Miners hold FTSE 100 in positive territory following Chinese demand boost

Miners lead the gainers on the FTSE 100 thanks to an iron ore price rally; housebuilders rebound from Friday's sell-off

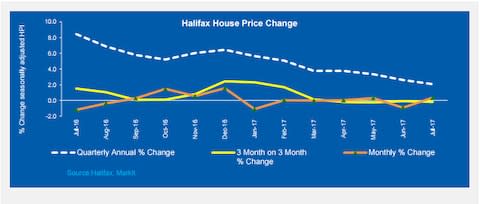

House price growth drops to four year low; fall blamed on sluggish wage growth

Dollar retreats from Friday's highs against the pound and euro to weigh on European equities

Dow Jones index hits record intraday high before retreating

Markets wrap: FTSE 100 inches closer to all-time high

The FTSE 100 inched a little closer to its all-time high today after a surge in iron ore prices lifted London mining giants.

The metal's price rallied after the Chinese government announced it would be restricting production to curb pollution in its northern cities.

Global miners Anglo American, Glencore, Rio Tinto and BHP Billiton topped the FTSE 100 scoreboard following the rise with the index's gains also supported by housebuilders rebounding from Friday's losses.

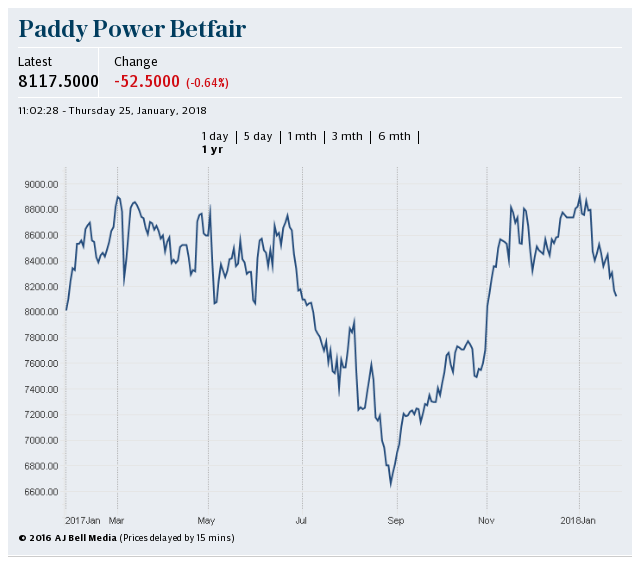

At the other end, bookie Paddy Power Betfair fell furthest, dropping nearly 5pc, after announcing the departure of its chief executive Breon Corcoran. The overall index closed 20.23 points higher at 7531.94.

On the currency markets, the pound has edged down 0.1pc against the dollar and is currently trading at $1.3026 with little economics data to stoke much movement.

IG's market analyst Josh Mahony commented on today's action:

"The FTSE has largely been in consolidation mode today, with only marginal gains after what seemed like a decisive shift higher on Friday.

"We are looking at a pivotal week, with potential bullish reversals for the likes of the FTSE, DAX and US dollar set against potential weakness for European FX, Gold and Crude. Friday seemed to lay the groundwork for indices, FX and commodities to all reverse recent trends.

"The current indecision should be resolved as the week goes on."

Ageing population to make productivity crisis worse

Britain’s productivity crisis risks getting worse because the population is ageing steadily, leaving relatively fewer younger, more dynamic workers who typically innovate more.

Unless drastic action is taken to boost skills and creativity, or to increase the number of young workers, then growth will struggle to pick up, according to new economic research published in the journal of the National Institute of Economic and Social Research.

“The share of young workers impacts the innovation process positively and, as a result, a change in the demographic profile that skews the distribution of the population to the right [older], leads to a decline in innovation activity,” said the paper, written by Yunus Aksoy, Henrique Basso and Ron Smith.

Read Tim Wallace's full report here

Job swap! Manchester and Stansted airport bosses switch roles

The bosses of Manchester and Stansted airports are swapping jobs in a bid to put their skills to best use as each site deals with a major project.

Andrew Cowan, chief executive of Stansted airport, will swap with his opposite number at Manchester, Ken O'Toole, in September.

Manchester Airports Group (MAG) owns both sites.

Before joining the company in 2013 as chief operating officer, Mr Cowan was group chief executive of Robertson Group, one of the largest independently owned construction, infrastructure and support services companies in the UK.

The airport's owners see this experience as important as Manchester Airport begins a £1bn programme to build a new terminal so that it can make better use of its two runways.

At Stansted, meanwhile, Mr O'Toole, who has been boss of Manchester airport since 2013, will work on a project to make better use of the existing runway and increase the airport's capacity to 44 million passengers a year.

Read Bradley Gerrard's full report here

Dow Jones retreats into negative territory

The Dow Jones has reversed its early gains and retreated into what as of late has become unfamiliar territory for the index: the red.

Pulled back by healthcare and telecom losses, it is now a couple of points down for the session while the Nasdaq enjoys a modest advance and S&P 500 nudges up slightly.

The Dow Jones hit the fresh all-time intraday high "off the fumes" of last Friday's solid jobs report, according to Spreadex analyst Connor Campbell.

I don't think today will live long in the memory of Mr Campbell:

"A deathly dull day was enlivened by the sight of the Dow Jones sneaking its way to a fresh all-time high.

"After flagging around lunchtime the FTSE stole a bit of buzz from the US open to climb 0.2%, re-hitting 7530 in the process. The UK index isn’t too far off its own all-time high, though with such a dreary week on the cards it may need another sharp drop from the pound to propel it back to those levels.

"Though looking at sterling’s performance this Monday it’s not unfeasible that the FTSE will get its wish."

Plus500 eyes expansion as shares rocket on bumper six months

Plus500 saw its shares soar almost 15pc on Monday after the trading business posted record results and pledged to expand despite a major trading crackdown in Europe.

The Aim-listed, Israel-based firm saw its net profits more than double to $90.7m (£69.5m) for the six months to June 30, driven by a surge in new clients as well as a rise in existing customers increasing their trading activity.

The period marks a record first half for the group, with the profit surge and a 19pc rise in revenues to $188.4m being "significantly" ahead of expectations.

The bonanza run has led the company, which cashed in on renewed interest in spreadbetting following the Brexit vote last June, to explore "new avenues for growth" .

Read Lucy Burton's full report here

Dow Jones hits all-time intraday record high... again

It didn't have to take much but the Dow Jones index in the US has hit another intraday record high shortly after the opening bell in New York.

The benchmark US index has nudged up 14 points to just over 22,100, buoyed by modest gains made by earnings season winners Boeing, Apple and McDonalds.

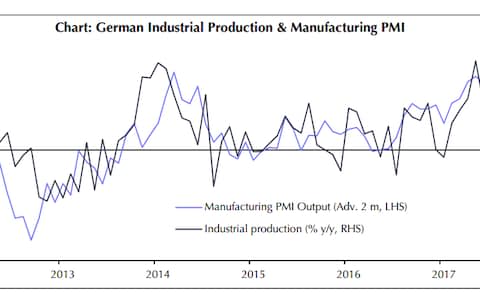

European markets are little changed this afternoon with the FTSE 100 outperforming its peers on the continent thanks to the heavy presence of rising mining stocks on the index and the DAX dipping 0.4pc following weaker-than-expected industrial production data in Germany.

Meanwhile on the forex markets, the pound has reversed the small gains it made against the dollar this morning and is now in flat territory, trading at $1.3026.

Struggling Lonmin looks for new ways to save cash

Mining group Lonmin is looking for ways to raise cash and cut costs as it struggles to cope with the flatlining price of platinum, its key product.

The South Africa-based miner has announced a scheme to save $37m (£28m) by September 2018 that could see the axe fall on mainly back office roles.

The London-listed group will also look to sell space in its processing plant, which is estimated to be running at about 60pc capacity, to other platinum producers.

It is also seeking partners to help finance a pair of capital projects to extend the life of two of its mines. A failure to find a partner for these projects could put 5,000 jobs at risk.

Lonmin did not put a figure on how much it is hoping to raise from these latest measures.

Shares jumped 3.4pc in intraday trading following the announcement.

Read Jon Yeomans' full report here

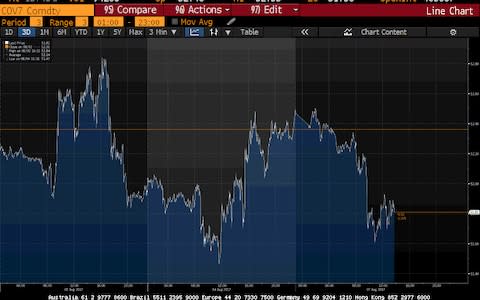

Brent crude stabilises after 1.25pc slump

Brent crude's drift downwards today as OPEC meets to discuss compliance to production cuts has halted at just under $52 per barrel.

With prices recently supported last week by a US stocks drawdown and Baker Hughes' rig count falling, can OPEC also persuade traders it's serious on compliance to help lift the price further?

Not according to Mihir Kapadia, chief executive at Sun Global Investments:

"The deal so far hasn't produced meaningful reductions in global output and inventories.

"The OPEC cartel are also aware that any signs of price improvements act as a catalyst for further US drilling, further contributing to the vicious cycle of creating and clearing the glut."

He added that the chances of WTI, the cheaper US crude benchmark, breaking through the $52 per barrel barrier are "very bleak".

British biotech Vernalis hit by US setback for cough and cold treatment

British biotech Vernalis has been hit by a setback for one of its key cough and cold treatments, sending the Aim-listed firm’s shares down 16pc.

Vernalis told investors - which include fund manager Neil Woodford and institution Invesco - it had received a so-called complete response letter (CRL) from US agency the Food and Drug Administration for its product CCP-08.

It means the medicines regulator is not prepared to approve it at this time. It comes after Vernalis received a similar CRL for sister cold remedy CCP-07 in April.

Ian Garland, chief executive of Vernalis, confirmed both products had encountered similar difficulties, but said they remained “of the utmost importance” to the company.

Read Iain Withers' full report here

Federal Reserve speakers the highlight of proceedings in the US

With consumer credit figures the only economics data due in the US to move currency markets this afternoon, investor focus across the pond has shifted to two dovish speakers from the Federal Reserve. James Bullard and Neel Kashkari, the latter of which is a voting member at the central bank, will be speak on the US economy shortly after markets close in Europe.

Last Friday's strong labour market data has cranked up the pressure on the doves at the Fed to raise interest rates once more before the end of the year with key US inflation data due this Friday seen as another indicator on how the central bank will vote.

Ahead of US markets opening, Connor Campbell, Spreadex analyst, said this on today's action:

"Yawn. Beyond one piece of, admittedly intriguing, German data there was sweet F.A. for the markets to work with this Monday."

"Those hoping for a bit more excitement this afternoon look set to be out of luck. There’s nothing of note on offer from the US, explaining why the Dow Jones is expected to open just 20 points higher after the bell. Still, that would push the Dow above 22100, so the index can’t have too many complaints."

I'll leave you to work out what F.A. stands for.

British Gas under pressure as regulator tightens pre-pay meter price cap

Britain’s largest energy supplier is under further pressure after the regulator turned up the heat on its price cap for pre-payment meters and the Government announced a second major review of energy prices.

British Gas, which is owned by Centrica, will bear the brunt of Ofgem’s plan to lower the cap on pre-pay meter energy prices by as much as £19 a year for 3 million homes due to its high number of customers who pay via meter top-ups.

The regulator brought in a price cap for pre-pay customers in April this year as the political appetite to lower bills across the energy market was reignited ahead of the general election. The tighter cap will come in from October, at around the same time that the results of a fresh review into energy supply costs is expected to be revealed.

Industry analysts have told the Telegraph that the pre-pay cap will not have a material impact on the group’s supply profits but margins will still feel a squeeze as a result of the harsh political glare on the industry.

The latest reminder of the industry’s regulatory woes rattled investors, causing the share price of Centrica to fall by 0.85pc to a near eight-week low of £1.98.

Read Jillian Ambrose's full report here

Lunchtime update: Miners help FTSE 100 stay in positive territory

The miners are keeping the FTSE 100 afloat as we enter the afternoon with the UK's benchmark index the standout performer in Europe.

Mining stocks have been lifted by the price of iron ore rallying on news that the Chinese government will force producers to cut their output in the north of the country during the winter, bringing forward demand in the region.

Elsewhere, Paddy Power Betfair has plunged 5.7pc this morning after its chief executive Breon Corcoran announced that he is leaving the bookie after 16 years. On the FTSE 250, defense and technology specialist QinetiQ has advanced 4.2pc following a broker upgrade while Ultra Electronics, one of the few companies reporting today, has slipped 3.4pc after posting a first half revenue drop.

With few economic releases to move the currency markets this morning, the pound has edged up against the dollar but fallen around 0.3pc against the euro despite slightly weaker data coming out of the eurozone today.

Here's the current state of play in Europe:

FTSE 100: +0.10pc

DAX: -0.46pc

CAC 40: -0.01pc

IBEX: -0.05pc

Is the dollar due a rebound?

The dollar has retreated this morning from Friday's highs inspired by the exceptional jobs data stateside.

Sterling has nudged up just 0.15pc against the greenback but the dollar has shed 0.4pc of its value against the euro.

Michael Hewson, CMC Markets analyst, believes, however, that the dollar could be due a more sustained recovery:

"The last five months have not been good ones for the US dollar index, and the general consensus is that we could well have further to fall.

"The last time the US dollar index fell for five months in a row was back in 2011, and you have go back to 2003 to find the last time we saw six successive monthly declines, which would on the law of probability suggest the scope for a rebound."

City Index analyst Kathleen Brooks has also found some reason for optimism for the dollar:

"The USD/Israeli shekel tends to be a lead indicator for the dollar index. Over the last year, USD/ILS peaked ahead of the dollar index in December 2016, it then continued to decline through February and March, even though the dollar index made a stab at recovery before joining the USD/ILS in a sustained downtrend for the next few months."

Paddy Power Betfair share price dive: A hat-trick of issues for shareholders

Paddy Power Betfair has come off this morning's lows following the announcement of chief executive Breon Corcoran's departure but the bookie still remains firmly in the red for the session, around 5.5pc down.

A mixture of a "reassuring hint" about tomorrow's interim results and "some understandable bargain hunting" has lifted the stock from its 8.6pc dive this morning, explains Mike Van Dulken, head of research at Accendo Markets.

He added on investors' jitters on Paddy Power this morning:

"Shock stems from losing an important figure and business driver, especially with last year’s merger. Uncertainty stems from whether Peter Jackson - CEO of Worldpay since March, CEO of Travelex 2010-2015 – and his wealth of financial and consumer experience (non-exec board member since 2016) will be enough to lead the gaming giant.

"Today’s drop scupper the shares recent rebound, and extends the mid-June downturn, adding to a rocky ride for both it and peers over the last twelve months. Fierce competition and consolidation are one problem. A lack of major summer sporting events this year makes it a brace. A new man at the top makes it a hat-trick of issues for PPB shareholders."

German industy still performed well in second quarter despite June's fall, says Capital Economics

Despite the unexpected dip in output, today's German industrial production figures for June still show the quarter performing well in the second quarter as a whole, according to Capital Economics' European economist Jack Allen.

Industrial output was expected to nudge up 0.2pc in June but instead it recorded a 1.1pc fall with a broad-based decline blamed for the drop.

He commented:

"Forward-looking indicators suggest that industry will continue to perform well. Indeed, industrial orders rose by 1.0% in May and 1.1% in June, which bodes well for output in the near term.

"The manufacturing current conditions and expectations indices of the Ifo survey rose to multi-year highs in July. And even though the manufacturing PMI declined for the second straight month in July, it is still consistent with annual industrial production growth of about 3%."

Tesco scraps 5p shopping bags for 10p 'Bags for Life'

Tesco is scrapping its 5p plastic carrier bags and replacing them with a new 10p Bag for Life made from 94pc recycled plastic.

The announcement follows a successful 10-week trial in Aberdeen, Dundee and Norwich, where Tesco found that customers bought significantly fewer bags when only pricer bags were offered.

Removing the 5p single-use carrier bags will "significantly reduce the number of bags sold and will therefore help reduce litter and bags sent to landfill," Tesco said. The single-use carrier bags will cease to be offered in stores from August 28.

Money from the new 10p bag, which will be replaced for free if damaged, will go towards funding community projects across Britain.

Tesco has given out 1.5 billion fewer single-use bags since the introduction of the carrier bag charge in England in 2015, but still sells more than 700 million each year.

Read Sophie Christie's full report here

Chinese production curbs lift miners on the FTSE 100

Back in Black: Iron Ore futures back in +ve territory for '17. China steel mills see buoyant prices; Underpins demand for ore. @jasminengztpic.twitter.com/jhbfAl17IK

— Ed Ludlow (@EdLudlow) August 7, 2017

Iron ore's rally to a four-month high has lifted the miners in London this morning with the FTSE 100 taking its foot off the gas slightly as the morning progresses.

Iron ore has been boosted by a surge in purchases after China asked producers to cut their output in the north of the country during the winter months, bringing forward demand.

Anglo American is the top riser from the sector, advancing 2.2pc, with Glencore hot on its heels, recording a 2pc rise this morning.

Josh Mahony, IG market analyst, said this on the rest of the action:

"The FTSE 100 is pausing for breathe this morning, off the back of Friday’s substantial rally which took the index into levels not seen since mid-June. Thursday and Friday dished out a double whammy of downside for the pound, thanks to the BoE and US payrolls.

"Thankfully for European stock bulls, the tentative signs we are seeing a bearish reversal for European currencies against the dollar could see investors shift back into the likes of the DAX and FTSE."

Euro gains on the pound despite weaker-than-expected data

German industrial output drops unexpectedly in June, pouring some cold water on recent growth optimism.https://t.co/kN8NAtSrLepic.twitter.com/lefVFallMf

— Holger Zschaepitz (@Schuldensuehner) August 7, 2017

The euro has held onto its gains against the pound shortly following the disappointing UK house price data despite German industrial production unexpectedly falling in June for the first time in 2017. The pound is currently 0.3pc lower against the euro, trading at €1.1059.

The euro has also brushed off Sentix's investor confidence index for the region coming in at 27.7, slightly lower than expected but still close to its recent ten-year high.

Paddy Power Betfair takes a punt on Worldpay boss as new CEO

Paddy Power Betfair has hired the UK boss of Worldpay as its new CEO, after chief executive Breon Corcoran announced he was stepping down.

Peter Jackson will join the FTSE 100 bookie later this year, having been the UK chief executive of payments provider Worldpay since March.

The news sent Paddy Power Betfair shares down more than 5pc in early trade to £74.50.

Mr Jackson's move comes after Worldpay agreed to a £7.9bn takeover by US rival Vantiv.

Paddy Power hailed Mr Jackson’s “extensive experience in consumer businesses” having previously served as boss of Travelex between 2010 and 2015. He has also worked for Santander, Lloyds Bank and HBOS.

Read Jon Yeomans' full report here

Brent crude slips 0.5pc as OPEC meets in Abu Dhabi

Brent crude has slipped 0.5pc this morning as oil cartel OPEC meets in Abu Dhabi to discuss compliance to production cuts agreed to in March.

OPEC pledged to extend output cuts for a further nine months in March to help lift the stubbornly low oil price but compliance among the cartel's members has started to ebb.

Brent is trading at $52.14 per barrel this morning as traders await more details with a stronger dollar also putting pressure on the price.

ING head of foreign exchange strategy Chris Turner doesn't see the two-day meeting as allaying many fears within the market, however:

"Noise around the meeting will occupy the attention of petro FX, but the big picture story remains the same: oil prices stuck in the US$45-55/bbl range – with US shale producers increasing supply and hedging activity when prices reach the top of this range – will not be a game-changer for petro FX."

Paddy Power Betfair plunges after announcing chief executive departure

The only big mover on the FTSE 100 so far this morning is Paddy Power Betfair, which has dived 6.8pc following the announcement that chief executive Breon Corcoran's 16-year stint at the bookie is over and that Worldpay boss Peter Jackson will be his successor.

At the other end, medical supplier ConvaTec has rebounded from Friday's losses to lead the blue-chip index, rising 2pc early on, while the FTSE 250 has nudged up into positive territory with defence and technology group QinetiQ advancing 4.8pc on a broker upgrade from Goldman Sachs.

Spreadex analyst Connor Campbell isn't too hopeful of the excitement picking up any time soon:

"This week, and the first half especially, is an absolute snooze, tumbleweed drifting across the economic calendar until Thursday’s UK manufacturing data and Friday’s US inflation reading.

"That explains why the markets were relatively muted after the bell – not particularly negative, just fairly sluggish. The FTSE nudged around 15 points higher, keeping the index at a 7530, 7 week high after it benefited from last week’s pound-pummelling Bank of England dovishness.

"Talking of sterling, the currency doesn’t look likely to recover last week’s chunky losses any time soon."

House prices grow at lowest annual rate in four years

Annual house price growth slowed to its lowest rate in July since 2013, according to data just released by Halifax.

Prices fell by 0.2pc on a quarterly basis, the fourth successive quarterly fall, while home sales between May and June dipped by 3pc. The average UK house price came in at £219,266 with prices in the three months to July being 2.1pc higher than in the same three months a year earlier.

Russell Galley, managing director at Halifax Community Bank, blamed the squeeze on spending power caused by sluggish wage growth for the housing market's continuing struggles.

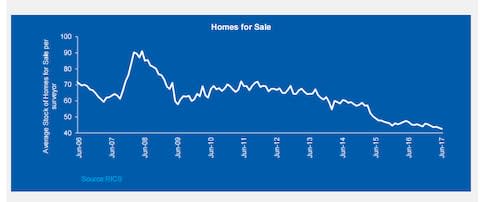

However, he added that prices should still be supported by the low mortgage rate environment and an ongoing shortage of properties for sale.

Mr Galley commented:

"House prices continue to remain broadly flat, as they have since the start of the year.

“The rise in the employment level by 175,000 in the three months to May helped push the unemployment rate down to 4.5%, the lowest since June 1975. However, this improvement in the jobs market has not, as yet, boosted wage growth, resulting in earnings rising at a slower rate than consumer prices.

"This squeeze on spending power, together with the impact on property transactions of the stamp duty changes in 2016 now being realised, along with affordability concerns, appear to have contributed to weaker housing demand."

Agenda: Global stock markets continue to be lifted by US jobs data

Markets start week in 'risk-on' mood: Asia stocks at highest in 10yrs after UN Sec Council voted unanimously to impose sanctions on N.Korea. pic.twitter.com/6vQud58MI3

— Holger Zschaepitz (@Schuldensuehner) August 7, 2017

Welcome to our live markets coverage.

European equities continue to be lifted by Friday's strong US jobs data in the new week with the resultant stronger dollar still pushing down the euro and pound.

On the currency markets, the pound is stuck at Friday's lows against the dollar, trading at $1.3043, while against the euro it has nudged down to €1.1070.

Iron ore prices rallying to a four-month high has lifted the FTSE 100 miners early on while the housebuilding stocks have rebounded from Friday's sell-off based on fears that the government's Help to Buy scheme was under threat. The overall index has advanced around 20 points this morning, nearing its all-time closing high of 7,547.63

Corporate news is quite thin on the ground this morning with no blue-chip stocks reporting interim results. Bookie Paddy Power Betfair unveiling Worldpay boss Peter Jackson as its new chief executive is the highlight.

It's also looking a little light on the economics front with UK house price data due any minute now and investor confidence figures from the eurozone the other focal point for investors today.

Interim results: Ultra Electronics Holdings, Telit Communications

AGM: Akers Biosciences

Economics: Halifax house price index m/m (UK), Labour market conditions index m/m (US), Consumer credit (US), Sentix investor confidence (EU), Industrial production m/m (GER)

Yahoo Finance

Yahoo Finance