How Will Gartner's (IT) Top Line Shape Up in Q1 Earnings?

Gartner, Inc. IT will report first-quarter 2018 results on May 8 before the bell.

In the to-be-reported quarter, the company’s top line is expected to be driven by strength in the Research and the Events segments. The Zacks Consensus Estimate for revenues is pegged at $929 million, mirroring an increase of 48.6%.

In a year’s time, shares of the company have gained 8.5%, underperforming the industry’s rally of 24.2%.

Given this backdrop, let’s delve deeper to find out the factors likely to have a bearing on the company’s first-quarter revenues.

Research and Events Revenues Likely to Increase

The Zacks Consensus Estimate for the Research segment’s first-quarter revenues is pegged at $729 million, reflecting an improvement of 44.4% from the year-ago quarter’s actual figure. As far as Events revenues are concerned, the consensus estimate stands at $40.1 million indicating 13.8% year-over-year growth.

Notably, the projected improvement in revenues at these two segments is likely to be driven by strength in the heritage Gartner business.

In the fourth quarter of 2017, revenues at the Research segment increased 43%, with heritage Gartner Research revenues increasing 19%. Meanwhile, the Events segment’s revenues were up 22%, with heritage Gartner Events revenues increasing 7%.

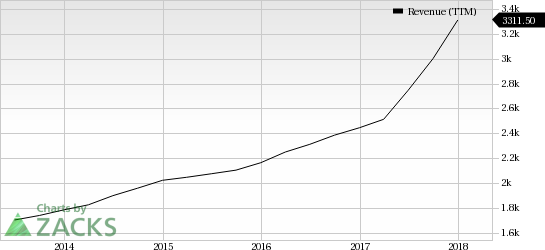

Gartner, Inc. Revenue (TTM)

Gartner, Inc. Revenue (TTM) | Gartner, Inc. Quote

Consulting Revenues Expected to Decline

The Zacks Consensus Estimate for first-quarter revenues at the Consulting segment is pegged at $84 million, reflecting a year-over-year decline of 1.2%. The downturn can be attributed to higher turnover at Managing Partners in certain regions and underperformance in the company’s Contract Optimization business. In the last reported quarter, this segment’s revenues were up 5%.

Zacks Rank & Stocks to Consider

Gartner currently has a Zacks Rank #4 (Sell).

Some better-ranked stocks in the broader Business Services sector are CRA International CRAI, FTI Consulting FCN and NV5 Global NVEE, each sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

In the trailing four quarters, CRA International, FTI Consulting and NV5 Global have delivered a positive earnings surprise of 41.7%, 31.9% and 10.3%, respectively.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Gartner, Inc. (IT) : Free Stock Analysis Report

CRA International,Inc. (CRAI) : Free Stock Analysis Report

FTI Consulting, Inc. (FCN) : Free Stock Analysis Report

NV5 Global, Inc. (NVEE) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance