Full-time workers to lose £151 this leap year

Brits on a full-time salary will “lose” out on £151 ($196) due to the upcoming leap year day 29 February.

This year’s leap year day may fly under the radar for a lot of people, but a study from personal finance comparison site Finder has found that that many Brits on a full-time salary will lose money because of it.

With salaries being paid on a monthly basis, an extra day in the month means full-time employees in Britain will work for one more day than usual, but without getting paid anything for it. The average Brit earns £129 for each working day in the year, so this is effectively what they will miss out on.

Read more: Tons of Travel Deals Are Being Offered for Leap Year

Those being paid £40,000 per year earn £169 a day so will be losing out on £192 this leap year.

And those who earn £80,000 per annum make £340 per day so will be losing out on £362.

On top of this, the average Brit spends around £22 per day on living expenses. This extra day of spending will actually impact bank balances, as it won’t be matched by any additional income coming in.

Read more: Should women propose promotion not marriage in leap year 2020?

To put this in perspective, things that could be purchased with this ‘lost money’ include one month’s utility bull, a luxury spa day for two, five months of broadband, a weekend city break in Krakow for two —including flights and hotel — or a used Playstation 4.

There isn’t much that full-time employees can do about the upcoming leap year day, but Charlie Barton, banking and investments specialist at Finder, gave some tips on how to limit the financial hit that a day of extra living costs will bring.

How so save money this 29 February

Get to grips with your spending — Apps like Yolt and Emma let you manage multiple accounts at once and give real-time spending updates so you can keep on top of what you are spending.

Start micro-saving every day — Apps like Money Dashboard and Moneybox help you create realistic savings targets, invest spare change and help you avoid being overcharged on bills. The popular challenger bank Monzo also has a “pots” feature that lets you open several pots at once and money held in them is kept away from your overall balance so it’s not accidentally spent.

Make your own coffee and or lunches — Research has found that you could save up to £1,840 a year not buying ready-made lunches and £303 by making your own coffee. With over £2,000 in savings that could be made it is worth considering ditching your regular luxury coffees and lunches.

Read more: Leap year proposals could add £50m to the UK economy in 2020

Making sure your savings are in the right place — If you are managing to save, ensure your savings aren’t sitting in a current account without an interest rate. Instead put your money to work and place it in a savings account with a good interest rate so it can grow.

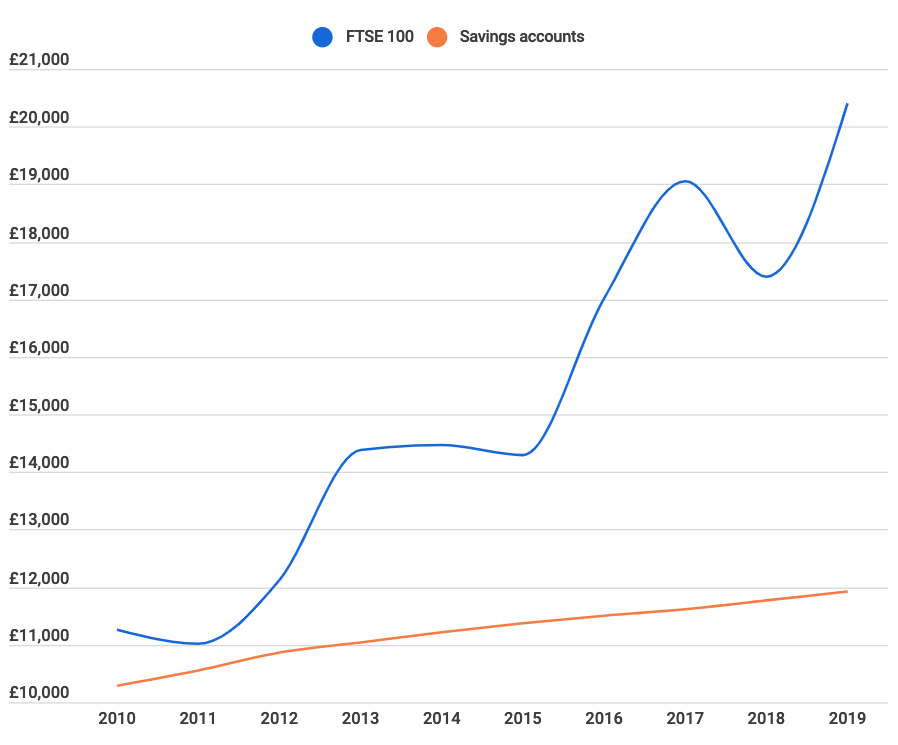

Consider a stocks and shares individuals savings account (ISA) — It may be worth considering putting some of your savings into a stocks and shares isa. On average, over the last 50 years they have returned 5.4% whereas savings accounts have returned 1.9%. However, it is always worth noting that this can result in losing money if the value of stocks falls, like with the current market wobbles over Coronavirus fears at the moment.

Yahoo Finance

Yahoo Finance