fuboTV (NYSE:FUBO) Reports Upbeat Q1, Stock Soars

Live sports and TV streaming service fuboTV (NYSE:FUBO) beat analysts' expectations in Q1 CY2024, with revenue up 24% year on year to $402.3 million. It made a non-GAAP loss of $0.11 per share, improving from its loss of $0.37 per share in the same quarter last year.

Is now the time to buy fuboTV? Find out in our full research report.

fuboTV (FUBO) Q1 CY2024 Highlights:

Revenue: $402.3 million vs analyst estimates of $381.3 million (5.5% beat)

EPS (non-GAAP): -$0.11 vs analyst estimates of -$0.15

Gross Margin (GAAP): 6.9%, up from 1% in the same quarter last year

Free Cash Flow was -$70.76 million compared to -$5.85 million in the previous quarter

Domestic Subscribers: 1.51 million

Domestic ARPU: $84.54

Market Capitalization: $464.8 million

Originally launched as a soccer streaming platform, fuboTV (NYSE:FUBO) is a video streaming service specializing in live sports, news, and entertainment content.

Media

The advent of the internet changed how shows, films, music, and overall information flow. As a result, many media companies now face secular headwinds as attention shifts online. Some have made concerted efforts to adapt by introducing digital subscriptions, podcasts, and streaming platforms. Time will tell if their strategies succeed and which companies will emerge as the long-term winners.

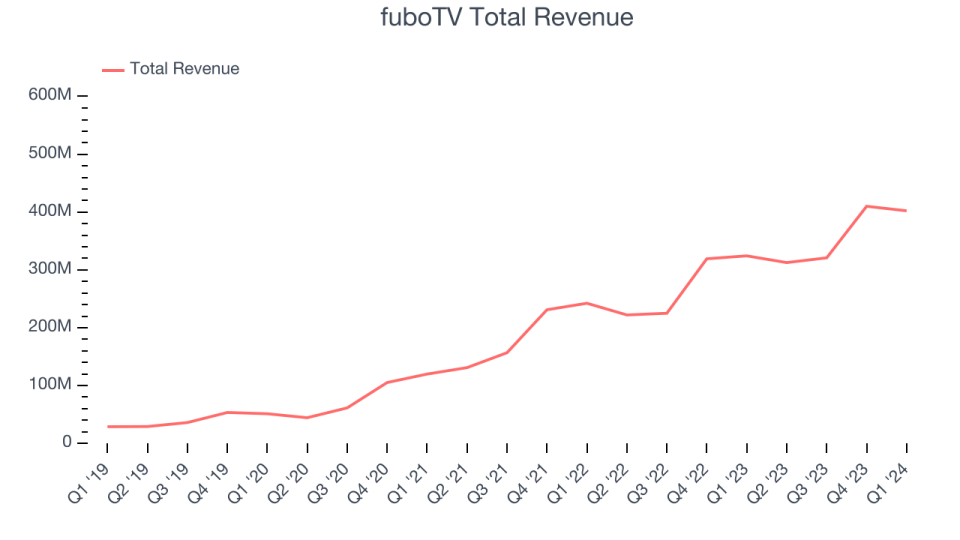

Sales Growth

Reviewing a company's long-term performance can reveal insights into its business quality. Any business can have short-term success, but a top-tier one sustains growth for years. fuboTV's annualized revenue growth rate of 74.2% over the last five years was incredible for a consumer discretionary business.

Within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends. That's why we also follow short-term performance. fuboTV's recent history shows its momentum has slowed as its annualized revenue growth of 37.9% over the last two years is below its five-year trend.

This quarter, fuboTV reported remarkable year-on-year revenue growth of 24%, and its $402.3 million of revenue topped Wall Street estimates by 5.5%. Looking ahead, Wall Street expects sales to grow 11.9% over the next 12 months, a deceleration from this quarter.

Today’s young investors likely haven’t read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

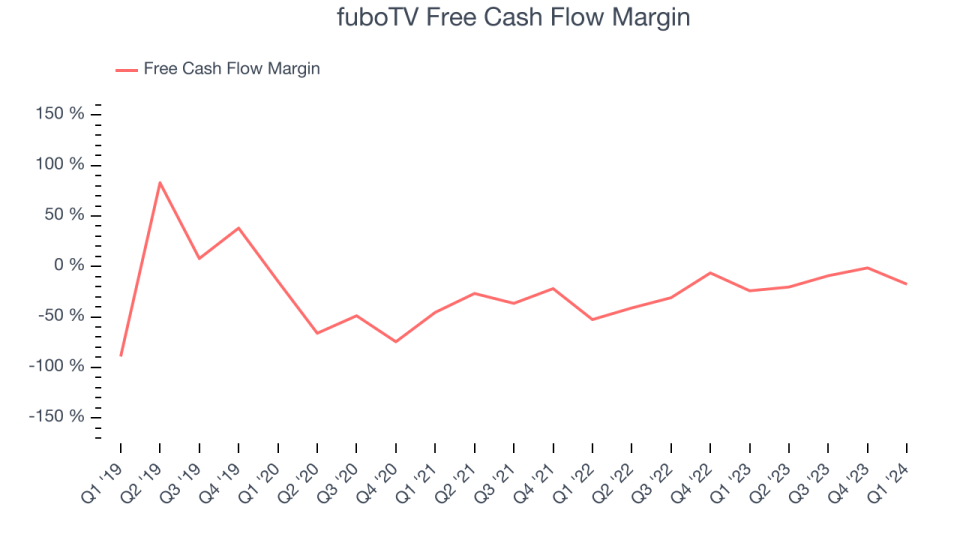

Cash Is King

If you've followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can't use accounting profits to pay the bills.

Over the last two years, fuboTV's demanding reinvestments to stay relevant with consumers have drained company resources. Its free cash flow margin has been among the worst in the consumer discretionary sector, averaging negative 16.9%.

fuboTV burned through $70.76 million of cash in Q1, equivalent to a negative 17.6% margin, increasing its cash burn by 9.6% year on year. Over the next year, analysts predict fuboTV will continue burning cash, albeit to a lesser extent. Their consensus estimates imply its LTM free cash flow margin of negative 11.8% will increase to negative 4.8%.

Key Takeaways from fuboTV's Q1 Results

We were impressed by how significantly fuboTV blew past analysts' revenue and EPS expectations this quarter. That was driven by outperformance in its domestic average revenue per user (ARPU) of $84.54 compared to estimates of $79.81. On the other hand, it was still unprofitable from an adjusted EBITDA perspective, though its loss did meet Wall Street's projections. Zooming out, we think this was a great quarter that shareholders will appreciate. The stock is up 5.2% after reporting and currently trades at $1.63 per share.

fuboTV may have had a good quarter, but does that mean you should invest right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.

Yahoo Finance

Yahoo Finance