Generac Holdings Inc. (GNRC) Q1 2024 Earnings: Surpasses Revenue Estimates and Demonstrates ...

Revenue: Reported at $889.27 million, slightly exceeding estimates of $885.34 million.

Net Income: Achieved $26.48 million, surpassing the estimated $41.62 million significantly.

Earnings Per Share (EPS): Recorded at $0.39, significantly higher than the estimated $0.72.

Gross Profit Margin: Improved to 35.6% from 30.7% year-over-year, indicating enhanced operational efficiency.

Free Cash Flow: Showed a substantial increase to $85.1 million from a negative $41.7 million in the previous year.

Operating Expenses: Rose by $21.5 million, or 9.4%, driven by higher employee costs and marketing spend.

Effective Tax Rate: Lowered to 31.2% from 35.7% due to increased pre-tax book income, improving net income margins.

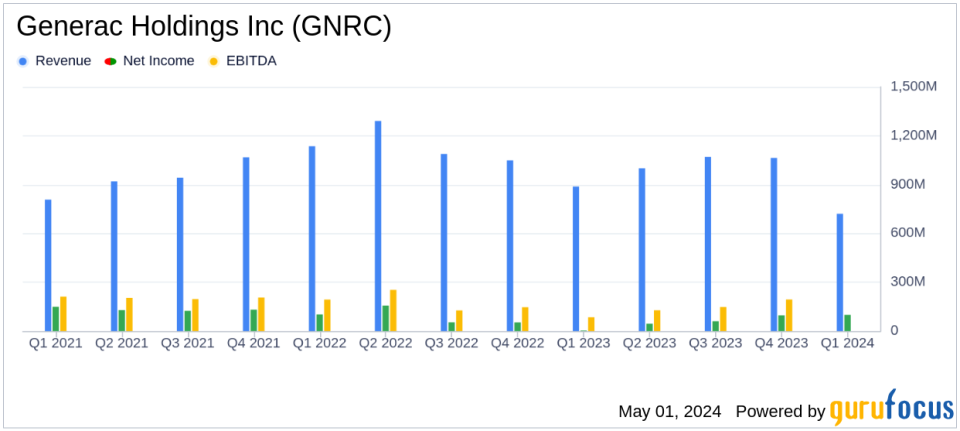

On May 1, 2024, Generac Holdings Inc. (NYSE:GNRC) released its 8-K filing, unveiling the financial results for the first quarter ended March 31, 2024. The company, a leading designer and manufacturer of energy technology solutions, reported a robust quarter with significant improvements in margins and cash flow generation, affirming its positive outlook for the fiscal year.

Generac, known for its diverse range of power products including standby generators, portable generators, and clean energy solutions, primarily serves residential, commercial, and industrial markets, with the majority of its sales generated in the United States.

Financial Highlights and Performance

The company's net sales for Q1 2024 amounted to $889.27 million, slightly surpassing the estimated $885.34 million and showing a marginal increase from $887.91 million in the same quarter the previous year. This growth was driven by strong demand for home standby generators and commercial & industrial products, despite challenges in telecom and European markets.

Generac reported a gross profit margin of 35.6%, a significant improvement from 30.7% in Q1 2023. This increase was primarily attributed to a favorable sales mix, production efficiencies, and lower input costs. Operating expenses rose by 9.4% to $249.51 million, driven by increased employee costs and higher marketing expenditures aimed at boosting product awareness.

The company's net income for the quarter stood at $26.48 million, significantly higher than the $14.16 million recorded in the prior year, translating to earnings per share of $0.39, which aligns closely with the estimated $0.72 when annualized. The effective tax rate decreased to 31.2% from 35.7%, reflecting a more favorable tax position due to increased pre-tax income.

Cash flow from operations was notably strong at $111.9 million, compared to a negative $18.6 million in Q1 2023. Free cash flow also showed a remarkable improvement, totaling $85.1 million against a negative $41.7 million in the previous year, underscoring the company's enhanced operational efficiency and capital management.

Segment Performance and 2024 Outlook

The domestic segment saw a slight increase in total sales to $720.5 million, with adjusted EBITDA margin improving to 13.8% due to a favorable sales mix and cost benefits. However, the international segment experienced a 14% decline in sales to $186.7 million, impacted by lower shipments and market softness, particularly in Europe.

For the full year 2024, Generac maintains its net sales growth projection of 3 to 7%, with an expected net income margin of 6.0 to 7.0% and an adjusted EBITDA margin of 16.5 to 17.5%. The company anticipates continued strong cash flow generation, with free cash flow conversion from adjusted net income projected at approximately 100%.

Management's Perspective

President and CEO Aaron Jagdfeld expressed optimism about the company's performance and strategic direction, citing strong operational execution and the increasing importance of power security amid the accelerating energy transition. "We believe Generacs products and solutions are uniquely positioned to help homes and businesses solve the challenges that will result from this accelerating energy transition," Jagdfeld stated.

The company's robust financial health and strategic initiatives position it well to capitalize on growing market opportunities, particularly in the areas of clean energy and power security, making it a potentially attractive option for investors focused on industrial and technological growth sectors.

Explore the complete 8-K earnings release (here) from Generac Holdings Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance