GBP/USD Daily Forecast – Sterling Regains Upward Momentum, Crosses Major Resistance

GBP/USD eased lower on Monday, hinting of a bearish continuation, but has seen fresh bids in early trading on Tuesday. The pair has crossed above a notable technical area and is trading near the psychological 1.3000 level.

British parliament returned from recess and the focus for GBP/USD traders will soon shift to Brexit once again. Parliament is expected to start formal negotiation talks with the EU on Monday which can trigger a rise in volatility for the Sterling pairs.

New fears arising from China’s inability to contain the Coronavirus shook investors on Monday. The S&P 500 posted the largest single-day decline in two years. The UK FTSE erased gains for the year and last traded at levels not seen since early October.

Expectations for a rate cut have risen on the back of the Coronavirus escalation. The CME FedWatch tool shows a one in three chance of a cut in June versus the roughly 50% chance priced in last week. The shift in expectations can trigger some further downside in the dollar which had otherwise risen steadily for most of February.

The economic calendar is relatively light, the Conference Board is expected to release consumer confidence figures later in the North American Session.

Technical Analysis

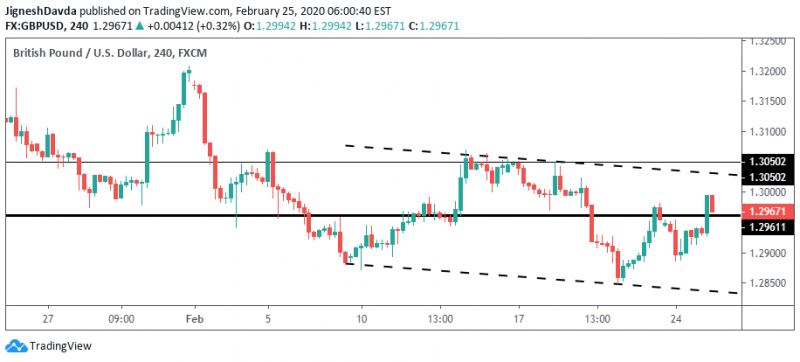

The British pound is leading the majors in early trading today and the upward move in GBP/USD is significant. The pair has crossed over a major technical level at 1.2961 which has acted as both resistance and support since the fourth quarter.

Further, the pair is currently trading above its 100-day moving average, which falls near the horizontal level. Although how the pair closes in relation to it at the end of the day will be important.

On a 4-hour chart, GBP/USD has posted a sequence of higher highs and higher lows, building towards the case for further near-term strength.

Channel resistance for the pair comes into play around 1.3030 with further resistance from a horizontal level at 1.3050.

To the downside, the reaction around 1.2961 will be important for short-term price swings. A break below yesterday’s low near 1.2900 will invalidate the near-term bullish view.

Bottom Line

GBP/USD is seeing renewed upside momentum although a daily close above the 100 DMA will be important for bulls.

Sterling volatility is expected to rise as formal negotiations with the EU begin on Monday.

This article was originally posted on FX Empire

Yahoo Finance

Yahoo Finance