Gannett (GCI) Q3 Earnings Miss, Revenues Beat Estimates

Diversified media conglomerate, Gannett Co., Inc. GCI delivered lower-than-expected bottom-line third-quarter 2016 results. The company posted adjusted quarterly earnings of 6 cents a share that missed the Zacks Consensus Estimate of 17 cents, and plunged from 43 cents reported in the year-ago quarter. Higher operating expenses adversely impacted the bottom line.

On a GAAP basis, the company reported loss of 21 cents a share as against earnings of 33 cents in the prior-year quarter.

Gannett reported total revenue of $772.3 million in the quarter, up 10.1% from the prior-year quarter, and came ahead of the Zacks Consensus Estimate of $769 million. Excluding $14.3 million of unfavorable foreign currency translation and $7.4 million of selected exited operations, revenue surged 13.2% year over year.

The increase in revenue came on the back of the buyout of Journal Media Group, Inc., North Jersey Media Group and ReachLocal, and sustained improvement witnessed in national digital advertising revenue. This was partly offset by fall in print advertising demand and an adverse impact on classified employment revenues from an unfavorable affiliate agreement change with CareerBuilder.

However, excluding the impact on revenues from buyouts, foreign currency translations and selected exited operations, total revenue declined 8.6% from the year-ago period. Management hinted that national digital advertising revenue soared 18.5%, whereas digital-only subscriptions advanced 45%.

Advertising revenue increased 11.7% to $429.1 million, whereas circulation revenue jumped 7.7% to $285.6 million. Other operating revenue grew 11.2% to $57.7 million.

Adjusted EBITDA plunged 43% to $55.3 million, while adjusted EBITDA margin contracted 660 basis points to 7.2%.

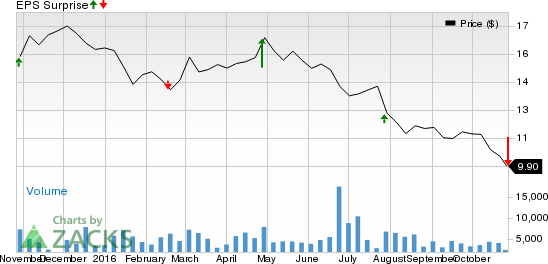

GANNETT CO INC Price and EPS Surprise

GANNETT CO INC Price and EPS Surprise | GANNETT CO INC Quote

Segment Details

Publishing segment revenue came in at $736.6 million, up 5% from the prior-year quarter. Excluding unfavorable foreign currency translation and selected exited operations, revenue advanced 8.2%. The increase in revenue was driven higher national digital advertising revenue and incremental revenue from Jersey Media Group and the North Jersey Media Group. This was partly offset by a 14.8% decline in print advertising revenue. Digital advertising revenue increased 6.2% to $98.8 million during the quarter.

ReachLocal segment revenue came in at $35 million, reflecting the partial period from the date of buyout, Aug 9, 2016, through the end of the quarter under review. Gannett expects that by the middle of 2017 it will be able to fully leverage ReachLocal across all its 109 local markets in the U.S.

Strategic Initiatives

Gannett is realigning its cost structure and streamlining its operations to increase efficiencies and safeguard its earnings and cash flows from dwindling print advertising revenue. Management has commenced incremental cost containing actions aggregating $30 million annually. It also remains focused on improving its digital business with an aim to lower dependency on soft print media business and traditional advertising. Other publishing companies such as New Media Investment Group Inc. NEWM, The New York Times Company NYT and The McClatchy Company MNI are also trying to adapt to different revenue generating ways.

In sync with this trend, Gannett invested an undisclosed amount in Digg, a digital media company. The company also intends to undertake strategic acquisitions in order to strengthen its position in the newspaper industry.

Gannett acquired Journal Media Group, the owner of the Milwaukee Journal Sentinel and other newspapers. The company recently completed the buyout of leading golf publication, Golfweek. In Jul 2016, Gannett completed the acquisition of North Jersey Media Group Inc., and in August, the company concluded the buyout of digital marketing solutions company ReachLocal, Inc.

Other Financial Aspects

In the quarter, Gannett paid dividends of $18.7 million. During the quarter, net cash flow from operating activities was about $24.1 million and incurred capital expenditures of $18.9 million, thereby generating free cash flow of approximately $5.2 million.

Outlook

Gannett expects revenue growth of 14–16% for the final quarter of 2016. Management anticipates adjusted EBITDA margins to increase significantly sequentially but to remain below the prior year level. Capital expenditures are expected in the band of $20–$25 million for the fourth quarter.

Gannett currently carries a Zacks Rank #4 (Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Confidential from Zacks

Beyond this Analyst Blog, would you like to see Zacks' best recommendations that are not available to the public? Our Executive VP, Steve Reitmeister, knows when key trades are about to be triggered and which of our experts has the hottest hand. Click to see them now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

NY TIMES A (NYT): Free Stock Analysis Report

GANNETT CO INC (GCI): Free Stock Analysis Report

NEW MEDIA INV (NEWM): Free Stock Analysis Report

MCCLATCHY CO-A (MNI): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance