Fund With 24% Returns Bets on Long-Term Stock Rally for Malaysia

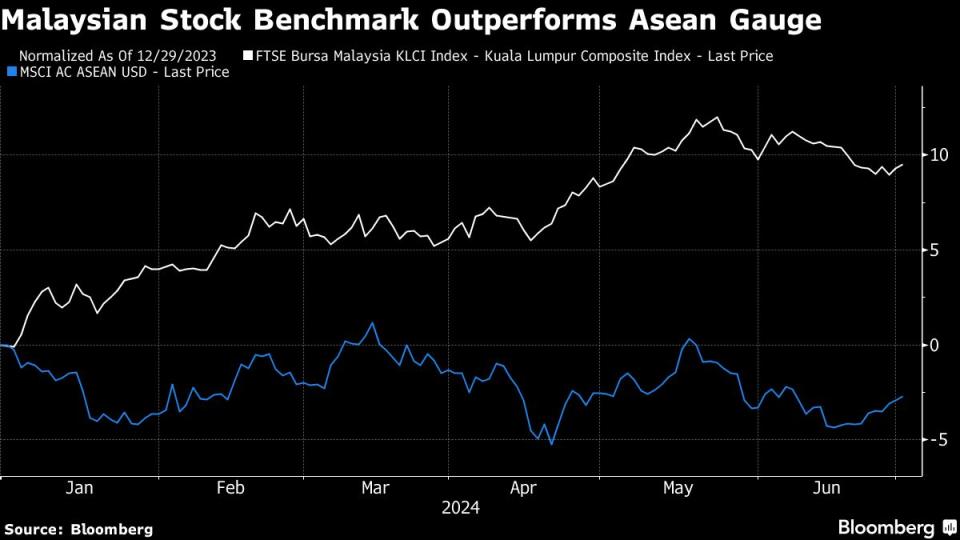

(Bloomberg) -- Malaysia’s government policies are positioning the nation’s stocks as a long-term winner in the region, with a nearly 10% rally likely to extend, according to one of Asia’s top-performing funds.

Most Read from Bloomberg

Democrats Weigh Mid-July Vote to Formally Tap Biden as Nominee

Trump Immunity Ruling Means Any Trial Before Election Unlikely

Beryl Becomes Earliest Ever Category 5 Hurricane in Atlantic

‘Upflation’ Is the Latest Retail Trend Driving Up Prices for US Consumers

Trump Isn't Going to Like the Supreme Court's Immunity Decision

“We are getting more confident on the policies that have been announced so far,” and are identifying potential beneficiaries of new measures that will be implemented, said Chun Hong Lee, a portfolio manager at Principal Asset Management Bhd. The benchmark KLCI Index may rise another 5% to 9% in the next 12 months, he added.

Sustained domestic investments and fiscal consolidation, coupled with the stabilization of the ringgit, will help narrow risk premiums and raise valuations for local shares, he said in an interview last week.

After three years of negative returns, Malaysia’s benchmark index is outperforming in Southeast Asia as the country becomes a focal point for investments in semiconductors and artificial intelligence-driven data centers. Its success in luring companies such as Google and Microsoft Corp. suggests Prime Minister Anwar Ibrahim’s policies are taking shape after he took power less than two years ago.

Anwar is boosting spending in the semiconductor industry and building manufacturing capabilities and renewable energy capacity, while foreign investments have gained. Growing investor confidence in his plans is a turnaround from last year when global funds retreated amid uncertainty over the government’s proposition to increase revenue and plug its fiscal deficit.

Interest in local stocks also coincide with authorities’ plea to domestic asset managers to repatriate their foreign income to support the market and the ringgit.

Lee’s bet on the country’s policy direction and AI boom is paying off. The 1.7 billion ringgit ($361 million) Principal Dali Equity Growth Fund, which he manages, beat the benchmark gauge with year-to-date returns of 24%. The fund investments are in accordance with Islamic principles and regulatory policies.

Power company Tenaga Nasional Bhd., tech firm My E.G. Services Bhd. and construction outfit Sunway Bhd. are among the fund’s top holdings as Lee favors utilities, builders and telecommunication companies.

Investments in data centers are expected to start contributing to the economy in six to 12 months, which bodes well for companies’ earnings outlook. There has been an upgrade in consensus earnings after disappointing results prior to 2024, said Lee, who is based in Kuala Lumpur.

Political stability is another factor that makes local shares a standout in the region as Thailand’s premier deals with legal cases, Vietnam undergoes a power transition and a rift between Philippines’ leaders widens.

To be sure, a delay or a less aggressive interest rate cut by the Federal Reserve may affect flows into Malaysian equities. Foreign investors are also closely watching the pace of local reforms before buying more shares.

“We think that things will move positively for equity market. We just need to watch the execution of government policy,” said Lee.

--With assistance from John Cheng.

Most Read from Bloomberg Businessweek

The Fried Chicken Sandwich Wars Are More Cutthroat Than Ever Before

Japan’s Tiny Kei-Trucks Have a Cult Following in the US, and Some States Are Pushing Back

RTO Mandates Are Killing the Euphoric Work-Life Balance Some Moms Found

The FBI’s Star Cooperator May Have Been Running New Scams All Along

©2024 Bloomberg L.P.

Yahoo Finance

Yahoo Finance