GBP/USD – Strong Job Numbers Lift Pound

GBP/USD is trading sideways in Wednesday trade. Currently, the pair is trading at 1.3055, up 0.07% on the day.

Unemployment Claims Slide, Wages Steady

After a host of weak U.K. releases last year, positive employment reports on Tuesday were a breath of fresh air and gave the pound a slight boost. Wage growth remained steady at 3.2% in November, edging above the forecast of 3.1 percent. Unemployment rolls dropped sharply to 14.9 thousand in December, down from 28.8 thousand a month earlier. This marked the lowest level since January. There was no change in the unemployment rate, which remained pegged at 3.8 percent.

Technical Analysis

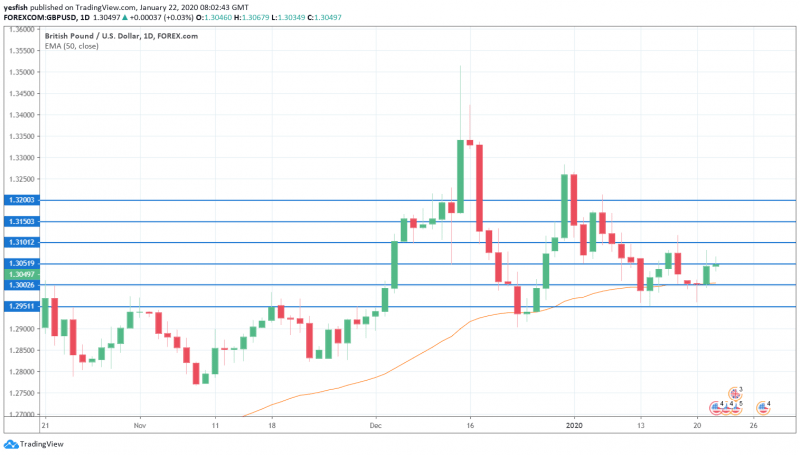

With GBP/USD posting gains on Tuesday, the key 1.300 line has some breathing room in support. The 50-EMA line is also situated at 1.3000. Below, 1.2950 is providing support. On the upside, the pair tested 1.3050 in the Asian session. Above, there is resistance at the round number of 1.3200.

Pacific Currencies – Daily Summary

USD/CNY

It’s been a busy week for USD/CNY. After hitting an 8-month low on Monday, the Chinese yuan reversed directions on Tuesday and recorded its highest one-day surge since August. Currently, the pair is trading at 6.9038, down 0.01% on the day. There are no Chinese events on the schedule.

AUD/USD – Aussie Dips to 5-Week Low

AUD/USD is on a downward trend, as the pair continues to put pressure on support at the 0.6800 line. The pair is currently trading at 0.6837, down 0.14% on the day. In economic news, consumer confidence continues to fall. Westpac Consumer Sentiment declined by 1.8% in January, its fourth decline in five months. We could see stronger movement in the Asian session on Thursday, with the release of Employment Change, which is expected to slow to 12.2 thousand in December, compared to 39.9 thousand in November.

NZD/USD

With no key New Zealand events until Thursday, it’s not surprising that NZD/USD has been drifting this week. The pair continues to test support at the round number of 0.6600. Currently, the pair is trading at 0.6589, down 0.09% on the day. On Thursday, New Zealand releases CPI for the fourth quarter, which is expected to slow to 0.4%, down from 0.7% in Q2.

This article was originally posted on FX Empire

Yahoo Finance

Yahoo Finance