General Electric's (GE) Arm Opens $8M Facility in Brisbane

General Electric’s GE subsidiary GE Aviation has opened a new service center in Australia for its Asia-Pacific customers. The $8 million facility at Brisbane airport provides customers with maintenance, repair and overhaul services and expands GE’s footprint in the Asia-Pacific region.

The state-of-the-art facility is GE Aviation’s largest systems service center in the Asia-Pacific region. The service center supports avionics, flight management, electrical power and DOWTY propeller systems for Boeing 737 and 787, Q400 and F-50 regional aircraft and the Royal Australian Air Force’s fleet of C-130J Super Hercules and C-27J Spartan Military Transport Aircraft.

The facility is expected to create several jobs in Brisbane, boost the economy and contribute to Brisbane airport’s growth.

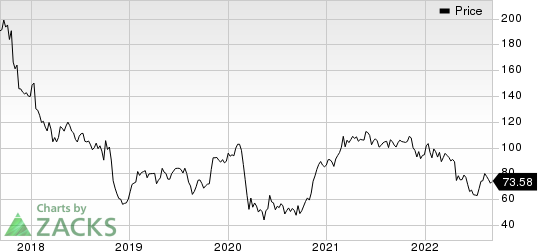

General Electric Company Price

General Electric Company price | General Electric Company Quote

GE Australia Country Leader Sam Maresh said, “We are delighted to mark a new chapter in our Australian operations and our near two-decade relationship with Brisbane Airport with the opening of a leading aviation servicing facility that creates fresh opportunities for GE Aviation."

The opening of this new facility in Brisbane adds to GE’s growth story in the Aerospace segment. Continued recovery in the commercial market is driving growth of the segment. Significant growth in commercial services and continued strength in spare parts sales are boosting segmental revenues, which increased 27% year over year to $6,127 million in the second quarter. General Electric will operate as an aviation-focused company starting in early 2024.

Zacks Rank & Key Picks

General Electric carries a Zacks Rank #3 (Hold).

Some better-ranked stocks within the Conglomerates sector are as follows:

Carlisle Companies CSL currently sports a Zacks Rank #1 (Strong Buy). CSL pulled off a trailing four-quarter earnings surprise of 28%, on average. You can see the complete list of today’s Zacks #1 Rank stocks.

Carlisle Companies has an estimated earnings growth rate of 114.4% for the current year. Shares of CSL have rallied more than 22% in the year-to-date period.

Griffon Corporation GFF presently flaunts a Zacks Rank #1. GFF delivered a trailing four-quarter earnings surprise of 104.6%, on average.

Griffon has an estimated earnings growth rate of 124.1% for the current year. Shares of GFF have gained more than 12% so far this year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

General Electric Company (GE) : Free Stock Analysis Report

Carlisle Companies Incorporated (CSL) : Free Stock Analysis Report

Griffon Corporation (GFF) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance