GBP/USD Daily Forecast – Sterling Struggles to Hold on to Yesterday’s Gain

Trade War and UK Politics Pulling GBP/USD in Different Directions

While the positive developments in the trade war between the US and China have resulted in a bullish dollar, GBP/USD has been underpinned in the early week as investors are hopeful a smooth Brexit will materialize in January.

Boosting optimism was an unexpected announcement from Brexit Party Leader Nigel Farage who said on Monday that he will not contest the 317 seats won by Theresa May. He will instead focus on unseating those standing in the way of a smooth EU exit.

The declaration is a major victory for Prime Minister Boris Johnson. It puts him one step closer to winning a majority at the election to be held on December 12.

Sterling shot up higher on the announcement, gaining roughly 1% against the dollar. But sellers have defended a technical resistance area and the pound to dollar exchange rate has given up over half of the gain.

Weighing on GBP/USD are the positive developments in the trade war between the US and China. Later today, a trade update is expected from US President Trump as he is scheduled to deliver a speech in New York. This could see GBP/USD further unwind its recent gain, depending of course on what Trump says.

Technical Analysis

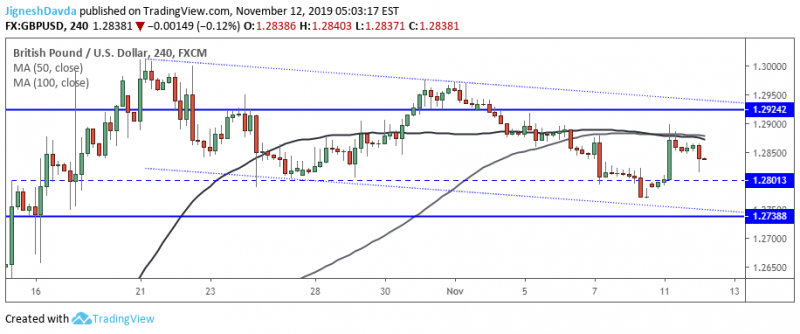

The rally in GBP/USD was capped by a confluence of the 50 and 100-period moving average on a 4-hour chart. The pair is seeing a bit of pressure in the early day, although I suspect the markets may take a breather until hearing what Trump has to say later in the day.

In yesterday’s forecast, I discussed how a rally toward 1.2880 might offer a good opportunity for bears. The pair is showing strong selling pressure from the area, however, yesterday’s upward momentum was quite strong. It resulted in a bullish reversal candlestick pattern on a daily chart and therefore today’s daily close will be important.

The pair is on pace to reverse a bulk of the recent gain which would invalidate the bullish pattern. I think it will ultimately depend on how Trump’s speech goes.

A key level to keep an eye out on today is the 1.2800 level. This is a level that held the pair up in late October. As well, the exchange rate traded close to it ahead of Farage’s announcement yesterday.

Bottom Line

GBP/USD is boosted by positive UK political developments, although it has given up a bulk of the recent gain.

US President will speak later today in New York. A trade update is expected and a volatile reaction is likely in the markets.

This article was originally posted on FX Empire

Yahoo Finance

Yahoo Finance