General Electric (GE) Prices Tender Offer, To Reduce Debt

General Electric Company GE yesterday priced its tender offer to purchase the U.S. dollar-denominated notes for cash. The tender is valid for three sets of securities, with upsizing in purchase targets announced for the second and third sets.

Notably, the offering was announced originally on May 24 and is expected to expire on Jun 21, 2021. The action will help the company to lower its debt position.

It is worth noting here that General Electric’s shares have declined 0.1% yesterday, ending the trading session at $13.90.

Inside the Headlines

As noted, the tender offer is valid for three sets of securities, issued by either General Electric or General Electric Capital Corporation (or GE Capital, which primarily offers financial services across various businesses). The principal amount of the securities in the three sets is $1,000, while their pricing has been discussed below. Securities purchased by the company will be retired and canceled.

The first set of securities includes GE Capital-issued 4.650% notes due 2021, 3.150% notes due 2022 and 3.100% notes due 2023. Of this, each 2021 notes has been priced at $1,015.41. while 2022 and 2023 notes have been priced at $1,034.82 and 1,042.17, respectively. In addition, the set includes 2.700% notes due 2022, which have been priced at $1,013.14. General Electric noted that it can opt to purchase any or all notes from the set.

From the second set, General Electric will purchase notes worth $2.7 billion, marking an increase from the previously targeted $1 billion. The set includes 6.150% notes due 2037, 5.875% notes due 2038 and 6.875% notes due 2039. Of this, per 2037 notes has been priced at $1,373.00, while 2038 notes at $1,340.80 and 2039 notes at $1,475.78. All the notes have been originally issued by GE Capital and have been assumed by General Electric.

In relation to the third set, General Electric will purchase back notes worth $3.9 billion, higher than the previously targeted $1 billion. The set includes notes that have been originally issued by General Electric. The 4.250% notes due 2040 have been priced at $1,146.45, while 4.125% notes due 2042 at $1,132.19 and 4.500% notes due 2044 at $1,185.59. Notes, with a coupon rate of 4.350% and expiring on 2050, have been priced at $1,169.42.

The move will enable General Electric to strengthen its balance sheet. The company targets to bring Industrial net debt/EBITDA ratio to less than 2.5 and GE Capital debt/equity ratio to less than 4, going forward. Exiting first-quarter 2021, General Electric’s borrowings were $66.9 billion, down 4.8% from $70.3 billion at the end of the fourth quarter of 2020.

Zacks Rank, Share Price Performance and Earnings Estimates

General Electric currently has a market capitalization of $122.1 billion and a Zacks Rank #3 (Hold). Solid liquidity position, portfolio-restructuring measures and actions to lower debts are expected to aid the company in the quarters ahead. However, the market-related challenges in the aviation business are concerning for the company.

In the past three months, the conglomerate’s shares have gained 4.9% as compared with the industry’s growth of 8.9%.

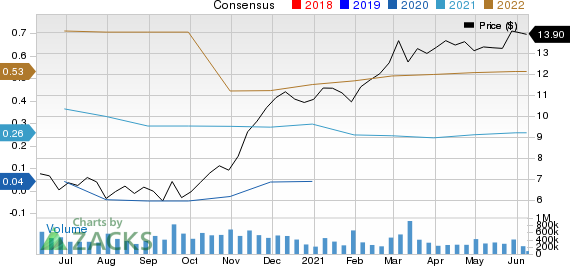

Image Source: Zacks Investment Research

In the past 60 days, the Zacks Consensus Estimate for its earnings is pegged at 4 cents for the second quarter of 2021, reflecting growth of 33.3% from the 60-day-ago figure. Notably, earnings estimates are pegged at 26 cents for 2021 and 53 cents for 2022, reflecting increases of 8.3% and 1.9% from the respective 60-day-ago figures.

General Electric Company Price and Consensus

General Electric Company price-consensus-chart | General Electric Company Quote

Stocks to Consider

Three better-ranked stocks in the industry are Carlisle Companies Incorporated CSL, Griffon Corporation GFF and Crane Co. CR. While Carlisle presently sports a Zacks Rank #1 (Strong Buy), both Griffon and Crane carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

In the past 60 days, earnings estimates for the companies have improved for the current year. Also, earnings surprise for the last reported quarter was 116.18% for Carlisle, 50.00% for Griffon and 26.72% for Crane.

Infrastructure Stock Boom to Sweep America

A massive push to rebuild the crumbling U.S. infrastructure will soon be underway. It’s bipartisan, urgent, and inevitable. Trillions will be spent. Fortunes will be made.

The only question is “Will you get into the right stocks early when their growth potential is greatest?”

Zacks has released a Special Report to help you do just that, and today it’s free. Discover 7 special companies that look to gain the most from construction and repair to roads, bridges, and buildings, plus cargo hauling and energy transformation on an almost unimaginable scale.

Download FREE: How to Profit from Trillions on Spending for Infrastructure >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

General Electric Company (GE) : Free Stock Analysis Report

Carlisle Companies Incorporated (CSL) : Free Stock Analysis Report

Crane Co. (CR) : Free Stock Analysis Report

Griffon Corporation (GFF) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance