Gerdau to Divest Chilean Steel Units, Offers to Buy Bonds

Brazilian steel producer Gerdau S.A. GGB yesterday announced that it has signed an agreement to sell its long steel industrial units in Chile. Additionally, the company commenced a cash tender offer to purchase $500 million worth of its bonds.

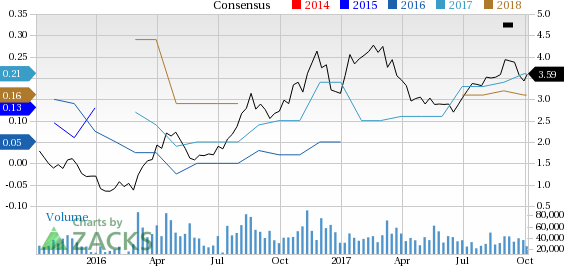

The company’s American Depository Receipts (ADRs) gained roughly 0.3% yesterday, ending the trading session at $3.59.

Notably, market sentiments have been positive for Gerdau since the beginning of this year. The company’s ADRs have yielded 14.3% return year to date, outperforming 7.2% gain of the industry.

Details on the Divestment Deal

As revealed, Gerdau will sell 100% stake in the Chilean steel assets to local groups Matco and Ingenieria e Inversiones. The transaction, valued at approximately $154 million, is anticipated to be completed following a go-ahead signal from the Chilean antitrust authority.

The to-be-divested assets can produce up to 520,000 tons of steel annually.

Over time, Gerdau has been restructuring its business portfolio inorganically, aiming at strengthening its core and profitable businesses as well as lowering debt burdens. In first-half of 2017, the company divested its business unit — Premier Thermal Solutions, L.L.C. to Z Capital Partners, L.L.C., the private equity management arm of Z Capital Group, L.L.C.

Details on Cash Tender Offer

Gerdau made the cash tender offer for its outstanding 7% Bonds due 2020, 5.75% Bonds due 2021 and 5.893% Bonds due 2024. The Bonds due 2020 were issued by Gerdau Holdings Inc. while those due 2021 were issued by Gerdau Trade Inc. Bonds due 2024 were jointly issued by Gerdau Holdings Inc. and GTL Trade Finance Inc.

As revealed, the company has offered to pay cash consideration of $1,096.3 for every $1,000 principal amount of Bonds due 2020, $1,090 for Bonds due 2021 and $1,076.3 for Bonds due 2024. Through the tender offer, Gerdau intends to manage its liabilities well.

Gerdau had long-term debt of approximately R$15.6 billion at the end of second-quarter 2017. Net debt to earnings before interest, tax, depreciation and amortization ratio in the quarter was 3.6, up from 3.5 in the previous quarter. We believe that, if unchecked, such high debt levels will increase the company’s financial obligations and adversely impact its profitability.

Gerdau S.A. Price and Consensus

Gerdau S.A. Price and Consensus | Gerdau S.A. Quote

Zacks Rank & Other Stocks to Consider

Gerdau currently has $6.3 billion market capitalization. It carries a Zacks Rank #2 (Buy).

Other stocks worth considering in the steel industry include ThyssenKrupp AG TKAMY, Carpenter Technology Corporation CRS and Kobe Steel Limited KBSTY. While ThyssenKrupp sports a Zacks Rank #1 (Strong Buy), both Carpenter Technology and Kobe Steel Limited carry a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

ThyssenKrupp AG’s earnings estimates for fiscal 2018 improved over the last 60 days.

Carpenter Technology’s earnings estimates for fiscal 2018 were revised upward over the last 60 days. Also, the company pulled off an average positive earnings surprise of 16.79% for the last four quarters.

Kobe Steel Limited’s earnings estimates for fiscal 2018 improved over the past 60 days.

4 Stocks to Watch after the Massive Equifax Hack

Cybersecurity stocks spiked on recent news of a data breach affecting 143 million Americans. But which stocks are the best buy candidates right now? And what does the future hold for the cybersecurity industry?

Equifax is just the most recent victim. Computer hacking and identity theft are more common than ever. Zacks has just released Cybersecurity! An Investor’s Guide to inform Zacks.com readers about this $170 billion/year space. More importantly, it highlights 4 cybersecurity picks with strong profit potential.

Get the new Investing Guide now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Gerdau S.A. (GGB) : Free Stock Analysis Report

Kobe Steel Ltd. (KBSTY) : Free Stock Analysis Report

Carpenter Technology Corporation (CRS) : Free Stock Analysis Report

ThyssenKrupp AG Sponsored ADR (TKAMY) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance