GeneDx Holdings Corp (WGS) Q1 2024 Earnings: Surpasses Revenue Expectations and Narrows Losses

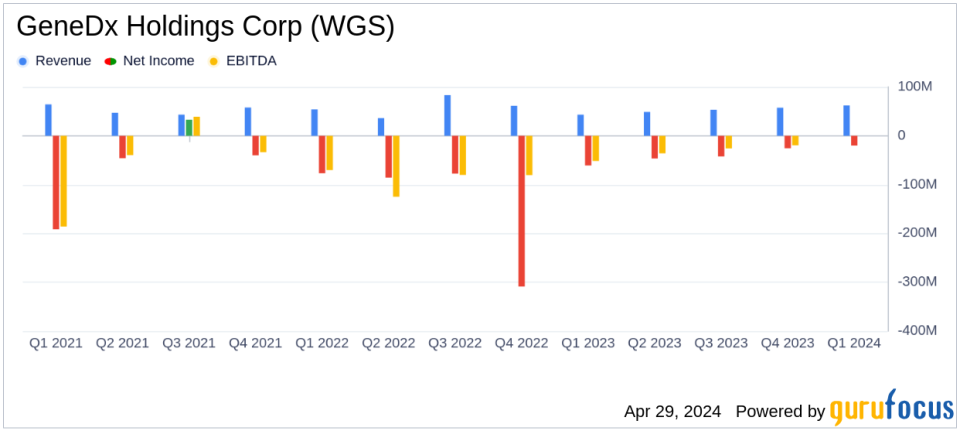

Revenue: Reported $61.5 million from continuing operations, a 51% year-over-year increase, surpassing the estimate of $49.46 million.

Net Loss: Adjusted net loss narrowed to $8.5 million, significantly improving by 83% year-over-year, compared to an estimated net loss of $15.85 million.

Gross Margin: Adjusted gross margin from continuing operations expanded to 61%, up from 34% in the previous year, indicating improved operational efficiency.

Exome and Genome Test Revenue: Grew to $44.0 million, marking a 96% increase year-over-year, driven by a 91% rise in test volume.

Operating Expenses: Adjusted total operating expenses reduced to $45.4 million, reflecting a 26% decrease year-over-year, contributing to better cost management.

Cash Burn: Total net use of cash improved by 71% year-over-year, showcasing enhanced financial stability.

Revenue Guidance: Raised FY 2024 revenue expectations to between $235 million and $245 million, indicating confidence in sustained growth.

On April 29, 2024, GeneDx Holdings Corp (NASDAQ:WGS) released its 8-K filing, unveiling a robust financial performance for the first quarter of 2024. The company reported a substantial increase in revenue and a significant reduction in net losses, outperforming analyst expectations and setting a positive trajectory for the fiscal year.

GeneDx, a pioneer in genomic insights for improved health outcomes, reported a first-quarter revenue of $61.5 million from continuing operations, marking a 51% year-over-year increase. This growth was primarily driven by a 96% increase in exome and genome test revenue, which totaled $44.0 million. The company's performance exceeded the estimated quarterly revenue of $49.46 million projected by analysts.

The adjusted net loss for the quarter was significantly reduced to $8.5 million, an 83% improvement year-over-year, and better than the anticipated net loss of $15.85 million. This financial enhancement is attributed to strategic operational efficiencies and a focus on high-margin genomic testing services.

Operational Highlights and Strategic Achievements

GeneDx's commitment to expanding its genomic testing capabilities is evident from its impressive test volume growth. The volume of exome and genome tests conducted reached 16,592, up 91% from the previous year. This increase reflects the company's strengthened market position and its ongoing efforts to enhance diagnostic accuracy and accessibility.

Adjusted gross margins saw a significant rise to 61%, up from 34% in the same quarter last year, driven by improved reimbursement rates and operational efficiencies. The company also reported a 71% reduction in cash burn compared to the first quarter of 2023, demonstrating effective cost management and a move towards sustainable growth.

Financial Position and Future Outlook

As of March 31, 2024, GeneDx's cash reserves, including cash equivalents, marketable securities, and restricted cash, stood at $113.9 million. This strong liquidity position supports the company's strategic initiatives and its path to profitability, expected by 2025.

In light of these results, GeneDx has raised its revenue guidance for FY 2024 to between $235 million and $245 million, reflecting confidence in its operational strategies and market demand for its testing services.

Industry Impact and Investor Implications

The substantial growth in GeneDx's exome and genome testing services not only underscores the company's leadership in the genomic diagnostics market but also highlights the increasing acceptance of personalized medicine. For investors, GeneDx's trajectory offers a promising avenue, particularly as the company approaches profitability and continues to expand its market share in the burgeoning field of genomic medicine.

Overall, GeneDx's Q1 2024 performance signals a strong start to the year, with financial and operational metrics aligning well with the company's long-term strategic goals. This positions GeneDx as a noteworthy contender in the precision medicine industry, with potential benefits for both healthcare outcomes and shareholder value.

Explore the complete 8-K earnings release (here) from GeneDx Holdings Corp for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance