Can Gaming Bounce Back to Boost NVIDIA (NVDA) Q2 Earnings?

NVIDIA NVDA has been enduring a dull Gaming segment, which is expected to recover in the second quarter of fiscal 2020. Results of the same are scheduled to be reported on Aug 15.

Notably, the company despite having generated substantial revenues from its gaming business has been hit by a deteriorating trend in the segment over the last few quarters. Depletion of GPU channel inventory following soft demand from crypto miners has dampened its prospects.

However, normalization in channel inventory level and ramp-up of Turing products are anticipated to aid sequential growth in gaming revenues in the soon-to-be-reported quarter.

Click here to know how the company’s overall Q2 performance is likely to be.

NVIDIA Banks on Gaming Business

NVIDIA’s fortunes are tied to its gaming segment, which is its steadfast and largest revenue driver.

The chip giant’s results in the fiscal second quarter are expected to benefit from the growing sales of Turing-powered GPUs. To this end, the launch of mid-range GeForce products is a tailwind. The introduction of GeForce GTX 1660 Ti, 1660 and 1650 in the last reported quarter has driven Turing to generate rich PC gaming volumes for both desktops and laptops.

Notably, strong demand for gaming laptops is likely to be a key catalyst for the company. Moreover, higher volume of Tetra-powered Nintendo NTDOY Switch gaming consoles is projected to lend a big boost. Further, the rising momentum in games supporting the ray-tracing feature is a positive.

Also on the last earnings call, management sounded optimistic about the stabilization in Chinese gaming demand.

However, Intel’s INTC CPU shortage is likely to pose a persistent challenge to the sales of gaming GPUs for laptops in the soon-to-be-reported quarter. Lower revenues from desktop gaming are a key concern as well.

Moreover, increase in lower-margin Switch revenues is likely to be an overhang on the gross margins this earnings season.

Further, intensifying competition from Advanced Micro Devices AMD makes us anxious about the upcoming results.

The company expects Gaming revenues to normalize between the fiscal second and the third quarter. Therefore, it remains to be seen how much impact it can make on the upcoming quarterly results.

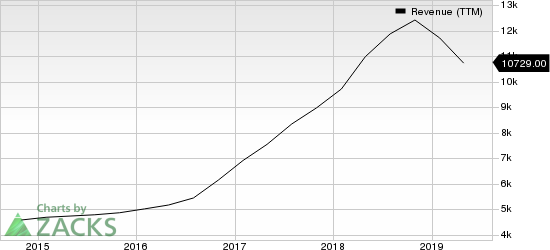

NVIDIA Corporation Revenue (TTM)

NVIDIA Corporation revenue-ttm | NVIDIA Corporation Quote

NVIDIA carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Advanced Micro Devices, Inc. (AMD) : Free Stock Analysis Report

Nintendo Co. (NTDOY) : Free Stock Analysis Report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Intel Corporation (INTC) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance