German Exchange's Top 3 Value Picks For September 2024

The German market has shown resilience, with the DAX rising 2.17% following the European Central Bank's recent rate cut aimed at stimulating economic growth amid slowing inflation. As investors navigate these conditions, identifying undervalued stocks becomes crucial for capitalizing on potential market opportunities. In this context, a good stock is often characterized by strong fundamentals and a price that does not fully reflect its intrinsic value, offering significant upside potential in an evolving economic landscape.

Top 10 Undervalued Stocks Based On Cash Flows In Germany

Name | Current Price | Fair Value (Est) | Discount (Est) |

technotrans (XTRA:TTR1) | €20.00 | €31.80 | 37.1% |

init innovation in traffic systems (XTRA:IXX) | €36.60 | €52.83 | 30.7% |

Formycon (XTRA:FYB) | €50.40 | €71.85 | 29.9% |

Gerresheimer (XTRA:GXI) | €101.80 | €196.05 | 48.1% |

Schweizer Electronic (XTRA:SCE) | €3.72 | €7.19 | 48.3% |

Verbio (XTRA:VBK) | €15.60 | €29.95 | 47.9% |

elumeo (XTRA:ELB) | €2.12 | €3.87 | 45.2% |

MTU Aero Engines (XTRA:MTX) | €276.30 | €491.30 | 43.8% |

Vectron Systems (XTRA:V3S) | €11.70 | €17.32 | 32.5% |

Basler (XTRA:BSL) | €9.53 | €14.10 | 32.4% |

Let's review some notable picks from our screened stocks.

adidas

Overview: adidas AG, with a market cap of €40.55 billion, designs, develops, produces, and markets athletic and sports lifestyle products across Europe, the Middle East, Africa, North America, Greater China, the Asia-Pacific region, and Latin America.

Operations: The company's revenue segments include €3.26 billion from Greater China, €2.39 billion from Latin America, and €5.07 billion from North America.

Estimated Discount To Fair Value: 17.8%

adidas is trading 17.8% below its estimated fair value of €276.18, with a current price of €227.1, indicating it may be undervalued based on cash flows. The company has shown strong earnings growth, reporting net income of €190 million for Q2 2024 compared to €84 million a year ago and raising its full-year guidance due to better-than-expected performance. Earnings are forecast to grow significantly at 41.82% per year over the next three years.

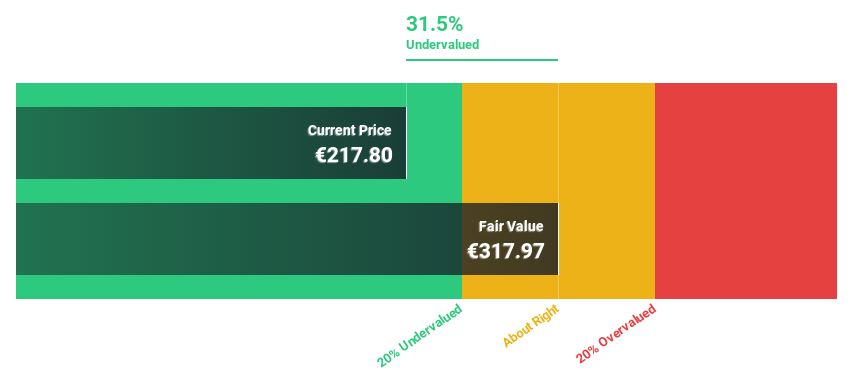

Stemmer Imaging

Overview: Stemmer Imaging AG provides machine vision technology for various applications globally and has a market cap of €318.50 million.

Operations: Stemmer Imaging generates €126.23 million in revenue from its machine vision technology segment.

Estimated Discount To Fair Value: 17.7%

Stemmer Imaging is trading at €49, below its estimated fair value of €59.5. Revenue growth is forecasted at 13.3% per year, outpacing the German market's 5.4%. Earnings are projected to grow significantly at 23.2% annually over the next three years. However, recent earnings reports show a decline in net income and sales compared to last year. A takeover offer by MiddleGround Capital at €48 per share presents an immediate value realization opportunity for shareholders.

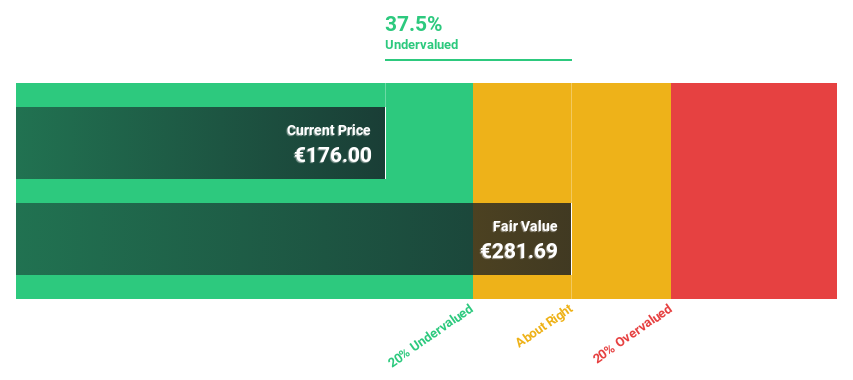

SAP

Overview: SAP SE, along with its subsidiaries, offers applications, technology, and services globally and has a market cap of approximately €240.14 billion.

Operations: SAP's revenue from applications, technology, and services amounts to €32.54 billion.

Estimated Discount To Fair Value: 14.8%

SAP is trading at €206.1, below its estimated fair value of €241.88. The company's revenue and earnings are forecasted to grow faster than the German market, with annual profit growth expected to be significant over the next three years. However, recent financial results were impacted by large one-off items, leading to lower net income compared to last year. SAP's upcoming Innovation Day and new partnerships highlight ongoing efforts in cloud ERP adoption and technological innovation.

Insights from our recent growth report point to a promising forecast for SAP's business outlook.

Navigate through the intricacies of SAP with our comprehensive financial health report here.

Taking Advantage

Click this link to deep-dive into the 20 companies within our Undervalued German Stocks Based On Cash Flows screener.

Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Interested In Other Possibilities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include XTRA:ADS XTRA:S9I and XTRA:SAP.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com