Can Gap (GPS) Get Back on Track Via Strategic Growth Efforts?

Gap GPS is grappling with drab demand from inflationary pressure, which, in turn, resulted in reduced consumer spending. This led to dismal fourth-quarter fiscal 2022 results, wherein the top and bottom lines lagged the Zacks Consensus Estimate. Both metrics declined year over year.

For the fiscal fourth quarter, the adjusted loss of 75 cents compared unfavorably with a loss of 2 cents reported in fourth-quarter fiscal 2021. Net sales declined 6% year over year to $4,243 million. The metric decreased 19% from the pre-pandemic level. Comparable sales (comps) fell 5% on a year-over-year basis.

The adjusted gross margin of 35% contracted 480 basis points (bps) year over year due to a 430-bps decline in adjusted merchandise margins, stemming from huge discounts and inflationary headwinds. The adjusted operating loss was $6 million in the reported quarter, excluding impairment charges related to inventory, $35 million in costs related to the transition of Old Navy Mexico, and an $83-million gain on sale related to a UK distribution center.

Consequently, management expects first-quarter fiscal 2023 sales to decline in the mid-single-digit range, whereas the prior-year quarter’s reported figure was $3.5 billion. For fiscal 2023, net sales are anticipated to decrease in the low to mid-single-digit range, whereas our estimate is pegged at a 4.6% decline. This might be due to the continued uncertain consumer environment and higher promotions. Also, rising prices of essential commodities are likely to continue to hurt lower-income consumers' spending on non-essentials like apparel.

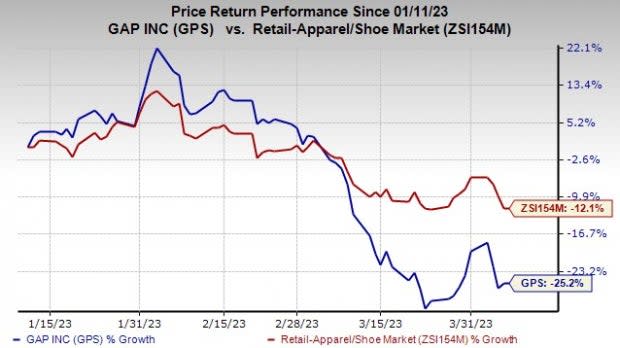

Image Source: Zacks Investment Research

We note that shares of GPS have lost 25.2% in the past three months compared with the industry’s 12.1% growth.

Brighter Side of the Story

However, the company has been banking on its Athleta brand, which has been serving as a key catalyst for long. The Athleta brand’s value-driven active and lifestyle categories, increased digital marketing investments, and focus on product strategy have been aiding sales. Although net sales fell 1% in fourth-quarter fiscal 2022 for the Athleta brand, the metric grew 51% from the pre-pandemic level.

Segmental results gained from continued share gains. Increased focus on performance active and active lifestyle products to capitalize on the evolving shopping trends bodes well. It has also emerged as one of the fastest-growing women's athleisure brands in North America. Driven by these factors, Athleta has been on track to reach $2 billion in net sales by fiscal 2023.

Gap is on track with its aggressive cost-management actions. The company has been making efforts to simplify and optimize its operating model and structure, including increasing spans of control and decreasing management layers to improve the quality and speed of decision-making, as well as creating a consistent organizational structure across all four brands.

These actions are expected to generate $300 million in annualized savings, of which half is expected to be realized in the latter half of fiscal 2023.

Apart from these efforts, the company is expected to realize $250 million in annualized savings, as announced in the third quarter of fiscal 2022. Over the last six months, it identified $550 million in annualized savings in total. Gap revealed plans to further optimize its marketing spend and rationalize its technology investments over the next few years.

The company’s Power Plan 2023, which focuses on opening highly-profitable Old Navy and Athleta stores, while closing the underperforming Gap and Banana Republic stores, bodes well. As part of the plan, it expects the Old Navy and Athleta brands to contribute 70% to sales by 2023. As part of its 350-store closure plan, the company expects to close 50-55 Gap and Banana Republic stores this year. With the closing of underperforming Gap and Banana Republic stores, the company expects to realize $100 million in EBITDA savings on an annualized basis by the end of 2023.

The company expects to leverage its powerful platform to deliver competitive omni capabilities to meet customers’ needs, all fueled by its scaled operations. It anticipates the e-commerce business to contribute 50% of sales by the end of 2023. Through the plan, the company expects to deliver consistent sales growth, margin expansion and strong operating cash flow.

Wrapping Up

Although inflation-led sluggish demand is a concern, Gap looks well-placed for further growth on the back of its Athleta brand, cost-saving efforts and Power Plan 2023. Topping it, a VGM Score of A and a long-term earnings growth rate of 12% raise optimism in this Zacks Rank #3 (Hold) stock.

Stocks to Consider

Here are some better-ranked stocks you may want to consider, Urban Outfitters URBN, DICK’S Sporting Goods DKS and Ulta Beauty ULTA.

Urban Outfitters, a leading lifestyle product and services company, currently carries a Zacks Rank #2 (Buy). Its expected EPS growth rate for three to five years is 18%.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Zacks Consensus Estimate for Urban Outfitters’ current fiscal-year revenues suggests growth of 5% from the year-ago reported figure.

DICK’S Sporting, which operates as a major omni-channel sporting goods retailer offering athletic shoes, apparel, accessories and a broad selection of outdoor and athletic equipment, carries a Zacks Rank #2 at present. Its expected EPS growth rate for three to five years is 5.4%.

The Zacks Consensus Estimate for DICK’S Sporting’s current fiscal-year revenues and EPS suggests growth of 2.2% and 10%, respectively, from the year-ago reported figures. DKS has a trailing four-quarter earnings surprise of 10%, on average.

Ulta Beauty operates specialty retail stores selling cosmetics, fragrances, haircare and skincare products, and related accessories and services. ULTA currently carries a Zacks Rank #2.

The Zacks Consensus Estimate for Ulta Beauty’s current financial-year EPS suggests an increase of 5% from the year-ago reported figure. ULTA has a trailing four-quarter earnings surprise of 26.2%, on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The Gap, Inc. (GPS) : Free Stock Analysis Report

Urban Outfitters, Inc. (URBN) : Free Stock Analysis Report

DICK'S Sporting Goods, Inc. (DKS) : Free Stock Analysis Report

Ulta Beauty Inc. (ULTA) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance