GBP/USD Daily Price Forecast – GBP/USD Opens Nearly Flat as EU Leaders Reject Brexit Proposals

The GBP/USD pair kicks off the new trading week with a range bound momentum on Monday halting Friday’s bullish stance with the price action remaining range bound near Friday’s high, as European leadership in Brussels have flat-out rejected British Prime Minister Theresa May’s latest Brexit proposal, stating that the ‘third option’ proposal would rob the European Union of “decision-making autonomy”, by preventing the EU from retaining the right to withdraw access to European trade markets if the deal were to be accepted. The EU has rejected the UK’s latest proposal on how to govern the city of London’s access to European financial markets after Brexit, and PM May and her cohort within the UK parliament are once again back to the drawing board on how to negotiate a smooth Brexit, with hard-line Brexiteers on one side steadily gearing up to begin making moves to outright oust Theresa May, and staunch European leaders in Brussels unwilling to make sacrifices on their part so that the UK can cherry-pick EU laws to follow or abandon.

GBPUSD Likely to be Weak

After last week’s dismal showing for economic data from the UK, the Sterling heads into a trading week that is decidedly thin on the macro calendar, is expected to see fresh bearish action as Brexit once again returns to headlines, and the only slated event for Monday is a speech from the Bank of England’s (BoE) MPC Member Haldane due later in the day at 17:00 GMT. On similar note, US calendar has a light schedule for the day as well. The m/m June Existing Home Sales figures for the US are expected at 14:00 GMT, and expected to improve slightly to 5.47 million, slightly higher than the previous reading of 5.43 million.

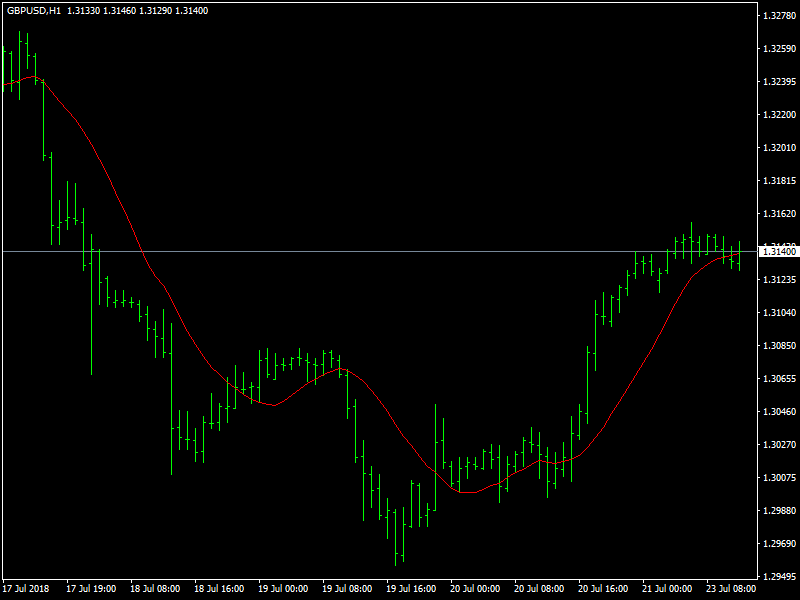

A steeply-bearish British Pound continues to be hampered by Brexit concerns, broad-market USD-selling is seeing the pair rise, as opposed to intrinsic strength from GBP bids, which remains non-existent. However the rise remained capped within a 20pip price range for majority of Asian market hours. The daily chart indicates that bears are still in control of the pair, as the latest recovery stalled below its 20 DMA, while technical indicators have managed to recover some ground, but remain in negative territory. In the 4 hours chart, the pair settled above a sharply bearish 20 SMA, still some 150 pips below the 200 EMA, while technical indicators stand well above their midlines, but lost their upward strength. Expected support and resistance for the pair are at 1.3100 / 1.3065 and 1.3195 / 1.3240 respectively.

This article was originally posted on FX Empire

More From FXEMPIRE:

Scalping, Swing and Long-Term Trading Strategies: A Complete Guide

GBP/USD Daily Price Forecast – GBP/USD Opens Nearly Flat as EU Leaders Reject Brexit Proposals

AUD/USD and NZD/USD Fundamental Daily Forecast – Counter-Trend Strength Not Likely to Last

Oil Rises as Trump Sends a Threat to Iran, US Dollar Trading Under Pressure

US Dollar Extends Losses on Trump’s Comments, Now Focus Shifts to ECB

Yahoo Finance

Yahoo Finance