GBP/USD Daily Fundamental Forecast – December 12, 2017

The pound was largely aimless during the course of the day. Though the GBPUSD pair ended lower for the day, not much can be read into the move lower as there was not much fundamentals around and the moves were largely driven by market positioning and the market forces as well. The real fundamental driven market should begin from today as there is a host of economic data and events later in the week.

GBPUSD Awaits Data

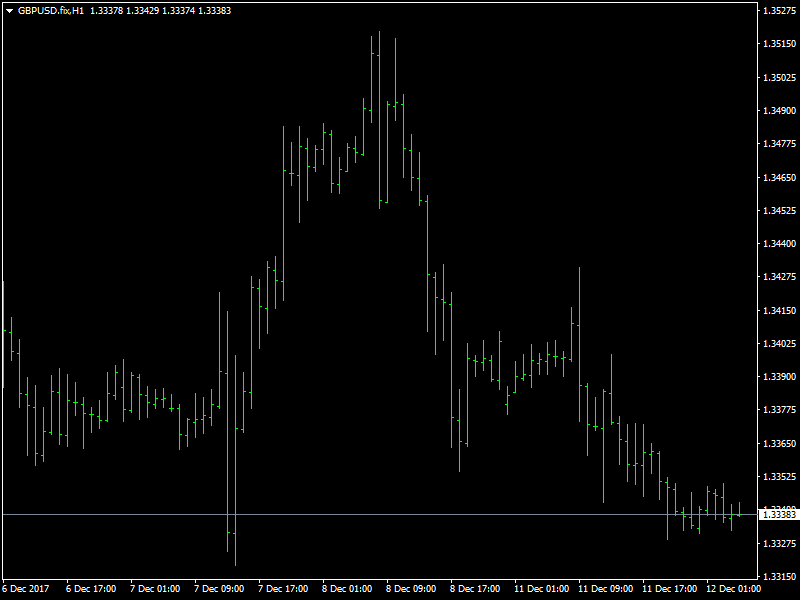

The pound tried to break through the 1.34 region and move higher over the last 24 hours but this move was largely met with a lot of selling which pushed the pair back lower and it trades below 1.3350 as of this writing. The dollar was generally steady during the course of the day yesterday and this added to the pressure on the pound. There was not much developments in the Brexit process and this led to a stalemate as far as the pound is concerned.

The volatility is expected to pick up later in the week, starting today, as the various central banks come out with their respective announcements. This includes the Fed which is expected to hike rates and this should be supportive of the dollar. The BOE is also expected to come out with its rate statement and though a rate hike is not expected, the market would be watching out for the tone of the statement so that it can gauge when the next rate hike is going to be.

Looking ahead to the rest of the day, we have the PPI data from the US and the inflation data in the form of CPI from the UK and both of these data are likely to bring in good volatility. We believe that the inflation data should be supportive of the pound which should help the pair to move up in the short term.

This article was originally posted on FX Empire

More From FXEMPIRE:

DAX Index Price Forecast December 12, 2017, Technical Analysis

Price of Gold Fundamental Daily Forecast – No Evidence that Liquidation Break is Over

Oil Price Fundamental Daily Forecast – Brent Could Spike to $67 to $70 a Barrel

Bitcoin Price Analysis December 12, 2017, Technical Analysis

Natural Gas Price Fundamental Daily Forecast – Consolidating Ahead of Updated Weather Forecast

Yahoo Finance

Yahoo Finance