GKN hits back at Melrose's 'fake premium' as takeover battle heats up

GKN has gone on the offensive in its battle to spurn a hostile takeover from Melrose, branding the 32pc premium its suitor is claiming as “fake”.

The blue-chip engineer’s chief executive Anne Stevens spoke out, saying she needed to “debunk inaccurate assertions” from Melrose, which has launched a £7.4bn bid for the business.

Top of her hit-list was the premium which Melrose says its cash-and-paper offer for GKN valuing its shares at 430.1p provides.

Calling Melrose’s claims “misleading”, GKN said the true premium is actually a third of amount at just under 11pc.

The smaller figure was arrived at because Melrose’s takeover - which would give GKN shareholders an immediate 81p-a-share cash payout and 57pc ownership of the combined business - leverages the target company’s balance sheet to finance the payout, which would cost £1.4bn.

A lack of synergies between the businesses also reduces the premium that the for the combined entity, because its debt level would jump from GKN’s current 0.6 times earnings to 2.3 times.

In a statement to the market, GKN said: “Our shareholders are themselves funding the majority of this premium.”

A source close to GKN called the premium “illusory”, adding: “We could leverage up our balance sheet and pay our shareholders from that - which is what Melrose is effectively doing.”

The company also worked through Melrose’s other claims, issuing rebuttals for each point. Management denied that they wanted what they said Melrose claimed was a "hasty break-up”, instead saying splitting GKN up into its core aerospace and automotive units would “be determined by the need to maximise the economic benefits and minimise the costs associated with separation”.

Ms Stevens will instead focus on improving cash generation and margins in the short-term.

Management also raised doubts over whether mid-cap Melrose can repeat with GKN the success it has had with smaller businesses it has taken over previously, calling Melrose’s prior acquisitions “substantially smaller, and supplying vastly different customer types”.

"GKN is five times bigger than anything Melrose has taken on before", the target company said, adding its suitor “has very limited experience at board level of managing tier 1 aerospace and automotive suppliers”.

GKN also pointed to newly appointed boss Ms Stevens’ track record, notably her relevant industry experience. Her previous roles include work for Ford and Lockheed Martin.

“Anne Stevens has direct experience of tier 1 supplier relationships and of transforming a business of the size, complexity and technological content of GKN,” the company said in a statement. “Importantly, she has experience in aerospace, automotive and powder metallurgy.”

Having taken until the afternoon to digest GKN's claims about the "fake" premium, Melrose countered saying the "real premium for shareholders is reflected in the current share prices of GKN and Melrose, both of which have risen substantially since the approach".

Simon Peckham, chief executive of Melrose, added: "In less than a week shareholders have seen 104p per share or £1.8bn added to the value of GKN which they can, if they wish, realise today in the market. Melrose’s actions have done that, not GKN's management."

He added that the cash element of his company's offer could be reinvested in shares in the combined company, allowing investors to Melrose to get more exposure to the improvements Melrose pledges to bring.

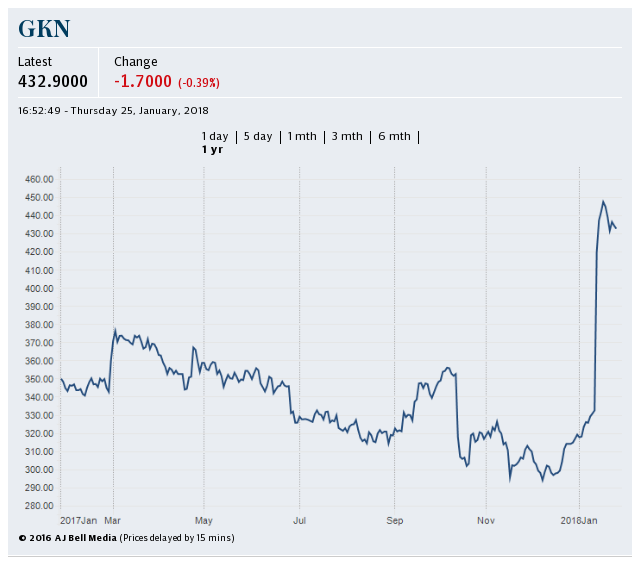

GKN shares - which have soared more than a third since Melrose’s approach was revealed last week - slipped slightly to 446.1p. Melrose shares were flat at 234p.

Yahoo Finance

Yahoo Finance