Goverment nods through Melrose's £8bn takeover of GKN

Melrose's £8.1bn takeover of GKN has been approved by the Government, which has said it will not intervene on national security grounds.

Business Secretary Greg Clark referred the deal to the Ministry of Defence because of the sensitive defence projects in which the company is involved, such as the F-35 stealth fighter.

However, in a House of Commons debate Mr Clark said the Government had secured a series of post-offer commitments from Melrose that had allayed concerns.

These included commitments by Melrose that it will inform ministers of any decision to sell a part of GKN that works on defence contracts, along with details of the potential buyers and an agreement that the Secretary of State's approval is required to dispose of any business working on projects affecting national security.

Turnaround investor Melrose also agreed that it would hold on to GKN's core aerospace business for at least five years.

The agreement came as Melrose took a final final swipe at the management of GKN after its acquisition of the engineering business, saying the company under-performed during the bitter takeover battle.

Melrose pitched its bid for GKN to investors saying the company was failing to hit profit targets and needed new management to achieve these.

GKN’s quarterly accounts for the first three months of the year - which the new owner pointed out were “sourced directly from the GKN group management accounts produced prior to Melrose acquiring the business" - showed revenues were flat at £2.6bn, while operating profits fell 15.6pc to £181m. The margin was 1.2 points lower at 7pc.

Melrose won control of GKN last month when 52.4pc of investors backed its offer, but the trading update revealed the target company spent £107m trying to fend off the approach.

A £39m “break fee” for GKN’s attempted tie-up with US competitor Dana - which was abandoned when Melrose took won the takeover fight - helped push up the company’s debt in the quarter by £235m to £1.1bn.

“Continuing struggles” in GKN’s troubled US aerospace unit - which many believe triggered Melrose’s swoop - resulted in sales slipping 1pc and margins falling 5pc in the division, meaning it made a loss in the quarter.

GKN’s automotive arm eked out sales growth of 7pc but tighter margins meant profits in the division were flat.

Melrose said that the accounts justified the bid, as they showed that GKN had “achieved sales growth at the expense of operating margins”.

However, Melrose said it was still confident it will be able to turn around GKN, adding it had factored in further declines to its takeover plan.

“While this gives Melrose a lower starting point for GKN than current market consensus opinion, Melrose allowed for further under-performance… and remains confident it will be able to deliver on all the statements it made during the offer period over the medium term,” Melrose said.

Analysts at Investec, Melrose’s house broker, said with the takeover “signed and sealed, now it’s time to deliver” for the new owner of GKN.

Investec added it did not expect Melrose to set out its plans for operational improvements to GKN until September, and called GKN’s trading, especially in the aerospace arm “challenging”.

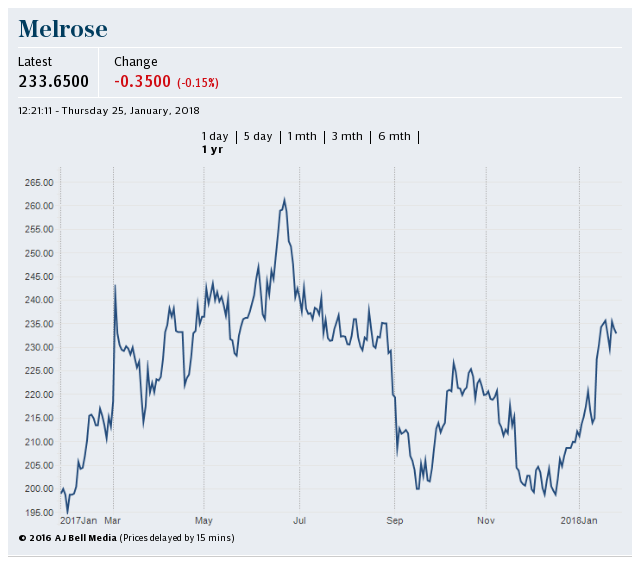

Shares in Melrose, which replaced GKN in the FTSE 100 index, dipped 1.5pc.

Union Unite criticised the takeover battle, saying without tougher controls on bids "short-term speculators and hedge funds will drive a coach and horses" through the UK’s industrial strategy.

It claimed Melrose's victory was driven by speculators influencing the outcome through financial engineering such as shorting shares. Unite said as much of 25pc of GKN's shareholder base could have been influenced by hedge funds using derivatives to control shares, rather than actually owning them outright.

Steve Turner, Unite assistant general secretary, added: "Ministers need to ask themselves is it right that national defence interests and those of long-term investors can be trumped by short-term speculators who do not even own shares in a takeover target."

Yahoo Finance

Yahoo Finance