Genel Energy poised for a ‘relaunch’ amid Kurdish gas boom

Genel Energy has a chance to relaunch its floundering fortunes amid an unexpected Kurdish gas boom which is set to test investor confidence in the politically turbulent region.

The troubled company said that fresh data from an independent resource assessment at its Miran and Bina Bawi gas fields in Kurdistan has revealed 40pc more gas reserves than previously thought.

Industry analysts at RBC Capital said the boom could relaunch Genel’s business under its new leadership team but a series of technical, political and commercial hurdles remain.

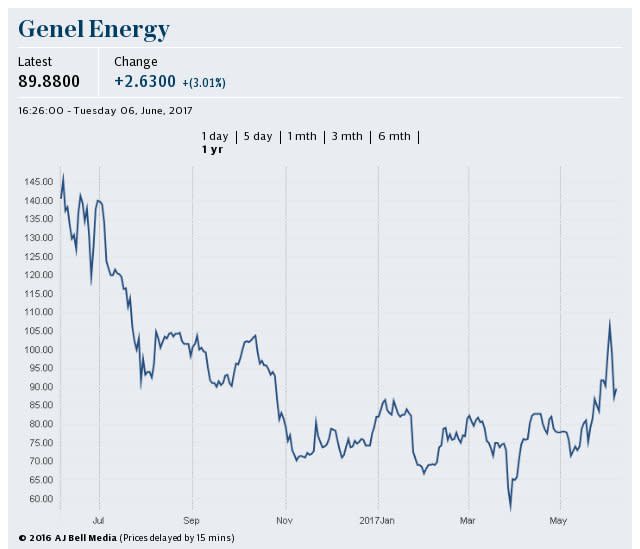

The group’s share price, which plummeted 90pc in the last four years, climbed by over 8pc in response to the news to 138p but remains well below the £11 a share price in 2014.

Genel will need to find a partner to develop the field, but ongoing political turbulence in the region combined with the group’s cash flow woes could scupper its chances.

“Although the security outlook for the region has improved, Kurdistan’s relationships with Baghdad and the outlook for gas sales to Turkey remain uncertain,” RBC warned.

In the past week major oil majors have signalled a revived interest in the region. BP marked its return to the oilfields of northern Iraq on Thursday with an ambitious deal to help Iraq more than double crude flows from its "super-giant" field in the north of the country.

Chevron said earlier this week that it would restart drilling in the region, and Russia’s Rosneft has also begun work in Iraqi Kurdistan.

The findings are a rare glimmer of hope for the producer which was abandoned by its founders in a boardroom exodus last summer, just six years after founding the Kurdistan-focused group.

Genel has been beset by problems, including disruption to payments from the Kurdistan Regional Government for crude exports because of the fighting against Islamic State in Iraq and Syria.

The group was also hard-hit by the oil price crash, made worse by failed exploration campaigns in Angola, Malta and Morocco.

Genel’s biggest hit was due to a major downward revision of reserves at Taq Taq, its biggest Kurdistan oil field, cutting its forecast to 59m barrels from the field, down from 172m at the end 2015 and 683m when Genel listed.

City financier Nat Rothschild stepped down from the board in the same week as chairman and former BP boss, Tony Hayward.

Under the new leadership of chief executive Murat Ozgul, Genel will offer a full trading update to the market next Thursday which is expected to show that its Tawke field is producing steadily and the Peshkhabir field is making an increasing contribution as it is developed.

Yahoo Finance

Yahoo Finance