General Dynamics (GD) Arm Wins Deal to Support Shipbuilding

General Dynamics Corporation’s GD business unit, NASSCO, recently clinched a $600-million modification contract to provide long-lead-time material support for building ships for the U.S. Navy, which mainly comprise two replenishment oiler ships and one expeditionary sea base (“ESB”) ship.

Through the contract, General Dynamics aims to support the critical programs of the U.S. Navy’s ship fleet that enhance maritime warship capabilities.

Details of the Contract

Per the deal, GD will be engaged in providing long-lead-time material support for building the seventh and eighth ships of the John Lewis-class fleet oiler (T-AO) program, coupled with the sixth ship of the ESB program.

The construction of ships is planned to commence from the third quarter of 2023 and continue till 2027.

What’s Favoring General Dynamics?

The changing dynamics of the military landscape and the rising geopolitical tension make it mandatory for a country to continuously evolve and strengthen its defense structure. To this end, Navy ships form an integral part of any military missions and arm them in their ship warfare affairs.

In this context, it is imperative to mention that General Dynamics’ NASSCO is a prime contractor of shipbuilding for the U.S Navy and has been delivering next-generation ships to the Navy for a decade. It offers full-service ship designs to its customers and also tailors ship designs to meet owners’ requirements while maintaining a highly producible, cost-effective product.

Considering its excellence and in-depth experience in building ships for the military, NASSCO has been winning multiple contracts from the Pentagon. The latest contract win is a bright example of that. The strong order lineup bears a testament to its leading position in the shipbuilding market.

NASSCO is also scheduled to deliver later this year the lead ship of the new 742-foot-long, 49,850-ton fleet oiler class, the John Lewis (T-AO 205). Three more are under construction — the future USNS Harvey Milk (T-AO 206), the future USNS Earl Warren (T-AO 207) and the future USNS Robert F. Kennedy (T-AO 208) — and two are under contract.

Such a solid order flow is likely to bolster General Dynamics’ revenue generation prospects from its NASSCO unit and may provide a boost to its overall top line.

Growth Prospects

Nations are reinforcing their defense capabilities to deter any warfare-like situation.

In this context, per the report from Mordor Intelligence, the global shipbuilding market???is projected to witness a CAGR of 4.8% during the 2022-2027 period. Such abounding growth trends indicate ample growth opportunities for General Dynamics as it enjoys a lucrative position in the shipbuilding market.

A few defense primes that can reap the multitude of gains from the expanding shipbuilding market are BAE Systems BAESY, Mitsubishi Heavy Industries MHVYF and Huntington IngallsHII.

BAE Systems designs and manufactures naval ships and submarines as well as state-of-the-art combat systems and equipment. It also offers an array of associated services, including training solutions, maintenance and modernization programs, to support ships and equipment in service worldwide.

The long-term earnings growth rate of BAESY is pegged at 7.2%. Shares of BAE Systems have rallied 38.7% in the past year.

Mitsubishi Heavy Industries manufactures naval surface ships and submarines. The company also provides after-sales service for destroyers and submarines.

The Zacks Consensus Estimate for Mitsubishi’s 2022 earnings indicates a growth rate of 4.9% from the prior-year reported figure. Shares of MHVYF have returned 20.8% value to investors in the past year.

Huntington Ingalls’ business segment, Ingalls, has in-depth experience in manufacturing amphibious assault and expeditionary ships for the U.S. Navy. Being the U.S. Navy's primary surface combatant, the Aegis-equipped Arleigh Burke class (DDG 51) destroyers enjoy solid demand.

The Zacks Consensus Estimate for Huntington Ingalls’ 2022 earnings indicates a growth rate of 13.9% from the prior-year reported figure. Shares of HII have returned 2.5% value to investors in the past year.

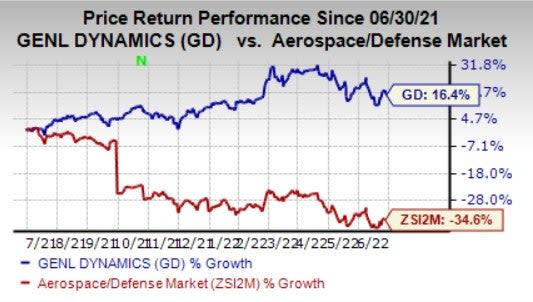

Price Performance

Shares of General Dynamics have rallied 16.4% in the past year against the industry’s decline of 34.6%.

Image Source: Zacks Investment Research

Zacks Rank

General Dynamics currently carries a Zacks Rank #3 (Hold). You can seethe complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

General Dynamics Corporation (GD) : Free Stock Analysis Report

Bae Systems PLC (BAESY) : Free Stock Analysis Report

Huntington Ingalls Industries, Inc. (HII) : Free Stock Analysis Report

Mitsubishi Heavy Industries, Ltd. (MHVYF) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance