GBP/USD Daily Forecast – Sterling Extends Recovery Above Major Resistance

The pound to dollar exchange rate is recovering higher this week after testing moving average support, boosted by a weaker dollar. GBP/USD was last seen nearing the 1.3000 handle after posting a low near 1.2870 in the early week.

GDP data from the UK released on Tuesday had little impact on the exchange rate as growth was flat in the fourth quarter which was largely expected. A recovery yesterday was held lower by a significant technical level at 1.2960 but the pair is seen scaling above it in early trading today.

A weaker dollar is aiding the pair in the current recovery. The US dollar index (DXY) has declined against five of its seven major counterparts in the week thus far. DXY turned lower yesterday, to end a six consecutive day rally, after trading at a fresh five-month high.

The session ahead might be a quiet one as the economic calendar is light. The main event to keep an eye on is Fed Chair Powell’s testimony to congress. The markets are not likely to react, similar to yesterday’s testimony, unless the Fed Chair alters his views from prior Fed communication.

Technical Analysis

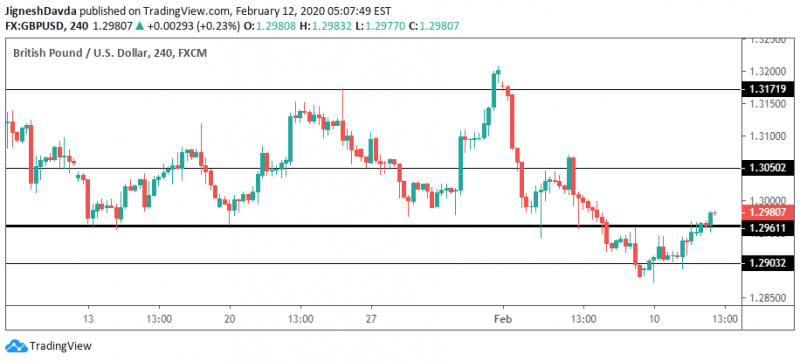

A major level has come into play at 1.2960. This level was responsible for holding the exchange rate lower for a majority of the fourth quarter, and then higher in the first month of the new year.

The technical level was respected on the initial approach yesterday, but bulls have managed to take the pair above it in early trading today. Where the pair closes today, in relation to the level, will be important for a directional bias in the week ahead.

There is not a lot of momentum in the current upswing, however, with the dollar showing signs of a pullback, the pair has the potential to extend further in the recovery.

Bottom Line

GBP/USD bears have failed to defend a major technical level at 1.2961 which hints at a further recovery.

The dollar index turned lower yesterday to end a prior six-day losing streak.

This article was originally posted on FX Empire

Yahoo Finance

Yahoo Finance