GBP/USD – Soft GDP Sends Pound Below 1.30

GBP/USD has recorded small losses in the Tuesday session. At the time of writing. the pair is trading at 1.2970, down 0.12% on the day.

GDP, Manufacturing Production Disappoint

The pound started the week with losses, falling below the key 1.3000 level. This was in response to dismal data out of the UK on Monday. The monthly GDP report for November pointed to contraction in the British economy, with a reading of -0.3%. This missed the estimate of 0.0% and points to an ongoing decline in economic activity – GDP has failed to post a gain since July. There was no relief from Manufacturing Production, which declined by 1.7% in November, well off the estimate of -0.3%. This marked the sharpest decline since April 2019 and highlights the weakness in the manufacturing sector.

Technical Analysis

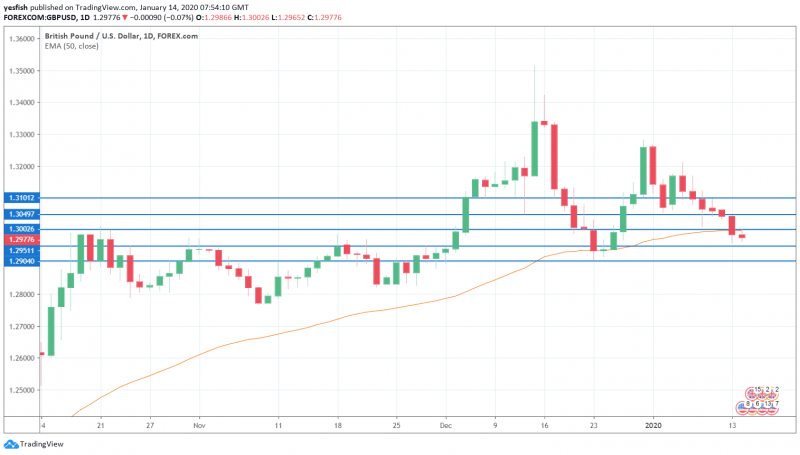

The pound is on a downtrend and broke below the 1.300 level on Monday. Below, there is immediate support at 1.2950, which could be tested on Tuesday. Next, we find support at 1.2902, just above the 1.29 level.

On the upside, the 50-EMA is at 1.2998, followed by the 1.3000, which has switched to resistance. It is a weak line. Above, there is resistance at 1.3050 and 1.3100.

Pacific Currencies – Daily Summary

USD/CNY

The Chinese yuan continues to flex its muscles. USD/CNY broke below 6.90 on Monday, for the first time since July 22. Currently, the pair is trading at 6.8841, down 0.12% on the day. The pair lost ground as China’s trade surplus improved to 329 billion yuan ($46.8 billion) in December, up sharply from 274 billion yuan ($38.7 billion) a month earlier. Later on Tuesday, China releases New Loans.

AUD/USD

AUD/USD has steadied on Tuesday, after falling 0.80% at the start of the week. The pair is currently trading at 0.6907, up 0.14% on the day. There are no Australian events on the schedule.

NZD/USD

NZD/USD is trading sideways on Tuesday. The pair is trading at 0.6629, down 0.01% on the day. in economic news, New Zealand Building Consents fell by 8.5% in November, its steepest decline since July.

This article was originally posted on FX Empire

Yahoo Finance

Yahoo Finance