Trump slump: Dollar sinks to four-month low and Dow Jones heads for longest losing streak since 2011 on reflation trade doubts

Dollar tanks to four-month low on Trump's political setback

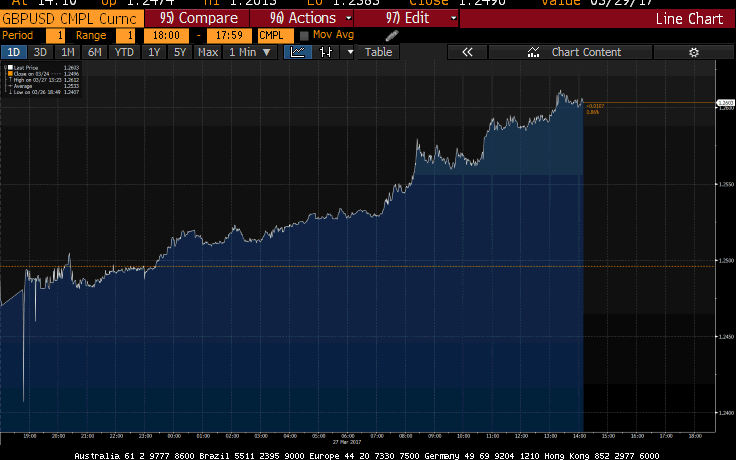

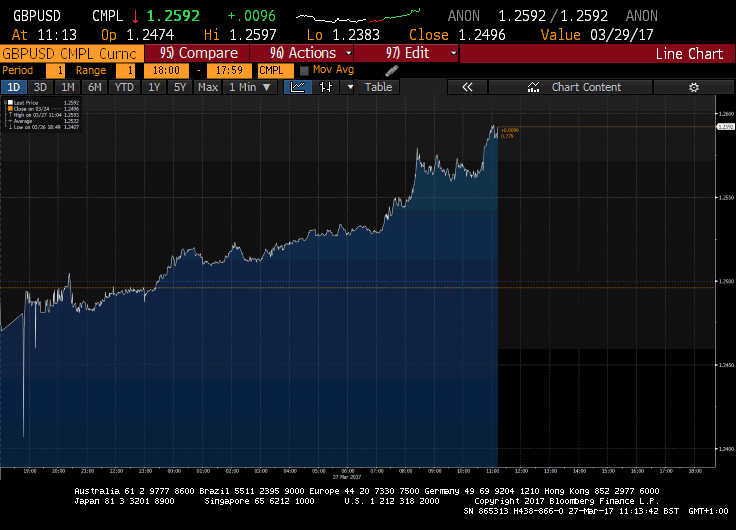

Pound surges to eight-week high as dollar wobbles

European bourses falter on US policy woes

Morgan Stanley lifts 12-month FTSE 100 target to 7,700

Gold hits one-month high on Trump setback

Markets wrap: Dollar skids to four-month low and Dow Jones heads for longest losing streak since 2011

The dollar plunged to a four-month low and US equities came under heavy selling pressure as investors lost confidence in Donald Trump’s ability to deliver on his ambitious economic agenda, after Friday’s healthcare reform defeat.

In a stunning setback, the US President failed to rally enough support from his own Republican party to repeal and replace Obamacare, which was billed as his first major test since taking office in January.

The dollar index, which hit a 14-year high in early January, sank below 99.0 for the first time since November 11, two days after Trump’s presidential victory. The dollar weakness lifted the pound across $1.26 against the US dollar for the first time since February 2, while the euro surged to a four-month high of $1.09.

The dollar has lost nearly everything it's gained since Donald Trump was elected in November https://t.co/lbIpzs0Dc5pic.twitter.com/GTaxXSBe2l

— Bloomberg (@business) March 27, 2017

Meanwhile, the Dow Jones was nursing triple digit losses, of 169.94 points, at the opening bell. The Nasdaq and the S&P 500 opened 53.7 and 20.34 points lower, respectively.

However, US stocks came off session lows in late trading as investors picked up beaten-down stocks. Despite more than halving its losses in late trade, the Dow Jones remained on track for an eight-day losing streak, its longest since August 2011.

If the Dow finishes down today, will be the longest losing streak (days) in 5.5 years. Via @MarketsContextpic.twitter.com/UaFAApgzOI

— David Jones (@JonesTheMarkets) March 27, 2017

Wall Street has rallied since Trump’s shock victory in November on bets his election promises, including tax cuts, mega infrastructure spending and bank deregulation, would pass through Congress. Since November 9, the Dow Jones has made gains of 10.5pc and broken the 21,000 threshold for the first time ever as the so called ‘Trump trade’ boosted stock markets.

Michael Hewson, of CMC Markets, said: “Having overseen a strong rally in stock markets over the past few months the new US president is learning a hard lesson in the differences between campaign promises and the ability to deliver them in a difficult political environment.”

The fallout from the inability to pass the reform of Obamacare also weighed on European bourses. London’s FTSE 100 lost 0.6pc, the German DAX fell 0.6pc and the Euro Stoxx 600 tumbled 0.4pc.

US policy woes also sparked a rush on safe haven assets, lifting gold to a one-month high of $1,261.28 an ounce. The precious metal is now close to reversing its post-election losses.

With that, it's time to close. I'll be back tomorrow morning from 8.30am.

Wall St off lows as investors assess failed healthcare bil

US stocks came off session lows late Monday morning as investors picked up beaten-down stocks after Wall Street tumbled following the withdrawal of President Donald Trump's healthcare reform bill.

However, the Dow is on track for an eight-day losing streak as the failed bill raised questions about Trump's ability to push through with his economic agenda.

Wall Street has rallied since November on bets that Trump's campaign promises of tax cuts and deregulation would sail through a Congress controlled by Republicans.

Bit of a turnaround day so far - Dow rallies +100 off the opening low, still -70 from Friday's close. https://t.co/YWxDCfWWLg

— David Jones (@JonesTheMarkets) March 27, 2017

"This is the block in the Jenga game that at least topples part of the tower, but it's not to say that the game is over," said Robert Pavlik, chief market strategist at Boston Private Wealth.

"I think a pullback to 2,273 on the S&P 500, which is the 100-day moving average, is likely but it will not stay there. I think people will use this as a buying opportunity."

Report from Reuters

Market Report: Inchcape accelerates to 20-month high on rating upgrade

Car dealership Inchcape accelerated to a 20-month high after Exane BNP Paribas turned bullish on the mid-cap stock.

Upgrading its rating to “outperform” from “neutral”, the investment bank said Inchcape’s investment case has undergone “a sharp u-turn” over the past six months, thanks to an improved macroeconomic backdrop, favourable foreign exchange rate moves and M&A activity.

Analyst Georgios Pilakoutas said: “Growth is moving from new vehicle sales to aftersales, self-help and M&A; broadening the global presence and quality of the business.”

Exane believes consensus forecasts are “behind the agenda” and that the FTSE 250 stock’s valuation is failing to capture the emerging business.

Mr Pilakoutas added: “Inchcape is still misperceived as a UK automotive retailer heading into a consumer downturn.”

Shares have jumped by more than 42pc since its acquisition of South American business Indumotora in December and Exane thinks further M&A activity could add “at least” 10-15pc to Inchcape’s equity value.

In its wake, the bullish broker note lifted shares 37.5p, or 4.7pc, to 842.5p.

On the wider market, the FTSE 100 fell 43.32 points, or 0.59pc, to close at a one-month low of 7,293.50.

Mining stocks were among the biggest laggards after the dollar plunged to a four-and-a-half month low propelling the pound above $1.26 for the first time since February 2. Trump’s failed US healthcare bill sparked fears his other campaign promises would face similar opposition. In its wake, Glencore tumbled 14p to 305.8p, Antofagasta fell 39p to 791.5p, BHP Billiton dropped 48p to £11.97, Rio Tinto slipped 125.5p to £31.32 and Anglo American finished down 49p at £12.04.

The heavy selling-pressure across equities, or the so-called ‘Trump slump’, prompted a rush on safe haven assets. Gold jumped by more than 1pc to $1,261.03 an ounce, causing precious metals miners to bounce higher. Randgold Resources leapt 15p to £71.75 and Fresnillo advanced 5p to £15.50.

Meanwhile, Babcock International lost ground, down 39.5p to 877p, after it said that it will terminate its Magnox nuclear decommissioning contract in 2019. Joe Brent, of Liberum, said the surprise announcement is “marginally negative” as it will reduce the company’s pipeline by around 9pc to £10bn.

Bank of America Merrill Lynch downgraded British Airways owner IAG to “underperform” as believes performance and sentiment towards transatlantic and Asia-to-Europe routes is beginning to weaken. It knocked shares by 16p to 533.5p.

Lloyds was hurt by a rating downgrade, finishing 1.1p lower at 67p. Berenberg revised its rating down to “sell” amid concerns the bank is “riskier than perceived” and overvalued.

Elsewhere, housebuilder Taylor Wimpey rose 1.2p to 192.7p after UBS lifted its price target to 213p from 190p as it believes the group offers “an attractive exposure” to the UK residential new build market. UBS also raised Barratt Developments price target to 560p from 490p sending shares 1.5p higher to 544p.

On the mid-cap index, defence company Cobham slipped 2.4p to 126.8p after it revealed that it is under investigation by the Financial Conduct Authority for its handling of inside information prior to a trading and rights issue update in April last year.

FirstGroup rallied 4.1p to a nine-month high of 128.2p after its joint venture won the South Western rail franchise. Its peer Stagecoach was left disappointed after its unsuccessful bid, sending shares 2p lower to 198.1p.

Elsewhere, shares in UK materials testing company Exova leapt 29.1p to an almost three-year high of 248p as it confirmed it has received proposals for a cash offer, including one from Dutch group Element Materials Technology.

Investors welcomed new figures showing higher than anticipated reserved at two of Jersey Oil and Gas’ North Sea interests. Shares rose 18p to 250.5p.

Finally, media group Falcon Acquisitions enjoyed its first day on London’s main market, jumping 22.8pc to 17.5p.

European bourses end the day in negative territory on Trump slump

European bourses trimmed their losses by close after a torrid trading session dominated by questions about Trump's ability to deliver on his ambitious economic agenda.

By close of play:

FTSE 100: -0.59pc

DAX: -0.7pc

CAC 40: -0.17pc

IBEX: -0.21pc

Chris Beauchamp, of IG, said: "Markets are under firm downward pressure, but even now the magnitude of the fall is clearly limited, and already dip buyers are starting to appear. The impending end of the month, and the end of the quarter as well, is going to provide a significant tail wind, and it would be unwise to write off the rally just yet.

"There is a sense of unease following Friday’s healthcare debacle, but hope springs eternal and even now there are still clearly more than a few investors prepared to give the president the benefit of the doubt. In London the mining sector is bearing the brunt of the selling, but given the weakness in the US dollar it might be that a turnaround is at hand; it is certainly odd to see the normal inverse relationship between the greenback and commodity prices break down."

Pound soars three days before May triggers Article 50

A seven-week high for sterling three days before the Government triggers Article 50 was probably not quite what ‘Project Fear’ had in mind, Jasper Lawler, of London Capital Group, notes as the pound crosses $1.26 for the first time since February 2.

He added: "Another sterling swoon once Article 50 is triggered and issues like the EU exit fee provoke fears of a hard Brexit seems likely. But it also seems increasingly apparent the market believes sterling is undervalued."

Gold close to reversing its post-election losses

Gold is close to reversing its post-election losses after Trump's failure to push through a healthcare reform package on Friday prompted a rush on safe haven assets.

That knocked the dollar to a four-month low versus a basket of currencies and drove a drop in stock markets, with European indices sliding nearly 1 percent in early trade and US stocks opening lower.

Spot gold was up 1.2pc at $1,259.11 an ounce, having touched a one-month high of $1,261.03. U.S gold futures for April delivery were up $10.70 at $1,259.20.

"This is entirely driven by the weaker U.S. dollar," Commerzbank analyst Carsten Fritsch said. "The euro is at the highest level versus the greenback since immediately after the U.S. election. The Trumpflation trade is being priced out after the failure to repeal Obamacare."

Dollar and Gold close to reversing all of their post-election moves. $UUP$GLDpic.twitter.com/i3yAk5KMwc

— Charlie Bilello (@charliebilello) March 27, 2017

Gold had already rallied sharply from its March 15 low after a less hawkish policy statement than expected from the Federal Reserve, which dampened expectations for near-term increases in US interest rates.

Gold is highly sensitive to rising US rates, which increase the opportunity cost of holding non-yielding bullion while boosting the dollar, in which it is priced.

The metal ran into resistance in earlier trade at its 200-day moving average, now at $1,259 an ounce. The 200-day average also halted last month's sharp price rally. A close above that threshold could trigger follow-through buying, analysts said.

"While the bull camp is back in control of the gold market, it may be difficult to re-test the 2017 high above $1,261 unless risk-aversion continues to grow," futures analysis and forecasting specialist Hightower said in a report on Monday.

Report from Reuters

Is the Trump honeymoon over?

FXTM Vice President of Market Research Jameel Ahmad points out that investors have priced in "huge premiums" into the financial markets following the night Trump was declared victorious in the US election based on his campaign promises.

However, he says Trump's actions speak louder than words. "This could be a turning point and investors will need to monitor how the markets react as trading continues to get underway for the new week."

Where does this leave President Trump?

Mr Ahmad added: "Under the spotlight to provide the necessary clarity on his tax reforms plans. Trump has already signalled that he is set to move onto the next phase of his Presidential plan, which is cutting taxes and this is the key contributor to the heavy rally throughout the financial markets. Tax reforms and fiscal stimulus promises also represents a key reason why heavy gains were priced into the markets as investors thought Trump could be good for the US economy, but few people would have thought replacing the unpopular Obamacare would become this complicated and it’s unlikely passing tax reforms and other aspects of fiscal stimulus that will increase national debt will be plain sailing."

Investors begin to lose faith in Trump's ability to deliver on campaign promises

As US stocks extend their fall, Michael Hewson, of CMC Markets, said investors are starting to lose faith in the ability of Trump to deliver "anything close to what he promised on the campaign trail on to the statute books".

He added: "The new President appears to be getting a harsh lesson in the realities of politics on Capitol Hill, a lesson that the previous President Barack Obama knows only too well.

"While a lot of the focus is inevitably being focussed on the extent of last week’s declines and today’s sharply lower open, the fact remains that US markets still remain up 8pc from when President Trump won the keys to the White House. That being said that doesn’t mean we won’t see further declines in the coming days given that since November, sell-offs have been few and far between."

£19bn wiped off FTSE 100 as Trump trade stalls

As the FTSE 100 extends its losses, down 1.01pc, more than £19bn has been wiped off its value amid doubts over Trump's ability to deliver on his campaign promises.

Wall Street opens lower amid 'Trump slump'

US stocks joined their European counterparts deep in the red this afternoon as the 'Trump trade' appeared to stall following Friday's failure to pass the healthcare bill, which stoked fears about Trump's ability to deliver on his ambitious economic agenda.

Here's a look at how US stock markets fared at the opening bell:

Dow Jones: -0.83pc

Nasdaq: -0.92pc

S&P 500: -0.87pc

It looks like the Dow Jones is on track for its longest losing streak since 2011...

The Dow has fallen for 7 days in a row. The run has extended only twice in at least 27 years, last on 2 Aug 2011, 1421 sessions ago #stocks

— Context Analysis (@MarketsContext) March 26, 2017

Pound tops $1.26 for first time since February 2

The Trump slump propels the pound across the $1.26 barrier for the first time since February 2. The local currency is trading 0.9pc higher at $1.2607 against the US dollar.

Euro breaks $1.09 for first time since November

#Euro just jumps above $1.09, highest since Nov. pic.twitter.com/JM5lkXQU1x

— Holger Zschaepitz (@Schuldensuehner) March 27, 2017

Dow poised for longest losing streak since 2011

US stock index futures are already pointing for a steep fall for the Dow Jones at the opening bell this afternoon and if the Dow closes down again, it would mark its eight consecutive day of losses - its longest losing streak since 2011.

Dow poised for longest losing streak since 2011 as investors focus on U.S. policy outlook https://t.co/90EYT4hpqgpic.twitter.com/zcusvAnzmp

— Wall Street Journal (@WSJ) March 27, 2017

Dollar hits fresh four-month low against Japanese yen

Ouch! Dollar hits a new four-month low against the Japanese yen, falling to 110.09.

It also slipped to its lowest level against the Swiss France since November 9 of 0.9818, while the dollar index fell below 99 for the first time since November 11 (that's the aftermath of the Trump presidential victory).

Euro rises to four-and-a-half-month high

The euro has extended its gains this afternoon hitting a four-and-a-half-month high. It rose by as much as 0.8pc to $1.0879.

Praet: Eurozone growth to firm but ECB stimulus still necessary

The eurozone's economic recovery will continue to broaden but a rise in inflation is still only temporary, driven by higher energy costs, European Central Bank chief economist Peter Praet said today.

ECB Praet on the wires.#eurusdpic.twitter.com/Ci3U7c3G4T

— Sigma Squawk (@SigmaSquawk) March 27, 2017

"We need to look through the recent surge in inflation, which is driven by transient factors that will probably fade before long," Praet said in Madrid.

"Our conclusion that a very substantial degree of monetary accommodation is still needed for underlying inflation pressures to build up and support headline inflation in the medium term remains valid," Praet added.

#ECB Praet: underlying #inflation pressures still give scant indication of a convincing upward trend; domestic cost pressures remain subdued

— Howard Archer (@HowardArcherUK) March 27, 2017

Lautenschlaeger: ECB should prepare for eventual end of stimulus

It is premature for the European Central Bank to discuss any change in its policy stance but the bank should make preparations for its eventual exit from extraordinary stimulus, executive board member Sabine Lautenschlaeger told CNBC.

Lautenschläger: It is not our job to decide about the structure of the banking system. But banks' business models need to be viable.

— ECB (@ecb) March 27, 2017

She said growth prospects are good and she was hoping for more solid data through June, which could then prompt a discussion of the bank's policy stance, she said.

"We should prepare for a change in the policy and as soon as the data is stable and we have a sustainable path towards our objective of price stability, then we are well prepared to do," Lautenschlaeger said.

Report from Reuters

EURUSD breaks above 200-day moving average for first time since November

����#EURUSD breaks above 200D-MA for the first time since the #Trump election night. �� EUR/Scandies are bid ��������. pic.twitter.com/TO4cBtPtYj

— Kristoffer Lomholt (@lomholt10) March 27, 2017

US stock index futures slump to six-week low

US stock index futures slumped to six-week lows after Friday's healthcare bill defeat, which stoked concerns about Trump's ability to deliver on his economic agenda.

Here's a look at the US opening calls courtesy of IG:

US Opening Calls:#DOW 20490 -0.56%#SPX 2329 -0.67%#NASDAQ 5337 -0.53%#IGOpeningCall

— IGSquawk (@IGSquawk) March 27, 2017

Government's bungled handling of nuclear decommissioning deal hits Babcock

Shares in Babcock tumbled 3.7pc to 882.9p, putting it on track for its worst day since November, after it arrived at a mutual agreement with the UK to terminate its Magnox nuclear decommissioning contact in 2019. Alan Tovey reports:

A£6.1bn deal to clean up Britain’s redundant fleet of Magnox nuclear reactors has been pulled after the Government bungled how the work was awarded.

The taxpayer will also pay almost £100m in compensation to companies who bid for Magnox work but failed to get it, after the High Court ruled contracts had been botched.

The Nuclear Decommissioning Authority (NDA) announced on Monday the early termination of the deal awarded to the Cavendish Fluor Partnership (CFP), in which a FTSE 100 engineer has a 65pc stake.

The news sent Babcock’s shares down more than 3pc, but announcing that the contract would now end after five years instead of 14, Energy Secretary Greg Clark made it clear the decision has “no reflection” on CFP’s work.

Instead, the deal to decommission the 12 Magnox sites, along with a reactor at Sellafield, was pulled because the way it was awarded was mishandled by bureaucrats.

What the healthcare failure signals

Neil Wilson, of ETX Capital, says Trump's failure to pass the healthcare bill has "spooked markets" as it raises doubts about whether he can get the "much more market-sensitive tax and spend legislation through".

He adds: "All this casts a pall over the president’s ability to get any meaningful reform on the move. Same old Washington gridlock, you might say."

Mr Wilson is undecided on how difficult it will be to pass the fiscal expansion, adding it "might be easier to get through, or it might be harder".

"We just don’t know yet what the GOP is likely to do. We do know that there are a number of fiscal hawks among the Republicans who are ideologically opposed to the sort of fiscal expansion Trump wants. That is a significant roadblock and may make progress very hard. Exploding the deficit is not going to sit well with many."

Market calm evaporates as doubts grow about Donald Trump's ability to implement his agenda https://t.co/iltAD5atfIhttps://t.co/1CYnF5Mjrf

— Bloomberg (@business) March 27, 2017

Meanwhile, he thinks a "significantly watered-down" set of tax reforms look more likely for a number of reasons.

"The current plans are very complex. Savings from scrapping Obamacare vanished with last week’s failure. Trump still has to get Congress to agree to extend funding for the government –talk of cash for a wall might see Congress turn off the taps. If Trump can pass reconciliation instructions in his budget resolution in May or June, it would mean he can pass tax reform with a bare majority – something that looks increasingly essential to getting any major tax changes done. Again this looks tough.

"Trump is mired in the usual Washington gridlock. But does that matter and should it necessarily entail a reversal for equities to their pre-election equilibrium? Some people argue failure on tax will reverse the equity rally – the selloff we see now certainly plays into that narrative. But we’ve had years of deadlock in the US political system and that hasn’t exactly been bad for stocks either. US stocks remain up a tenth since early November."

Half-time update: European bourses hurt by Trump policy woes

Trump's policy woes have wreaked havoc on European shares today. Equities came under heavy selling pressure as soon as markets opened after Friday's healthcare defeat. Trump's failure to pass the healthcare bill has sparked concerns about his ability to push through his fiscal spending plans and tax reforms.

Let's take a look at the current state of play in Europe:

FTSE 100: -0.67pc

DAX: -0.68pc

CAC 40: -0.2pc

IBEX: -0.3pc

Mike van Dulken, of Accendo Markets, said: "Global equities are nursing losses after Trump's US healthcare reform bill withdrawal highlighted Republican divisions that fuel doubts about passing the other stimulus pledges that got him elected. Whilst an unfortunate stumble at his first major hurdle, market weakness is thus far limited, suggesting hope it might even open the door to making earlier headway on the pro-growth policies (infrastructure spending, bank deregulation, tax reform) that inspired the recent global risk-on rally.

"The UK FTSE is struggling under the weight of Miners (stronger GBP, weaker base metals prices) and Banks (US deregulation difficulties, lower US inflation and fewer Fed rate hikes). This is easily overshadowing minor benefit from Healthcare (reform withdrawn) and Safehaven Miners (precious metals rallied)."

Shares in Cobham stumble on FCA probe

Defence firm Cobham cam under pressure, dropping 2.5pc to 125.8p, after it said it was under investigation by the Financial Conduct Authority.

In a statement the FTSE 250 firm said:

"On 24 March 2017, Cobham was informed orally by the Financial Conduct Authority ('FCA') that it was being referred to the FCA's Enforcement division for investigation in connection with the Company's handling of inside information prior to its trading update and announcement of its intention to undertake the 2016 Rights Issue on 26 April 2016. The Company is cooperating fully with the FCA and will update the market on the outcome in due course."

Stagecoach loses South West Trains franchise after 20 years to FirstGroup-Hong Kong joint venture

Shares in Stagecoach are in reverse today, down 1pc at 198p, after it lost the South West Trains franchise. Sam Dean has the details:

Stagecoach has lost the South West Trains franchise after operating the network for more than 20 years.

The Department for Transport has awarded the new contract for the service to British transport company FirstGroup and Hong Kong-based MTR Corporation, with the franchise operating from August 2017 until at least August 2024.

Stagecoach chief executive Martin Griffiths said the company was “disappointed” to lose out on the rail network, which runs trains to London from cities such as Bristol and Exeter.

“We are proud to have operated the network under the South West Trains brand for more than 20 years and we are disappointed that we have been unsuccessful in our bid for the new franchise,” Mr Griffiths said.

Stagecoach was the first company to take over a British franchise when it took control of the South West brand in 1996.

Dollar extends losses, sliding to a four-month low

Meanwhile, the dollar continues to fall. It is now floundering at a four-month low against a basked of currencies amid concerns about the prospect of Trump's mega-spending plans after he failed to push through the healthcare bill.

The dollar fall 0.5pc on the day against the basket of other major currencies used to measure its broader strength. At 99.038 the index was at its lowest since three days after Trump was elected in November.

In January, the index surged to a 14-year high amid expectations of stimulus and tax reforms under the Trump presidency.

The dollar has lost nearly everything it's gained since Donald Trump was elected in November https://t.co/lbIpzs0Dc5pic.twitter.com/GTaxXSBe2l

— Bloomberg (@business) March 27, 2017

Pound heads towards $1.26, hitting eight-week high

The pound has extended its gains against the US dollar, touching an eight-week high of $1.2594 in mid-morning trade after the dollar sank following Trump's failure to pass the healthcare bill on Friday.

The local currency rose by as much as 0.76pc heading towards the $1.26 barrier. At $1.2594, the pound is trading at its highest level since February 2 when it hit $1.2707.

However, FXTM Research Analyst Lukman Otunuga, thinks the gains might be short-lived.

He said: "Despite the gains the sterling has displayed this quarter, the uncertainty of Brexit may ensure weakness remains a recurrent market theme in the longer term with bears on standby to exploit the technical bounce to attack prices lower.

"While the recent CPI and retail sales report have somewhat boosted sentiment towards Sterling, investors should be under no illusion that the bearish bias has changed. With further weakness expected as the Brexit negations get under way this week, the current technical bounce on the GBPUSD could come to an abrupt end."

FTSE 100 tanks to one-month low

The FTSE 100 is floundering at a one-month low in mid-morning trader after coming under heavy selling pressure in the wake of Trump's healthcare defeat.

It fell by as much as 1.1pc to 7,255.78, marking its lowest level since February 28 when it touched 7,246.60.

Will Trump ramp up noise for fiscal reforms in order to counter a potential Trump slump?

Anthony Cheung, of Amplify Trading,expects US President Donald Trump will "ramp up the noise for fiscal reforms" in order to counter "any potential aggressive unwind of the Trump trade".

Seems by front running the bad news Trump has managed to negate a portion of negative market response thus far.... 1/2

— Anthony Cheung (@AWMCheung) March 27, 2017

Seems by front running the bad news Trump has managed to negate a portion of negative market response thus far.... 1/2

— Anthony Cheung (@AWMCheung) March 27, 2017

In his morning briefing, Mr Cheung explains what Trump's failure to appeal Obamacare means for the market:

Could Trump rally start to reverse rapidly?

Joshua Mahony, of IG, points out that market anxiety is beginning to intensify, as Trump’s failure to pass his healthcare reforms raises questions over his ability to get other reforms through congress.

He said: "The selling has ramped up this morning, in the wake of Trump’s inability to pass his healthcare reforms on Friday. The problem for markets is two-fold, with the inability to pass the healthcare reforms meaning any tax cuts will be diminished, while markets are now left wondering whether the President’s lack of support in congress will make his tax cuts hard to pass in any form. Incredibly, at a time when the Republicans control both the House and the Senate, we are faced with a position where internal factions mean Trump still cannot get the required support to make a meaningful impact as President.

"With stock markets having enjoyed an incredible three-months after Trump’s election win, we are now starting to see a significant amount of fear creep in over whether this runaway rally could turn into a rapid reversal. First the rejection of his travel bans, now Trumpcare, it is becoming apparent that the President’s plans are becoming unstuck one-by-one."

Dow Jones poised for heavy sell-off

Wall Street is expected to follow its European counterparts deep into negative territory when the opening bell sounds later today. The Dow Jones is expected to sink 140 points as traders offload stocks after Trump's healthcare defeat on Friday.

Dow futures off 140 points. https://t.co/dhmbBgMZhGpic.twitter.com/IRgjqb9k4b

— Joe Weisenthal (@TheStalwart) March 27, 2017

Morgan Stanley hikes FTSE 100's 12-month target to 7,700

The FTSE 100 may be suffering a sharp sell-off this morning but that hasn't deterred Morgan Stanley from lifting its 12-month target for the blue chip index to 7,700 for 2017.

The US investment bank also sees earnings per share growth of 24pc for the FTSE 100.

Meanwhile, it sees the MSCI Europe index rising by as much as 8pc over the next 12 months.

The US investment bank attributed the target revisions to the return of inflation and Europe's financial sector, which it believes is in a "sweet spot".

Morgan Stanley analysts said: "We believe they have entered a sweet spot where most, if not all, relevant factors are positive and/or improving."

Bank of England to check banks ready for range of Brexit outcomes

British banks need to prepare for a wide range of potential outcomes and avoid sudden changes to lending as the country gets ready to leave the European Union, Bank of England policymakers said on Monday.

Just two days before Prime Minister Theresa May plans to formally notify the European Union that Britain is ready to start two years of exit talks, the central bank said banks will have to provide copies of contingency plans to reassure regulators that they are ready for "a range of possible outcomes".

The Bank of England's Financial Policy Committee is asking Britain's banks to show how they can avoid their continental customers being abruptly cut off after Brexit.

At a glance | What is Article 50?

Lenders worry that Britain will not secure continued, unfettered access to the bloc's single market, and some are already planning to beef up their presence on the continent.

"Sudden adjustment could disrupt the provision of market liquidity and investment banking services," the FPC said in a quarterly policy statement.

Changes to bank business models after Brexit would reduce the resilience of the UK financial system and the BoE said it was "examining appropriate mitigants", without elaborating further.

BT fined £42m by Ofcom for 'serious breach' of rules in largest penalty ever imposed by the regulator

Shares in BT fell 1.2pc this morning after it was fined £42m by Ofcom for a "serious breach" of rules. Sophie Jamieson has the details:

BT has been fined £42m by the communications regulator for a "serious breach" of rules, in the largest fine ever imposed on a telecoms provider.

Ofcom conducted an investigation into Openreach, the arm of BT that develops and maintains the telecoms network in the UK which is used by other telephone and broadband providers.

It found BT had misused the terms of its contracts to cut compensation payments for delays in connecting high-speed business lines, known as ethernet services, to other telecoms providers. Such lines provide connections for schools, hospitals and libraries as well as businesses.

BT to be fined £42 million by Ofcom for breaching contracts with telecoms providers https://t.co/ejsO5qhYil

— Ofcom (@Ofcom) March 26, 2017

Ofcom found that Openreach wrongly assumed major wholesale customers had agreed to installation delays. The investigation was triggered by a complaint by Vodafone, which relies on BT ethernet services to connect its mobile masts.

German business morale hits highest level since July 2011

Away from the Trump slump, German business morale brightened unexpectedly in March, a survey showed on Monday, suggesting company executives in Europe's largest economy are brushing off concerns about the threat of rising protectionism.

The Munich-based Ifo economic institute said its business climate index, based on a monthly survey of some 7,000 firms, rose to 112.3 from an upwardly revised reading of 111.1 in February.

Germany's Ifo business climate index rises in March to its highest in almost 6 years. pic.twitter.com/6QNppHBOqI

— Jamie McGeever (@ReutersJamie) March 27, 2017

This was the highest reading since July 2011 and it came in stronger than a Reuters consensus forecast for 111.0.

"The upswing in the German economy is gaining impetus," Ifo chief Clemens Fuest said in a statement, adding that the upwards trend in assessments of the current business situation continued unabated and the business outlook also improved.

The rise in the headline figure was driven by improved sentiment in the manufacturing, construction and retailing sectors, while the business climate in wholesaling deteriorated.

Report from Reuters

Gold hits one-month high on Trump setback

Investors flocked to safe-haven assets this morning propelling gold to a one-month high as the dollar fell and equities plunged after Trump's healthcare bill setback.

Failure to pass the US healthcare bill on Friday raised concerns about Trump's ability to deliver on his campaign promises.

The precious metal rose by as much as 1.1pc to $1,258 an ounce.

Trump slump: What the experts have to say

Here's what the experts have to say about this morning's sharp-sell across equity markets:

Michael Hewson, of CMC Markets says the decline in US stocks last week's reflects "some concern that the optimism about President Trump’s various programs for reform may well have been somewhat misplaced".

"This failure would seem to suggest that investor optimism is likely to be misplaced if they think that it will be easier for President Trump to shift gears and focus on tax reform and fare any better than he has on health care reform. If anything it will be much harder given that the consensus on this is probably likely to be much more difficult to achieve than on health care, which suggests that a lot of the optimism about the reflation and fiscal stimulus trade may well have to be reassessed as well."

Rebecca O'Keeffe, Head of Investment at stockbroker Interactive Investor, thinks Friday's political fallout calls into question Trump's ability to manage the different factions of the Republican party and increases concerns on whether the President can deliver his proposed economic policies, including his vital tax plans.

She adds: "Equity valuations have been underpinned by the Trump reflation trade since November, but the failure of the Healthcare bill raises major doubts about the strength of the Administration and risks unwinding all the gains that the market has seen over the past five months."

USD needs healthcare not healthchaos - World First Morning Update March 27th - https://t.co/oDN2uNKmlmpic.twitter.com/vQrjNXja2f

— World First (@World_First) March 27, 2017

Kathleen Brooks, of City Index, reckons the markets are having their own 'Trump Tantrum' as investors seriously doubt whether the President’s abrasive style will work in Washington.

She said: "The Trump “disappointment trade” is now in full swing. The biggest losers on the Dow Jones last week were Goldman Sachs, Du Pont, Pfizer and Boeing, all companies that were reliant on Trump’s policy agenda. We expect losses from banking stocks, materials and construction firms, and healthcare companies in the next few days as the markets adjust to this set back for Trump. How he reacts will be crucial, so we will watch his Twitter account with a close eye. A spat with Congress is likely to keep the markets on edge, weigh on stock markets globally and push up volatility."

#Euro jumps to highest since Nov. Dollar is shattered as everyone heads for exits after a 5mth party following Trump's Health-Care debacle. pic.twitter.com/tRtTUqck7Y

— Holger Zschaepitz (@Schuldensuehner) March 27, 2017

Naeem Aslam, of Think Markets, says the reason for the panic which is triggering market’s selloff, which is actually across the board, is it’s intensity, especially in those sectors which we mentioned a few ago in our special report.

"Investors are anxious to see if the big infrastructure and tax reform bills will have any shot of making it in the House and if Congress is going to give them their blessing rather than tough time.

"It is this in particular which is prompting the panic in the market and has everyone running for the hills. The king dollar is being beaten down today against a basket of major currencies. Everyone wants to find themselves a safe bet as trading begins today."

FTSE 100 extends losses down 1.1pc on Trump slump

The sharp-sell off on the FTSE 100 has intensified just over an hour into trading after Trump's healthcare defeat on Friday.

The blue chip index is off by 1.05pc, or 75.70 points, at 7,259.97.

Connor Campbell, of SpreadEx, said: "Given that the global indices had been inflated by the President’s various promises, it is no surprise that the reaction to his ‘Trumpcare’ failure has been so vitriolic.

"Investors likely don’t care one bit about the state of America’s healthcare; they do care, however, about what this defeat means for his ability to push through the more market-relevant vows, namely tax reform and infrastructure spending. It certainly doesn’t mean anything good, with Trump seemingly unable to unite the Republican Party as a law-making entity."

Pound surges above $1.25 to seven-week high

The pound broke the $1.25 barrier in early trade, hitting a seven-week high, after Trump's failure to pass the US healthcare bill raised concerns about his ability to deliver on other campaign promises.

The local currency surged by more than 0.8pc to $1.2580 against the dollar, its highest level since February 9.

Against the euro, it also made ground, up 0.2pc to 86.43p per euro.

European bourses tank after Trump setback

European bourses suffered a sharp sell-off in early trade after US president Donald Trump's failure to pass his healthcare bill stoked concerns about his ability to deliver on fiscal spending plans and tax reforms.

Here's a snapshot of the current state of play:

Mike van Dulken, of Accendo Markets, said: "Calls for a negative start to the new trading week come after late Friday’s withdrawal of Trump’s Healthcare bill, due to a continued lack of Republican support sapped optimism. While it puts into doubt ease of passage for other stimulus measures it could actually allow the new government proceed more quickly with the pro-growth infrastructure spending, deregulation and tax cut trio that have fuelled a 4-month global reflation rally.

"The FTSE is hindered by GBP strength (due to USD weakness) weighing on its 70pc of internationally-generated profits as well as a drop in commodity prices (base metals Oil) as fresh risk aversion kicks in; a double whammy blow for Miners and Oil majors."

China stocks hurt by tightening concerns and US policy woes

Overnight in Asia, China stocks slipped, as any optimism felt from data showing surging profits at industrial firms was offset by fresh property curbs and signs that monetary policy may be further tightened. Shares were also hurt by Trump's healthcare defeat.

The blue-chip CSI300 index fell 0.3pc, to 3,478.04 points, while the Shanghai Composite Index shed 0.1pc to 3,266.96 points.

Good morning from Berlin. Markets start the week in Risk-Off mode on US Health-Care flop. Dollar plunges, close to erasing post-Trump rally. pic.twitter.com/jGBaSG3BHn

— Holger Zschaepitz (@Schuldensuehner) March 27, 2017

Dollar hit by Trump's healthcare defeat

The dollar slid to a near two-month low against a basket of currencies on Monday as concerns mounted about the chances of US fiscal stimulus after President Donald Trump's failure to push through a healthcare reform bill.

Trump's inability to deliver on a major election campaign promise marked a big setback for a Republican president whose own party controls Congress, and raised doubts whether he will be able to push through tax reforms and mega-spending packages.

"Concerns towards the Trump administration have been reignited after his healthcare legislation setback. This is resulting in a bout of risk aversion weighing on the dollar," said Shin Kadota, senior strategist at Barclays in Tokyo.

"There isn't much going for the dollar right now and the market will be bracing for its further decline."

Dragged down by declining U.S. yields, the dollar index against a basket of major currencies was down 0.4pc at 99.258, its lowest since February 2.

The index had risen to a 14-year high near 104.00 early in January when expectations for significant stimulus under the Trump presidency were at their peak.

Report from Reuters

Agenda: Is the Trump slump on its way?

Good morning and welcome to our live markets coverage.

Markets have started the week on the back foot as US President Donald Trump's failure on healthcare reform raised questions about his ability to push through tax cuts and fiscal spending to boost the economy.

On Friday, Trump failed to get enough support from his own Republican party to "repeal and replace" the Obamacare health insurance reforms. This has depressed stock market indices and the dollar putting the so-called 'Trumpflation trades' are under heavy selling pressure in early trade.

Dollar Index DXY plunges as Trump trade took a big hit after US Health-Care flop. Dollar is close to erasing post-Trump rally. pic.twitter.com/EHHLd3neiU

— Holger Zschaepitz (@Schuldensuehner) March 27, 2017

Also on the agenda:

Full-year results: Eleco, Bank of Cyprus Holdings, Inspired Energy, X5 Retail Group

Interim results: You Gov

Trading update: Toople

Economics: GfK consumer climate (GER), private loans y/y (EU), M3 money supply y/y (EU)

This week's developed market events: German #IFO, #Fed speakers, Eurozone #CPI and UK #GDP. Our forecasts here... ^MB pic.twitter.com/avz4M1tnFN

— ING Economics (@ING_Economics) March 26, 2017

Yahoo Finance

Yahoo Finance