GE HealthCare's (GEHC) New Tie-Up to Boost Patient Care in Mexico

GE HealthCare Technologies Inc. GEHC recently inked an agreement with Salud Digna. The agreement aims to deploy digital solutions to improve the efficiency of care protocols for clinicians on Computed tomography (CT), Magnetic resonance (MR) and ultrasound systems across Mexico.

The deployment of these digital solutions is an extension of a previous agreement that was signed earlier this year to supply more than 400 GE HealthCare imaging and ultrasound solutions across Salud Digna’s facilities.

The agreement between GE HealthCare and Salud Digna also includes the deployment of a digital dose management solution to track and manage radiation and contrast exposure within the patient workflow.

The latest partnership is expected to strengthen GE HealthCare’s foothold in the global digital solutions space.

Rationale Behind the Collaboration

Per GE HealthCare, the solutions and technologies are aimed at helping improve care for the 20 million patients Salud Digna treats every year. The protocol standardization solution that will be deployed at Salud Digna will likely allow the health system to track and update protocols on CT and MR equipment across facilities automatically through the cloud. This, in turn, is expected to reduce variability in dose and exam quality, thereby aiding in delivering consistent image quality and optimal patient care.

The agreement regarding the digital dose management solution aims to aid clinicians in using appropriate radiation levels and delivering better-informed, patient-centered and effective care.

Per GE HealthCare’s management, its digital solutions, tracking and updates can be done centrally and automatically applied to all devices irrespective of location. This will likely enhance the company’s ability to drive productivity and standardization.

Salud Digna’s management believes that the protocol automatization and dose management solutions will aid it in maximizing their use and help ensure consistent image quality and accurate diagnosis for each patient.

Industry Prospects

Per a report by Fortune Business Insights, the global radiation dose management market size is anticipated to grow from $662.9 million in 2023 to $1,678.5 million by 2030 at a CAGR of 14.2%. Factors like the increasing demand for early detection of severe conditions, the growing prevalence of chronic diseases and the rising demand for medical imaging procedures are likely to drive the market.

Given the market potential, the latest collaboration is expected to provide a significant boost to GE HealthCare’s business globally.

Notable Tie-Ups

In May, GE HealthCare expanded its long-term partnership with Tampa General Hospital (TGH) by announcing an agreement to deploy GE HealthCare’s Imaging and Ultrasound technology solutions to benefit clinicians and patients in TGH Imaging’s outpatient facilities across the state of Florida.

The same month, GE HealthCare announced a collaboration with Medis Medical Imaging to advance precision care in the diagnosis and treatment of coronary artery disease.

Price Performance

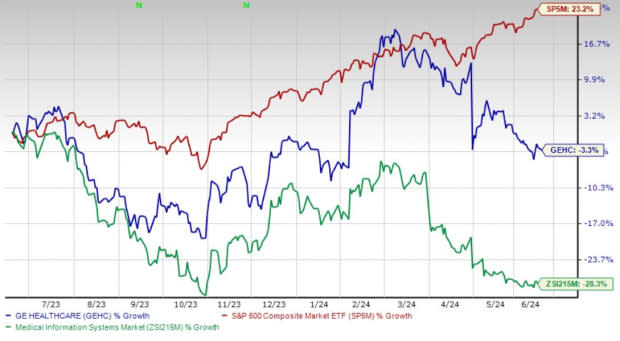

Shares of GE HealthCare have lost 3.3% in the past year compared with the industry’s 28.3% decline. The S&P 500 has witnessed 23.2% growth in the said time frame.

Image Source: Zacks Investment Research

Zacks Rank & Key Picks

Currently, GE HealthCare carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the broader medical space are DaVita Inc. DVA, Boston Scientific Corporation BSX and Ecolab Inc. ECL.

DaVita, carrying a Zacks Rank #2 (Buy) at present, has an estimated long-term growth rate of 13.6%. DVA’s earnings surpassed estimates in each of the trailing four quarters, with the average surprise being 29.4%. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

DaVita’s shares have gained 43.4% compared with the industry’s 15.2% rise in the past year.

Boston Scientific, carrying a Zacks Rank of 2 at present, has an estimated long-term growth rate of 12.5%. BSX’s earnings surpassed estimates in each of the trailing four quarters, with the average being 7.5%.

Boston Scientific has gained 40.4% against the industry’s 1.8% decline in the past year.

Ecolab, carrying a Zacks Rank of 2 at present, has an estimated long-term growth rate of 14.3%. ECL’s earnings surpassed estimates in each of the trailing four quarters, with the average surprise being 1.3%.

Ecolab’s shares have rallied 31.3% against the industry’s 12.9% decline in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Boston Scientific Corporation (BSX) : Free Stock Analysis Report

Ecolab Inc. (ECL) : Free Stock Analysis Report

DaVita Inc. (DVA) : Free Stock Analysis Report

GE HealthCare Technologies Inc. (GEHC) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance