Gibraltar (NASDAQ:ROCK) Misses Q2 Revenue Estimates

Renewable energy and infrastructure solutions provider Gibraltar Industries (NASDAQ:ROCK) fell short of analysts' expectations in Q2 CY2024, with revenue down 3.3% year on year to $353 million. The company's full-year revenue guidance of $1.4 billion at the midpoint also came in 2.3% below analysts' estimates. It made a GAAP profit of $1.05 per share, improving from its profit of $1 per share in the same quarter last year.

Is now the time to buy Gibraltar? Find out in our full research report.

Gibraltar (ROCK) Q2 CY2024 Highlights:

Revenue: $353 million vs analyst estimates of $373.6 million (5.5% miss)

EPS: $1.05 vs analyst expectations of $1.21 (13% miss)

The company dropped its revenue guidance for the full year from $1.46 billion to $1.4 billion at the midpoint, a 3.8% decrease

Gross Margin (GAAP): 27.2%, in line with the same quarter last year

Free Cash Flow of $32.13 million, down 34.2% from the previous quarter

Market Capitalization: $2.44 billion

“We delivered solid execution and strong operating cash flow performance across Gibraltar, generating $36 million, while overcoming two market headwinds that impacted growth in our Residential and Renewables businesses in the quarter. The residential market experienced unexpected channel destocking which started in late May / early June. We offset some of this impact through participation gains, which will support our residential growth plan in the second half. Although net sales for Renewables were up versus prior year, it was less than expected as some customers continued to have project delays related to ongoing trade and regulatory issues. Agtech bookings surpassed $90 million in the quarter, a record for the business, and support strong revenue growth in the second half. We continue to work toward achieving growth in all four segments in 2024 while expanding margin and driving cash flow, and we feel positive about our full year outlook,” stated Chairman and CEO Bill Bosway.

Gibraltar (NASDAQ:ROCK) makes renewable energy, agriculture technology and infrastructure products. Its mission statement is to make everyday living more sustainable.

Home Construction Materials

Traditionally, home construction materials companies have built economic moats with expertise in specialized areas, brand recognition, and strong relationships with contractors. More recently, advances to address labor availability and job site productivity have spurred innovation that is driving incremental demand. However, these companies are at the whim of residential construction volumes, which tend to be cyclical and can be impacted heavily by economic factors such as interest rates. Additionally, the costs of raw materials can be driven by a myriad of worldwide factors and greatly influence the profitability of home construction materials companies.

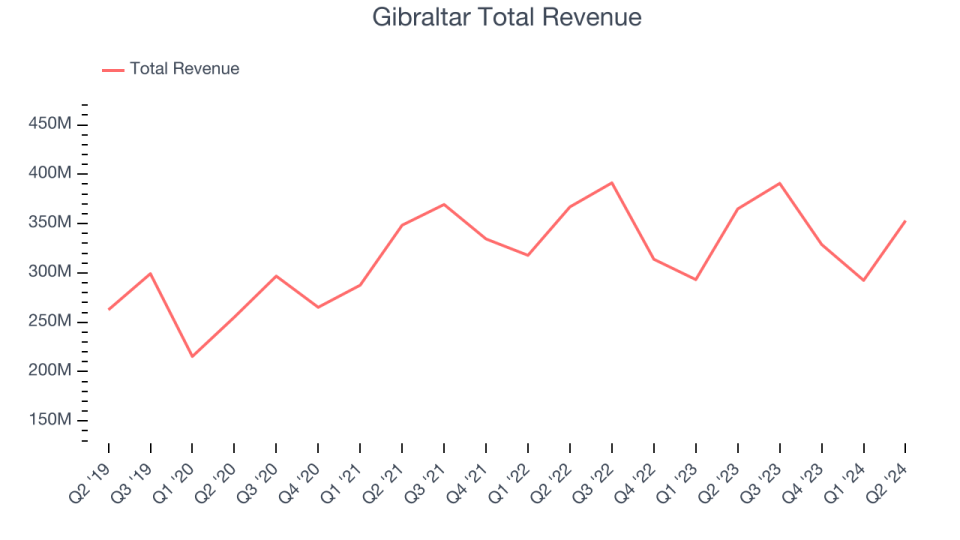

Sales Growth

A company's long-term performance is an indicator of its overall business quality. While any business can experience short-term success, top-performing ones enjoy sustained growth for multiple years. Regrettably, Gibraltar's sales grew at a weak 5.9% compounded annual growth rate over the last five years. This shows it failed to expand in any major way and is a rough starting point for our analysis.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. Gibraltar's recent history shows its demand slowed as its revenue was flat over the last two years.

This quarter, Gibraltar missed Wall Street's estimates and reported a rather uninspiring 3.3% year-on-year revenue decline, generating $353 million of revenue. Looking ahead, Wall Street expects sales to grow 9% over the next 12 months, an acceleration from this quarter.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) semiconductor stock benefitting from the rise of AI. Click here to access our free report on our favorite semiconductor growth story.

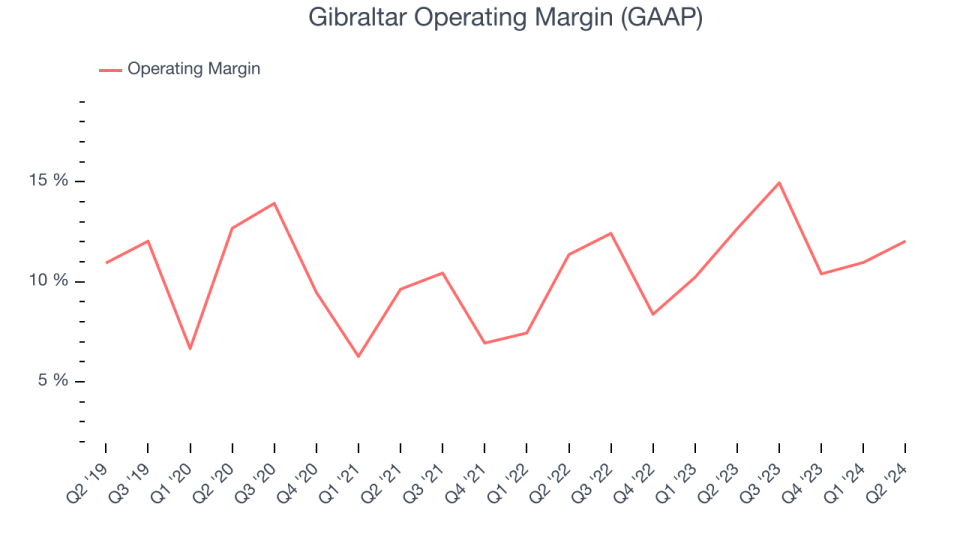

Operating Margin

Gibraltar has managed its expenses well over the last five years. It demonstrated solid profitability for an industrials business, producing an average operating margin of 10.6%. This result was particularly impressive because of its low gross margin, which is mostly a factor of what it sells and takes huge shifts to move meaningfully. Companies have more control over their operating margins, and it's a show of well-managed operations if they're high when gross margins are low.

Analyzing the trend in its profitability, Gibraltar's annual operating margin rose by 2.1 percentage points over the last five years, showing its efficiency has improved.

This quarter, Gibraltar generated an operating profit margin of 12%, in line with the same quarter last year. This indicates the company's cost structure has recently been stable.

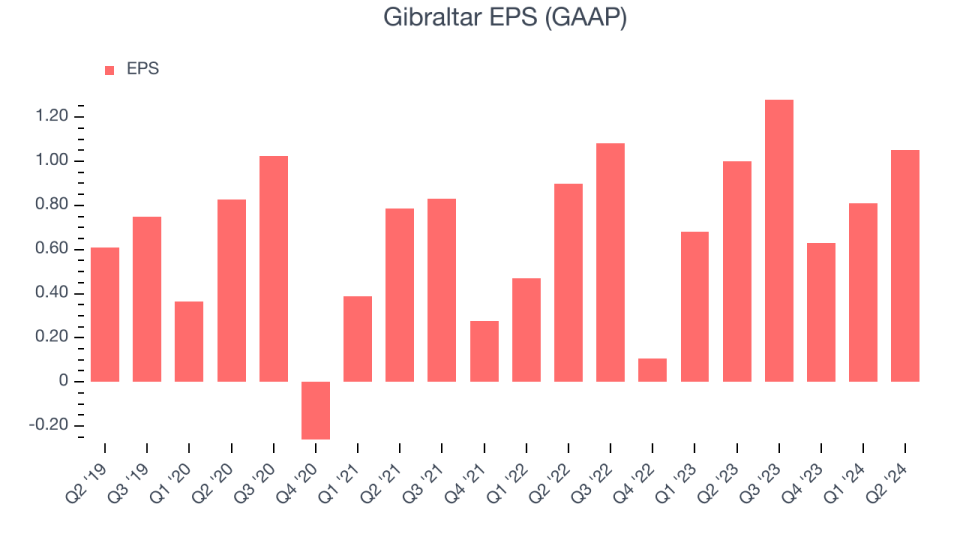

EPS

Analyzing long-term revenue trends tells us about a company's historical growth, but the long-term change in its earnings per share (EPS) points to the profitability of that growth–for example, a company could inflate its sales through excessive spending on advertising and promotions.

Gibraltar's EPS grew at a spectacular 15.7% compounded annual growth rate over the last five years, higher than its 5.9% annualized revenue growth. This tells us the company became more profitable as it expanded.

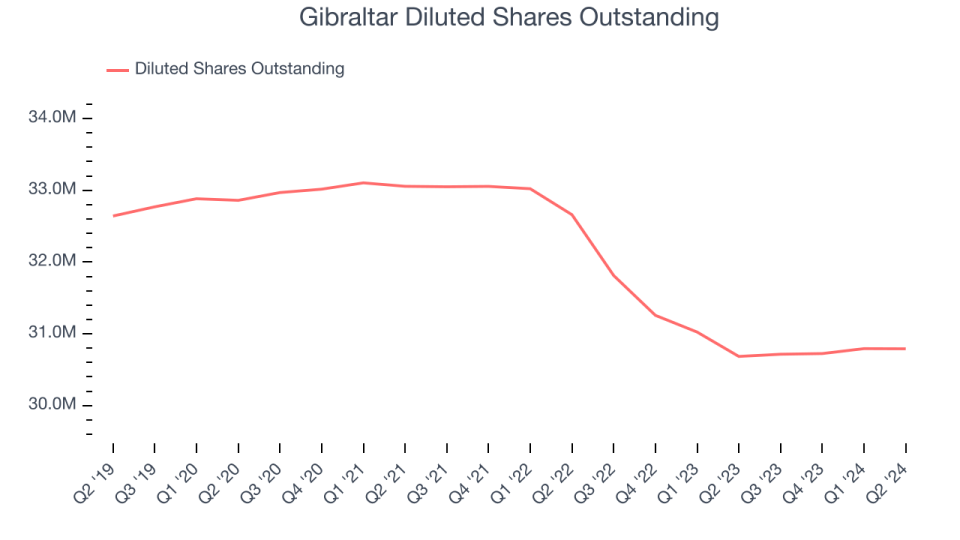

Diving into the nuances of Gibraltar's earnings can give us a better understanding of its performance. As we mentioned earlier, Gibraltar's operating margin was flat this quarter but expanded by 2.1 percentage points over the last five years. On top of that, its share count shrank by 5.7%. These are positive signs for shareholders because improving profitability and share buybacks turbocharge EPS growth relative to revenue growth.

Like with revenue, we also analyze EPS over a more recent period because it can give insight into an emerging theme or development for the business. For Gibraltar, its two-year annual EPS growth of 23.4% was higher than its five-year trend. We love it when earnings growth accelerates, especially when it accelerates off an already high base.

In Q2, Gibraltar reported EPS at $1.05, up from $1 in the same quarter last year. Despite growing year on year, this print missed analysts' estimates, but we care more about long-term EPS growth than short-term movements. Over the next 12 months, Wall Street expects Gibraltar to grow its earnings. Analysts are projecting its EPS of $3.77 in the last year to climb by 31% to $4.94.

Key Takeaways from Gibraltar's Q2 Results

We struggled to find many positives in these results. Its revenue and EPS unfortunately missed Wall Street's estimates and it lowered its full-year revenue guidance. Overall, this quarter could have been better. The stock remained flat at $80.21 immediately after reporting.

So should you invest in Gibraltar right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.