GBP/USD Daily Fundamental Forecast – December 29, 2017

The pound has joined the euro in moving higher against the dollar as we witness a lot of selling in the dollar since the beginning of the week. As the markets are still in a holiday mode, we find that the selling has not assumed gigantic proportions as yet and in fact, we feel that there would not have been any dollar selling if the market had been at full liquidity.

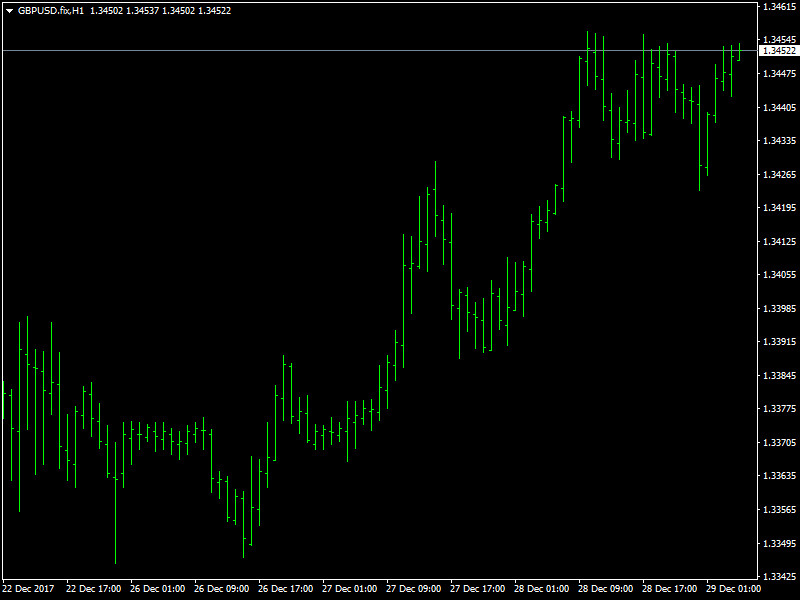

GBPUSD Moves Towards 1.3450

There are no fundamentals or economic events to support the fall of the dollar at this point of time and hence, these look more like trade flows rather than anything else. This is why it gives raise to doubts on whether these moves would stick when the market returns to full liquidity towards the second week of January. The pound has pushed through towards the 1.3450 region during this period and continues to trade in that region as of this writing and we would not be surprised if this move carries on for today and pushes against the 1.35 region as well.

The pound has been buoyed by the progress in the Brexit talks which seem to be moving ahead as planned but the weakness in the dollar is not something that could be explained very easily. We also believe that the pound is around the fair value that is expected from it, during this period, but with more rate hikes along the way from the Fed, during the course of 2018, we continue to favor dollar strength in the year ahead.

Looking ahead to the rest of the day, we do not have any major news from the UK or the US, which is quite expected as today is the final trading day of the year and there would be a lot of traders looking forward to another long weekend. We should see much more action and volatility in the coming weeks and so traders can afford to relax today.

This article was originally posted on FX Empire

Yahoo Finance

Yahoo Finance