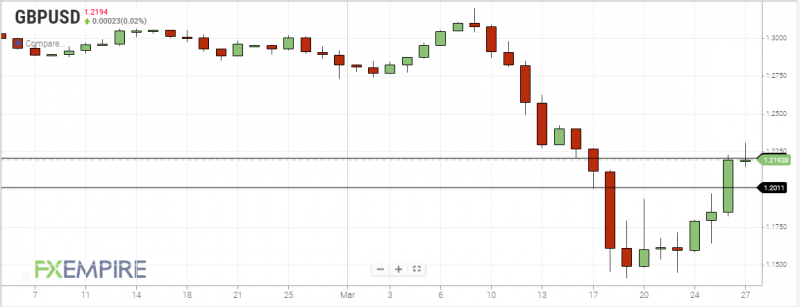

GBP/USD Rallies For Three Straight Sessions To Wipe Out Bulk of Last Week’s Loss

The British pound has erased most of last week’s losses and has crossed back above the 1.2000 level after finding a bottom earlier in the week just below the 1.1500 level.

The pair has been aided by a weaker dollar as the US dollar index is down over 3% in the week thus far, as measured from the early week high.

Jobless claims in the United States rose at a record high of 3.28 million people last week which is several multiples larger than prior peaks. The data is considered important as it is one of few economic reports that offers a real-time view in the economy.

Yet, the markets mostly shrugged off the bad news as Fed Chair Powell offered encouraging words. Powell, in a rare interview with CNBC, reaffirmed that the Fed will continue to act to support the economy and that the bank is “not going to run out of ammunition”. His words were enough to keep the equity markets supported despite the record high jobless claims.

The UK has stepped up its efforts once again in battling negative economic impacts of the Coronavirus. Chancellor Sunak announced a program yesterday to aid self-employed individuals and freelancer and provide them the same 80% wage compensation offered to other workers.

The program aims to help most people that fall into this category although is capped to those with an income of less than 50 thousand pounds per year. There were also several measures in place to prevent fraudulent misuse of the program.

The Bank of England met yesterday and voted unanimously to hold the interest rate unchanged after two recent emergency rate cuts that brought the interest rate down to 0.1%.

Technical Analysis

The British pound has made a strong come back, and if it holds near current levels into the end of the week, the pair will print a bullish reversal candlestick pattern on a weekly chart.

At the same time, the pair is faced with notable resistance near the 1.2200 handle. While GBP/USD is testing this resistance, the US dollar index (DXY) is testing support from a weekly level that previously served to hold the exchange rate down in September and February.

The dollar could reverse from here, which stands to once again put pressure on GBP/USD, although there have not been any signs of a reversal in the currency pair as of yet.

Bottom Line

GBP/USD is on pace to signal a bullish reversal on a weekly chart although is currently facing resistance.

The dollar is at a key inflection point and could reverse, inline with the earlier bullish trend.

This article was originally posted on FX Empire

More From FXEMPIRE:

AUD/USD Price Forecast – Australian Dollar Showing Signs of Exhaustion

Natural Gas Price Fundamental Daily Forecast – Gains Capped as Covid-19 Weighs on Supply, Demand

GBP/USD Rallies For Three Straight Sessions To Wipe Out Bulk of Last Week’s Loss

Price of Gold Fundamental Daily Forecast – Despite Early Weakness, Market Remains Well Supported

Yahoo Finance

Yahoo Finance