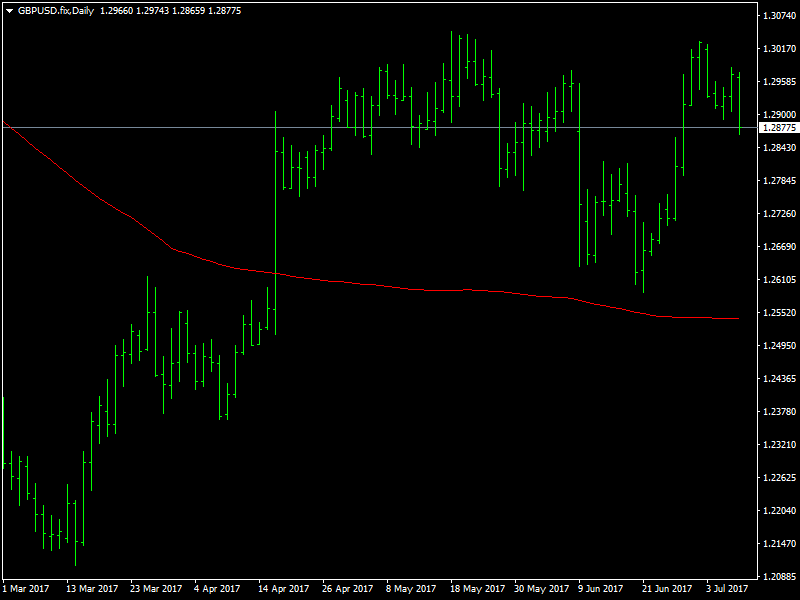

GBP/USD Fundamental Analysis – week of July 10, 2017

The GBPUSD pair had a relatively quiet week when compared to the other pairs on what turned out to be a very volatile week in the markets. This was quite expected as this was the first week of the month and usually, there is a slew of data from the various parts of the world and this tends to bring in a lot of volatility. The pound spent most of the week in a consolidation mode with not much of action.

GBPUSD Reacts Slow to Data

It was also a week where the focus was very much on the dollar with the FOMC minutes, the ADP and the NFP, all lined up for the week. Though there was a lot of PMI data from the UK, they did not bring in much of volatility as they were largely along expected lines. So, it was left to the dollar traders to bring in some action. The FOMC minutes didnt bring in much action as the Fed members stuck to the expected lines and they did not say or do anything that the market did not know already and they refused to give any hint of when the next rate hike would be.

The ADP data missed the expectations and this gave rise to doubts on whether the incoming data from the US in the future would also continue to miss expectations, as it has been doing over the past several weeks. This placed the dollar bulls on the backfoot and helped the GBPUSD pair to push through 1.29 and then through 1.2950 during the day and the pair briefly threatened to push through 1.30 and challenge the range highs again but that plan fell through.

The manufacturing production data from the UK missed expectations and this brought in some pressure on the pound which increased further as the NFP came in stronger than expected and boosted the dollar. This pushed the GBPUSD pair lower and the pair closed below 1.29 for the week and it looks quite week and unless there is a quick break higher, we should see the pair fall back into its familiar trading range.

Looking ahead to the coming week, we have a Yellen speech and retail sales and PPI data from the US and we have the average earnings index from the UK. We believe that the GBPUSD pair would consolidate with a bearish bias in the coming week as the market digests the US data and this could lead to a bullish bias for the dollar in the short term.

This article was originally posted on FX Empire

Yahoo Finance

Yahoo Finance