GBP/USD Daily Forecast – Range Persists Below 20 DMA

The Brexit Clock is Ticking

British Prime Minister Boris Johnson put forth a new Brexit plan last week that Parliament can likely get behind. However, officials in Brussels didn’t seem too excited about the proposal and highlighted several concerns.

Johnson has vowed to deliver an EU exit by October 31 but time is running out for the British PM. He will need to secure a deal by the EU summit next week or request an extension. I think its quite likely that further efforts from Johnson will tend to dominate headlines moving forward, causing a rise in volatility for Sterling pairs.

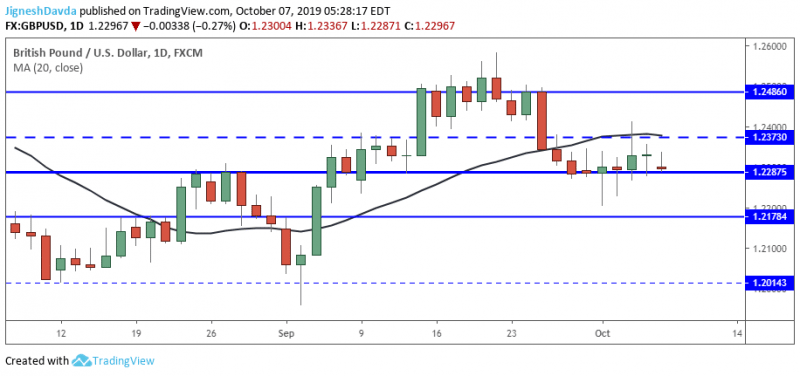

GBP/USD has been held higher, on a daily close basis, by a horizontal technical support level at 1.2287 since late September. At the same time, recovery rallies have struggled at resistance from the 20-day moving average to trigger a range.

A recovery attempt last week was hindered by the mentioned overhead resistance. The pair fell under further pressure after the US unemployment rate unexpectedly fell to 3.5%. However, losses were not sustained and the exchange rate is essentially directionless at this stage.

Technical Analysis

Support at 1.2287 is considered important as it offered major resistance in August to end a two-week recovery. Although the pair has fallen below the level on an intraday basis a few times, daily closes have held above it, indicating some strength.

At the same time, Overhead resistance at 1.2373 carries confluence with the 20-day moving average and has held the upside.

A break from either level will tend to clarify the near-term directional bias for GBP/USD. Considering the looming Brexit deadline, we are likely to see a technical break from the range fairly soon.

The dollar has not shown any concrete signs of reversing against its major counterparts. From that standpoint GBP/USD has a slight bearish bias. But how things play out with Brexit will tend to trump dollar fluctuations.

Bottom Line

GBP/USD continues to trade in a range.

With the Brexit deadline nearing, volatility is likely to increase.

Range support for the pair remains at 1.2287, resistance resides at 1.2373.

This article was originally posted on FX Empire

Yahoo Finance

Yahoo Finance