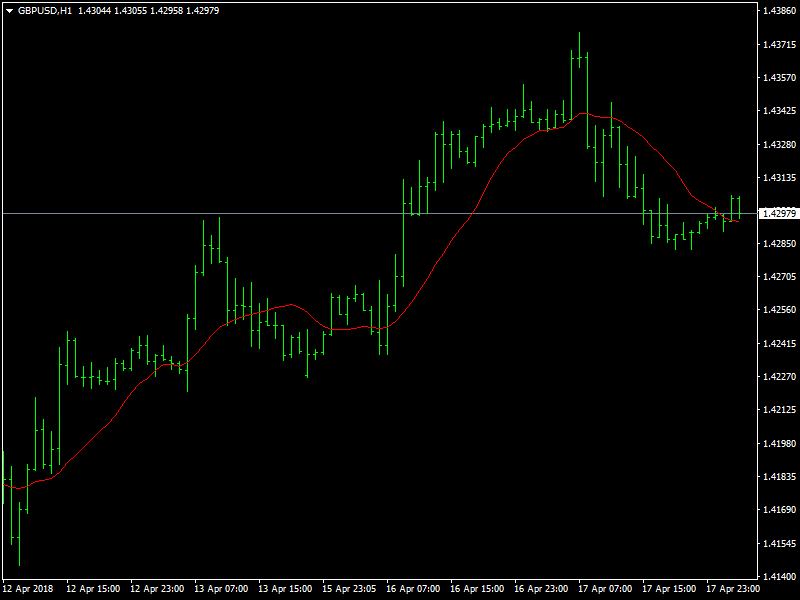

GBP/USD Corrects But on Target for 1.45

The GBPUD moved lower during the course of the day yesterday though there has not been any specific reason for this kind of price action. The dollar did strengthen a little during the course of the day but we have to attribute this correction in the pair more to the technicals rather than to anything fundamental as such.

GBPUSD Corrects

There was not much fundamentals around yesterday in the markets and with the pound having enjoyed some strong trend over the last few days and moving higher, it is only expected that there was some correction. This is also the highs of the range since the Brexit began and if the bulls manage to push through this region, then their next target is likely to be the 1.45 region in due course of time. They are seemingly in control at this point of time and they would hope to carry on with the good work that they have done so far.

On the other hand, it is important that the incoming data from the UK supports their push higher. So far, that has not happened as the data has been choppy at best and that is why we are seeing the slight struggle at the highs from the pound. We have some important data coming up and the traders would hope for the data to show some strength in the UK economy which would be useful and helpful for the BOE to make its rate hike decision and they would hope that they would be able to join the other major countries in the rate hike cycle.

Looking ahead to the rest of the day, we do not have any major data from the US but we have the CPI data from the UK which would be watched closely. If it does come out stronger, and it would be a surprise if it did, we should see the pair well on its way to 1.45.

This article was originally posted on FX Empire

Yahoo Finance

Yahoo Finance