GE Aerospace Takes Center Stage in T. Rowe Price Equity Income Fund's Q1 Portfolio Adjustments

Insight into the Fund's Latest Investment Moves and Stock Market Strategies

T. Rowe Price Equity Income Fund, known for its conservative and value-oriented investment philosophy, has revealed its N-PORT filing for the first quarter of 2024. The fund, managed by John Linehan since November 2015, primarily targets large-cap stocks with a history of paying dividends or those perceived as undervalued. The fund's strategy is to achieve a high level of dividend income coupled with long-term capital growth, maintaining at least 80% of its net assets in common stocks.

Summary of New Buys

T Rowe Price Equity Income Fund (Trades, Portfolio) expanded its portfolio with 3 new stocks:

Bristol-Myers Squibb Co (NYSE:BMY) was the most significant new addition, with 1,275,000 shares valued at $69.14 million, making up 0.38% of the portfolio.

Rexford Industrial Realty Inc (NYSE:REXR) was acquired with 880,000 shares, representing 0.25% of the portfolio and valued at $44.26 million.

Baker Hughes Co (NASDAQ:BKR) was added with 1,025,000 shares, accounting for 0.19% of the portfolio and valued at $34.34 million.

Key Position Increases

The fund also bolstered its holdings in 33 stocks, with notable increases in:

Citigroup Inc (NYSE:C) saw an addition of 1,160,000 shares, bringing the total to 3,030,000 shares. This represents a 62.03% increase in shares and a 0.41% portfolio impact, with a total value of $191.62 million.

Ameren Corp (NYSE:AEE) had 850,000 shares added, resulting in a total of 1,805,000 shares. This marks an 89.01% increase in shares, with a total value of $133.50 million.

Summary of Sold Out Positions

The fund exited its positions in 3 holdings during the first quarter of 2024:

Welltower Inc (NYSE:WELL) was completely sold off with 345,000 shares, impacting the portfolio by -0.18%.

Meta Platforms Inc (NASDAQ:META) was liquidated with all 75,000 shares, causing a -0.16% portfolio impact.

Key Position Reductions

In addition, T Rowe Price Equity Income Fund (Trades, Portfolio) reduced its stakes in 55 stocks. The most significant reductions include:

GE Aerospace (NYSE:GE) was cut by 615,000 shares, leading to a -19.68% decrease in shares and a -0.46% portfolio impact. The stock's average trading price was $117.76 during the quarter, with a 3-month return of 53.77% and a year-to-date return of 54.18%.

American International Group Inc (NYSE:AIG) was reduced by 765,000 shares, resulting in an -11.98% share count reduction and a -0.31% portfolio impact. The stock's average trading price for the quarter was $71.37, with a 3-month return of 10.43% and a year-to-date return of 9.57%.

Portfolio Overview

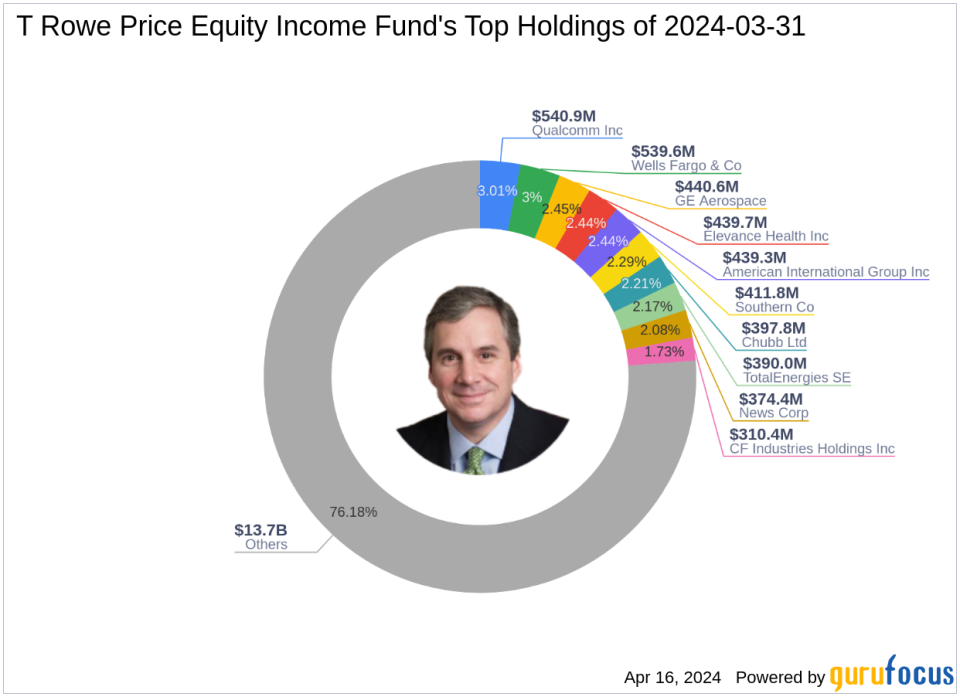

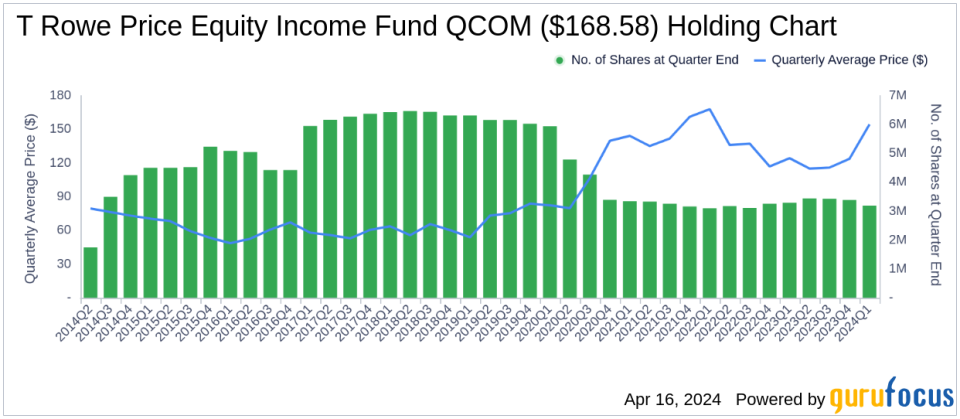

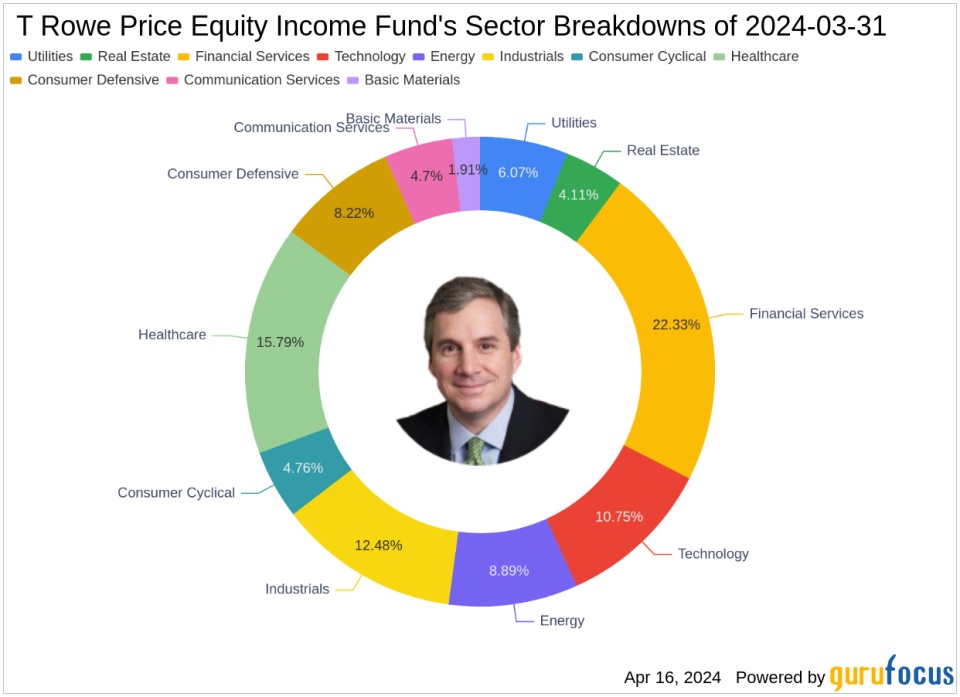

As of the first quarter of 2024, T Rowe Price Equity Income Fund (Trades, Portfolio)'s portfolio comprised 116 stocks. The top holdings included 3.01% in Qualcomm Inc (NASDAQ:QCOM), 3% in Wells Fargo & Co (NYSE:WFC), 2.45% in GE Aerospace (NYSE:GE), 2.44% in American International Group Inc (NYSE:AIG), and 2.44% in Elevance Health Inc (NYSE:ELV). The fund's investments are mainly concentrated across 11 industries, including Financial Services, Healthcare, Industrials, Technology, Energy, Consumer Defensive, Utilities, Consumer Cyclical, Communication Services, Real Estate, and Basic Materials.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance