BMW to make all-electric Mini in UK; Trump working on 'very big' US-UK trade deal

Donald Trump says he is working on a "very big and exciting" trade deal with the UK

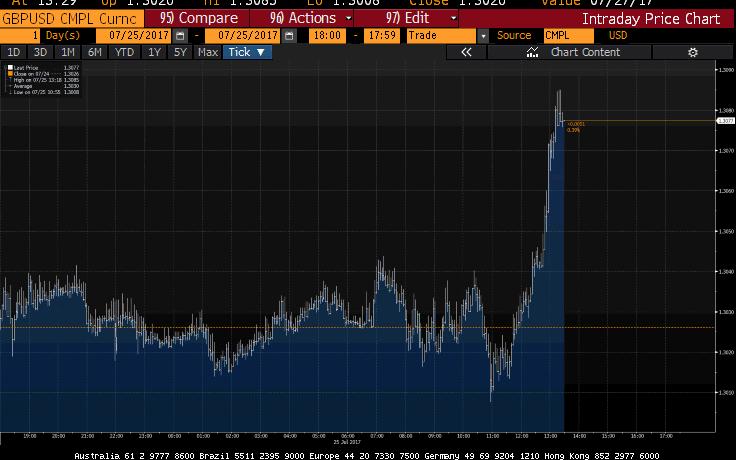

Upbeat CBI manufacturing survey lifts pound against the dollar

BMW will make its new all-electric Mini in Oxford

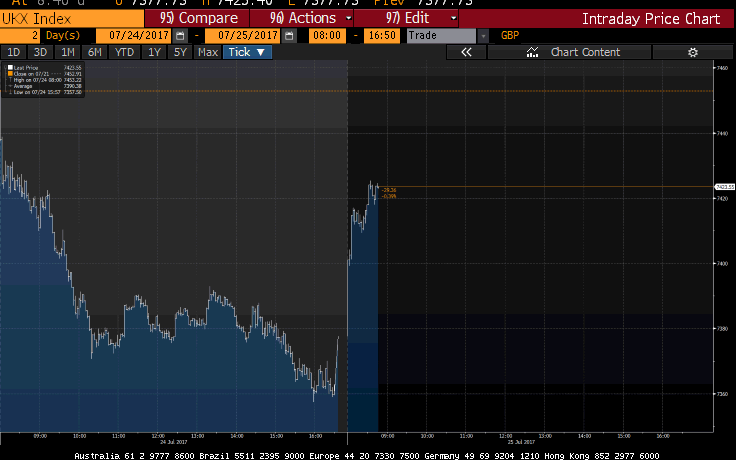

FTSE 100 rebounds into positive territory as the miners and oil majors lift the index

Markets wrap: Resurgent FTSE 100 boosted by mining sector

A resurgent FTSE 100 has erased most of the losses it sustained in yesterday's IMF-induced sell-off today to finish 57.09 points higher at 7434.82.

Mining stocks boosted by a copper price rally has lifted the blue-chip index with Informa and Segro advancing after posting stronger-than-expected interim results.

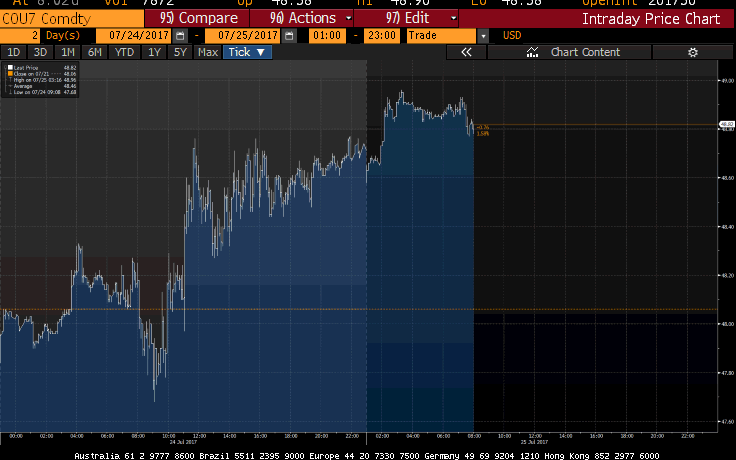

The price of Brent crude has touched over $50 per barrel in the last few moments as trader confidence increases in pledges made at OPEC's meeting with other major oil producers in St Petersburg yesterday.

The pound is flat against a nervy dollar ahead of tomorrow's Federal Reserve meeting and preliminary UK GDP figures.

Outside the markets, news that the UK manufacturing sector grew at its fastest pace since 1995 and that BMW has picked the UK ahead of Germany and the Netherlands to make its first all-electric car in Oxford has provided Britain's manufacturing industry a timely boost.

Josh Mahony, market analyst at IG commented on today's play:

"This morning’s FTSE rally seems to have hit the buffers somewhat, with the index slowing its ascent into the close. Interestingly we have seen the FTSE and pound move in tandem today, with morning gains giving way to consolidation.

"Despite Donald Trump’s tweet promising the development of a massive US-UK post-Brexit trade deal, both the pound and FTSE seem to have topped off at that very moment."

'Bargain hunting' helping to lift the FTSE 100

Big jump for copper pic.twitter.com/F0daU9Oq0x

— Thomas Biesheuvel (@tbiesheuvel) July 25, 2017

A steady pound and "bargain hunting" has helped the FTSE 100 erase most of the losses it sustained yesterday, according to David Madden, CMC Markets analyst. With many of the huge global miners and two oil majors listed in London, the FTSE 100's performance today has moved in lock-step with the fortunes of the commodity stocks.

He added:

"The bullish move in copper and iron ore prices has driven up the share prices of Rio Tinto, BHP Billiton, Glencore, and Anglo American. BP and Royal Dutch Shell are in positive territory as the energy market is stronger as Saudi Arabia stated it would cut its oil exports in August.

Brent crude has drifted upwards towards $50 per barrel this afternoon as confidence within the market increases over OPEC's pledges yesterday. It is currently trading at $49.60 per barrel this afternoon, a 2pc rise.

Meanwhile in the US, strong earnings from Caterpillar and McDonald's has helped the Dow Jones advance around 0.5pc this afternoon. The S&P 500 is hovering just below the record intraday high it hit shortly after the opening bell.

All time highs duPont, McDonalds. Blowout earnings Caterpillar. Optimism expands, the Trump growth agenda is working! #MAGAnomics

— Steve Cortes (@CortesSteve) July 25, 2017

Virgin Money chief hits back at 'overblown' market reaction to house price warning

The boss of Virgin Money has hit back at the market reaction to the FTSE 250 company's first-half results, with shares in the group tumbling after it warned of "areas of weakness" in the UK housing market.

The challenger bank said that "in the near term there may be some areas of weakness to be navigated" across Britain's housing sector in its results on Tuesday, sending shares down 9pc despite reporting a surge in profits.

Speaking to The Telegraph after the results were published, chief executive Jayne-Anne Gadhia said the investor reaction was "overblown" and she is confident the housing market will remain flat on last year.

"Today I'm faced with this peculiar situation – [it's] the best results we've had ever, but the market has started to look for negatives," she said, insisting that the group's capital ratio is also where it should be.

Read Lucy Burton's full report here

US consumer confidence at second-highest level since 2000

#ConsumerConfidence up 3.8pts in July to 121.5 (1985=100). US #consumers' view of current conditions at 16yr high. https://t.co/AcHDZqlPdqpic.twitter.com/S3cw6PASnO

— The Conference Board (@Conferenceboard) July 25, 2017

US consumer confidence rose to its second-highest level since 2000 in July, according to the latest Conference Board Consumer Confidence Index.

Analysts were expecting a slight dip but consumer confidence has in fact risen by 3.8 points to 121.5 since June.

Consumer spending still not tracking to consumer confidence, which paints a very sunny picture. pic.twitter.com/UvC9XFcAEF

— George Pearkes (@pearkes) July 25, 2017

Capital Economics' US economist Michael Pearce commented that the reading suggests that "consumption growth will accelerate in the second half of the year".

He added:

"The increase in the headline consumer confidence index, from 117.3 to 121.1, was better than the consensus expectation of a small fall.

"It was driven by another rise in the current conditions sub-index to a fresh 16-year high, reflecting falling gasoline prices, the strength of the job market, and recent record highs in the stock market."

Boost for Britain as BMW picks Oxford over Germany and Netherlands to build new electric Mini

Britain’s car making industry has received a major vote of confidence after BMW announced it will build an all-electric version of the Mini in the UK.

The German car giant said the full-electric Mini E will roll off the production lines at its Oxford plant - which is the historic home of the iconic car - from 2019.

There had been speculation that the work could go to BMW’s factory in the Netherlands which currently produces a smaller amount of the fleet or even an entirely new plant in Germany.

However the news guarantees the future of the 4,500 staff at plant, who currently build the bulk of the 360,000 Minis built each year.

Read Alan Tovey's full report here

Provident Financial profits hit by 'painful' salesforce change

The boss of Provident Financial has warned that a "painful" rejig of the group's door-to-door salesforce will hurt the company until at least September, after the company announced a huge hit to profits for the first-half.

The FTSE 100 company said its pre-tax profits had fallen 45.6pc to £90m in the six months to June 30 after a decision to end its reliance on self-employed workers left it with fewer staff than expected to knock on doors and collect money.

"The transition from the old world to the new world has been painful, a larger number of agents walked off the case earlier than expected," chief executive Peter Crook said, adding the new model wasn't going to be a "well-oiled machine until a few months down the road".

Provident has slumped to the bottom of the FTSE 100 leaderboard, its shares sliding 5.2pc today.

Read Lucy Burton's full report on Provident Financial here

Npower teams up with Allianz to power home services push

Big Six energy supplier Npower could soon insure its customers boilers and central heating systems through a new partnership with German insurance giant Allianz.

The pair are planning to power into the home services market with a range of heating care packages this summer which could expand into other cover options, and countries across Europe.

Npower, which is owned by Germany’s Innogy, is hoping the well-trodden path into home services will help to diversify its retail offering beyond electricity and heat into the smart home revolution.

Under the plan npower will introduce bespoke home services products to its customer base and Allianz Worldwide Partners in the UK will fulfil the services using its network of engineers.

Read Jillian Ambrose's full report here

Reaction to BMW's announcement on the new Mini

Here's some reaction from Twitter to the news that BMW will make its first-ever all-electric Mini at its Oxford plant from 2019, starting with Greg Clark, Secretary of State for Business, Energy and Industrial Strategy:

BMW to build Electric MINI in UK. A landmark decision that is a vote of confidence in the workforce and in the determination of 1/2

— Greg Clark (@GregClarkMP) July 25, 2017

of our Industrial Strategy to make Britain the go-to place in the world for the next generation of vehicles. 2/2

— Greg Clark (@GregClarkMP) July 25, 2017

Smart by BMW: if Brexit turns out "hard", simply keep Mini production for UK in Oxford, sidestep the politics by producing rest in NL.

— Roel (@RoelD_) July 25, 2017

Whoop....BMW confirm the electric #mini is to be built in Cowley! Great news for technology, Oxford and the environment.

— The Oxford Trust (@TheOxfordTrust) July 25, 2017

Trump says he is working on a 'big and exciting' trade deal with UK

Working on major Trade Deal with the United Kingdom. Could be very big & exciting. JOBS! The E.U. is very protectionist with the U.S. STOP!

— Donald J. Trump (@realDonaldTrump) July 25, 2017

Donald Trump has told his Twitter followers this afternoon that he is working on a "very big and exciting" trade deal with the UK.

Some are attributing the pound's movement against the dollar and euro in the last hour to this tweet from US president Donald Trump.

As far as I can see sterling has actually plateaued against the dollar since Mr Trump tweeted on a potential trade deal but did dip against the euro briefly. It should be noted, however, that against the euro trading has been very choppy today.

Nonetheless, if true its obviously a massive post-Brexit boost for the UK economy but for now it's probably one to file under 'we'll see'.

Trump says he is working on 'major trade deal' with UK. Perhaps it will be as successful as his Health Care Bill. ha https://t.co/DPJPF4hmTI

— Vernal Scott (@vernalscott) July 25, 2017

BMW's all-electric Mini to be manufactured in Oxford

German carmaker BMW has announced that it will make its new all-electric Mini at its plant in Oxford, providing a major boost to the UK car industry.

The new car will go into production in 2019 and BMW said that it expects new electrified vehicles to account for between 15-25pc of sales by 2025.

BMW said:

"The electric Mini’s electric drivetrain will be built at the BMW Group’s e-mobility centre at Plants Dingolfing and Landshut in Bavaria before being integrated into the car at Plant Oxford, which is the main production location for the MINI 3 door model."

Pound advances following upbeat CBI manufacturing survey

The pound has rallied against the dollar since the CBI released its manufacturing survey late this morning. The survey showed that production grew at its fastest pace in 22 years and that employee headcount increased its fastest rate in three year.

Against the dollar, sterling has advanced 0.4pc to $1.3076 but it remains flat against the euro after paring early losses.

Howard Archer, chief economic advisor to the EY ITEM Club commented:

"A notable feature of the quarterly CBI survey is that manufacturers’ investment intentions picked up in the July quarter despite current economic and political uncertainties, while there was also a strengthening in employment intentions.

"The survey pointed to a marked easing of price pressures which fuels hope that UK inflation is close to peaking, news which will go down well at the Bank of England."

Despite the consumer squeeze, UK manufacturing is booming according to the CBI. Strongest output growth since 1990s! https://t.co/rKCz37U1u7

— Andrew Sentance (@asentance) July 25, 2017

The CBI's upbeat manufacturing survey is 'often misleading' says Pantheon Macro

The CBI's manufacturing survey has been misleadingly upbeat over the last six months, according to Pantheon Macro following the latest release from the business organisation.

Its chief UK economist Samuel Tombs added:

"The CBI’s survey has a small sample size and it is not seasonally adjusted, despite showing a strong seasonal pattern.

"Its measure of orders also reflects the number of manufacturers reporting them to be above or below “normal”, which is a moving target.

"For now, then, we’re inclined to place less weight than usual on the CBI’s survey."

Segro boosts profits as demand for warehouse space continues

Increasing pressure among retailers to offer shorter delivery times is putting a squeeze on the amount of warehousing space available in the UK, the chief executive of Segro has said.

David Sleath said the property company was benefiting from “supply/ demand tension” in both British and southern European markets as internet shopping booms.

He said the company has accelerated its development pipeline in order to try and meet demand, and has already let two-thirds of the planned buildings ahead of their completion.

“Our development programme is the largest we’ve had in our history,” he said.

Read Rhiannon Bury's full report here

Half-time update: FTSE 100 recovers from yesterday's heavy losses

The FTSE 100 has been "given the green light" to recoup yesterday's losses by Brent crude passing the $49 per barrel mark and the price of copper rising, according to Spreadex analyst Connor Campbell.

Robust Chinese demand and a weak dollar lifted the three month LME copper price to around $6,170 per tonne, a five-month high.

The big miners on the FTSE 100 have leapt to the top of the FTSE 100 leaderboard in response with Anglo American gaining 5.4pc after also telling shareholders that its earnings will be boosted by a strong performance from its Kumba Iron Ore subsidiary.

Mr Campbell added:

"That translated to an 85 point rise, effectively the same amount it shed during Monday’s IMF-blighted trading.

"After a slow start the Eurozone indices matched their UK peer’s perky performance, in part inspired by a better than forecast German Ifo business climate figure.

"This meant the DAX surged 80 points – admittedly still leaving the index roughly 700 points away from the all-time highs seen last month – while the CAC rose 1.3%."

Here's the current state of play in Europe:

FTSE 100: +0.94pc

DAX: +0.58pc

CAC 40: +1.10pc

IBEX: +1.53pc

CBI survey reaction: Manufacturing on a 'strong footing'

Manufacturing surged in July, according to the CBI. Trouble is, the survey has said that throughout 2017, but official data have been dire: pic.twitter.com/ztDV9kPkoW

— Samuel Tombs (@samueltombs) July 25, 2017

Manufacturing has started the third quarter on a "strong footing" and could offset the consumer spending slowdown, according to Capital Economics.

Its assistant economist Andrew Wishart commented:

"The business optimism balance increased from +1 to +5 while investment intentions also strengthened. And although the export expectations balance dipped from +30 to +13, suggesting that the benefits from the weaker pound may be fading somewhat, the expected prices balance fell sharply from +29 to +9.

"This provides another reason to expect the rise in inflation to be temporary. Overall, then, the latest survey data supports our view that the manufacturing sector should help to offset a slowdown in consumer services this year."

Production grew at fastest pace in second quarter since January 1995, according to CBI

Manufacturing output growth hit a 22-year high. Similar growth is expected over the next quarter. #CBI_ITShttps://t.co/8mzJjNr87vpic.twitter.com/l2I9Mdc87z

— CBI Economics (@CBI_Economics) July 25, 2017

UK manufacturing grew at its fastest pace since January 1995 in the three months to July, according to a survey by the CBI.

The CBI's chief economist Rain Newton-Smith said:

"Output growth among UK manufacturers is the highest we’ve seen since the mid ‘90s, prompting the strongest hiring spree we’ve seen in the last three years. Cost pressures are easing and firms are upbeat about the outlook for export orders.

“It’s great to see the benefits from the decline in sterling for UK exporters feeding through. But the flipside is the broader hit to consumer spending power across the economy from stronger inflation, which is likely to have fuelled the slowdown in the economy in Q1 and is expected to pull down growth in Q2.”

Michael Kors looks to walk off with Jimmy Choo in £900m deal

Michael Kors, the US handbag maker, has made an offer to snap up luxury shoe brand Jimmy Choo in a £896m deal.

The proposed sale of Jimmy Choo, which rose to prominence after being regularly featured in US TV show Sex and The City, follows an auction process that was kicked off in April by majority owner JAB Holdings, the investment vehicle of the wealthy German Reimann family, which owns a near-68pc stake in the London-listed company.

JAB has recently been shifting its focus away from high-end goods and towards its interests in coffee and sandwiches after sealing billion dollar takeovers for Douwe Egberts coffee and US bagel chain Panera Bread.

Michael Kors made the move for Jimmy Choo after losing out in a takeover tussle with Coach to buy accessories firm Kate Spade earlier this year. It is the New York-based fashion company's first takeover since listing in 2011.

Shares surged 33.25p, or 17pc, to 228.25p following the announcement.

Read Ashley Armstrong's full report here

Fever-Tree continues to fizz as it raises profit forecasts again

The rapid growth of premium drinks brand Fever-Tree shows no sign of slowing as the posh tonic maker upgraded its profits forecasts following a 77pc spike in revenues.

Fever-Tree's share price has now increased by more than 1000pc since it listed in late 2014 as the company has capitalised on the remarkable growth in demand for gin.

It was last year’s best performing stock on London’s junior Aim market and has consistently smashed market expectations.

In its results for the first six months of the year, it toasted growth of 113pc in the UK, while revenue climbed 77pc to £71.9m, compared to £40.6m in the first half of 2016.

Shares have advanced 156p, or 8.9pc, to £19.01 this morning.

'Degree of hesitancy' on the currency markets ahead of Fed meeting

There is a "degree of hesitancy" on the currency markets today as traders await the conclusion of the Federal Reserve's policy meeting tomorrow, according to Joshua Mahony, market analyst at IG. Any hawkish hints on when the committee will begin winding down the Fed's balance sheet would send the weak dollar soaring.

In the last week the dollar has hit a near one-year low against a basket of the leading currencies as concerns rise that president Donald Trump doesn't have the political capital to push through his economic plans.

The greenback wasn't helped by a more dovish appearance by Fed chair Janet Yellen in front of US Congress a few weeks ago.

Mr Mahony added that the recent dollar weakness has helped the commodity sector:

"The FTSE is being helped by gains in the commodity sector, with the likes of Anglo American, BHP Billiton, and Antofagasta amongst the firms near the top of the leader board.

"The dollar weakness story of late is certainly a help for commodity prices, with copper and gold in particular gaining ground this week."

The pound is flat against the dollar this morning and is trading at $1.3032.

TD Securities 1/4: The USD continues to bleed lower to a 3-year low. The Fed meeting this week may not alter dynamics much #Fed#forex#fx

— Francesc Riverola (@Francesc_Forex) July 25, 2017

Brent crude pushes past $49 per barrel

Brent crude has spiked in the last half an hour and pushed above $49 per barrel as traders digest yesterday's meeting in St Petersburg between OPEC members and other large oil producers.

Saudi Arabia pledged to cut exports from next month while the cartel said it would put a cap on Nigerian production, which had been excluded from the cuts due to domestic conflict.

The oil cartel said that it would encourage its members to stick with the production cuts agreed to in March to stop the price drifting back towards $45 per barrel after Ecuador recently signaled that it was going to break rank and increase production.

Respite for shoppers as food inflation slows down

British households hit by recent food price hikes have been given respite by a slowdown in grocery inflation, new research shows.

Fresh figures from Kantar Worldpanel show that food price inflation has levelled out at 3.2pc, the same rate of increase as this time last month.

Food prices have been soaring since the vote to leave the European Union thanks to rising import costs as a result of the weaker pound.

The increase in prices has boosted supermarket sales, which were particularly buoyant last month as the UK enjoyed its hottest June day in 40 years.

Read Sam Dean's full report here

German business confidence hits record high

ifo Business Climate Index July: Business Situation and Expectations by Sector https://t.co/R40FAMUmeOpic.twitter.com/TAjiOfnhph

— CESifoGroup (@CESifoGroup) July 25, 2017

German business confidence hit a record high in July, according to a keenly-watched survey from Ifo. The Ifo Business Climate Index rose to 116 points in July from 115.2 even though PMI readings from yesterday hinted at a slight slowdown in the Eurozone region.

Capital Economics chief European economist Jennifer McKeown said that the results are encouraging given the euro's current strength and the ECB's hints on tapering its quantitative easing programme.

However, she cautioned:

"There are good reasons not to take this at face value. The Ifo has been too optimistic for a few months now, pointing to a pick-up in GDP growth which hasn’t materialised.

"And while the PMI is not a perfect indicator either, it points to a slight slowdown in the quarterly pace of growth from Q1’s 0.6%. On balance, we believe the message from the hard data that Q2 will be very strong, but we suspect that growth will slow a bit thereafter."

#Germany powers ahead! The #Ifo index hit another record high in July, signalling very solid #GDP growth going forward. pic.twitter.com/aUE9tZvVTA

— jeroen blokland (@jsblokland) July 25, 2017

Informa the top riser on FTSE 100 after Euroforum disposal; Acacia Mining sheds 11pc early on

Publishing and events company Informa is leading the pack early on the FTSE 100 after telling shareholders that it has agreed to sell its stake in Euroforum and it upped its dividend. Its shares are 6.5pc higher at 719.5p.

Property developer Segro has risen 4.3pc in early trading after posting a 23pc rise in its adjusted pre-tax profits with the acquisition of a portfolio of assets near airports and strong rental growth underpinning the increase.

Meanwhile on the FTSE 250, Acacia Mining has plummeted a further 11pc after it announced just before the closing bell yesterday that the Tanzanian authorities has handed the company a $190bn tax bill.

Tanzania stopped Acacia exporting gold concentrate in March, accusing the company of under-reporting how much it produced and evading tax as a result.

An 'almost immediate rebound' from the FTSE 100 this morning

There has been "an almost immediate rebound" from the heavy losses the FTSE 100 suffered yesterday, according to Spreadex analyst Connor Campbell.

He commented:

"A healthy start from the commodity sector – itself aided by a $49 per barrel-eyeing rise from Brent Crude and copper’s continued climb – alongside a fairly muted open from the pound allowed the FTSE to surge back across 7400 with a 50 point increase."

The other major European indices have also all opened in positive territory with German automobile stocks rebounding from losses made yesterday after allegations of collusion among the big German carmakers emerged.

Overnight round-up

Overnight, stock markets in the US and Asia were mixed with the Nasdaq hitting a fresh all-time high as investors look towards results from Facebook and Amazon and the Nikkei 225 in Japan edging down as investors digested the minutes from the Bank of Japan's latest meeting.

There were few surprises in the BoJ release with the committee's members underlining how far inflation needed to go before reaching the central bank's 2pc target.

Bank of Japan policymakers contested how much to disclose about a possible quantitative easing exit at its June…

— governn1 (@governn1) July 25, 2017

Alphabet, Google's parent company, reported its latest results after the closing bell in New York with its shares falling around 3pc in after-market trading as the EU's $2.7bn fine weighed on earnings.

Alphabet profits dragged down by Google's £2.1bn EU fine https://t.co/fItTy4jBeupic.twitter.com/xzEb08fMHS

— Telegraph Technology (@TelegraphTech) July 24, 2017

The US Federal Reserve begins its two-day policy meeting today with investors eager to hear more details on when the central bank is planning to unwind its balance sheet. It won't be until tomorrow that we hear anything from the committee, however.

Mike Van Dulken, head of research at the Accendo Markets, commented on the Fed meeting:

"It may provide some clarity on the outlook for further rate hikes in light of recent poor inflation data, and investors are eager to know more about the timing of its balance sheet unwind, however, Yellen may again only offer crumbs with which we can ponder for the rest of the summer."

Agenda: FTSE 100 recovers from heavy losses; Brent crude holds gains

Welcome to our live markets coverage.

After brushing aside the IMF's cut to its UK GDP forecast, the pound overnight has stabilised around the $1.3030 mark against the dollar and recouped some of the losses it made against the euro late last week after disappointing PMI readings in the Eurozone pulled the currency off its highs yesterday. Sterling has edged down this morning against the euro and is trading at €1.1183.

The FTSE 100 has recovered some of the heavy losses it made yesterday with only a handful of stocks in the red this morning. Reckitt Benckiser is falling for a second consecutive day following its results yesterday and chemical company Croda International has shed 3.2pc of its value despite reporting a 16pc rise in its first half pre-tax profit.

Crude oil climbed a little higher overnight after oil cartel OPEC and other major oil producers met in St Petersburg to discuss the persistent softness of the price of oil. This morning Brent crude has settled around $48.80 per barrel with Saudi Arabia's pledge to cut exports from next month underpinning the gains.

Provident Financial's 46pc fall in pre-tax profit is the highlight of the corporate releases this morning. Investors haven't dumped the stock in early trading, however, its shares have nudged up 2p to £22.99.

Interim results: Provident Financial, Tyman, Proteome Sciences, Rathbone Brothers, Informa, Segro, Spectris, Croda International, Domino’s Pizza Group Full result: Games Workshop Group, PZ Cussons, Joules Group

AGM: Mytrah Energy, TLA Worldwide, Intermediate Capital Group, Big Sofa Technologies Group

Trading statement: Intermediate Capital Group, Victrex

Economics: House price index m/m (US), S&P/CS composite-20 house price index y/y (US), CB consumer confidence (US), Richmond manufacturing index (US), German Ifo business climate (GER)

Yahoo Finance

Yahoo Finance