This Gen Z'er Makes $120K A Year And Still Feels "Stuck" — Here's What His Life Looks Like Right Now

As a Gen Z'er, I sometimes find it hard not to compare myself to others my age. Seeing some of my peers buying homes (how?!), traveling the world, and getting married sometimes makes me feel like I'm "not where I'm supposed to be." I think it's common to feel like you're supposed to have everything figured out by a certain age — but that's not realistic for everybody.

So, to showcase that there's no real timeline to follow in life, I sought out Gen Z'ers from the BuzzFeed Community who were willing to share their lives with me — and the internet — by highlighting parts of their day-to-day existence.

Welcome back to Gen Z Journals.

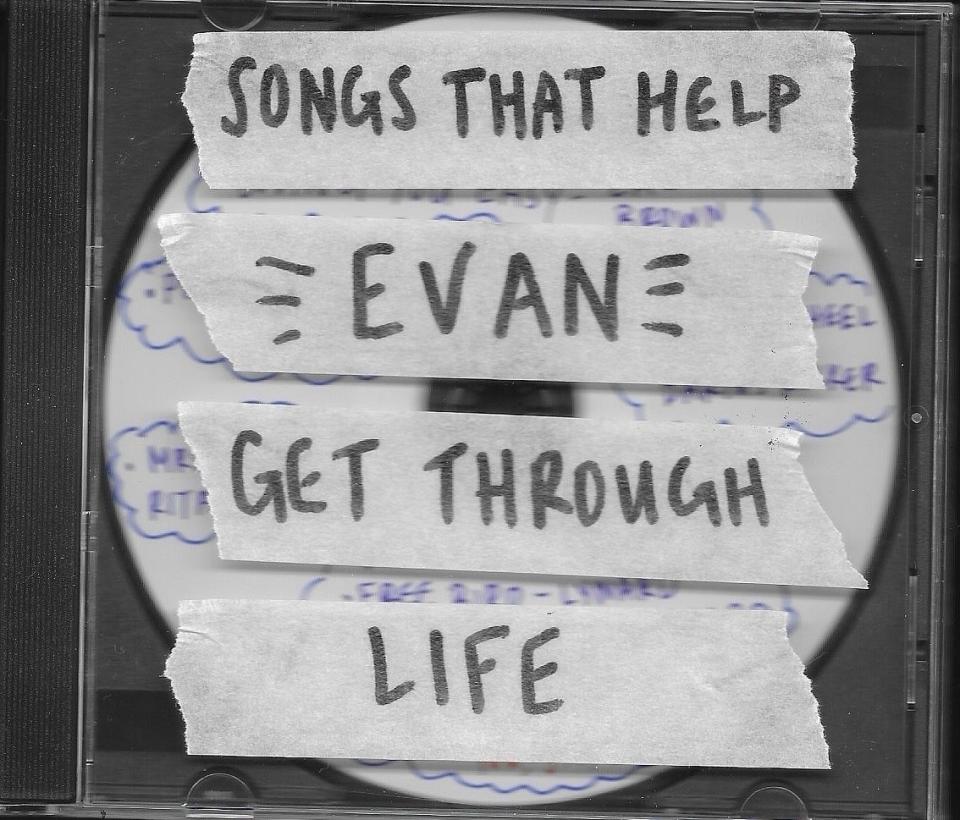

This week: Meet Evan (he/him), a 26-year-old from New York City. The remainder of this post will be from his POV.

Note: To remain anonymous, "Evan" is a pseudonym.

I am the lead analyst for a start-up hedge fund on Wall Street. "Analyst" is a pretty catch-all term, but generally is associated with entry-level roles. Being the lead analyst means I am the "go-to" and in charge of coordinating the other analysts' work. As for actual work, it is a mix of assisting traders, undertaking research, and a little bit of anything else you can think of — all while being trained to eventually take on a higher position, like a researcher or trader.

My work-related earnings come in three parts. The first is a flat salary of $120k yearly (I just received a raise from $90k to $120k last month). The second is a cash performance-based bonus of $25k; however, I've yet to receive this bonus as the company is still in "fundraising mode." The final is a "stock option," better described as a revenue share of the investment fund. I have been in my position for three years and would not consider myself looking to switch companies unless a truly good offer came my way.

Post-tax, my new monthly income is about $6,760. I consider myself fortunate enough to budget on a monthly basis, so that's how most of my costs present themselves.

Monthly expenses:

• Rent: $3049 (I live alone in a small NYC studio apartment right now)

• Electricity: around $70, but this varies based on the season (AC = expensive)

• Internet: $60

• Student loans: $500

• Phone: $50

• Car + apartment insurance: $63 (I don’t actually have a car, but it's so I don’t lose future coverage)

• Groceries: around $250 after splitting with my lovely girlfriend

• Gym: $87

• Laundry: $40

• Subway: $30–50 to get to work and around the city

• Spotify: $11

All in all, I just about breakeven at the moment. I pay my rent and student loans, and the rest I put on my credit card, which I always pay off fully. The credit card bill comes out to around $2,100 a month. Any leftovers get invested in the roth IRA or a non-retirement account. I keep a small cash fund in my bank account, which is about $2-3k in case of emergencies.

Nonessential monthly expenses (ideal budget I try to stick to):

• Social life/date night/eating out: $500

• Roth IRA contribution: $583 (this gets me to the 7k contribution limit)

• Non-roth investing accounts: $833 (this equals about $10k/year)

• Miscellaneous (clothes, medical, etc.): $417

I try to put any leftovers into my savings account.

As for how I feel about my financial situation, I feel really weirdly stuck. I know readers and commenters will have their opinions on me saying this, as I understand I definitely have a lot of privilege and make more than the average person, but living in New York City is a big thing psychologically. I think many older people really don't understand the combined cost of housing, college, and general inflation and how much that harms Gen Z'ers — no matter their income. Where I live, the average rent in Manhattan for a one-bedroom is about $4-4.5k. Most studios still go for over $3k, and some don't have actual kitchens in them. When shelter costs eat up over half of your paycheck, getting them month-to-month feels really tough. Throw in the cost of student loans, and that can be most of your paycheck out the window before you even buy food or pay for electricity. Inflation since COVID has been the real killer; basic food staples leaped in price.

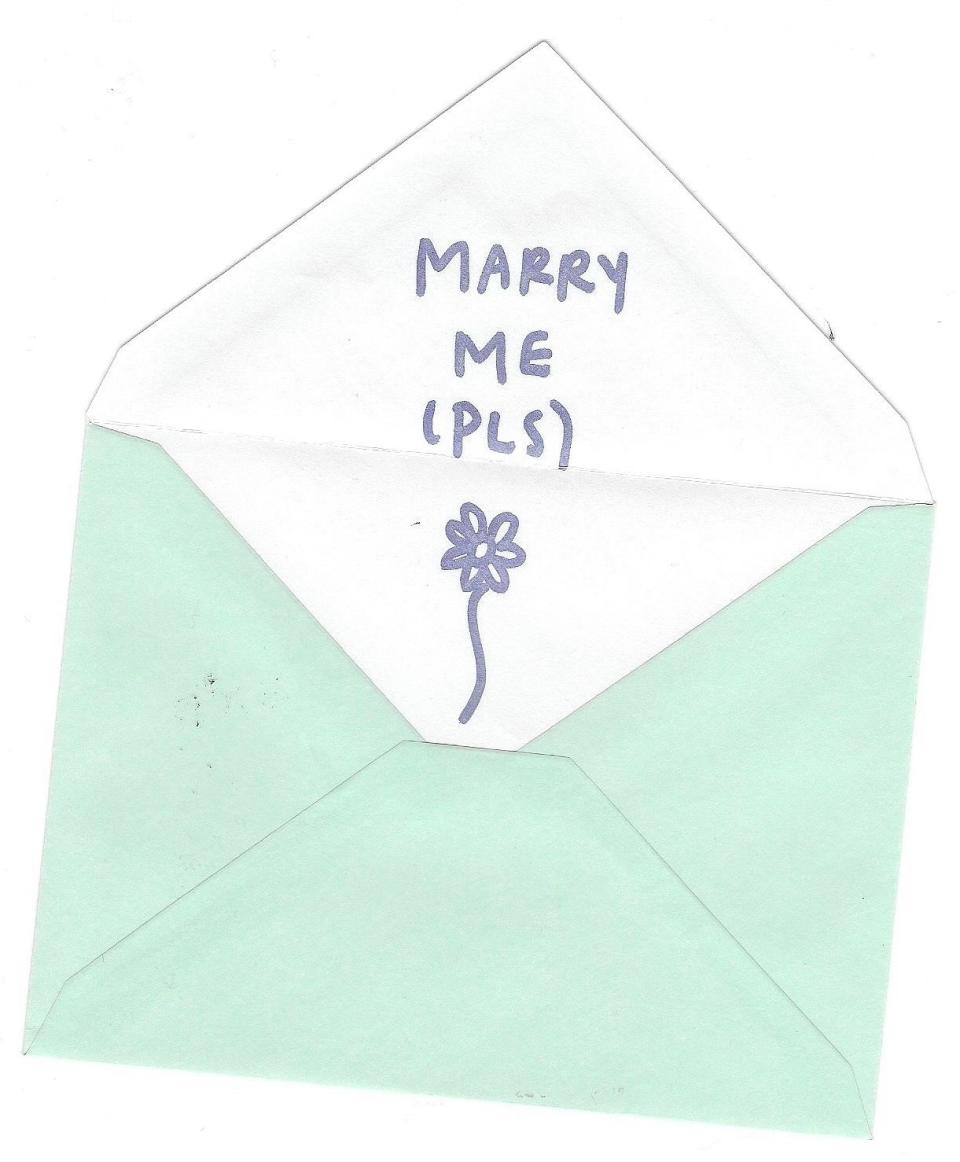

Right now, I'm in the middle of moving in with my girlfriend. Our relationship is ready for that kind of step, and my lease is ending, so it's only natural. The extra foil is that her parents own her apartment outright (no mortgage), so my housing costs will drop from over $3k per month to about $800 in building maintenance fees (for those who don't know, most co-ops in NYC have a monthly maintenance fee, so even if you own the apartment without a mortgage, you pay a cost to the building as well). The $800 would be my half of the costs while she pays her own half. Renting this apartment in its area would cost roughly $8–10k per month. Naturally, this will drastically increase my income post-monthly expenses, finally taking me from "negative to barely breaking even" to actually making money. I want to and will marry my girlfriend — that is an absolute. I understand the break I have lucked into.

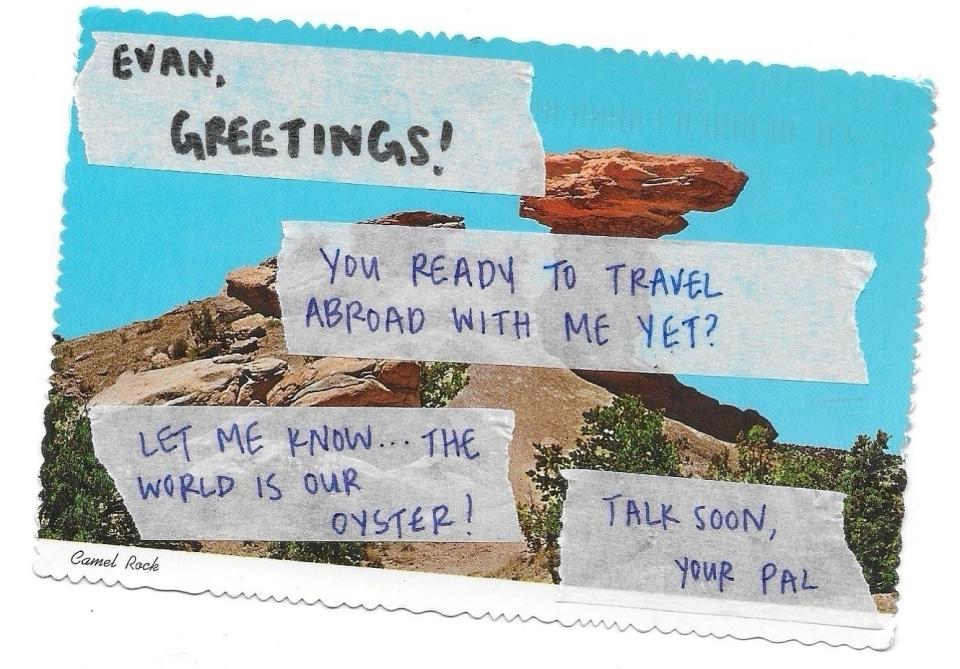

Getting off of general economic matters, I think a lot of my "feeling stuck" is trying to navigate what to do with my newfound "free cash." My soul tells me to use it to travel and create new memories with the person I love, especially while I still have the youthfulness and health to do so. My brain says to invest it — that money can grow, and then hopefully, things work out well, and I won't need to struggle later in life. But then my heart and people in the outside world want me to put it all toward marriage so I can get that wrapped up on a timeline that fits the vision of the older generation. Being stuck in the quicksand of finding the right balance can be frustrating because there's only one chance to get it right.

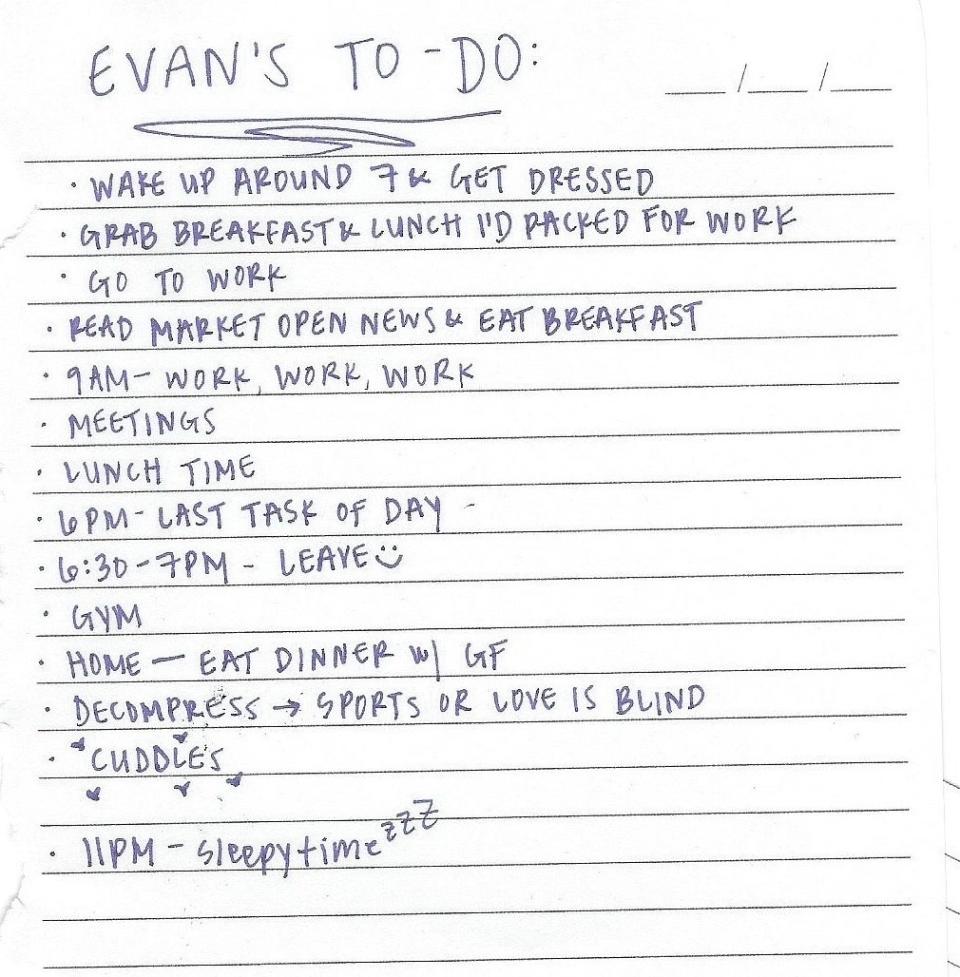

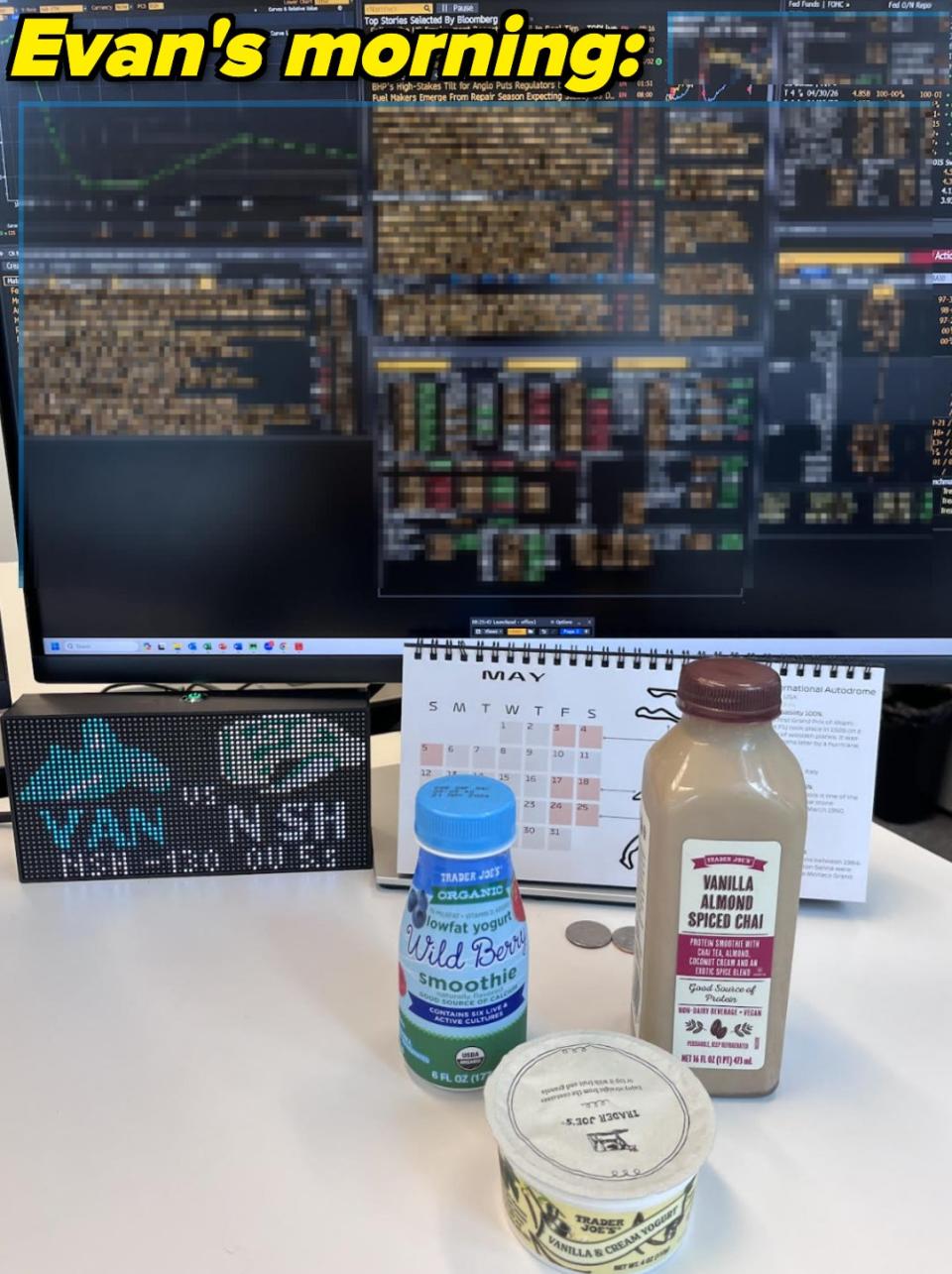

• I wake up around 7 a.m., then get dressed and ready for work.

• I grab the breakfast and lunch I prepped the previous night.

• Walk/take the subway to work, depending on the weather. (It's about a 15-minute walk.)

• I eat my breakfast and read the market open news and any overnight emails

• Around nine, things can start to pick up a little more. It's hard to describe without totally violating my NDA, but there's a lot of Microsoft Excel, PowerPoint, Word, and reading research reports.

• I eat lunch whenever I get hungry — about 12–2 p.m. I work while eating, generally catching up on the news that's happened that day and some texts and non-work news.

• I tend to start my last task for the day at 6 p.m., so I generally leave between 6:30 and 7:00 p.m. I do have to stay longer sometimes; the latest I have ever left was 11 p.m. This is actually pretty good by industry standards for Wall Street finance and investment banking.

• Time permitting, I go to the gym three or four times a week.

• Come home. My girlfriend and I split time between our places but are always together at night.

• Eat dinner. Normally, it's already cooked since we tend to meal prep during the weekend, and whichever one of us is home first will heat up food for the other (assuming they didn't go out to eat with a friend/we're not going out).

• Decompress with my girlfriend: We share stories about our day and catch up on stuff. I tend to throw sports on in the background, or she will have reality TV on, and we will cuddle up on the couch and watch.

• Get ready and go to bed around 11 p.m. I can't fall asleep that early, so I'll watch YouTube or more sports on my phone until midnight.

I am a big data nerd, so I actually track my sleep pretty religiously. On average, I get about six and a half hours. It is really consistent, but I am prone to about one night every week or so where I don’t sleep. I wouldn’t say there’s a specific reason; I just can’t fall asleep.

I am in a very serious and loving relationship with my girlfriend. She is the greatest thing to ever happen to me, and every day, I find something new about her that makes me fall in love even more. We are each other's best friends and support each other in every way possible — making food for each other, being an open ear to vent to about anything, and finding new ways to surprise each other and show that we care. Our relationship is built upon communication, and I know that I can go to her with anything, and she can come to me with anything. We keep each other from being lonely, even if that's just from the presence of the other, while we do our own things separately when in the same room.

The biggest changes I went through recently are getting a promotion at work and starting/settling into the relationship I am currently in. For the first one, the promotion came with new responsibilities, which I had to adapt to. It’s going smoothly so far, but there are definitely things that I know are headed my way that I have never faced before and will need to adapt to. The raise with the promotion has been huge for me; with my previous salary, I was losing money every month. I was making about $90k a year, and as a result, I couldn’t save any money. Plus, my living costs — even when kept to their most basic — were more than I made in a given month. The result was me losing a big chunk of my savings from working while still living at home for two years.

The really huge change in my life has been meeting and dating my current girlfriend. We've been dating for about six months now, and things have settled into a routine that we really enjoy. I'm bragging a bit here, but she has been the greatest thing to ever happen to me, and I love her so much! We have become best friends, and every day, we find new ways to make each other laugh and smile.

That said, given we’re moving in together and all signs point to marriage, there are eyes, comments, and whispers among our families — and obviously discussions between my girlfriend and me — about timing. I can’t escape the subtle pressure that appears of when to propose, and from some more than others, that timeline has been pushed forward. Like I said, I will marry her, but I am finally getting the chance to save and invest money for my and, ostensibly, our future together, and the pressure to put all my savings into an engagement ring and then wedding conflict heavily. A ring (we’ve discussed what it’ll look like, so I know the rough price) plus a wedding don’t come cheap, and the pressure to propose at the end of the year, no later than next summer, with an anticipated 2026-ish ceremony, has thrown me off a bit.

There are definitely a lot of societal expectations to settle down, especially since I've gotten a raise, my girlfriend has gotten a new job, and we're moving in together. Most of our pressure is marriage-based, as buying a house in this economy is probably the biggest joke to young millennials and people at the top of Gen Z like myself. The pressure to get married while also needing to save for retirement and other things like potential kids and home is there. I don't think my parents have realized that I may never move out of the city since they view the suburbs as the ultimate end goal. My vision for my future is one where I hope for success, and I acknowledge that I've had the privilege to set myself up for it. But at any moment, my company could decide to cease to exist, and I would be out of the job.

I love my friends, but as a victim of my own circumstances, very few live near me. Many of my friends growing up still live in their hometowns or did not move to NYC because of the costs. I see them occasionally on weekends and try to host them in the city when I can. My friends from college almost exclusively live on the West Coast. I went to a very regional college in California, most of whom are from California, Washington, or Colorado. Almost all of them now live and work in Los Angeles, San Francisco, or San Diego. We talk often, but it's hard to hang out when you're dealing with 3,000 miles of distance and a three-hour time difference.

I find it hard to make new friends since I have a pretty decent amount of social anxiety. I take a bit to warm up to a person before I feel confident actually being able to talk to them, and I really struggle to reach out to people first. Combine that with a pretty tight work schedule, and it makes it hard to meet new people. After moving in with my girlfriend and settling in, I'll probably try a little harder.

I don't know if I could say I do or don't feel like I'm where I'm supposed to be at my current age. 26 is a really weird age, and social media highlights it. Some friends are getting grad or doctorate degrees; some are randomly unemployed friends who quit their jobs to travel the world; others are just at home doing nothing, living off their parents; some are having kids. As a result, I feel like I find myself somewhere in the middle — nothing too notable in any direction to post and boast about. What I do think has happened with social media is that everyone thinks the grass is greener on the other side and that making more money can solve the problem. Everyone thinks more money equals more free time, and that's just not reality.

I am fully aware that I got a better head start at life than most. That said, you judge yourself compared to those closest to you, which can be a struggle. No one should feel like they can't talk about feeling stuck/trapped where they are. The notion that $100k or any specific salary will completely erase someone's problems isn't true. I know what I've had to do to earn the chance to get to where I am, and no one should try to minimize someone else's efforts in doing so.

In the finance industry, 80+ hour workweeks can be very common, and that can include working on weekends; it can be draining and stressful. I have “unlimited PTO,” but my bosses will look down on me if I take more than a week off during the year. If I took two full weeks off over the course of a full year, they would bring it up negatively in a review scenario. Often, even if I'm on a trip, I'm expected to be available if needed to work (and not necessarily for an emergency).

I am not trying to whine, brag, or preach, as I know my fellow Gen Z'ers can be in worse positions, but I guess I would like to aim my message a little bit more toward the younglings who see all this stuff on social media that depict the "perfect life." The "perfect" social media life you see, for the most part, doesn't exist. All people have their problems, and they can be solved through a mix of effort and luck. A fancy job title and a higher salary than the person next to you on the subway means nothing in the long run; you can still be miserable.

Find what and who makes you happy in your own way at your own speed. Listen to what advice others have to say, but be able to sniff out the BS.

If you relate to any of these stories or if you're interested in hearing stories from more people, let me know in the comments below! If you have a Gen Z Journal of your own to share, you can fill out this short form with just the basics. We'll be in touch to discuss it further if your story is a fit.

Note: This submission has been edited for length and/or clarity.

Want more Gen Z Journals? Read more here.

Yahoo Finance

Yahoo Finance