Geospace Technologies Reports Mixed Q2 2024 Results with Strategic Adjustments and Stock ...

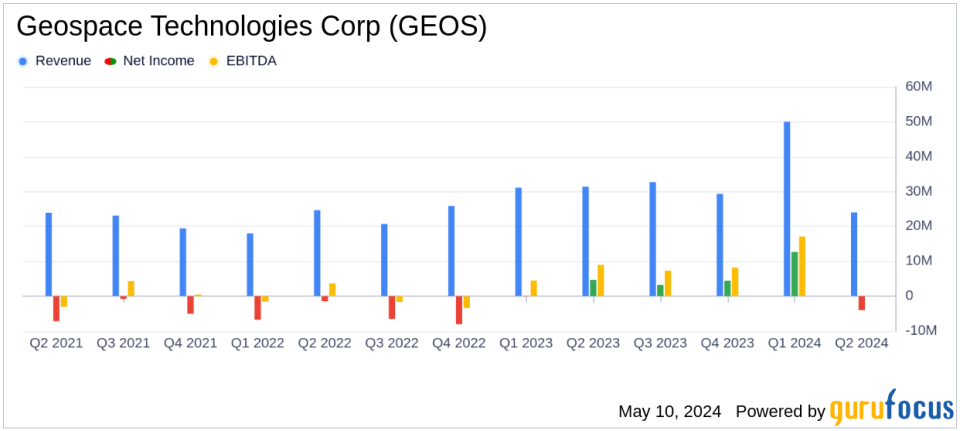

Q2 Revenue: $24.3M, down 22.6% from $31.4M in the same quarter last year.

Q2 Net Loss: $4.3M, or ($0.32) per diluted share, compared to a net income of $4.6M, or $0.35 per diluted share in Q2 last year.

6-Month Revenue: $74.3M, up 18.9% from $62.5M in the same period last year.

6-Month Net Income: $8.4M, or $0.62 per diluted share, an increase from $4.5M, or $0.35 per diluted share in the prior year.

Cash and Short-Term Investments: $51.2M as of March 31, 2024.

Stock Repurchase Program: Authorized up to $5M of its outstanding common stock.

Appointment: Richard Kelley as Chief Operating Officer, bringing extensive industry experience.

On May 9, 2024, Geospace Technologies Corp (NASDAQ:GEOS) disclosed its financial outcomes for the second quarter ended March 31, 2024, through its 8-K filing. The company, known for its seismic instruments and equipment for the oil and gas industry, reported a decrease in quarterly revenue and a shift to a net loss, contrasting with the profit achieved in the same period last year.

For Q2 2024, Geospace announced revenues of $24.3 million, a decrease from $31.4 million in Q2 2023. This downturn led to a net loss of $4.3 million, or ($0.32) per diluted share, a significant drop from a net income of $4.6 million, or $0.35 per diluted share, in the prior year. Despite this quarterly setback, the six-month figures tell a more positive story, with revenues climbing to $74.3 million from $62.5 million, and net income reaching $8.4 million, or $0.62 per diluted share, up from $4.5 million, or $0.35 per diluted share in the previous year.

Segment Performance and Strategic Initiatives

The Oil and Gas Markets segment, traditionally a major revenue contributor, experienced a 41% drop in quarterly revenue to $10.8 million, primarily due to lower utilization of marine OBX rental fleet. However, a significant $30 million sale in the first quarter bolstered the six-month performance, showing an overall increase of 32% to $50.8 million.

The Adjacent Markets segment slightly decreased by 4% in revenue to $12.2 million in Q2, while the Emerging Markets segment showed promising growth, contributing $1.1 million, primarily from a nearly completed government contract.

Financial Position and Corporate Developments

Geospace remains robust in its financial position with $51.2 million in cash and short-term investments and no debt. The company's liquidity is further supported by an additional borrowing capacity of $11.3 million under its bank credit facilities.

On the corporate front, Geospace welcomed Richard Kelley as the new Chief Operating Officer on April 29, 2024. His extensive experience in the oil & gas seismic industry is expected to strengthen the company's operational capabilities. Additionally, the Board of Directors has authorized a stock repurchase program, allowing the company to buy back up to $5 million of its common stock, which underscores the managements confidence in the companys value.

Outlook and Management Commentary

President and CEO Walter R. Wheeler expressed optimism about the future, citing the strategic measures in place to enhance profitability and stabilize revenue sources. Despite the challenges faced in Q2, the company anticipates improved performance in the latter half of the fiscal year, particularly with expected better utilization of its ocean bottom nodes.

Geospace Technologies plans to continue its focus on diversifying its product lines and leveraging its strong balance sheet to navigate the volatile oil and gas market, aiming for sustained growth and shareholder value enhancement.

Conclusion

While Q2 2024 posed challenges for Geospace Technologies, the company's strategic adjustments and robust financial health provide a solid foundation for future growth. Investors and stakeholders may look forward to potential improvements in performance as the company continues to adapt and optimize its operations in the evolving market landscape.

Explore the complete 8-K earnings release (here) from Geospace Technologies Corp for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance