GBP/USD Daily Forecast – Sterling Holds Near Highs Awaiting Further Brexit News

Brexit Talks Resume in Brussels

EU’s chief negotiator Michael Barnier wanted a legal text of a potential deal delivered by Tuesday but after negotiating until 1:30 AM yesterday, an agreement could not be made. Talks resume today, taking it right down to the wire as negotiations are not meant to take place during the EU summit which starts tomorrow.

I suspect GBP/USD will extend gains if we get word later in the day that a legal text was finalized. However, UK Prime Minister Johnson still has his work cut out for him.

If he’s able to come to an agreement with EU negotiators today, the deal will still need to be approved by the member states at the EU summit which takes place on Thursday and Friday.

But more importantly, the UK parliament needs to vote on the deal. Since Johnson has lost his majority, it’s unclear if all his efforts will be fruitful since parliament could turn it down.

If a deal is not reached, Johnson will be required to request an extension under the recently passed Benn act. This could get tricky as the British PM has said several times that the UK will leave on October 31 no matter what. But when pressed for an answer, he has also said that he will abide by the law.

Technical Analysis

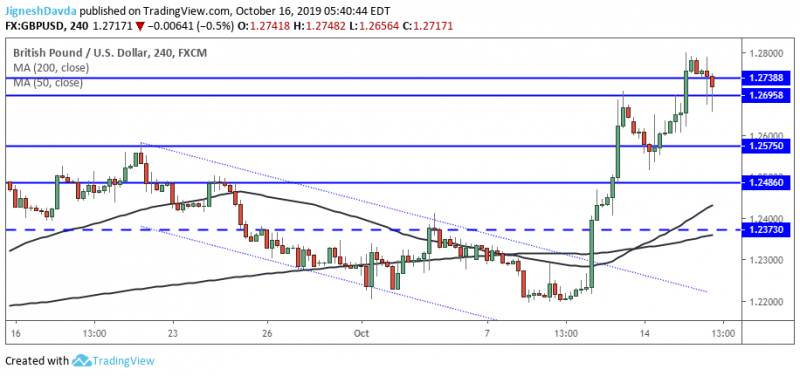

GBP/USD is up about 4% since Johnson announced last week that he found a pathway to a potential deal. Although technical indicators are in oversold territory at this point, I think the exchange rate can continue to move higher if there is further positive news.

The next level I have my eye on is 1.2924. This level was respected on a weekly chart after the referendum that took place over three years ago.

Price action is likely to be volatile and therefore I’m looking at support at 1.2575. Normally, that level would fall well out of the daily range for the pair. However, considering what is at stake, I’m not ruling out a dip towards it.

Bottom Line

An announcement might come that a deal has been agreed on with negotiators later today.

The legal text of these negotiations would then be put forth to a vote at the EU summit.

If approved at the EU summit, it will go to the UK parliament. In a rare move, parliament will convene on Saturday to decide on the next step.

This article was originally posted on FX Empire

Yahoo Finance

Yahoo Finance