Pound subdued as top officials warn Bank of England will 'probably not forecast the next financial crisis'

Bank of England: Our economic forecasts will always be wrong

The Bank of England will "probably not forecast the next financial crisis" as economic forecasting can never be completely accurate, top officials have warned.

The Bank has poured resources into economic forecasting since the financial crisis when its predictions were utterly wrong.

But even so, it struggles to get the numbers spot on. Last year it anticipated a sharp economic slowdown following the Brexit vote, but in fact the economy has continued growing at almost exactly the same pace as it did before the referendum.

“I am never confident of any forecast,” said Gertjan Vlieghe, a member of the interest rate-setting Monetary Policy Committee.

"We are probably not going to forecast the next financial crisis, nor are we going to forecast the next recession. Models are just not that good."

UK public finances show smaller-than-expected January surplus

UK public finances showed a smaller-than-expected January surplus following a methodology change, data from the Office for National Statistics showed this morning. It reported a surplus in the public finances of £9.4bn last month. That was smaller than a forecast for a surplus of £13.8bn.

Chancellor Philip Hammond is aiming to bring Britain's budget deficit - one of the biggest among the world's rich economies - down to £68.2bn - or 3.5pc of gross domestic product - in the 2016/17 financial year which ends in March. That target looks achievable based on the latest figures

Eurozone businesses grow at fastest pace since April 2011

Eurozone private sector and manufacturing growth unexpectedly accelerated to near a six-year high in February and job creation reached its fastest since August 2007, propelled by strong demand and optimism about the future, a survey found.

IHS Markit's eurozone flash composite Purchasing Managers' Index, seen as a good overall growth indicator, rose sharply to 56.0, the highest since April 2011, from 54.4 in January, confounding expectations for a slight dip to 54.3.

"The increased momentum is due to demand growing at a stronger rate, but also that upturn becoming more broad-based," said Chris Williamson, chief business economist at IHS Markit.

Other key market highlights:

FTSE 100 dragged lower after HSBC reports 62pc profit slump

Pound subdued in afternoon trade after BoE testimony

UK public finances show smaller-than-expected January surplus

Eurozone businesses grow at fastest pace since April 2011

Haldane: Forecast errors since Brexit are nothing like scale made before financial crisis

Carney: Inflation overshoot is entirely caused by currency factor

Market Report: Concerns about European growth weigh on AO World

Online electricals retailer AO World slumped towards the bottom of the mid-cap index amid concerns about growth in European markets.

Morgan Stanley downgraded its rating to “underweight” and cut its target price to 135p from 170p as it believes European growth may fall short of expectations over the next few years. Guidance is for 30pc growth, but analysts think this may not be achievable without “a significant step up in marketing spend”.

The US investment bank also warned that an acceleration in the UK business could be difficult given competition and potential macroeconomic headwinds.

Miriam Adisa, of Morgan Stanley, cautioned: “We have long-term concerns about AO’s ability to win share outside its core UK market”.

The bank cut its revenue guidance by 6pc and 10pc for 2018 and 2019, respectively. It also sees UK growth slowing to 7pc by 2020. Rattled by the bearish broker note, shares tumbled 7.5p, or 4.7pc to a six-month low of 152.5p.

AO World wasn’t the only mid-cap laggard, oilfield services company John Wood Group fell 65p to 753p, after it reported a 62pc fall in full-year profits.

Despite the sharp slide, the FTSE 250 managed to eke out gains of 0.14pc to 18,772.21. However, the FTSE 100 dipped into the red, down 25.03 points, or 0.34pc, to 7,274.83, dragged lower by HSBC. Europe’s largest bank plunged 46.6p, or 6.5pc, to 665.7p after full-year profits slumped 62pc as it took hefty writedowns from restructuring.

Elsewhere, Mediclinic warned on profits in its Middle East business sending shares 48p lower to 754p. Hargreaves Lansdown shed 41p to £13.22 after Bernstein downgraded it to “underperform” citing pressure on margins from competition.

Mediclinic International 1-year share price

Meanwhile, Randgold Resources and Fresnillo lost ground, down 125p and 18p, respectively, as gold prices fell on renewed expectations of a US rate rise next month.

On the other side, Rolls Royce rose 24.5p to 732.5p after it won a Trent 700 engines order from Hawaiian Airlines, and Sage bounced 13.5p higher to 648p as broker Stifel began covering the stock with a “buy” rating.

Retailer WH Smith rallied to an eight-month high, up 61p to £16.86, on a broker upgrade. Investec hiked its rating to “buy” as it believes its equity story is “evolving into a play on a structurally growing global travel market”. It also thinks its travel business could contribute to around 70pc of profits in five years time.

Finally, Vodafone rose 2.2p to 200.7p after India’s Reliance Industries’ Jio telecoms unit announced it will charge for its services from April, putting an end to seven months of free calls and data.

With that, it's time to close. I'll be back again tomorrow with more markets coverage.

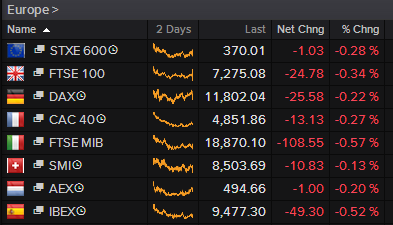

European bourses close higher but FTSE 100 hit by HSBC profit slump

European bourses closed higher after PMI data signaled growth in the eurozone area. However, FTSE 100 skidded into the red after HSBC reported a 62pc slump in full-year profits.

At the closing bell:

FTSE 100: -0.34pc

DAX: +1.28pc

CAC 40: +0.58pc

IBEX: +0.46pc

Weighing in on the slump in HSBC's shares, Jasper Lawler, of London Capital Group, said: "Shares of HSBC saw its biggest daily drop in 18 months after missing revenue forecasts and warning it could fall again this year. A $1bn increase in its stock buyback program did little to contain the disappointment. Although HSBC chief executive Stuart Gulliver may have had better days at the office, the 40+pc gain in the share price since Brexit should help him sleep just fine.

"These results were a dash of reality for investors in the banking sector who perhaps got a little ahead of themselves in hopes of financial deregulation, higher global growth and rising interest rates. The quarter included some heavy write-downs including for its disgraced European private bank. With lower write-downs and more time to benefit from higher global rates, we would expect next quarter to be a bit rosier."

Pound hits highest level against euro since December 22

The pound has hit its highest level against the euro since December 22, up 0.8pc at 84.45p.

Against the dollar, sterling is subdued, up just 0.03pc at $1.2461. Earlier in the day, it slumped to $1.2401 after the Bank of England policymakers warned the bank would probably not be able to forecast the next financial crisis.

Le Pen support drives European risk aversion

Joshua Mahony, of IG, highlights that heightened political fears in Europe, ranging from Le Pen’s resurgence, to Brexit, stand in stark contrast to the overwhelming expectation of greater prosperity under Trump’s rule in the US.

"The French elections are becoming an increasingly relevant risk to markets, with the chances of a victory for Le Pen rising with every month that passes. As the spread between French and German 10-year bond yields rises to a 4-year high, it is clear that the markets are increasingly factoring in a Le Pen victory as a distinct possibility. However, if there is anything we have learnt from polls in the UK and US, it is that the more controversial option can often be underrepresented up until the vote."

Oops: #France 10y risk spread over #Germany jumps to almost 80bps, highest since 2012 as Le Pen worries rise. pic.twitter.com/O2DREPqBsy

— Holger Zschaepitz (@Schuldensuehner) February 21, 2017

Capita writes down £50m of contracts as share price slides

Capita has written down the value of a number of historic contracts after a rocky year of trading, as it takes measures to shore up its business.

The company said this morning that it had written off assets worth £50m, most of which relate to the years 2012 to 2014, but some of which date back as far as 2009. It added that accrued income of around £40m would also be written down as a charge.

“These impairments will have no adverse impact on cash or future trading,” its board said in a statement, adding that it had not changed its outlook for its performance from its December statement.

However, analysts suggested that the writedowns were likely to hit the company’s pre-tax profit for the full year, which it will announce next week. Today’s news follows two profit warnings in the past three months, partly as a result of a slowdown in spending from some of its clients hitting its pipeline of work, and some structural issues in its IT enterprise services business.

Report by Rhiannon Bury (Read the full story here)

US stocks undeterred by 'dogy manufacturing and services PMIs'

Connor Campbell, of SpreadEx, flags that even some dodgy manufacturing and services PMIs haven't deterred the Dow Jones from crossing the 20,700 barrier.

"The former came in at 54.3 against the 55.0 seen last month, while the latter fell even further, from 55.6 to 53.9; that’s notable shift in sentiment, especially notable since it covers a purely Trump-led period. The US markets didn’t let it affect them however, with the Dow Jones crossing the 20700 mark for the first time in its history soon after the bell."

Eurozone PMIs outstripping US PMIs

Euro zone > US:

US mfg PMI 54.3

EZ mfg PMI 55.5

US services PMI 53.9

EZ services PMI 55.6

US composite PMI 54.3

EZ composite PMI 56.0— Jamie McGeever (@ReutersJamie) February 21, 2017

Euro zone economy (1.7%) grew faster than US (+1.6%) last year.

Euro zone PMIs outstripping US PMIs suggests this is still the case in Q1.— Jamie McGeever (@ReutersJamie) February 21, 2017

Drop in US PMIs suggests post-election upturn has lost some momentum

The drop in the flash US PMI numbers for February suggests that the post-election upturn has lost some momentum, Chris Williamson, of IHS Markit said this afternoon.

"Growth of business output, new orders and hiring all waned, as did inflationary pressures.

“February also saw a sharp pull-back in business optimism about the outlook over the next 12 months, which suggests companies have become more cautious about spending, investing and hiring.

“However, even with the February dip, the PMI remains at a level broadly consistent with the economy growing at a 2.5pc annualized rate in the first quarter. The survey’s employment index is meanwhile indicating that a respectable 165,000 jobs were added to the economy in February."

US PMI comes in below expectations.

Services 53.9 vs exp 55.6, Manufacturing 54.3 vs exp 55.0 pic.twitter.com/1Tuzyr7Ywm— Sigma Squawk (@SigmaSquawk) February 21, 2017

US private sector growth slows from January’s 14-month peak

US private sector growth weakened this month driven by slower momentum across the service economy, data from Markit showed this afternoon.

Here are the key findings:

Flash US Composite Output Index at 54.3 (55.8 in January). 2-month low.

Flash US Services Business Activity Index at 53.9 (55.6 in January). 2-month low.

Flash US Manufacturing PMI at 54.3 (55.0 in January). 2-month low.

Flash US Manufacturing Output Index at 55.7 (56.7 in January), 2-month low

Flash #US Composite Output Index at a 2-month low of 54.3 in Feb'17, down from 55.8 at the start of 2017. https://t.co/58JNIAk9aapic.twitter.com/FxCkDnkwDk

— Markit Economics (@MarkitEconomics) February 21, 2017

Wall Street hits new record high on strong retail results

Better-than-expected retail results and a rise in oil prices propelled US stocks to a new record high.

At the opening bell:

Dow Jones: +0.23pc

Nasdaq: +0.17pc

S&P 500: +0.23pc

Mediclinic shares tumble as it warns on profits in Middle East

Shares in Mediclinic dropped 5.7pc this afternoon after it warned on profits in its Middle East business. Julia Bradshaw reports:

Mediclinic International, the hospital provider, has issued its second profit warning in five months amid ongoing problems with its newly acquired Middle East business.

Shares in the FTSE 100 group, which is headquartered in South Africa, fell by as much as 5pc after the company announced that poor trading at Al Noor, an Abu-Dhabi hospital provider it acquired a year ago, had continued into the new year.

Mediclinic International 1-year share price

This, along with a generally grim trading outlook in the oil-dependent Emirate, meant profit and sales at Mediclinic's Middle East division would be lower than expected this year.

Mediclinic doubled in size after it completed the reverse takeover of London-listed Al Noor in February, propelling it into the blue-chip index and turning it into the third largest international hospital provider outside the United States, with clinics across Southern Africa, Switzerland and the Emirates.

US stock index futures hit record highs

US stocks are poised to hit record highs when the opening bell sounds later this afternoon after a surge in oil prices and upbeat corporate earnings. Stock index futures have already touched fresh highs.

Here's a look at the opening calls courtesy of IG:

US Opening Calls:#DOW 20669 +0.07%#SPX 2353 -0.04%#NASDAQ 5333 -0.11%#IGOpeningCall

— IGSquawk (@IGSquawk) February 21, 2017

Bank of England: Our economic forecasts will always be wrong

Here's our full story on the grilling the Bank's policymakers received this morning by economics correspondent Tim Wallace:

The Bank of England will "probably not forecast the next financial crisis" as economic forecasting can never be completely accurate, top officials have warned.

The Bank has poured resources into economic forecasting since the financial crisis when its predictions were utterly wrong.

But even so, it struggles to get the numbers spot on. Last year it anticipated a sharp economic slowdown following the Brexit vote, but in fact the economy has continued growing at almost exactly the same pace as it did before the referendum.

“I am never confident of any forecast,” said Gertjan Vlieghe, a member of the interest rate-setting Monetary Policy Committee.

Mark Carney goes on the defensive as MPs question him about economic slack https://t.co/iTaM3Y0x4vpic.twitter.com/1MiLWRarDa

— Bloomberg Brexit (@Brexit) February 21, 2017

He said economic models can never be perfectly accurate regardless of how much data and analysis the economists put into the prediction.

“It is still going to be the case that there are large forecast errors, we are probably not going to forecast the next financial crisis, nor are we going to forecast the next recession - models are just not that good," he told the Treasury Select Committee.

Governor Mark Carney said that the Bank had suspected the business and consumer surveys after the EU referendum were overly gloomy, but should have been bolder in adapting its own forecasts to reflect that.

“We didn’t think the economy would go into recession… we were towards the top end of forecasters at the time. We should have been higher, in retrospect,” said the Governor.

Eurozone picks up pace as growth hits six-year high

Here's our full report by Tim Wallace on the eurozone PMIs data which showed the economic growth in the region is accelerating at its fastest rate in almost six years:

Economic growth in the eurozone is accelerating as businesses expand at their fastest pace in almost six years.

Germany is growing at its fastest rate since 2013 while France is expanding more quickly than at any month since 2011, according to the purchasing managers’ index (PMI) from IHS Markit.

It also indicates that companies are hiring workers at the fastest pace in almost a decade, with the manufacturing and services industries both growing strongly.

“The eurozone economy moved up a gear in February. GDP growth of 0.6pc could be seen in the first quarter if this pace of expansion is sustained into March,” said Chris Williamson, chief business economist at IHS Markit.

“With inflows of new orders also surging and firms becoming even more optimistic about the year ahead, growth could even lift higher in coming months. The survey therefore indicates that companies are currently firmly focused on expanding in the face of rising sales and fuller order books.”

Half-time update: Germany's DAX surgest to highest level since May 2015

European bourses turned positive and the German DAX surged to its highest level since May 2015 this afternoon. However, FTSE 100 remained in the red as a 62pc slump in HSBC's full-year profits weighed on the blue chip index.

Just after 1pm:

FTSE 100: -0.2pc

DAX: +0.57pc

CAC 40: +0.33pc

IBEX: +0.24pc

BHP raises dividend as mining industry cements turnaround

Shares in BHP Billiton have dipped today despite rewarding its shareholders with a bigger than expected payout. Jon Yeomans has the details:

BHP Billiton, the world’s biggest miner by market cap, has drawn a line under a two-year industry downturn by reporting a return to the black and a better-than-expected interim dividend.

The Anglo Australian company posted pre-tax profits of $5.48bn (£4.41bn) in the six months to December 31, compared to a $7.46bn loss the year before, when it took a huge writedown in its US shale gas business and was forced to cancel its dividend.

Underlying earnings jumped 65pc to $9.9bn and revenue climbed 20pc to $18.8bn, as BHP reaped the rewards of a surge in the price of iron ore, its biggest product, as well as a recovery in coal and oil prices.

The miner rewarded investors with an interim dividend of 40 US cents a share, well above its minimum stated payout of 50pc of free cashflow, which would have been 30 cents a share.

Andrew Mackenzie, BHP chief executive, said falling costs and greater productivity from the company’s string of mines around the world, as well as higher prices, were responsible for the “strong” result.

Bank of England policymakers appearance before TSC comes to an end

And one final question for Mark Carney: Do you agree it's in everyone's best interests that the City flourishes after we leave the EU?

Carney responds: "Prudently flourishes.

"I agree that it is in everyone's best interests that the City prudently flourishes after we leave the EU."

Carney tying himself in knots over forward guidance. He can't bring himself to say that there isn't any at the mo.

— Philip Aldrick (@PhilAldrick) February 21, 2017

With that, the grilling is over.

Interesting session with #Carney of #BankofEngland : forecast assumes immigration falls from 300k to 150k .

— Helen Goodman (@HelenGoodmanMP) February 21, 2017

Carney: FTSE 100 is not the best asset price to judge health of underlying economy

The FTSE 100 is interesting, but not the best asset price to judge the health of the underlying economy, Mark Carney said this afternoon.

He told the Treasury Select Committee that the rise in the FTSE 100 since Brexit vote reflects the currency effect, the improvement in the global economy and the resilience of the UK economy on the margin re-enforced by the stance in monetary policy.

Carney points out that the FTSE 250 index of UK domestically focused companies has underperformed other share indices.

Bank did not come to a view on giving any explicit guidance on future rate moves

The Bank of England did not come to a view as a committee in February on giving any explicit guidance on future interest rate moves, Mark Carney told the Treasury Committee this afternoon.

He added that different members would ascribe different probabilities to the likelihood of rate rises versus rate cuts.

*CARNEY: RATES MAY RISE FASTER OR SLOWER THAN MARKET EXPECTS#RosesAreRedVioletsAreBlue

— Alberto Gallo (@macrocredit) February 21, 2017

Carney: UK retail market is very competitive

When asked if some suppliers are attempting unjustifiable price rises, Bank of England governor says the UK retail market is very competitive.

The effect of the weaker pound is likely to be largely passed through to fresh fruit and vegetables, some of the cost absorbed by manufacturers of more processed food stuffs, Mark Carney added.

Upside or downside risks to consumption growth?

When asked if they see upside or downside risks to consumption growth, here's what the Bank of England's policymakers had to say:

Dr Vlieghe: The past four to six weeks have shown a "decidedly more mixed" outlook for UK consumption.

Haldane: He sees downside risks to consumption growth.

Carney: The Bank of England governor believes risks to UK household consumption are "balanced".

Bank of England is looking at easing of credit conditions

Bank of England governor Mark Carney has said the central bank is looking at easing of credit conditions, for example on credit car repayment terms - that's a concern for the Bank.

Mark Carney goes on the defensive as MPs question him about economic slack https://t.co/iTaM3Y0x4vpic.twitter.com/1MiLWRarDa

— Bloomberg Brexit (@Brexit) February 21, 2017

You don’t need to be a weatherman to know which way the wind blows

David Cheetham, of XTB, weighs in on the grilling Bank of England policymakers are currently at the hands of the Treasury Committee. So far, he thinks Bank governor Mark Carney has remained "fairly steadfast in his dovish stance".

"The Governor said that there has been “no uptick in market inflation expectations since November” and that despite short run inflation expectations rising, the medium-term are not and this is “consistent with a temporary inflation overshoot.”

#Carney says what is causing #inflation overshoot important factor in #BOE tolerance. Says it is currently entirely due to currency factor

— Howard Archer (@HowardArcherUK) February 21, 2017

"These are the most relevant comments so far for the markets although there has been a muted reaction as this is broadly in keeping with comments made at the publication of the inflation report at the beginning of the month.

"On a side note comments from Andy Haldane, the central bank’s Chief Economist, will likely hit the headlines due to their quoteworthy nature. Mr Haldane admitted to making some “terrible” forecasting errors in light of economic projections post-Brexit but then chose to try and justify this by using a bizarre analogy, stating that there is more limited scope to improve economic forecasting than that of the weather. Indeed, it seems that the Bank may be coming to the realisation that they’ve had their own “Michael Fish moment.”

Bank's agents' survey points to deceleration in wage growth this year

Recent data on regular pay in the economy points to a slight down tick in the pace of growth this year, Mark Carney says.

BoE’s Carney: Agents' Survey Points To Wage Growth Deceleration This Year

— Livesquawk (@Livesquawk) February 21, 2017

He also points out that the Bank's agents' survey also shows a deceleration in wage growth this year.

Carney adds that weaker wage growth may reflect economic uncertainty and greater employer bargaining power.

Haldane: I find risk hard to understand

Not the most comforting statement from Bank of England chief economist Andy Haldane, as he concedes that explaining uncertainty to the general public can be tricky.

"We know that people find risk hart to understand. I find risk hard to understand."

Leaving single market and customs union will have only a "relatively modest" impact on growth, compared with current BoE forecast: Haldane

— Philip Aldrick (@PhilAldrick) February 21, 2017

He also tells the Treasury Select Committee that UK wage growth has been weaker even than weak productivity growth and low inflation would suggest.

He adds that equilibrium unemployment rate could easily be 4 or 5pc.

BoE’s Haldane: Unemployment Rate Equilibrium Could Easily Be 4% As 5%

— Livesquawk (@Livesquawk) February 21, 2017

McCafferty: Hope Bank can start gradual rate normalisation in coming years

Ian McCafferty thinks there is some hope the Bank can start gradual rate normalisation over the next two to three years.

Carney: BoE will 'never get any credit' for steps taken to mitigate risks around Brexit vote

The Bank of England will not hesitate to change policy if it thinks it is appropriate, governor Mark Carney has told the Treasury Committee today.

Carney to #TSC : we have to accept no one will thank us for it but our monetary policy decisions post #Brexit helped economy's resilience

— Silvia Borrelli (@London_Silvia) February 21, 2017

Carney says the Bank did take some serious steps to mitigate risk around the referendum, adding that it was important that the Bank did it.

"The Bank is never going to get any credit for it", Carney concludes.

Mark Carney + The Bank of England's report being vigorously critiqued at the Treasury select Committee.#greenline#cpi#rpi#fudgepic.twitter.com/FLnwtSfz2i

— Sigma Squawk (@SigmaSquawk) February 21, 2017

Haldane: Pick up in inflation expectations a concern for BoE

If inflation expectations keep on picking up from here, that would be a concern for the Bank, chief economist Andy Haldane says.

Carney: There has been no uptick in market inflation expectations since November

Since November, there has been no uptick in market inflation expectations, Mark Carney tells the Treasury Committee.

The Bank governor says short-run inflation expectations are rising in the UK, but market medium-term expectations are not rising, which is consistent with temporary overshoot of inflation.

Carney expects UK inflation to fall back in 2021.

carney: Inflation overshoot in BoE's 2020 fcast is "entirely" due to exchange rate effects.

— Philip Aldrick (@PhilAldrick) February 21, 2017

Carney: Inflation overshoot is entirely caused by currency factor

The Bank of England governor flags that current forecasts have not yet been discussed this morning.

Mark Carney says inflation overshoot is entirely caused by the currency factor.

#Carney blaming weaker #sterling for higher #inflation. This is only a start because these are going to get ugly once #A50 is triggered

— Naeem Aslam (@NaeemAslam23) February 21, 2017

He adds: "If we start to see second-round inflation effects on wage behaviour, that moves us closer to limit of toleration for inflation overshoot."

Good of #Carney to raise the fact that nothing has actually been discussed on current forecasts yet. Sterling finally wakes up (just) #BoE

— Craig Erlam (@craig_forex) February 21, 2017

BoE's Carney pushed to explain assumption at heart of low-rate policy

Bank of England Governor Mark Carney was challenged by lawmakers on Tuesday over the central bank's decision to alter a fundamental assumption that helps it to justify keeping interest rates at a record low.

The BoE said earlier this month it believed Britain's unemployment rate could fall to 4.5 percent - down from a previous estimate of 5 percent - before it starts to push up inflation.

That could help the central bank to keep rates low for longer, despite the resilience of Britain's economy so far to the decision by voters last year to leave the European Union.

Britain's unemployment rate currently stands at 4.8 percent.

Andrew Tyrie, the head of a panel of lawmakers who monitor the BoE, pressed Carney to explain the change during a regular question-and-answer session in parliament.

"This matters a lot because the Bank of England can allow forecast growth to rise without inflationary consequences once you've lowered this number," Tyrie said. "And indeed that seems to be a crucial ingredient for your making of assumptions on whether to raise interest rates."

Carney said the decision to lower the so-called equilibrium unemployment rate estimate was the result of an annual review and that some members of the Bank's Monetary Policy Committee had felt for years that it was too high.

Report from Reuters

Bank of England's forecast errors since Brexit are nothing like scale made before financial crisis

The Bank's forecast errors since Brexit are nothing like the scale made before the financial crisis, chief economist Andy Haldane tells the Treasury Committee.

"I actually was drawing a distinction between our learning from the time of the global financial crisis - which was a big one, massive error, big learning, to which we and others have then responded - and the events over the last six to 12 months where the error was on nothing like the scale, and quite a lot of what we have learned is basically new news, including policy changes."

BoE's Haldane: Our F’cast Errors Since Brexit Nothing Like The Scale Made Before Financial Crisis - RTRS

— Livesquawk (@Livesquawk) February 21, 2017

Carney: Immigration has marginal downward impact on inflation at 2-3yr horizon

Bank of England governor Mark Carney tells the Treasury Committee that immigration has a marginal downward impact on inflation at the two-three year horizon.

He adds that the Bank will need to pay particular attention to the effect of changes in migration over coming years on inflation.

Carney: "The MPC has been overpredicting wage growth consistently for the last several years."

A new way to say rising inflation is no prob— Ashraf Laidi (@alaidi) February 21, 2017

Pound weakens as Bank of England policymakers testify to Treasury Committee

The pound has weakened since the Bank of England's top policymakers began testifying to the Treasury Committee. It is currently down 0.3pc on the day at $1.2423 against the US dollar.

BOE members including Carney are testifying to treasury select committee, GBP weakening as they are talking...

BOE members including Carney are testifying to treasury select committee, GBP weakening as they are talking... pic.twitter.com/thWVy92swK

— City Index (@CityIndex) February 21, 2017

Vlieghe: Unlikely Bank will be able to forecast next financial crisis or recession

"I'm never confident of any forecast," Dr Gertjan Vlieghe tells the Treasury Committee. Laughter ensues.

Dr Vlieghe says the Bank of England is unlikely to be able to forecast the next financial crisis or recession, models are not that good.

He argues that it is wrong to think that even a better model would allow recessions or crises to be forecast with certainty.

"We are probably not going to forecast the next financial crisis, nor are we going to forecast the next recession. Models are just not that good.

"There isn't one model which is right or wrong, and if only we had found a slightly better model then we wouldn't have made the mistakes that we have made. Some of this discussion is leading to unrealistic expectations of what we're going to get from economics in the next five years."

Carney: UK households tend to look through economic uncertainty

Bank of England governor Mark Carney chimes in on the Bank's impact of Brexit.

He tells the Treasury Committee that UK households tend to look through economic uncertainty unless it leads to tighter financial conditions.

Quite testy exchanges between Tyrie and Mark Carney at Treasury Select Committee. They seem to like winding each other up

— Ben Glaze (@benglaze) February 21, 2017

Haldane: We have not fundamentally changed our view on the long-run impact of Brexit

Bank of England chief economist Andy Haldane says the Bank has not fundamentally changed our view on the long-run impact of Brexit,

"Have we changed our view in the shorter run? Yes, somewhat. That's why forecasts for growth have been revised up."

Upward revisions to UK growth forecasts reflect stimulus since referendum, unexpected consumer behaviour and a stronger world economy.

BoE's Haldane: Haven’t Fundamentally Changed View On Long-Run Impact Of Brexit

— Livesquawk (@Livesquawk) February 21, 2017

Most consumers so far have looked through impact of referendum, Haldane says, adding that perhaps that should not have been a surprise.

"It is certainly true that a majority of consumers so far have looked through the impact of what we've seen over the last six to nine months. In some ways perhaps that shouldn't be a surprise because there are more people in jobs than was the case nine months ago and their wages are still going up, their real income has been growing.

"That is now however about to change a bit as their incomes are squeezed by the rise in prices."

BoE's Haldane says market rate hike expectations could hurt economy

Bank of England chief economist Andy Haldane said this morning that a sharp increase in market expectations for an interest rate hike could tighten credit conditions and harm the economy.

Haldane said he was comfortable with the central bank's neutral policy stance, pointing out that trying to read the path of Britain's economy was "unusually difficult" following last year's Brexit vote.

"In the current fragile environment, however, I would be concerned if there were to be too sharp a rise in market interest rates, in expectation of Bank Rate being raised in the near future," Haldane said in a written annual statement to lawmakers.

He said this could tighten credit conditions, restricting consumer and business spending. "That triple-whammy could cause a sharper slowing in the UK economy than I believe would be desirable from a monetary policy perspective," Haldane said.

Haldane: Autumn Budget statement will have a material effect on British economic growth

Back to Andy Haldane, he tells the Treasury Select Committee that the Autumn Budget statement will have a material effect on British economic growth.

"Despite fiscal loosening in Autumn Statement, there is still a net headwind from budget contraction over the coming years."

Andrew Tyrie really skewered Andy Haldane on this subject as he waffled and contradicted himself #BoE#TSChttps://t.co/HwXuoJPCEE

— Shaun Richards (@notayesmansecon) February 21, 2017

Dovish Haldane on supporting growth/keeping lid on inflation trade-off: risks are symmetric but not really pic.twitter.com/4YVKqcbu5l

— Szu Ping Chan (@szupingc) February 21, 2017

Cafferty supports reduction in BoE estimate of equilibrium unemployment rate

When asked if he supports the Bank's decision to reduce the equilibrium level of UK unemployment from 5pc to 4.5pc, Ian McCafferty says he supports the reduction in the Bank's estimate, but is less sure about the size of the reduction.

He would have preferred a reduction to 4.75pc, not 4.5pc.

McCafferty is explaining his caution about the judgement of the magnitude of The Bank's newly discovered extra slack in the economy.

— Sigma Squawk (@SigmaSquawk) February 21, 2017

Cafferty adds that skills shortages and level of vacancies suggest we are closer to full employment than weak wage growth suggests.

Some MPC members thought the equilibrium unemployment rate could be below 4.5pc, others thought it could be over 4.5-4.75pc, he said.

Haldane: Risks to interest rates are two-sided and symmetric

The Bank of England chief economist Andy Haldane has also said that risks to interest rates are two-sided and symmetric. He would be concerned if there were to be a sharp rise in market interest rates.

Haldane adds that big improvements have been made in incorporating financial sector into the Bank's economic models.

Tyrie: "Past mistakes are not a guide to future performance?" Haldane: "Is our forecasting framework better? Yes." #TSC

— Kamal Ahmed (@bbckamal) February 21, 2017

He thinks too sharp a rise in market interest rates could tighten credit conditions, hitting consumer and business spending.

The Bank is also taking potentially irrational consumer behaviour better into account than before, Haldane said.

Haldane: There was collective amnesia at central banks in run-up to financial crisis

And the grilling begins. Andrew Tyrie begins by asking Bank of England chief economist Andy Haldane if economics is a Michael Fish profession.

Andy Haldane points out he was speaking about financial crisis and that data has since improved. He tells the Treasury Committee economics, by its nature, is a Michael Fish profession. It's like meteorology as it is about forecasting. It is prone to forecasting errors as with weather forecasting.

Tyrie, TSC: "Is economics a Michael Fish profession?" Andy Haldane points out he was speaking about financial crisis - data have improved.

— Kamal Ahmed (@bbckamal) February 21, 2017

Haldane adds that it is important to learn from those errors.

"The bank has made some notable errors."

He thinks there was collective amnesia at central banks and academia in the run up to the last financial crisis.

Haldane says that reading and navigating the UK economy is unusually difficult at the current juncture.

The scope for economic forecasting to improve is more limited than weather forecasting.

Andy Haldane of @bankofengland says Bank made 'sizeable errors' in forecasting during financial crisis & says the errors were 'predictable'

— Mark Broad (@markabroad) February 21, 2017

Live: Bank of England Governor Mark Carney gives evidence to Treasury Committee

Mark Carney is giving evidence to Treasury Select Committee following the Bank of England February 2017 Inflation Report. Watch it live here:

Welcome news for the Chancellor: UK posts biggest January surplus since 2000

Welcome news for the Chancellor as borrowing on course to undershoot the OBR forecast. pic.twitter.com/IlDzFXTbEf

— Duncan Weldon (@DuncanWeldon) February 21, 2017

Everyone likes the months when more tax comes in than spending goes out

Torsten Bell, of Resolution Foundation weighs in on the smaller-than-expected January surplus:

Everyone likes the months when more tax comes in than spending goes out - January surplus up £0.3bn on last January at £9.4bn https://t.co/tYlZoaK988

— Torsten Bell (@TorstenBell) February 21, 2017

Good news for CX: borrowing for yr to date is 20% down on same period last yr, compared to expected fall of just 5% in OBR's (dire) forecast pic.twitter.com/BwMoXE4rxc

— Torsten Bell (@TorstenBell) February 21, 2017

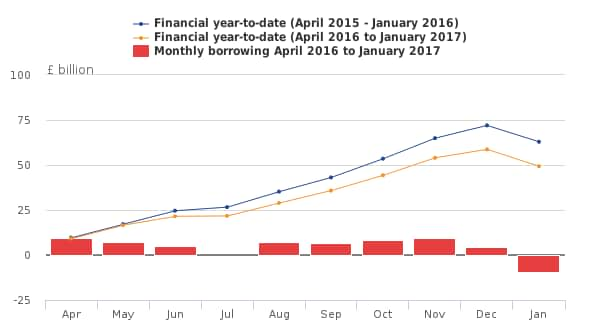

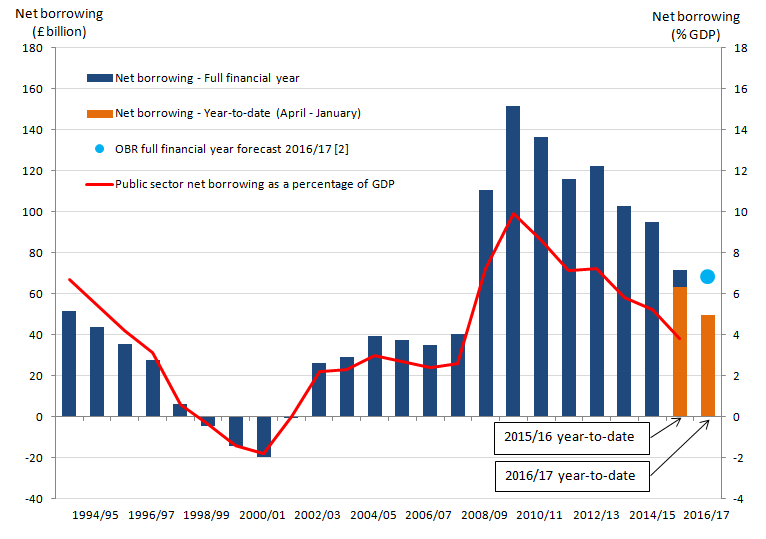

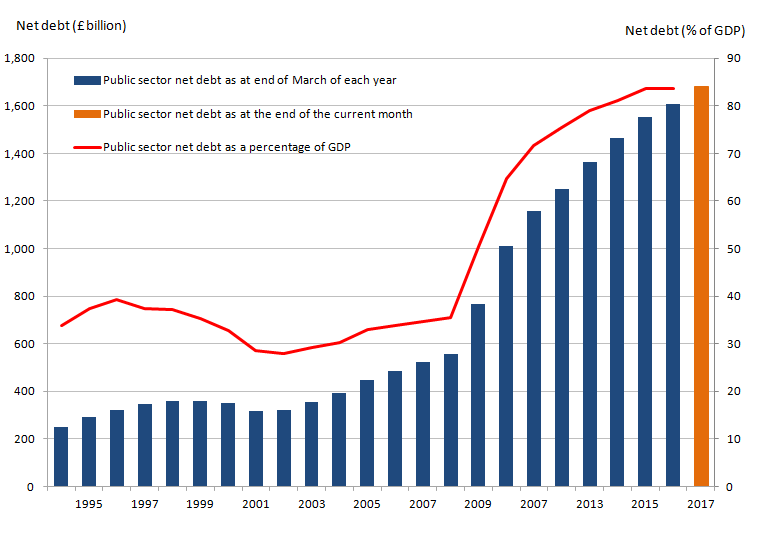

UK public finances: Key charts

Official data showed Britain reported its biggest surplus on record in the public finances for January which is typically when a lot of tax revenues flow into the public coffers. The Office for National Statistics reported a surplus in the public finances of £9.4bn last month. That was smaller than a forecast for a surplus of £13.8bn.

Here are the key charts:

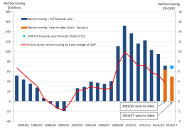

The first chart presents cumulative public sector net borrowing (excluding public sector banks) by month in the current financial year-to-date and compares the cumulative borrowing in the current financial year-to-date to that in the previous financial year.

Chart 2 illustrates that annual borrowing has generally been falling since the peak in the financial year ending March 2010 (April 2009 to March 2010). In the financial year ending March 2016 (April 2015 to March 2016), the public sector borrowed £71.7bn. This was £23.2bn lower than in the previous financial year and less than half of that in the financial year ending March 2010.

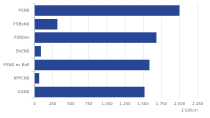

Chart 3 breaks down outstanding public sector net debt at the end of January 2017 into the sub-sectors of the public sector. In addition to PSND ex, this presentation includes the impact of public sector banks on debt.

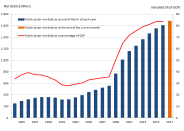

Chart 4 illustrates public sector net debt excluding public sector banks (PSND ex) from the financial year ending March 1994 to the end of January 2017.

UK public finances show smaller-than-expected January surplus

UK public finances showed a smaller-than-expected January surplus following a methodology change, data from the Office for National Statistics showed this morning. It reported a surplus in the public finances of £9.4bn last month. That was smaller than a forecast for a surplus of £13.8bn.

Chancellor Philip Hammond is aiming to bring Britain's budget deficit - one of the biggest among the world's rich economies - down to £68.2bn - or 3.5pc of gross domestic product - in the 2016/17 financial year which ends in March. That target looks achievable based on the latest figures

Here's the key points:

Public sector net borrowing (excluding public sector banks) decreased by £13.6bn to £49.3bn in the current financial year-to-date (April 2016 to January 2017), compared with the same period in the previous financial year; this is the lowest year-to-date borrowing since the financial year-to-date ending January 2008.

Public sector net borrowing (excluding public sector banks) was in surplus by £9.4bn in January 2017, a £0.3bn larger surplus than in January 2016; this is the highest January surplus since 2000.

Public sector net debt (excluding public sector banks) was £1,682.8bn at the end of January 2017, equivalent to 85.3pc of gross domestic product (GDP); an increase of £91.7bn (or 1.9pc points as a ratio of GDP) since January 2016.

Public sector net debt (excluding both public sector banks and Bank of England) was £1,589.2bn at the end of January 2017, equivalent to 80.5pc of gross domestic product (GDP); an increase of £43.6bn (or a decrease of 0.6pc points as a ratio of GDP) since January 2016.

Central government net cash requirement decreased by £12.8bn to £32.6bn in the current financial year-to-date, compared with the same period in the previous financial year; this is the lowest year-to-date central government net cash since January 2008.

Public sector net borrowing (PSNB Ex) was £9.4bn in surplus in Jan 17, biggest surplus since Jan 2000 https://t.co/jsR95JHjLa

— ONS (@ONS) February 21, 2017

Williamson: ECB will be cheered by signs of stronger growth and further upturn in price pressures

Commenting on the eurozone PMI flash estimates, Chris Williamson, Chief Business Economist at IHS Markit says the eurozone economy moved up a gear this month.

“With inflows of new orders also surging and firms becoming even more optimistic about the year ahead, growth could even lift higher in coming months.

“The survey therefore indicates that companies are currently firmly focused on expanding in the face of rising sales and fuller order books.

Eurozone set for +0.6% GDP in Q1 after rise in February flash PMI. Employment growth at 9½ year high https://t.co/5EhXIrazN4

— Chris Williamson (@WilliamsonChris) February 21, 2017

“The big surprise was France, where the PMI inched above that of Germany for the first time since August 2012. Both countries look to be growing at rates equivalent to 0.6-0.7pc in the first quarter. France’s revival represents a much-needed broadening out of the region’s recovery and bodes well for the eurozone’s upturn to become more selfsustaining.

“The ECB will be cheered by the signs of stronger growth and further upturn in price pressures, though will no doubt remain concerned that elections and Brexit could disrupt the business environment this year. No change in policy therefore looks likely until at least after the German elections in September.”

Price pressures in the eurozone continued to build in February according to flash #PMIpic.twitter.com/AS05mtyqJT

— Chris Williamson (@WilliamsonChris) February 21, 2017

Eurozone businesses grow at fastest pace since April 2011

Eurozone private sector and manufacturing growth unexpectedly accelerated to near a six-year high in February and job creation reached its fastest since August 2007, propelled by strong demand and optimism about the future, a survey found.

IHS Markit's eurozone flash composite Purchasing Managers' Index, seen as a good overall growth indicator, rose sharply to 56.0, the highest since April 2011, from 54.4 in January, confounding expectations for a slight dip to 54.3.

Euro area composite PMI and price pressure gauge (highest since June 2011) now both in 'ECB rate hikes' territory. pic.twitter.com/fUQ6oGtsCZ

— Frederik Ducrozet (@fwred) February 21, 2017

The broad-based acceleration, which showed France's momentum getting close to Germany's, suggests that if sustained, economic growth could hit 0.6 percent in the first quarter, according to Markit.

That is faster than the 0.4 percent economists predicted in a Reuters poll earlier this month and suggests an economy in rude health before key national elections this year in France, Germany and the Netherlands. ECILT/EU

"The increased momentum is due to demand growing at a stronger rate, but also that upturn becoming more broad-based," said Chris Williamson, chief business economist at IHS Markit.

"Importantly, what we now have is France joining the party. It's been a laggard in the region, and a drag on the euro zone upturn for a few years ... and there are finally signs the drag is easing."

The composite sub-index measuring employment, at 54.3, was the highest in more than nine years.

The renewed strength in the PMIs would also come as a welcome relief to the European Central Bank, widely expected to remain on the sidelines through upcoming national elections in three major economies in the currency bloc.

Euro zone PMI clearly didn't get the eurocrisis is back due to Greece/Le Pen memo. Composite at 56 (54.4 in Jan), 70-month high pic.twitter.com/xcNGjZydJg

— Pepijn Bergsen (@pbergsen) February 21, 2017

The euro zone flash manufacturing PMI rose to 55.5 from January's 55.2, the highest since April 2011. New export orders also rose to a near six-year high of 55.5 from January's 55.2, suggesting a weaker currency is helping boost demand.

The services PMI was also buoyant, with the business activity index rising to 55.6 from 53.7, easily beating the Reuters poll expectation of no change at 53.7 and the most optimistic forecast in the survey.

The services sub-index measuring incoming new business, at 55.8, was also the highest in nearly six years.

Report from Reuters

Eurozone flash PMIs beat expectations in February

Eurozone flash PMIs have beat expectations this month data from Markit showed this morning. Here's a snapshot of the flash PMI February readings for the eurozone:

Flash composite PMI: 56.0 (compares to forecasts of 54.3 and a reading of 54.4 in January; highest reading since April 2011)

Flash composite PMI employment index: 54.3 (Compares to 53.4 in January and marks its highest level since August 2007)

Flash manufacturing: 55.5 (Compares to forecast 55 and January reading of 55.2; highest since April 2011)

Flash manufacturing PMI output index: 57.2 (Compares to 56.1 in January and marks its highest level since April 2011)

Flash manufacturing new export orders index: 55.5 (Compares to 55.2 in January)

Flash services PMI: 55.6 (Beats forecasts of 53.7 and last month's reading of 53.7; also marks the highest reading since May 2011)

Flash services PMI new business index: 55.8 (Compares to 53.7 in January and highest level since April 2011)

#Euro Markit Composite PMI Flash at 56.0 https://t.co/bNjB59BM3Bpic.twitter.com/1aCcGk1Urv

— Trading Economics (@tEconomics) February 21, 2017

Anglo American swings back to profit and rows back on disposal plan

Shares in Anglo American dipped 0.4pc this morning even though the miner announced plans to reinstate dividends at the end of this year after cutting net debt and improving earnings. Jon Yeomans reports:

Mining giant Anglo American has turned its first annual profit in five years, while rowing back on a sweeping plan to sell off assets it hatched during the depths of the commodities downturn.

The FTSE 100 group, which celebrates its 100th anniversary this year, swung to a pre-tax profit of $1.59bn (£1.28bn) in the year to December 31, from a loss of $5.6bn a year earlier.

Underlying earnings before interest, tax and other charges jumped 25pc to $6bn, as an improvement in metal prices saw it rake in cash from iron ore and coal - two commodities it had vowed to exit in order to focus on diamonds, copper and platinum.

Group revenue edged up 1pc to $23.1bn.

Growth in Germany's private sector picks up to highest in nearly three years

Growth in Germany's private sector picked up in February to reach its highest level in nearly three years, driven by humming factories, data from Markit showed this morning.

Markit's flash composite Purchasing Managers' Index (PMI), rose to 56.1 from 54.8 in January. The index tracks activity in manufacturing and services, which account for more than two-thirds of the German economy.

The reading, comfortably above the 50 line that separates growth from contraction, marked a 34-month high and came in much better than the consensus forecast in a Reuters poll of 54.7.

#German angst with #ECB likely fueled by #PMI showing #prices charged by #services & #manufacturing companies rising at 67month high in Feb

— Howard Archer (@HowardArcherUK) February 21, 2017

IHS Markit economist Chris Williamson said the data suggested that the German economy was likely to grow 0.6 percent in the first three months of 2017 after expanding 0.4 percent in the final quarter of 2016.

"This is a broad-based upturn driven by manufacturing, but also helped by Germany's solid labour market," Williamson said.

The survey showed growth in manufacturing accelerated for the third consecutive month to reach 57.0, the highest level in nearly six years. Analysts had expected growth in manufacturing to slow to 56.0 after January's 56.4.

In the service sector, business activity accelerated more strongly than expected to hit a three-month high at 54.4. Analysts had expected a weaker pick-up to 53.6 from 53.4 in January.

Alongside the sharp rise for France, the German Composite PMI picked up strongly in Feb, consistent with quarterly GDP growth of about 0.6% pic.twitter.com/W8f5qIqgLK

— Capital Economics (@CapEconEurope) February 21, 2017

Reflecting stronger growth in output and new business, firms continued to hire more staff in February, with the overall rate of job creation picking up to reach its highest since June 2011.

The survey also signalled the sharpest increase in both input and output prices since mid-2011, pointing to rising inflation pressure in the euro zone's biggest economy.

Report from Reuters

French government bond spreads at highest level since 2012 as Le Pen worries rise

The premium that investors demand to hold French bonds instead of German debt rose to its highest since late 2012 after a poll showed Right-wing candidate Marine Le Pen narrowing the gap with more centrist opponents.

France's 10-year government bond yield spiked under pressure from fears that the French Presidential election could upset the status quo, as rising anti-establishment sentiment surfaced after last year's Brexit and the US election, while the low-risk German equivalents fell. This pushed the spread between the two yields to more than 80 points - its widest in five years.

The first round of the French Presidential election is scheduled on April 23, with the run-off between the top two contenders on May 7.

Oops: #France 10y risk spread over #Germany jumps to almost 80bps, highest since 2012 as Le Pen worries rise. pic.twitter.com/O2DREPqBsy

— Holger Zschaepitz (@Schuldensuehner) February 21, 2017

French business activity surges above expectations despite election uncertainty

French business activity surged passed expectations this month to near a six-year high, led by resurgent services, unfazed by political uncertainty two months from a presidential election, a monthly poll showed today.

Data compiler IHS Markit said its preliminary composite purchasing managers index jumped to 56.2 in February from 54.1 in January, reaching the highest level since May 2011 and beating expectations for a fall to 53.7.

It also marked the eight month in a row the index has been above the 50-point threshold dividing an expansion from a contraction in activity.

"It's a big surprise to see growth accelerate this markedly, especially in the run-up to a general elections," IHS Markit chief economist Chris Williamson said.

"Expectations about the outlook are picking up with very few instances of companies saying they were worried about the election result on the economy," he said.

Sky is the limit for French #PMI. "Magnifique" February survey, with both headline & details looking good. My take: https://t.co/paxG4VEKXspic.twitter.com/sCPHfoQ27W

— Maxime Sbaihi (@MxSba) February 21, 2017

Although most polls show far-right leader Marine Le Pen would come out on top in the April 23 first round of France's presidential election, she is also seen being easily beaten in a May 7 runoff round against independent Emmanuel Macron or conservative Francois Fillon.

Williamson said business activity at levels seen in February were commensurate with economic growth of 0.6 percent in the first quarter, which would be the best quarterly rate in a year.

A breakdown of the data showed that the service sector index jumped to 56.7 from 54.1 in January against expectations for a slight dip to 53.8.

French services PMI highest since August 2011 (56.7).

— Frederik Ducrozet (@fwred) February 21, 2017

Service providers saw new business surge as they stepped up price cuts, even though input prices rose at the fastest pace since the end of 2011, leaving profit margins squeezed.

With new business flowing in, services took on new staff at the fastest pace in over six years, which should help a nascent recovery in France's struggling labour market.

Meanwhile, manufacturing saw its index slip to 52.3 from 53.6. Economists had forecast virtually no change at 53.5 on average.

Manufacturers' output was stable from last month, but new orders eased as they sought to pass rising input prices on to customers, driving selling prices to the highest level since July 2011.

Report from Reuters

European bourses falter as HSBC drags financials lower

European bourses came under pressure this morning after HSBC reported a 62pc slump in full-year pre-tax profits, weighing heavily on financial stocks.

Here's a snapshot of the current state of play in Europe:

Mike van Dulken, of Accendo Markets, said: "Calls for a flat open come after a mixed day in Asia, echoing Europe’s close yesterday with no lead from the US on account of the President's day holiday. Politics still to the fore as polls suggest Le Pen closing the gap on rivals just two months before the first round of the French election. Note Greece has also missed yet another bailout deadline as creditors maintain demands on reforms."

HSBC profits slump after volatile year

Shares in HSBC are poised for their worst day in 18 months after it reported a 62pc slump in full-year pre-tax profits. Here's our full report:

HSBC reported on Tuesday that annual profit slumped following a year it said would be remembered for "unexpected economic and political events" and warned of risks in 2017 to the global economy's continuing recovery.

Europe's biggest bank said net profit for 2016 tumbled 82pc to $2.5bn (£2bn) from $13.5bn a year ago as annual revenue fell 18.5pc to $48bn.

UPDATE: HSBC shares extend losses, now -6%, biggest fall since Aug 2015 and second biggest in more than 5 years, after profits slump 62% pic.twitter.com/cqTqUmiED9

— Jamie McGeever (@ReutersJamie) February 21, 2017

In the most recent quarter, HSBC's net loss widened to $4.3bn from $1.3bn in the same period the previous year.

In a statement, Chairman Douglas Flint said uncertainties from last year's events "temporarily influenced investment activity and contributed to volatile financial market conditions," though he added that HSBC's performance was satisfactory. While he didn't mention any specifics, it was likely a reference to, among other things, Britain's unexpected vote to leave the European Union and Donald Trump's US election victory.

Mr Flint said the bank recently raised its forecast for global economic growth, based on the increasing chances that the U.S. will make changes to fiscal policy to boost the economy as well as growth in emerging markets.

Agenda: Investors eye UK public finances

Good morning and welcome to our live markets coverage.

After a rather subdued trading session as the US celebrated Presidents Day, the economics and corporate calendar is jam-packed today.

Overnight in Asia, Hong Kong shares suffered their biggest one-day loss in a month, weighed down by HSBC after it posted a bigger-than-expected drop in profits for 2016. The benchmark Hang Seng index erased early gains and ended down 0.8pc at 23,963.63 points, while Hong Kong China Enterprises Index lost 0.4pc to 10,408.56.

Good morning from Berlin. Asia stocks steady amid lack of cues. EM underperform w/ stronger Dollar but China bucking the trend. Euro < $1.06 pic.twitter.com/wL0DGK1qmo

— Holger Zschaepitz (@Schuldensuehner) February 21, 2017

We've got French, German and eurozone manufacturing and services PMI due for release between 8am and 9am.

PMI shows #French#manufacturing & #services output at 69-month high in Feb suggests economy is currently brushing off political uncertainty

— Howard Archer (@HowardArcherUK) February 21, 2017

Back in the UK, the public finances data will be released at 9.30am and Bank of England governor Mark Carney will be discussing the latest inflation report with the Treasury Committee at 10am.

Also on the agenda:

Full-year results: John Wood Group, HSBC Holdings, InterContinental Hotels, Lighthouse Group, Anglo American

Interim results: Green Reit, Image Scan Holdings, Vernalis, Galliford Try, BHP Billiton, Safestore Holdings

Trading update: Eros International, Utilitywise, Travelport Worldwide

Economics: Inflation report hearings (UK), CBI realised sales (UK), flash manufacturing PMI (US), flash services PMI (US), existing home sales (US), FOMC meeting minutes (US), flash manufacturing PMI (EU), flash services PMI (EU), flash manufacturing PMI (GER), flash services PMI (GER), Ifo business climate (GER), final CPI y/y (EU)

Opening calls - FTSE -11 points - HSBC -4%, other banks -2%, Anglo American & BHP Billiton +2%

— David Buik (@truemagic68) February 21, 2017

We'll be keeping you up to date with all the latest markets coverage throughout the day.

Yahoo Finance

Yahoo Finance