GBP/USD Daily Forecast – Sterling Falls Under Pressure as Brexit Uncertainty Weighs

Brexit Talks Remain at an Impasse

With the clock winding down, the UK does not appear to be any closer to reaching a Brexit deal, causing a bit of a sell-off in the British pound. While the Brexit deadline falls on October 31, It is largely expected that a deal should take place before that.

A law was recently passed that forces PM Boris Johnson to request an extension if a deal is not reached by the EU summit which takes place late next week. From that perspective, there is just over one week left.

There is still a lot of uncertainty surrounding Brexit and the looming October 31 deadline. The main hold up is the Irish backstop and after a lot of back and forth, the EU and UK can’t seem to agree on the issue.

Technical Analysis

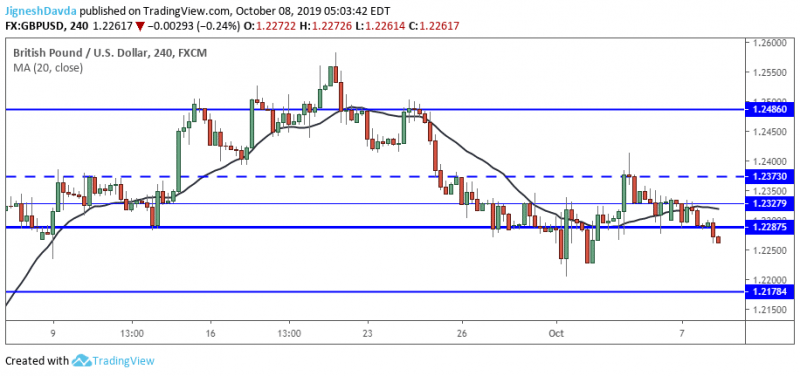

GBP/USD is under pressure in early trading, attempting to break an important support level. I think it is important to acknowledge that the dollar is weaker against all its counterparts in early trading except Sterling.

The exchange rate is trying to break below a horizontal level at 1.2287. This level has held it higher on a daily close basis for over a week.

More significant technical developments are taking place in the Sterling cross rates. GBP/AUD, GBP/NZD and GBP/CHF all trade at fresh lows not seen since early September, or in some cases even before that.

While the technical outlook certainly looks bearish for Sterling, volatility is likely to rise with the EU summit nearing. In this context, Sterling traders should exercise caution over the next week or so.

Overhead resistance in the session ahead resides at 1.2287. If we manage to get above 1.2327, it might suggest a reversal is taking place. While below 1.2287, the next area of downside interest falls at 1.2178.

Bottom Line

Sterling is under pressure against all the major currencies.

Volatility is likely to pick up with the EU summit just over a week away.

Major resistance for the session falls at 1.2287. A daily close below the level would signal a bearish technical break with a first target of 1.2178.

This article was originally posted on FX Empire

Yahoo Finance

Yahoo Finance