GBP/USD Daily Fundamental Forecast – October 17, 2017

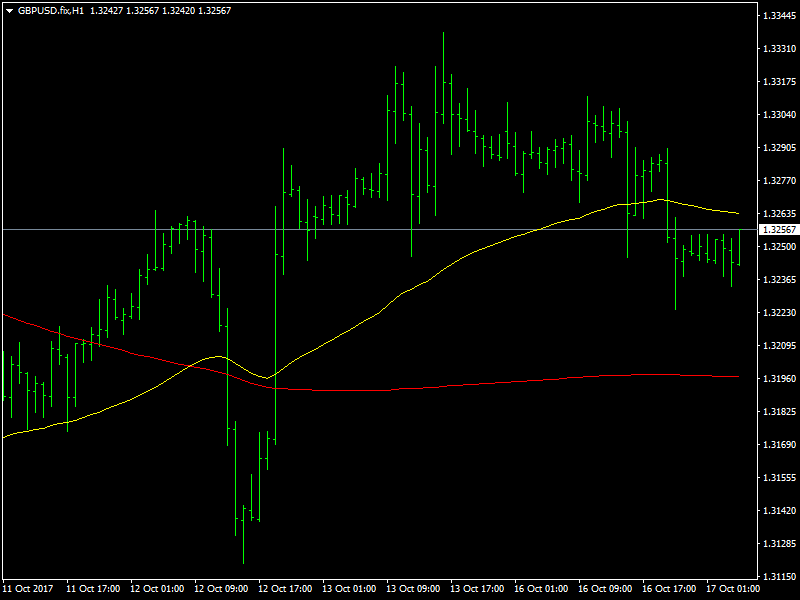

The GBPUSD pair had a brief look over the 1.3300 region during the course of trading yesterday but it has since weakened and moved lower mainly due to the fact that the dollar has picked up strength during this period. The pair did not seem to be much affected by the mixed data from the US on Friday but the events on Monday seem to have affected the pair quite a bit.

GBPUSD Choppy Ahead of Data

We had expected the move by the UK PM May to make her presence felt in the Brexit talks in Brussels to have a positive effect on the pound but so far, that has not yet happened. But of course, a lot of data is scheduled to be released from the UK during the course of the weak and that includes the retail sales data and tthe inflation data as well and maybe the market was positioning itself for that news yesterday and that is why we saw some choppy and weak trading yesterday.

The dollar seems to have shaken off its mixed data from Friday and has since moved higher against almost all the currencies. It got a shot in the arm yesterday when reports came in that John Taylor is being favored by Trump to replace Yellen as the Fed Chair. He is known to be a hawk and has favored rate hikes many times and if his appointment does go through, then that should be positive for the dollar. The market has already started pricing in this news and this was the reason for the dollar strength late in the day yesterday.

Looking ahead to the rest of the day, we have the CPI inflation data from the UK and we also have the BOE Governor Carney making a speech and both events are likely to bring in a lot of volatility in the GBPUSD pair. A break through 1.33 is likely to lead to a 200 pip rally and the same can be said for a break through 1.3200 as well as the consolidation continues.

This article was originally posted on FX Empire

More From FXEMPIRE:

DAX Index Price Forecast October 17, 2017, Technical Analysis

Natural Gas Price Forecast October 17, 2017, Technical Analysis

Major US Indices Forecast, October 17, 2017, Technical Analysis

Dow Jones 30 and NASDAQ 100 Index Price Forecast October 17, 2017, Technical Analysis

Price of Gold Fundamental Daily Forecast – Firmer U.S. Dollar Fuels Profit-Taking Sell-Off

Yahoo Finance

Yahoo Finance