from 14,551. It cautioned that could tumble to 8,000 to 9,000 in 2023 if the current selling rates continue.

Finch has now said if sales rates continue at the levels seen year to date, Persimmon would expect full year volumes to be toward the top end of the completions guidance.

Microsoft and Alphabet boosted by cloud progress

07:33 , Graeme Evans

Leading Wall Street indices closed sharply lower last night, although there was cheer after the closing bell when Google parent Alphabet and Microsoft beat results expectations.

Microsoft shares jumped 8% in after-hours trading after the cloud platform reported a 15% rise in operating profit to $22.4 billion (£18 billion) in the third quarter of its financial year.

Revenues lifted 10% on a constant currency basis to $52.9 billion (£42.6 billion), with Microsoft Cloud’s haul of $28.5 billion (£22.9 billion) was up 25%.

Chief executive Satya Nadella said: “Across the Microsoft Cloud, we are the platform of choice to help customers get the most value out of their digital spend and innovate for this next generation of AI.”

Google and YouTube owner Alphabet also reported momentum on the cloud side of the business as it beat revenues expectations for the first quarter with a 6% rise at constant currency rates to $69.8 billion (£56.2 billion).

Alphabet shares were 2% higher after the closing bell as it emerged that Google Cloud recorded an operating profit for the first time with a surplus of $191 million (£153.7 million).

Hargreaves Lansdown analyst Sophie Lund-Yates said: “This is a feat that has undoubtedly been accelerated by the recent uplift in demand and excitement around artificial intelligence.

“Despite not necessarily being the front runner in this space, the changing tech landscape is a tide that lifts all ships – all ships that can afford a seat at this table, of which there are very few.”

Reckitt Benckiser appoints company insider Kris Licht as new CEO

07:32 , Michael Hunter

FTSE 100 consumer products giant Reckitt Benckiser has chosen a company insider as its next chief executive, ending a seven-month search.

Kris Licht will become CEO designate from the start of May, taking over from temporary chief Nicandro Durante by the end of the year.

The Slough-based multinational lost its previous permanent CEO, Laxman Narasimhan, in September after just three years in charge, when the former PepsiCo executive was poached to run Starbucks, the global coffee chain.

Licht is the president of Reckitt’s health business and has been its chief customer officer since July 2020. He is also a former PepsiCo employee. He said it was an “honour” to take the top job at the maker of Finish dishwasher tablets and Cillit Bang cleaning products.

Reckitt said today that group like-for-like revenue rose almost 8% in the first quarter to £4 billion, and predicted growth for the full year in a range between 3% and 5%.

Standard Chartered posts highest profit in nine years

07:25 , Daniel O'Boyle

Emerging market-focused bank Standard Chartered posted its highest quarterly profit since its tumultous 2014, thanks in part to rising interest rates.

The business made $1.7 billion (£13.7 billion) in profit, the biggest profit it has made since the first quarter of 2014. That quarter was the last of a high point for the bank, before repeated profit warnings amid a slowdown in growth in its core markets.

“We have delivered another strong set of results in the first quarter of 2023, with income up 13% year-on-year and underlying profit before tax up 25%, CEO Bill Winters said. “Business performance continues to improve across our markets and products and has been achieved in what continues to be an uncertain environment.

“We remain optimistic about our continued strong performance and now expect 2023 income to grow around 10 per cent, the top end of our range, and remain confident in the delivery of all of our financial targets, including our return on tangible equity targets.”

Shares have risen by 1.3% today in Hong Kong.

Heathrow slams CAA price cap ‘clear errors’ as it posts another quarter of losses

07:16 , Simon Hunt

Heathrow Airport has slammed the Civil Aviation Authority’s “clear errors” as it posted yet another quarter of losses.

The firm posted an adjusted loss of £139 million in the first three months of 2023, despite a 58% jump in sales to £814 million.

Last month, the CAA published its final decision to set an average price cap of £23.06 at Heathrow. The airport said it had appealed the decision to the competition regulator.

The firm said: “Heathrow has not yet returned to profit with adjusted losses of £139 million in Q1 due to the revenue allowance in the CAA’s H7 settlement being set too low.”

Heathrow said there were “a number of areas in which the CAA has made clear errors which will undermine the investment needed to deliver the airport service and resilience consumers want.”

Recap: Yesterday’s top stories

06:41 , Simon Hunt

Good morning. Here’s a summary of our top stories from yesterday:

Ocado said it would close one of its biggest warehouses at Hatfield, putting as many as 2,300 jobs at risk.

UK public debt hit £2.5 trillion after public borrowing soared in March to hit a record £90,000 owed per household.

The owner of Primark said it was “nearly through” a period of price rises in signs of optimism for the high street after a wave of rocketing inflation.

Profits at Premier Inn owner Whitbread surged past pre-pandemic levels as the firm said it was benefitting from “the structural decline in the independent hotel sector.”

The founders of health grocer Planet Organic have bought the chain back from adminsitrators but said some stores would close and more than 60 staff would be laid off.

Today we’re expecting trading updates from:

Reckitt Benckiser Group

Smith & Nephew

Fresnillo

Yahoo Finance

Yahoo Finance