GBP/USD Daily Fundamental Forecast – September 19, 2017

It was a day of slow markets but even on such a day, the pound continued to be the star as its volatility continued to rock the markets over the last 24 hours. The only piece of important news in the market yesterday was the speech from Carney where the market expected him to be hawkish and this helped to drive the GBPUSD pair during the first half of the day and then the speech later from him drove it down.

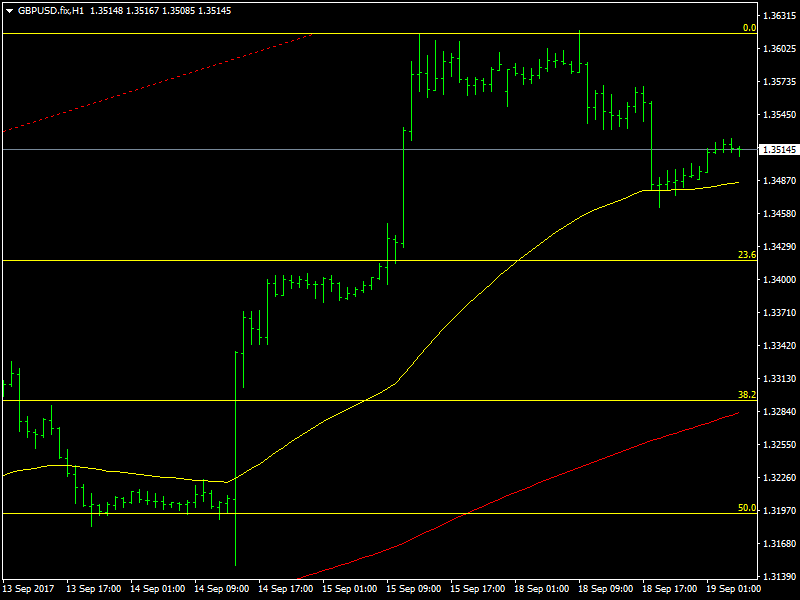

GBPUSD Remains Bullish

Though Carney did accept that some tightening would be required from the BOE to retain control of the economy, he did not give any specific timeline for the same and that seemed to disappoint the markets as the pound fell through after his speech and move below 1.35 later in the day. It has since bounced overnight and trades above 1.35 but we believe that this move down is just a correction of the larger uptrend and there is still some fuel left in the tank.

With the kind of incoming data and the developments in the UK economy, the BOE cannot stay in denial for long and hence we expect the BOE to begin to act in the coming months. The BOE has also promised some action despite the uncertainty continuing over the Brexit and a combination of these could lead to a rate hike in the coming months. The BOE and the markets would hope that the Brexit uncertainty would begin to clear up in a month or two which would then make the decision of the BOE easier.

Looking ahead to the rest of the day, we do not have any major news from the UK or the US for the rest of the day and hence expect some consolidation between 1.35 and 1.36 during the course of the day as the market prepares itself for the FOMC tomorrow. We expect the bullishness to continue in the GBPUSD pair in the short term with targets being 1.38 and 1.39.

This article was originally posted on FX Empire

Yahoo Finance

Yahoo Finance