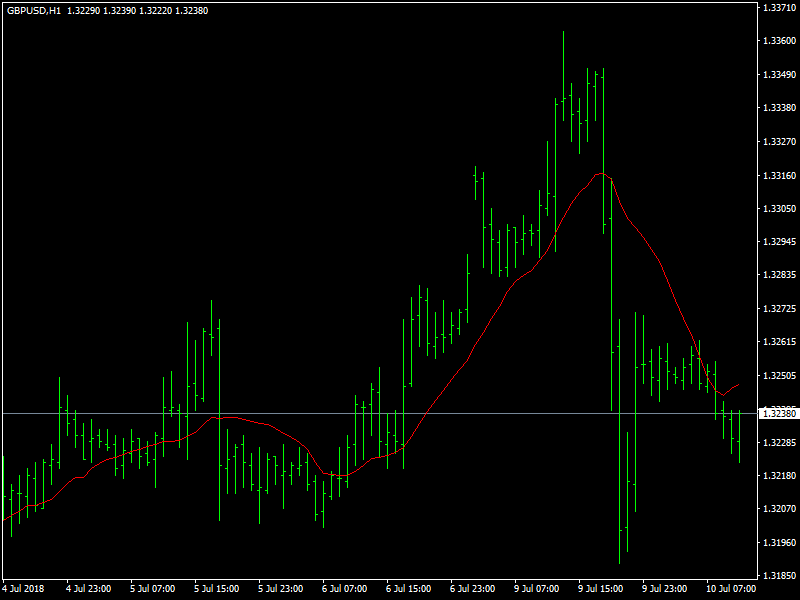

GBP/USD Price Forecast – British Pound Stagnates Over Brexit Woes

The British pound was frail on Tuesday after the departure of two key euro skeptic ministers raised worries about a “hard Brexit” while the dollar stood near three-week lows against its rivals after data showed soft U.S. wage growth. The pair stood at 1.3233 having fallen as low as 1.3189 on Monday, after Prime Minister Theresa May’s foreign minister and Brexit negotiator quit in protest at her plans to keep close trade ties with the European Union. The pair regained some ground after several Conservative lawmakers said May is likely safe from a leadership challenge despite the resignation of Boris Johnson and Brexit minister David Davis. Their departures shatter May’s own proclamation of cabinet unity last Friday, when she said she believed she had, after two years of wrangling, secured agreement on Britain’s biggest foreign and trading policy shift in almost half a century.

Pound Sluggish

While the expectations that the Bank of England might hike interest rates in the summer underpin the sterling, political uncertainties in UK are weighing on the currency. The dollar was not helped by Friday’s data showing U.S. wage growth remained tame despite tight labor market but the greenback some increase in Bid activity during late American market hours against major global currencies. The GBP/USD is trading down near 1.3240/30 price range ahead of Tuesday’s London market session. With Brexit concerns continuing to put a drag on the GBP’s chart action, Tuesday sees a raft of economic data, all dropping at 08:30 GMT.

Some of key macro data releases for the day in UK’s calendar include May’s (MOM basis) Industrial Production which is expected to come in at 0.5% (last -0.9%) and the Manufacturing Production (MOM basis) figure for May is also expected to improve to 0.7%. However the major focus of the day among investors of British Sterling is at May’s GDP (MOM basis) figure for the UK forecast to come in at 0.3%. This is the first time in UK’s market history to see GDP data on monthly basis and this data is expected to cause major fluctuations in price action as monthly GDP will not necessarily depict the true picture of a long term market impact like quarterly data. US Calendar for the day will see JOLTS Job Opening for May with no other major releases. Expected support and resistance for the pair are at 1.3217 / 1.3200 and 1.3262 / 1.3282 respectively.

This article was originally posted on FX Empire

More From FXEMPIRE:

USD/CAD Price Forecast – US Greenback Recovers Ground against Loonie over Increase in Dollar Bids

AUD/USD Reverse Bearish Divergence and M Pattern for a Counter Trend Setup

Price of Gold Fundamental Daily Forecast – Rally Stops Cold as Treasury Yields Surge

EUR/USD Price Forecast – EUR/USD Faces Pullback over Strong Resistance around 1.179 Handle

Yahoo Finance

Yahoo Finance